| Followers | 689 |

| Posts | 143817 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Friday, February 19, 2021 6:11:44 PM

By: Erin Swenlin | December 19, 2020

* (Click Read Full Story »»» at the bottom of the page for the charts to appear on the post)

Semiconductors are outperforming the market, but not all Semiconductors are enjoying the strong rally since September. Some of the more popular names have underperformed within their industry group and against the SPX. However, two are outshining the rest and have room to move higher.

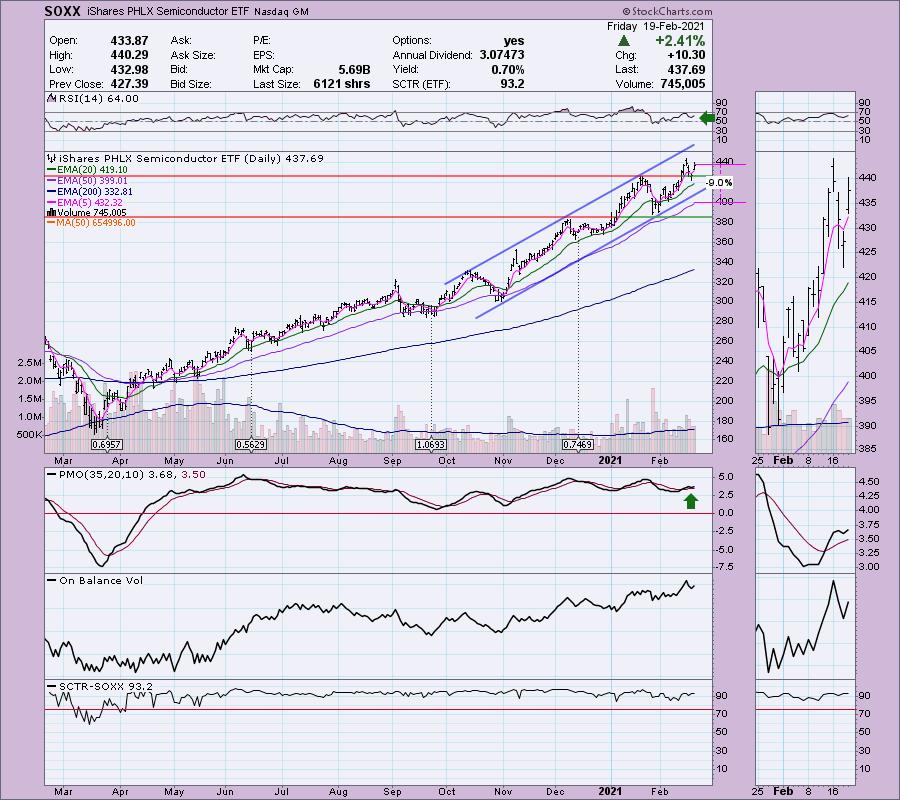

Looking at SOXX, the Semiconductor ETF, you can see a strong rising trend channel. After pulling back this week, they are now on their way back up. The PMO had topped, but now we have a bottom above the signal line.

These are the two Semiconductors that are well known. One is a clear outperformer, the other I'd steer clear of.

The outperformer is Micron Technology Inc (MU). Price broke out again. The RSI is positive and not that overbought. However, if it becomes overbought, we can see that the RSI can stay overbought for some time. The PMO is on a crossover BUY signal and has bottomed above the signal which is especially bullish. The SCTR has been in the "hot zone" above 75 since mid-November. A SCTR ranking of 75 or above implies internal and relative strength given the stock is considered in the upper quartile of its universe (in this case the universe is large-caps). I put a stop level on it that would put price below the 20-EMA. With the market acting toppy it is a good idea to have a stop in place.

Now look at the final three indicator windows. The first one shows us that Semiconductors have been outperforming the market since the September low. The second window shows that MU has been a clear outperformer against the SPX. The third window tells us this is a very strong selection within that industry group given that MU has been outperforming its Industry Group by a mile since September.

Now let's look at the other famous Semiconductor, Advanced Micro Devices (AMD). It is currently in a declining trend. The RSI is negative and the PMO has topped and is on a SELL signal. Notice the terrible performance of AMD relative to the SPX, but more importantly relative to the other Semiconductors.

Conclusion: Relative performance can help you select the strongest performers within a strong (or weak) industry group. Just remember if the industry group as a whole is not outperforming, your confidence level should be lower even if your stock is outperforming within the industry group. Think of it this way, a stock could be in decline and still show strong relative performance to its brethren simply because it is falling at a slower rate.

Happy Charting! - Erin

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

Recent AMD News

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 09/17/2024 08:21:52 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 09/13/2024 08:15:04 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 09/11/2024 08:19:11 PM

- AMD Advancing AI 2024 Event to Highlight Next-gen Instinct and EPYC Processors and Expanding Solutions Ecosystem • GlobeNewswire Inc. • 09/10/2024 01:00:00 PM

- AMD to Present at the Goldman Sachs Communacopia and Technology Conference • GlobeNewswire Inc. • 09/04/2024 01:00:00 PM

- AMD Appoints AI Industry Veteran Keith Strier to Expand Global AI Capabilities and Engagements • GlobeNewswire Inc. • 09/03/2024 08:15:00 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 08/22/2024 08:13:14 PM

- AMD 2023-24 Corporate Responsibility Report: Advancing Sustainability, Collaboration and Inclusion • GlobeNewswire Inc. • 08/21/2024 01:00:00 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 08/20/2024 08:26:54 PM

- AMD to Present at the Deutsche Bank Technology Conference • GlobeNewswire Inc. • 08/20/2024 08:15:00 PM

- Berkshire Reduces Stake in BofA, Hawaiian Airlines Soars 10%, Paramount Receives $4.3B Offer, and More • IH Market News • 08/20/2024 09:56:02 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 08/19/2024 08:26:24 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 08/19/2024 08:24:17 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 08/19/2024 08:22:02 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 08/19/2024 08:19:38 PM

- Futures Pointing To Roughly Flat Open On Wall Street • IH Market News • 08/19/2024 01:13:22 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 08/19/2024 10:22:30 AM

- AMD to Significantly Expand Data Center AI Systems Capabilities with Acquisition of Hyperscale Solutions Provider ZT Systems • GlobeNewswire Inc. • 08/19/2024 10:00:00 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 08/13/2024 08:36:07 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 08/13/2024 08:33:41 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 08/13/2024 08:31:32 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 08/13/2024 08:28:11 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 08/13/2024 08:22:55 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 08/13/2024 08:20:27 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 08/13/2024 08:17:08 PM

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM