Monday, November 20, 2017 1:38:53 PM

I used the last known share price of both stocks, and an conservative estimate for the settlement of 150 million based on this calculation: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=132476415

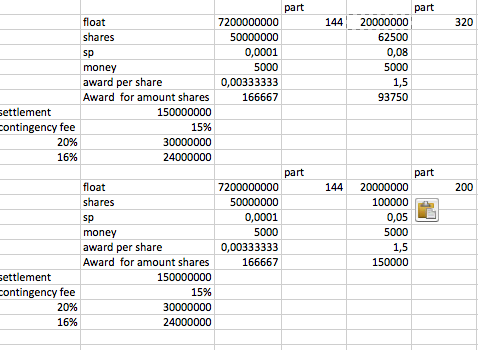

In this calculation (see image below) I went with the amount of shares $5000 dollar would buy you at this time for both GERS and BTZO

Based on the filing which shows you in my post on the BTZO board that the percentage of the windfall calculated for the common shares is 20% at GERS and 16% at BTZO (80% of GERS is owned by BTZO, so the rest theoretically owns 20% of the settlement money, and 80% of BTZO is owned by FCC, so the rest theoretically owns 20% of 80% (=16%) of the settlement money. )

The award given for $5000,- worth of BTZO shares at the last known share price of 0.0002 would get you $83.333

The award given for $5000,- worth of GERS shares at the last known share price of 0.08 would get you $93.750 if the float is 20 million shares, and $150.000 if the share price is 0.05

If you would be able to buy BTZO at 0.0001 $5000,- worth of BTZO shares would get you an award of $166.667.

All theoretically of course, if all numbers would be right and KK doesn't pull any tricks

Oohvie App Update Enhances Women's Health with Telemedicine and Online Scheduling • HLYK • Nov 11, 2024 8:00 AM

SANUWAVE Announces Record Quarterly Revenues: Q3 FY2024 Financial Results • SNWV • Nov 8, 2024 7:07 AM

DBG Pays Off $1.3 Million in Convertible Notes, which Retires All of the Company's Convertible Notes • DBGI • Nov 7, 2024 2:16 PM

SMX and FinGo Enter Into Collaboration Mandate to Develop a Joint 'Physical to Digital' Platform Service • SMX • Nov 7, 2024 8:48 AM

Rainmaker Worldwide Inc. (OTC: RAKR) Announces Successful Implementation of 1.6 Million Liter Per Day Wastewater Treatment Project in Iraq • RAKR • Nov 7, 2024 8:30 AM

SBC Medical Group Holdings and MEDIROM Healthcare Technologies Announce Business Alliance • SBC • Nov 7, 2024 7:00 AM