Thursday, August 17, 2023 8:19:18 AM

First, it was lowered from 1% IRR to 0.5% over a JPS par value, for the reason explained in the tweet below.

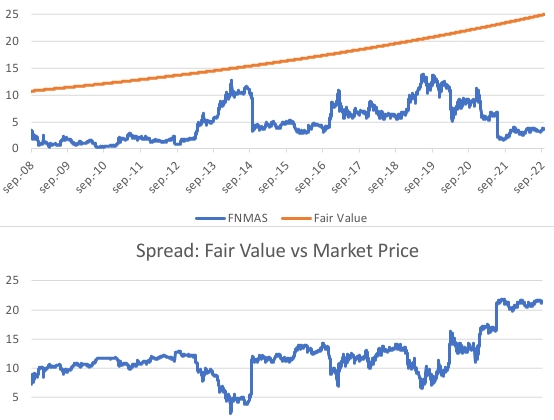

The prior 0.5% compound rate on a JPS, remains. But, instead of being assessed over its par value or face value, it's assessed over the true damage during Conservatorship: the Separate Account plan prevented the stocks from trading at their fair value all along.

Thus, the damage is the spread Fair Value versus the Market price, thus Punitive damages.

Their is no harm for economic loss, as it'd be fully redressed with the announcement of the Separate Account plan.

A fair value of a zero coupon JPS, is the price at an estimated 6% discount rate, discounting the time period to resume the dividend payments again, which should have occurred in mid 2022 for Freddie Mac and September 2022 for Fannie Mae, when they met 25% their Prescribed Capital Buffer.

The actual average of this spread on a $25 JPS, is $12.

It's estimated that the average rose to $12.5 up to date.

A 0.5% compound rate during 15 years on a $25 JPS, but assessed over half its par value, is $0.97 per stock.

Or, if you want to look at it the other way around, it's even less than a 0.25% rate on their full par value during 15 years (compounding effect. Now the principal is higher)

For a $50 JPS, it's $1.94 ps.

The Cs match a $50 JPS, as its fair value stuffers more unknowns. Anyway, certainly closer to a $50 JPS than a $25 JPS.

The plotters peddling the Government theft story which, by the way, the true reason of the spread mentioned and damage (the Separate Account plan is the underlying reason), match this amount, so we might end up getting twice as much.

THE EQUITY HOLDERS HALVE THE COMPENSATION FOR PUNITIVE DAMAGES AGAIN

— Conservatives against Trump (@CarlosVignote) August 17, 2023

$0.97ps($25 JPS 15yrs)@TheJusticeDept agrees w/ a 0.5% rate,but it might argue the damage =spread Fair Value🆚Mkt Price.

Actual avg till Sept 2022(estimated date div resumption)=$12

$12.5 up to date.#Fanniegate https://t.co/vhIW1t9WE1 pic.twitter.com/21ZhojFuBv

Glidelogic Corp. Becomes TikTok Shop Partner, Opening a New Chapter in E-commerce Services • GDLG • Jul 5, 2024 7:09 AM

Freedom Holdings Corporate Update; Announces Management Has Signed Letter of Intent • FHLD • Jul 3, 2024 9:00 AM

EWRC's 21 Moves Gaming Studios Moves to SONY Pictures Studios and Green Lights Development of a Third Upcoming Game • EWRC • Jul 2, 2024 8:00 AM

BNCM and DELEX Healthcare Group Announce Strategic Merger to Drive Expansion and Growth • BNCM • Jul 2, 2024 7:19 AM

NUBURU Announces Upcoming TV Interview Featuring CEO Brian Knaley on Fox Business, Bloomberg TV, and Newsmax TV as Sponsored Programming • BURU • Jul 1, 2024 1:57 PM

Mass Megawatts Announces $220,500 Debt Cancellation Agreement to Improve Financing and Sales of a New Product to be Announced on July 11 • MMMW • Jun 28, 2024 7:30 AM