Monday, November 20, 2017 11:10:50 AM

$INNV A SMALL CAP BIOTECH COMPANY COULD RETURN 300% or MORE IN GAINS

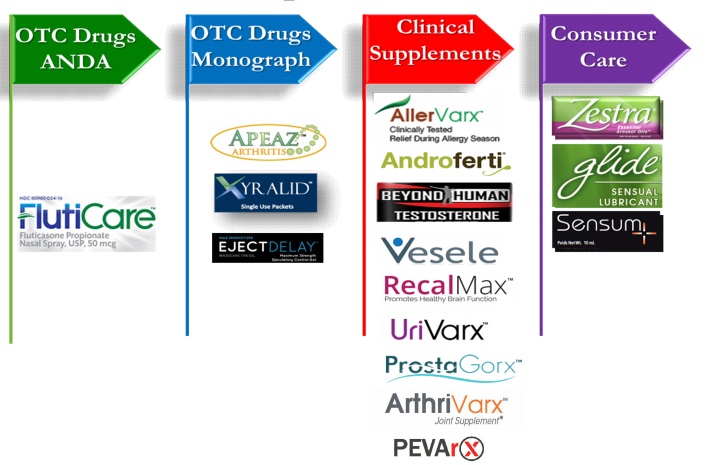

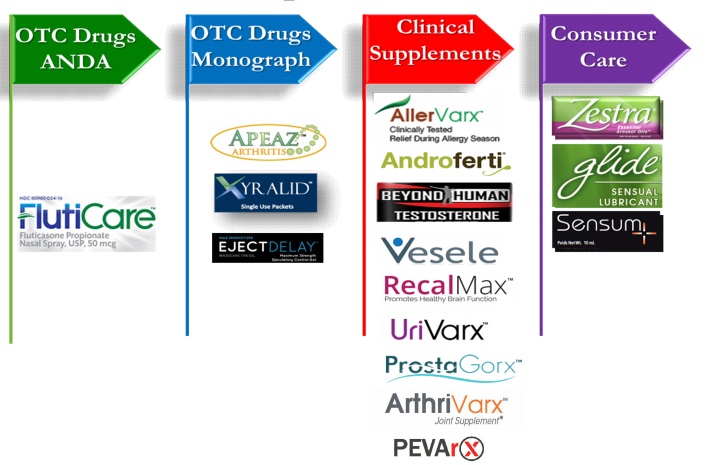

Innovus Pharmaceuticals, Inc. (OTCQB: INNV, "Innovus") is a fast-growing commercial stage pharmaceutical company that delivers safe, innovative and effective over-the-counter (OTC) medicine and a Leader in the OTC/Consumer Care Men’s and Women’s Health & Respiratory Diseases currently commercializing 21 products approved in 36 countries and on the market in 10 countries.

Their lead pipeline drug FlutiCare™ is the first and only nationally branded OTC product under approved ANDA No. 207957 in the U.S. market. FlutiCare™, which is equivalent to Flonase® by GlaxoSmithKline and ClariSpray® by Bayer, is 3rd national brand being marketed and sold in the U.S. This a big deal and a major development.

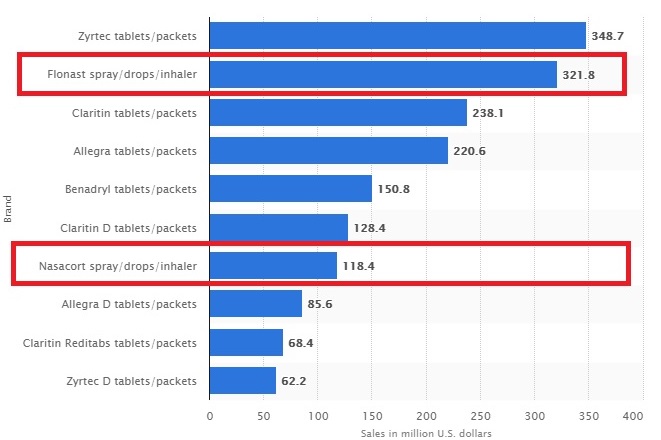

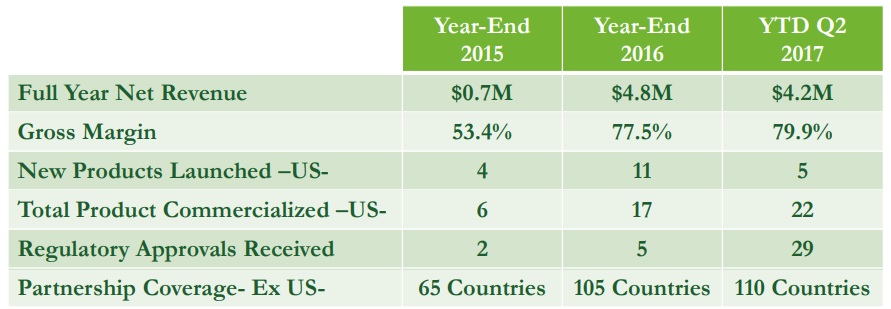

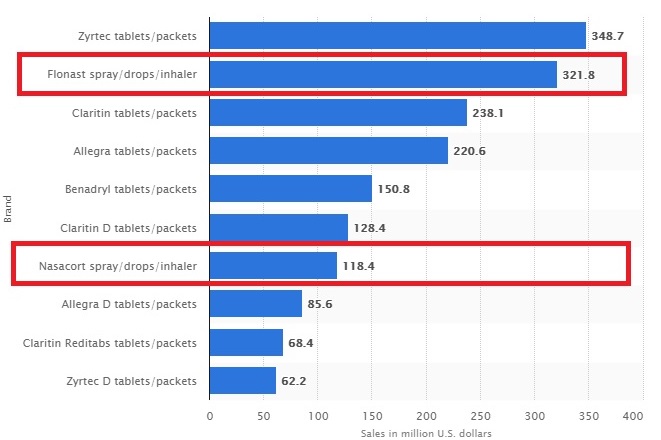

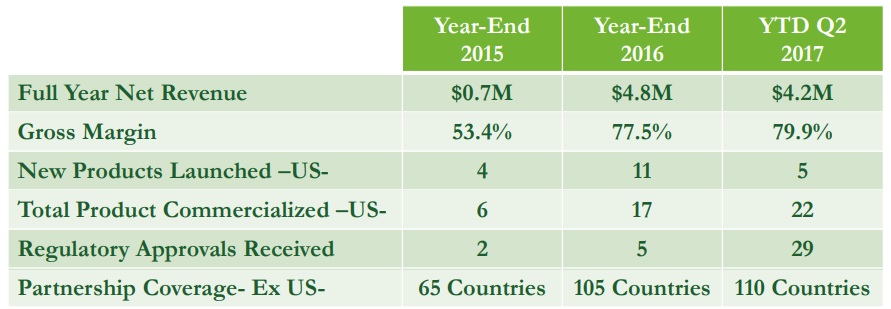

INNV per last Q filing has a strong cash position with $1,315,059 on hand, total asset of $7,677,405, and total current liabilities of $3,487,763 which is a decrease of $600k from the previous year. With a current market cap of $14,387,983 and trading around it’s 52 week low INNV is ridiculously oversold and undervalued for a biotech company despite strong revenue from existing products around ($8.2mill projected in 2017) and FlutiCare’s™ ($10-$15mill in 2017) providing significant long-term potential. To put this in perspective FlutiCare™ sales for 2018 will be around $10 - 15 million on the low end. Flonase has generated over $321 million in revenue in 2017, Nasacourt has generated over $118 million in 2017. The future bodes well for FlutiCare™ and INNV. Below is the current share structure for INNV showing 164 million in outstanding shares and a float of 108 million which is outstanding for a biotech on the verge of being profitable. A point that should not be lost is in the past 2 years has seen a boom in revenue and liabilities on the downtrend with convertible notes close to being eliminated. A fair price factoring profitable in about a few months should be in the $.50 to $1 range.

Share Structure

Market Value1 $14,387,983 a/o Nov 17, 2017

Authorized Shares 300,000,000 a/o Sep 25, 2017

Outstanding Shares 164,434,088 a/o Nov 10, 2017

-Restricted Not Available

-Unrestricted Not Available

Held at DTC Not Available

Float 108,530,426 a/o Sep 25, 2017

Par Value 0.001

Investment Highlights Courtesy of SeeThruEquity Issues who issued a Price Target of $0.65 based on solid fundamentals, current growth and upcoming revenue from FlutiCare™:

On November 14, 2017, Innovus reported 3Q17 results which demonstrated both sequential and YoY revenue growth, reflecting a growing portfolio of OTC products. Importantly, the company officially launched its newest and highest profile product line, FlutiCare™, a nasal steroid which management expects to have a transformational impact on the company. Highlights were as follows:

{}FlutiCare™ launches. INNV announced the official launch of FlutiCare™ OTC in the US on November 14, 2017. FlutiCare™ was the leading prescribed nasal steroid and form, and its OTC formulation is expected to be a significant driver of growth for Innovus in 4Q17 and 2018.

{}Innovus revenues rose by 18% to a record $2.2mn in 3Q17 versus $1.9mn in 3Q16 and were up sequentially from $2.0mn in 2Q17. Revenues for the first nine months of 2017 were $6.4mn, more than double $3.1mn in the comparable year-ago period.

{}Innovus is likely to come in towards the bottom of its guidance for $10- $15mn in revenues in 2017, due in part to the impact of weather disruptions in key markets. FlutiCare™ should be game-changing event for Innovus

Innovus officially launched FlutiCare™, a generic reformulation of Flonase® fluticasone propionate nasal spray for allergy symptoms, on November 14, 2017. The company has been building to the launch for the last year, and has previously commented that FlutiCare™ could reach annualized revenues of greater than $10mn+ by the end of its first year on the market. Although Innovus launched FlutiCare™ mid-quarter, we do expect Fluticare™ to be meaningful to sales due to pre-orders, as well as shipments in the channel through distributors Amerisource Bergen and McKesson. FlutiCare™ is expected to be available in 10,000 independent pharmacies, as well as online through INNV's Beyond Human platform, Amazon.com and Walmart.com.

Core products drive growth in 3Q17

Innovus reported 18% annual top line growth for its fiscal third quarter. Revenues rose to a record $2.2mn in 3Q17 versus $1.9mn in 3Q16, and were up 9% sequentially from $2.0mn in 2Q17. Revenues for the first nine months of 2017 were $6.4mn, well ahead of $3.1mn in the year-ago period. Revenue was driven by steady performance from the company's top five product families: Vesele®, UriVarx™,Sensum+®, Prostogorx® and Apeaz™, each of which are tracking at an annualized revenue run rate of greater than $1mn, according to management.

Price target of $0.65 for Innovus

Our price target is $0.65 for Innovus, which if achieved, represents substantial upside potential from the recent price of $0.09. The main driver of our thesis is our expectations for dramatic growth as a result of the expanding portfolio of products sold by Innovus, which should only accelerate with the launch of a potentially game-changing new product line in Fluticare™.

FlutiCare™ (fluticasone propionate nasal spray USP, 50 mcg per spray) is indicated for the temporary relief of hay fever and other upper respiratory allergies in adult and pediatric patients 4 years of age and older.

Recent Company News:

Innovus Pharma Launches FlutiCare™ OTC Nasal Spray Allergy Relief in the U.S. Announced that it has officially launched FlutiCare™ OTC in the U.S. FlutiCare™ contains the most prescribed nasal steroid active pharmaceutical ingredient (“API”) and form for nasal allergy relief over the last 7 years. The Company is launching FlutiCare™ in over 10,000 independent pharmacies, direct and through Amerisource Bergen and McKesson, via its Beyond Human® extensive print media platform and through its extensive online channels and distributors, including its own website, Amazon, and Walmart online stores. As a second phase of its launch, Innovus Pharma will launch FlutiCare™ to large retail stores.

Leading allergy remedy brands in the United States in 2017, based on sales (in million U.S. dollars)*

Being the 3rd national brand being marketed and sold in the U.S the chart above gives investors an indication of the potential revenue from FlutiCare™ given how much revenue their competitors generate.

"Having an approved ANDA drug in our product portfolio in a very large indication and being one of only three national brands in the U.S. is a great and long awaited achievement for Innovus Pharma," said Dr. Bassam Damaj,

The Company set a conservative target and currently expects between $10-15 million in additional revenue from the sales of FlutiCare™ in the U.S. in the first full 12 months from the launch date which was on Nov. 14th 2017.

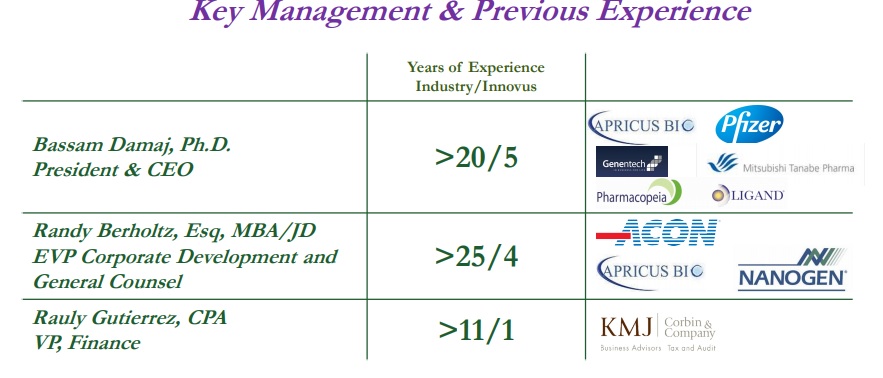

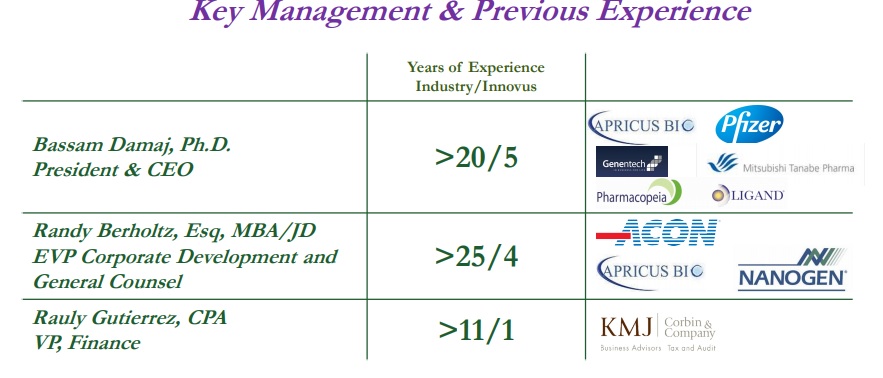

Experienced Leadership Team

Proven Track Record of Progress and Success

Innovus Pharma is a leader in Direct to Consumer Sales & Marketing. Below is an overview of their Proprietary Beyond Human® Direct to Consumer Sales & Marketing Platform.

Print Media (in ~3,000 newspapers and magazines reaching between 20-30 million consumers on a monthly basis)

~2 million consumer subscribers

Extensive online presence with over 160 websites

B2B/Bus Express/ FBA – Amazon Platfor

In addition to direct to consumer capabilities there is a well established retail distribution channel see below:

Retail Distributors

This due diligence report is courtesy of John Kent: https://twitter.com/KentsBrokerage

Biggest calls in the past 2 years:

#1 OWCP (Biotech) called at 52 week low .003-$3.50 (+116,566.67+ in gains) I provided the initial due diligence report on it

#2 SFOR (Technology) called at 52 week low .0002-.0295 (+14,650% in gains) I provided the initial due diligence report on it

#3 GIGL (RETAIL) called at 52 week low .0018-.26 (+14,344% in gains) I provided the initial due diligence report on it

Resources:

https://www.docdroid.net/jQZZsOd/innv2-dd.docx

https://finance.yahoo.com/news/seethruequity-issues-innovus-pharmaceuticals-innv-110000464.html

https://www.statista.com/statistics/194773/leading-us-cold-tablet-brands-in-2013-based-on-sales/

https://www.innovuspharma.com/pdf/AugustCorporatePresentation2017.pdf

http://www.businesswire.com/news/home/20170509005390/en/Innovus-Pharma-Announces-Commercial-Partnership-Launch-FlutiCare™

https://www.otcmarkets.com/stock/INNV/news/Innovus-Pharma-Launches-FlutiCare-trade--OTC-Nasal-Spray-Allergy-Relief-in-the-U-S-?id=175152&b=y

Innovus Pharmaceuticals, Inc. (OTCQB: INNV, "Innovus") is a fast-growing commercial stage pharmaceutical company that delivers safe, innovative and effective over-the-counter (OTC) medicine and a Leader in the OTC/Consumer Care Men’s and Women’s Health & Respiratory Diseases currently commercializing 21 products approved in 36 countries and on the market in 10 countries.

Their lead pipeline drug FlutiCare™ is the first and only nationally branded OTC product under approved ANDA No. 207957 in the U.S. market. FlutiCare™, which is equivalent to Flonase® by GlaxoSmithKline and ClariSpray® by Bayer, is 3rd national brand being marketed and sold in the U.S. This a big deal and a major development.

INNV per last Q filing has a strong cash position with $1,315,059 on hand, total asset of $7,677,405, and total current liabilities of $3,487,763 which is a decrease of $600k from the previous year. With a current market cap of $14,387,983 and trading around it’s 52 week low INNV is ridiculously oversold and undervalued for a biotech company despite strong revenue from existing products around ($8.2mill projected in 2017) and FlutiCare’s™ ($10-$15mill in 2017) providing significant long-term potential. To put this in perspective FlutiCare™ sales for 2018 will be around $10 - 15 million on the low end. Flonase has generated over $321 million in revenue in 2017, Nasacourt has generated over $118 million in 2017. The future bodes well for FlutiCare™ and INNV. Below is the current share structure for INNV showing 164 million in outstanding shares and a float of 108 million which is outstanding for a biotech on the verge of being profitable. A point that should not be lost is in the past 2 years has seen a boom in revenue and liabilities on the downtrend with convertible notes close to being eliminated. A fair price factoring profitable in about a few months should be in the $.50 to $1 range.

Share Structure

Market Value1 $14,387,983 a/o Nov 17, 2017

Authorized Shares 300,000,000 a/o Sep 25, 2017

Outstanding Shares 164,434,088 a/o Nov 10, 2017

-Restricted Not Available

-Unrestricted Not Available

Held at DTC Not Available

Float 108,530,426 a/o Sep 25, 2017

Par Value 0.001

Investment Highlights Courtesy of SeeThruEquity Issues who issued a Price Target of $0.65 based on solid fundamentals, current growth and upcoming revenue from FlutiCare™:

On November 14, 2017, Innovus reported 3Q17 results which demonstrated both sequential and YoY revenue growth, reflecting a growing portfolio of OTC products. Importantly, the company officially launched its newest and highest profile product line, FlutiCare™, a nasal steroid which management expects to have a transformational impact on the company. Highlights were as follows:

{}FlutiCare™ launches. INNV announced the official launch of FlutiCare™ OTC in the US on November 14, 2017. FlutiCare™ was the leading prescribed nasal steroid and form, and its OTC formulation is expected to be a significant driver of growth for Innovus in 4Q17 and 2018.

{}Innovus revenues rose by 18% to a record $2.2mn in 3Q17 versus $1.9mn in 3Q16 and were up sequentially from $2.0mn in 2Q17. Revenues for the first nine months of 2017 were $6.4mn, more than double $3.1mn in the comparable year-ago period.

{}Innovus is likely to come in towards the bottom of its guidance for $10- $15mn in revenues in 2017, due in part to the impact of weather disruptions in key markets. FlutiCare™ should be game-changing event for Innovus

Innovus officially launched FlutiCare™, a generic reformulation of Flonase® fluticasone propionate nasal spray for allergy symptoms, on November 14, 2017. The company has been building to the launch for the last year, and has previously commented that FlutiCare™ could reach annualized revenues of greater than $10mn+ by the end of its first year on the market. Although Innovus launched FlutiCare™ mid-quarter, we do expect Fluticare™ to be meaningful to sales due to pre-orders, as well as shipments in the channel through distributors Amerisource Bergen and McKesson. FlutiCare™ is expected to be available in 10,000 independent pharmacies, as well as online through INNV's Beyond Human platform, Amazon.com and Walmart.com.

Core products drive growth in 3Q17

Innovus reported 18% annual top line growth for its fiscal third quarter. Revenues rose to a record $2.2mn in 3Q17 versus $1.9mn in 3Q16, and were up 9% sequentially from $2.0mn in 2Q17. Revenues for the first nine months of 2017 were $6.4mn, well ahead of $3.1mn in the year-ago period. Revenue was driven by steady performance from the company's top five product families: Vesele®, UriVarx™,Sensum+®, Prostogorx® and Apeaz™, each of which are tracking at an annualized revenue run rate of greater than $1mn, according to management.

Price target of $0.65 for Innovus

Our price target is $0.65 for Innovus, which if achieved, represents substantial upside potential from the recent price of $0.09. The main driver of our thesis is our expectations for dramatic growth as a result of the expanding portfolio of products sold by Innovus, which should only accelerate with the launch of a potentially game-changing new product line in Fluticare™.

FlutiCare™ (fluticasone propionate nasal spray USP, 50 mcg per spray) is indicated for the temporary relief of hay fever and other upper respiratory allergies in adult and pediatric patients 4 years of age and older.

Recent Company News:

Innovus Pharma Launches FlutiCare™ OTC Nasal Spray Allergy Relief in the U.S. Announced that it has officially launched FlutiCare™ OTC in the U.S. FlutiCare™ contains the most prescribed nasal steroid active pharmaceutical ingredient (“API”) and form for nasal allergy relief over the last 7 years. The Company is launching FlutiCare™ in over 10,000 independent pharmacies, direct and through Amerisource Bergen and McKesson, via its Beyond Human® extensive print media platform and through its extensive online channels and distributors, including its own website, Amazon, and Walmart online stores. As a second phase of its launch, Innovus Pharma will launch FlutiCare™ to large retail stores.

Leading allergy remedy brands in the United States in 2017, based on sales (in million U.S. dollars)*

Being the 3rd national brand being marketed and sold in the U.S the chart above gives investors an indication of the potential revenue from FlutiCare™ given how much revenue their competitors generate.

"Having an approved ANDA drug in our product portfolio in a very large indication and being one of only three national brands in the U.S. is a great and long awaited achievement for Innovus Pharma," said Dr. Bassam Damaj,

The Company set a conservative target and currently expects between $10-15 million in additional revenue from the sales of FlutiCare™ in the U.S. in the first full 12 months from the launch date which was on Nov. 14th 2017.

Experienced Leadership Team

Proven Track Record of Progress and Success

Innovus Pharma is a leader in Direct to Consumer Sales & Marketing. Below is an overview of their Proprietary Beyond Human® Direct to Consumer Sales & Marketing Platform.

Print Media (in ~3,000 newspapers and magazines reaching between 20-30 million consumers on a monthly basis)

~2 million consumer subscribers

Extensive online presence with over 160 websites

B2B/Bus Express/ FBA – Amazon Platfor

In addition to direct to consumer capabilities there is a well established retail distribution channel see below:

Retail Distributors

This due diligence report is courtesy of John Kent: https://twitter.com/KentsBrokerage

Biggest calls in the past 2 years:

#1 OWCP (Biotech) called at 52 week low .003-$3.50 (+116,566.67+ in gains) I provided the initial due diligence report on it

#2 SFOR (Technology) called at 52 week low .0002-.0295 (+14,650% in gains) I provided the initial due diligence report on it

#3 GIGL (RETAIL) called at 52 week low .0018-.26 (+14,344% in gains) I provided the initial due diligence report on it

Resources:

https://www.docdroid.net/jQZZsOd/innv2-dd.docx

https://finance.yahoo.com/news/seethruequity-issues-innovus-pharmaceuticals-innv-110000464.html

https://www.statista.com/statistics/194773/leading-us-cold-tablet-brands-in-2013-based-on-sales/

https://www.innovuspharma.com/pdf/AugustCorporatePresentation2017.pdf

http://www.businesswire.com/news/home/20170509005390/en/Innovus-Pharma-Announces-Commercial-Partnership-Launch-FlutiCare™

https://www.otcmarkets.com/stock/INNV/news/Innovus-Pharma-Launches-FlutiCare-trade--OTC-Nasal-Spray-Allergy-Relief-in-the-U-S-?id=175152&b=y

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.