Thursday, August 17, 2023 3:01:18 AM

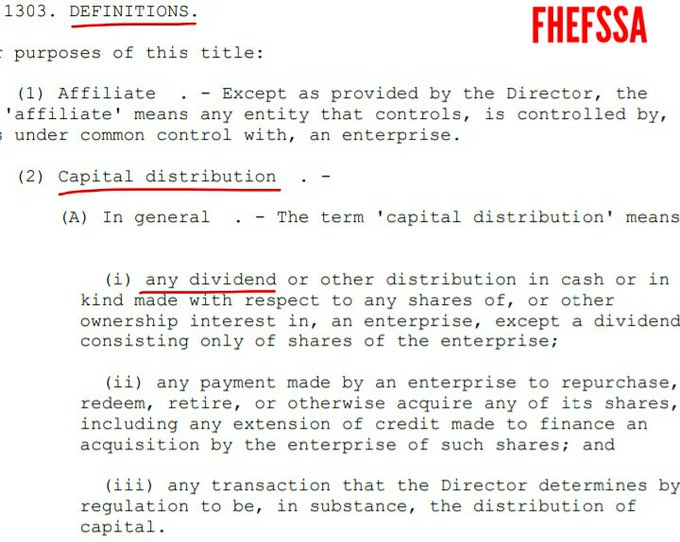

Definition of capital distribution:

(i) Any dividend and today's SPS LP increased for free every quarter as compensation to UST.

(ii) Stock buybacks.

(iii) Any other that the FHFA considers capital distribution through regulation. This is why the FHFA enacted in the famous July 20, 2011 (also Time Limitation of Acting Dtr DeMarco) Final Rule, the case of payments of claims in litigation judgments.

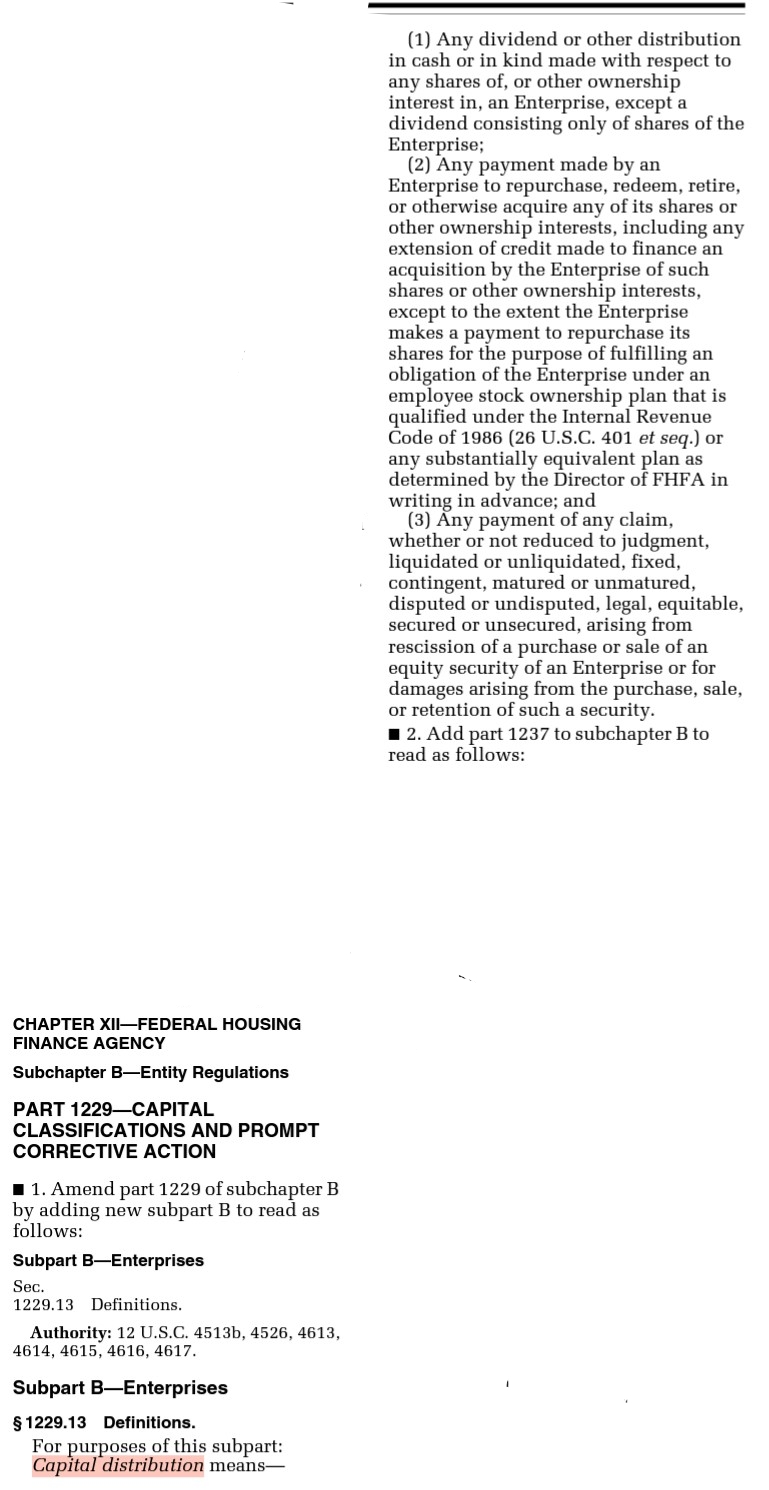

We can see it in the CFR 1229.13, how the FHFA updated the definition of capital distribution to include this case in #3.

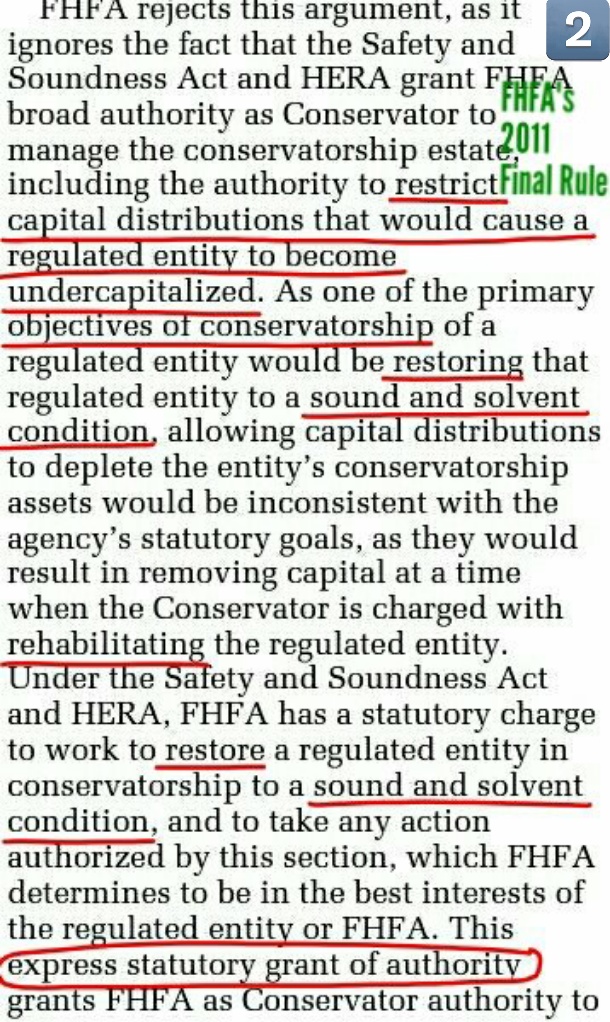

After the definiton was updated, the FHFA applied the FHEFSSA's Restriction on Capital Distributions, a prompt corrective action that HERA snuck at the end of the section Capital Classifications in the FHEFSSA, applied IN GENERAL when a company is undercapitalized.

We can read an extensive explanation of this case of payment of claims in securities litigation judgments, in the preface of this Final Rule:

I will zoom in the second paragraph with the reasoning in the next screenshot, because it has been used as a thorough explanation of the Separate Account plan: Rehab power, restriction on capital distributions, etc.

In the regulation, the FHFA codified this case in the CFR 1237.13, simply stating that it's barred in Conservatorship, as this Final Rule was meant "for the transparency of the Conservatorship", waiving the true reasoning behind posted in the preface, which is the FHEFSSA's Restriction on Capital Distributions.

This is why the Wall Street law firm representing the FHFA, made an oral motion to judge Lamberth to defer the judgment (this obscurantism or secrecy is another evidence of a Separate Account plan behind the scenes, that is what is upholding the law and based on Finance), likely highlighting both the U.S. Code 4617 (f): "no court may take any action...." and the FHEFSSA's Restriction on Capital Distributions when FnF are undercapitalized.

This way, the plotters FHFA-DOJ and the hedge funds continue to cover up this statutory provision that also bars dividends and today's SPS LP increased for free, as pointed out before.

A statutory provision that is the grounds of the Separate Account plan: the 10% and NWS dividends are barred, which means that they can't exist. Also, taking into consideration that there weren't funds legally available for distribution as dividend, out of a Retained Earnings account with deficit all along.

Then, the payments to UST were capital distributions that have been applied towards the exceptions to the Restriction on Capital Distributions, in order to legalize them, complying with the conservator's Rehab power, and under the guise of dividends, thanks to the conservator's Incidental Power: take any action authorized by this section, that is, the compliance with its powers and lying about it, to maintain the conservatorship and extortion of the resources out of FnF that, as Justice Alito would say: "it's beneficial to the Agency and the public it serves".

Exception: reduce the SPS

This Final Rule was also used to enact another exception to the restriction that supplements and shall not replace or affect the one set forth by law mentioned before, so it can't be used to override it and sneak a dividend to UST in the interests of the public.

Their Recapitalization (deplete capital for recap, is only feasible in a separate account)

Finally, a restriction on dividends means that they can't exist, then there have been capital distributions under the guise of dividends, not that a dividend was used for the repayment of the SPS and recapitalization.

No dividend at all.

The FHFA made clear in the preface of this Final Rule that no one can expect dividends until FnF become Adequately Capitalized again (now, it's has to be met 25% of their Prescribed Capital Buffer for the resumption of the dividend payments, under the Table 8: Payout ratio, in the February 16, 2021 Capital Rule). So, beyond the Adequately Capitalized threshold)

Glidelogic Corp. Becomes TikTok Shop Partner, Opening a New Chapter in E-commerce Services • GDLG • Jul 5, 2024 7:09 AM

Freedom Holdings Corporate Update; Announces Management Has Signed Letter of Intent • FHLD • Jul 3, 2024 9:00 AM

EWRC's 21 Moves Gaming Studios Moves to SONY Pictures Studios and Green Lights Development of a Third Upcoming Game • EWRC • Jul 2, 2024 8:00 AM

BNCM and DELEX Healthcare Group Announce Strategic Merger to Drive Expansion and Growth • BNCM • Jul 2, 2024 7:19 AM

NUBURU Announces Upcoming TV Interview Featuring CEO Brian Knaley on Fox Business, Bloomberg TV, and Newsmax TV as Sponsored Programming • BURU • Jul 1, 2024 1:57 PM

Mass Megawatts Announces $220,500 Debt Cancellation Agreement to Improve Financing and Sales of a New Product to be Announced on July 11 • MMMW • Jun 28, 2024 7:30 AM