Monday, January 08, 2018 6:38:16 AM

A Look At Some Bitcoin And Blockchain Companies

Jan. 8, 2018

by Matt Bohlsen

Summary

- What is a Blockchain?

- What are Cryptocurrencies? What is Bitcoin?

- Companies to play the Bitcoin and Blockchain boom.

This idea was discussed in more depth with members of my private investing community, Trend Investing.

My goal in this article is a very brief summary of what are Blockchain, Cryptocurrencies and Bitcoin. Next I will outline some options to invest in. Finally, in the conclusion I will give my views on the sector, and why you should consider investing despite the current crypto bubble/mania.

What is a blockchain?

A blockchain is a decentralized digital ledger, which is a continuously growing list of records, called blocks, which are linked and secured using cryptography. You can read more here. Being "decentralized" it is not controlled by a central body, as is the case with the current fiat currencies (USD etc).

What are Cryptocurrencies?

Cryptocurrencies are digital currencies. They use "cryptography" (encryption) to secure the transactions, to control the creation of additional units, and to verify the transfer of assets. The digital ledger (recordings) of these transactions is called the "blockchain". There are now over 1,324 different cryptocurrencies (known as "Altcoins" as they are an alternative to the original coin Bitcoin). Some of the most popular ones are Bitcoin [BTC] [XBT], Ether [ETH] (Ethereum), Litecoin [LTC], and Ripple [XRP]. You can read more about cryptos here, or view a list of cryptocurrencies here.

What is Bitcoin?

From Wikipedia -

Bitcoin is a cryptocurrency and worldwide payment system. It is the first decentralized digital currency – the system works without a central repository or single administrator. The network is peer-to-peer and transactions take place between users directly through the use of cryptography, without an intermediary. These transactions are verified by network nodes and recorded in a public distributed ledger called a blockchain. Bitcoin was invented by an unknown person or group of people under the name Satoshi Nakamoto[ and released as open-source software in 2009.

Bitcoins are created as a reward for a process known as mining. They can be exchanged for other currencies, products, and services. As of February 2015, over 100,000 merchants and vendors accepted Bitcoin as payment. Bitcoin can also be held as an investment. Research produced by Cambridge University estimates that in 2017, there are 2.9 to 5.8 million unique users using a cryptocurrency wallet, most of them using Bitcoin.

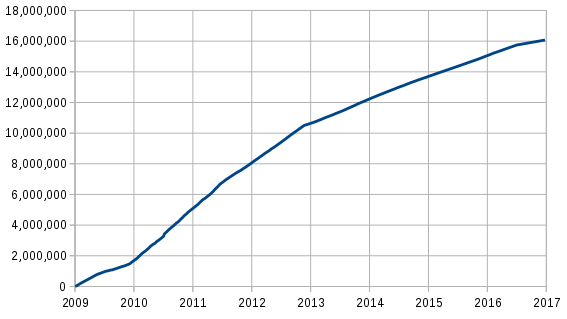

Bitcoin has a limited supply - just 21 million Bitcoins

A very key point to remember with Bitcoin is that the system was designed to reach a maximum of 21 million Bitcoins, and to date around 16.7 million have already been mined. This off course means supply is very limited, and with a growing demand we have seen the price of Bitcoin rise.

Number of Bitcoins mined

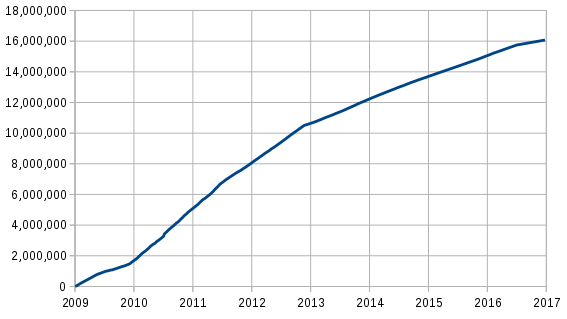

Bitcoin - 1 year chart - Current price = US$ 9,220

Source: Coindesk.com

Companies to play the Bitcoin boom

1) Buy Bitcoin [BTC] direct from a safe exchange

The most popular exchange is Coinbase.com. This would be the ideal way for investors to buy their own Bitcoin [BTC] directly. There are a few issues to watch. Not all countries can buy via Coinbase, as many are excluded. There are transactional fees when you buy, and when you move your Bitcoin to store it elsewhere. Finally if you lose your Bitcoin address/wallet/private key blockchain information then it may be impossible to recover, and you may have lost your Bitcoins.

2) Bitcoin Tracker EUR XBT Provider-ETN (COINXBE:SS) - Price = EURO 398

Bitcoin Tracker EUR is an open-end Exchange Traded Note incorporated in Sweden. The ETN provides investors with access to the returns of the underlying asset, EUR per bitcoin, less investor fees. The average EUR exchange rate of bitcoin from the exchanges:- Bitfinex, Bitstamp and OKCoin provides the underlying reference price.

The fund currently began on 10/05/2015 and has a market cap of USD 240m, and an expense ratio of 2.5%. Daily volume has varied from around 10,000 to 70,000 shares traded, showing ample liquidity.

Note: An alternative to the above fund is Bitcoin Tracker One (COINXBT:SS) by the same provider. It is in Swiss francs.

3) Bitcoin Investment Trust (OTCQX:GBTC) - Price = USD 1,563

Whilst this fund is quite accessible via the OTC market in the US, it trades at a significant premium to the current Bitcoin price. This makes it not an ideal choice at this time. You can read more on the price premium issue here.

4) Bitwise HOLD 10 Private Index Fund

The company describes their "private" fund - "The fund tracks the cryptocurrencies in the HOLD 10 Index, which is a basket of the largest (crypto) coins, weighted by inflation adjusted market capitalization and rebalanced monthly. The fund provides the security and convenience of a traditional investment vehicle. It’s currently only available to US accredited investors but we plan to launch additional funds in the future." You can read more here.

Companies to play the Blockchain boom

1) Global Blockchain Technologies Corp. [TSXV: BLOC] [GR: BWSP] (OTCPK:BLKCF) - Price = 2.40, USD 1.88

The company states:

Global Blockchain Technologies "BLOC" is an investment company that provides investors access to a mixture of assets in the blockchain space, strategically chosen to balance stability and growth. Blue chip holdings such as Ethereum and Bitcoin are complemented by best-of-breed "smaller cap" crypto holdings, many of which are not yet available to other investors. BLOC offers investors a basket of blockchain startups, small caps and blue chip holdings from team of industry pioneers, entrepreneurs. The company offers investment opportunities in initial coin offerings (ICOs).

BLOC is a Canadian investment banking company offering investors a basket of holdings within the blockchain realm, managed by a team of executives who have had a significant impact on the rise of blockchain. The company’s goal is to become the first publicly traded company with vertically integrated originators of top-tier blockchains and digital currencies. The company is also looking to list in Asia and Australia in order to offer 24-hour tradability.

The new ‘core’ team of the company is seeking to incubate about 6-12 “tokens” from startups to existing small cap companies, which it defines as those having caps of $100 million-$1 billion. In return for its initial funding and guidance, B LOC would retain a major equity stake in those firms. A combination of mature companies in the cryptocurrency market with small cap “tokens” and startups provides an effective platform for meaningful returns.

Chairman Nerayoff, a pioneer in the blockchain industry, is a serial entrepreneur who founded six companies in Silicon Valley and New York. CEO Willard, is also a pioneer in blockchains and founded the Agentic Group LLC. President Gouran, was founder of Nuovotel, one of the largest VoIP services. Kemper, CSO, is the executive director of the Blockchain Association of Canada.

Source

2) Riot Blockchain Inc. (Nasdaq:RIOT) - Price = USD 13.18

The company states on their website:

Riot Blockchain Inc is a first mover on the NASDAQ focused on blockchain technology. Riot Blockchain intends to gain exposure to the blockchain ecosystem through targeted investments in the sector, with a primary focus on the Bitcoin and Ethereum blockchains. The rollout of this strategy has commenced with strategic investments in Coinsquare.io, Tesspay.io, and Verady.com. Riot Blockchain has also launched its own Bitcoin mining operation.

Initial Coin Offerings ("ICOs")

Blockchain companies issue cryptocurrencies or other tokens through ICOs in order to raise capital. ICOs are largely unregulated, and ICO investing is like IPO investing - high risk/high reward.

Investors can view a list of 6 smaller blockchain companies here. Furthermore an indirect way to play the crypto/blockchain boom is to buy the chip makers that help the companies mine cryptos such as Nvidia (NVDA) and AMD (AMD).

For more reading I would recommend "Q&A: Why a Value Investor Decided to Buy Bitcoin."

Conclusion

I do not claim to be an expert on Bitcoin, Blockchain or Cryptos. I have been following the sector for the past year with interest, deciding if to invest. This means I am happy to learn more from others more knowledgeable than me on this topic.

My observations until now are:

1) Bitcoin is the one cryptocurrency most likely to survive. It is the original cryptocurrency, and it is the one used similar to gold to store wealth.

2) Bitcoin has a limited supply, and currently a growing demand (increasingly in the mainstream). Traditional currencies can be debased as central banks print more of it, but there will be only 21 million Bitcoins ever made. Read more here.

3) Bitcoin appears to me to offer an asymmetric risk reward. The risk of capital loss is there, but the reward of a possible 50 fold gain still remains possible if Bitcoin becomes the new global number one currency. It has been said the current value of the world's coins and banknotes is $7.6 trillion, meaning Bitcoin's value if it reached 100% the current money value of Bitcoin would be $361,000, or 36 x higher than the near $10,000 price today. So in ten years this could be closer to a 50 fold possible gain, even from today's price. Or it could be zero.

4) Blockchain will have uses across all industries and will succeed even if cryptos fail.

Given the above my viewpoint is the asymmetric risk/reward picture makes Bitcoin and blockchain compelling investments.

My approach for now is to take a position that I can afford to lose, and to buy some Bitcoin and blockchain companies now, with a very long term view. For now I will not get carried away and invest more than I can afford to lose, but neither will I sit on the sidelines and watch this huge opportunity go by.

Due to access and personal tax reasons I have chosen to buy Bitcoin via the Bitcoin Tracker EUR XBT Provider-ETN (COINXBE:SS) fund, as my retirement fund can easily buy or sell this via my online broker. It would also be wise to buy some direct bitcoin, and have some speculative money spread thinly in some Blockchain companies or Altcoins such as Ether and Litecoin etc.

As usual all comments are welcome.

Trend Investing

Thanks for reading this article. If you want to go to the next level, sign up for Trend Investing, my Marketplace service. I share my best investing ideas and latest articles on the latest trends that are going to change the business world. You will also get access to exclusive CEO interviews and chat room access to me, and to other sophisticated investors. I'd love to have you join our community as we look to take advantage of the hundreds of hours of work I've done to analyze the best opportunities in emerging industries, especially the electric vehicle and EV metals sector. You can learn more by reading "The Trend Investing Difference", or sign up here.

My related Trend Investing articles are:

Investing Well - 5 Key Ingredients For A Good Investment.

Top 5 Stock Picks To Consider For 2018.

Disclosure: I am/we are long BITCOIN TRACKER EUR XBT PROVIDER-ETN (COINXBE:SS), GLOBAL BLOCKCHAIN TECHNOLOGIES [TSXV:BLOC].

Jan. 8, 2018

by Matt Bohlsen

Summary

- What is a Blockchain?

- What are Cryptocurrencies? What is Bitcoin?

- Companies to play the Bitcoin and Blockchain boom.

This idea was discussed in more depth with members of my private investing community, Trend Investing.

My goal in this article is a very brief summary of what are Blockchain, Cryptocurrencies and Bitcoin. Next I will outline some options to invest in. Finally, in the conclusion I will give my views on the sector, and why you should consider investing despite the current crypto bubble/mania.

What is a blockchain?

A blockchain is a decentralized digital ledger, which is a continuously growing list of records, called blocks, which are linked and secured using cryptography. You can read more here. Being "decentralized" it is not controlled by a central body, as is the case with the current fiat currencies (USD etc).

What are Cryptocurrencies?

Cryptocurrencies are digital currencies. They use "cryptography" (encryption) to secure the transactions, to control the creation of additional units, and to verify the transfer of assets. The digital ledger (recordings) of these transactions is called the "blockchain". There are now over 1,324 different cryptocurrencies (known as "Altcoins" as they are an alternative to the original coin Bitcoin). Some of the most popular ones are Bitcoin [BTC] [XBT], Ether [ETH] (Ethereum), Litecoin [LTC], and Ripple [XRP]. You can read more about cryptos here, or view a list of cryptocurrencies here.

What is Bitcoin?

From Wikipedia -

Bitcoin is a cryptocurrency and worldwide payment system. It is the first decentralized digital currency – the system works without a central repository or single administrator. The network is peer-to-peer and transactions take place between users directly through the use of cryptography, without an intermediary. These transactions are verified by network nodes and recorded in a public distributed ledger called a blockchain. Bitcoin was invented by an unknown person or group of people under the name Satoshi Nakamoto[ and released as open-source software in 2009.

Bitcoins are created as a reward for a process known as mining. They can be exchanged for other currencies, products, and services. As of February 2015, over 100,000 merchants and vendors accepted Bitcoin as payment. Bitcoin can also be held as an investment. Research produced by Cambridge University estimates that in 2017, there are 2.9 to 5.8 million unique users using a cryptocurrency wallet, most of them using Bitcoin.

Bitcoin has a limited supply - just 21 million Bitcoins

A very key point to remember with Bitcoin is that the system was designed to reach a maximum of 21 million Bitcoins, and to date around 16.7 million have already been mined. This off course means supply is very limited, and with a growing demand we have seen the price of Bitcoin rise.

Number of Bitcoins mined

Bitcoin - 1 year chart - Current price = US$ 9,220

Source: Coindesk.com

Companies to play the Bitcoin boom

1) Buy Bitcoin [BTC] direct from a safe exchange

The most popular exchange is Coinbase.com. This would be the ideal way for investors to buy their own Bitcoin [BTC] directly. There are a few issues to watch. Not all countries can buy via Coinbase, as many are excluded. There are transactional fees when you buy, and when you move your Bitcoin to store it elsewhere. Finally if you lose your Bitcoin address/wallet/private key blockchain information then it may be impossible to recover, and you may have lost your Bitcoins.

2) Bitcoin Tracker EUR XBT Provider-ETN (COINXBE:SS) - Price = EURO 398

Bitcoin Tracker EUR is an open-end Exchange Traded Note incorporated in Sweden. The ETN provides investors with access to the returns of the underlying asset, EUR per bitcoin, less investor fees. The average EUR exchange rate of bitcoin from the exchanges:- Bitfinex, Bitstamp and OKCoin provides the underlying reference price.

The fund currently began on 10/05/2015 and has a market cap of USD 240m, and an expense ratio of 2.5%. Daily volume has varied from around 10,000 to 70,000 shares traded, showing ample liquidity.

Note: An alternative to the above fund is Bitcoin Tracker One (COINXBT:SS) by the same provider. It is in Swiss francs.

3) Bitcoin Investment Trust (OTCQX:GBTC) - Price = USD 1,563

Whilst this fund is quite accessible via the OTC market in the US, it trades at a significant premium to the current Bitcoin price. This makes it not an ideal choice at this time. You can read more on the price premium issue here.

4) Bitwise HOLD 10 Private Index Fund

The company describes their "private" fund - "The fund tracks the cryptocurrencies in the HOLD 10 Index, which is a basket of the largest (crypto) coins, weighted by inflation adjusted market capitalization and rebalanced monthly. The fund provides the security and convenience of a traditional investment vehicle. It’s currently only available to US accredited investors but we plan to launch additional funds in the future." You can read more here.

Companies to play the Blockchain boom

1) Global Blockchain Technologies Corp. [TSXV: BLOC] [GR: BWSP] (OTCPK:BLKCF) - Price = 2.40, USD 1.88

The company states:

Global Blockchain Technologies "BLOC" is an investment company that provides investors access to a mixture of assets in the blockchain space, strategically chosen to balance stability and growth. Blue chip holdings such as Ethereum and Bitcoin are complemented by best-of-breed "smaller cap" crypto holdings, many of which are not yet available to other investors. BLOC offers investors a basket of blockchain startups, small caps and blue chip holdings from team of industry pioneers, entrepreneurs. The company offers investment opportunities in initial coin offerings (ICOs).

BLOC is a Canadian investment banking company offering investors a basket of holdings within the blockchain realm, managed by a team of executives who have had a significant impact on the rise of blockchain. The company’s goal is to become the first publicly traded company with vertically integrated originators of top-tier blockchains and digital currencies. The company is also looking to list in Asia and Australia in order to offer 24-hour tradability.

The new ‘core’ team of the company is seeking to incubate about 6-12 “tokens” from startups to existing small cap companies, which it defines as those having caps of $100 million-$1 billion. In return for its initial funding and guidance, B LOC would retain a major equity stake in those firms. A combination of mature companies in the cryptocurrency market with small cap “tokens” and startups provides an effective platform for meaningful returns.

Chairman Nerayoff, a pioneer in the blockchain industry, is a serial entrepreneur who founded six companies in Silicon Valley and New York. CEO Willard, is also a pioneer in blockchains and founded the Agentic Group LLC. President Gouran, was founder of Nuovotel, one of the largest VoIP services. Kemper, CSO, is the executive director of the Blockchain Association of Canada.

Source

2) Riot Blockchain Inc. (Nasdaq:RIOT) - Price = USD 13.18

The company states on their website:

Riot Blockchain Inc is a first mover on the NASDAQ focused on blockchain technology. Riot Blockchain intends to gain exposure to the blockchain ecosystem through targeted investments in the sector, with a primary focus on the Bitcoin and Ethereum blockchains. The rollout of this strategy has commenced with strategic investments in Coinsquare.io, Tesspay.io, and Verady.com. Riot Blockchain has also launched its own Bitcoin mining operation.

Initial Coin Offerings ("ICOs")

Blockchain companies issue cryptocurrencies or other tokens through ICOs in order to raise capital. ICOs are largely unregulated, and ICO investing is like IPO investing - high risk/high reward.

Investors can view a list of 6 smaller blockchain companies here. Furthermore an indirect way to play the crypto/blockchain boom is to buy the chip makers that help the companies mine cryptos such as Nvidia (NVDA) and AMD (AMD).

For more reading I would recommend "Q&A: Why a Value Investor Decided to Buy Bitcoin."

Conclusion

I do not claim to be an expert on Bitcoin, Blockchain or Cryptos. I have been following the sector for the past year with interest, deciding if to invest. This means I am happy to learn more from others more knowledgeable than me on this topic.

My observations until now are:

1) Bitcoin is the one cryptocurrency most likely to survive. It is the original cryptocurrency, and it is the one used similar to gold to store wealth.

2) Bitcoin has a limited supply, and currently a growing demand (increasingly in the mainstream). Traditional currencies can be debased as central banks print more of it, but there will be only 21 million Bitcoins ever made. Read more here.

3) Bitcoin appears to me to offer an asymmetric risk reward. The risk of capital loss is there, but the reward of a possible 50 fold gain still remains possible if Bitcoin becomes the new global number one currency. It has been said the current value of the world's coins and banknotes is $7.6 trillion, meaning Bitcoin's value if it reached 100% the current money value of Bitcoin would be $361,000, or 36 x higher than the near $10,000 price today. So in ten years this could be closer to a 50 fold possible gain, even from today's price. Or it could be zero.

4) Blockchain will have uses across all industries and will succeed even if cryptos fail.

Given the above my viewpoint is the asymmetric risk/reward picture makes Bitcoin and blockchain compelling investments.

My approach for now is to take a position that I can afford to lose, and to buy some Bitcoin and blockchain companies now, with a very long term view. For now I will not get carried away and invest more than I can afford to lose, but neither will I sit on the sidelines and watch this huge opportunity go by.

Due to access and personal tax reasons I have chosen to buy Bitcoin via the Bitcoin Tracker EUR XBT Provider-ETN (COINXBE:SS) fund, as my retirement fund can easily buy or sell this via my online broker. It would also be wise to buy some direct bitcoin, and have some speculative money spread thinly in some Blockchain companies or Altcoins such as Ether and Litecoin etc.

As usual all comments are welcome.

Trend Investing

Thanks for reading this article. If you want to go to the next level, sign up for Trend Investing, my Marketplace service. I share my best investing ideas and latest articles on the latest trends that are going to change the business world. You will also get access to exclusive CEO interviews and chat room access to me, and to other sophisticated investors. I'd love to have you join our community as we look to take advantage of the hundreds of hours of work I've done to analyze the best opportunities in emerging industries, especially the electric vehicle and EV metals sector. You can learn more by reading "The Trend Investing Difference", or sign up here.

My related Trend Investing articles are:

Investing Well - 5 Key Ingredients For A Good Investment.

Top 5 Stock Picks To Consider For 2018.

Disclosure: I am/we are long BITCOIN TRACKER EUR XBT PROVIDER-ETN (COINXBE:SS), GLOBAL BLOCKCHAIN TECHNOLOGIES [TSXV:BLOC].

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.