Friday, November 03, 2017 12:49:48 AM

Catching Data

MMgys

Nov 2/OPEN INTEREST IN SILVER SKYROCKETS PAST 203,000 CONTRACTS OR 1.02 BILLION OZ/SILVER WITHSTANDS ANOTHER ATTACK BY OUR BANKERS/JEROME POWELL NAMED FED CHAIR/BITCOIN RISES ABOVE $7,000 PER COIN/TRUMP RELEASES HIS NEW TAX REFORM AND IS MET WITH LUKEWARM RESPONSE/UBS STATES THAT IT HAS NO CHANCE IN PASSING/

November 3, 2017 · by harveyorgan · in Uncategorized · Leave a comment

GOLD: $1277.55 UP $1.55

Silver: $17.12 down 6 cents

Closing access prices:

Gold $1276.80

silver: $17.12

SHANGHAI GOLD FIX: FIRST FIX 10 15 PM EST (2:15 SHANGHAI LOCAL TIME)

SECOND FIX: 2:15 AM EST (6:15 SHANGHAI LOCAL TIME)

SHANGHAI FIRST GOLD FIX: $1300.00 DOLLARS PER OZ

NY PRICE OF GOLD AT EXACT SAME TIME: $1280.50

PREMIUM FIRST FIX: $19.50(premiums getting larger)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

SECOND SHANGHAI GOLD FIX: $1297.80

NY GOLD PRICE AT THE EXACT SAME TIME: $1278.00

Premium of Shanghai 2nd fix/NY:$19.80 PREMIUMS GETTING LARGER)

CHINA REJECTS NEW YORK PRICING OF GOLD!!!!

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

LONDON FIRST GOLD FIX: 5:30 am est $1276.40

NY PRICING AT THE EXACT SAME TIME: $1276.65

LONDON SECOND GOLD FIX 10 AM: $1279.20

NY PRICING AT THE EXACT SAME TIME. 1277.40 ??

For comex gold:

NOVEMBER/

NOTICES FILINGS TODAY FOR OCT CONTRACT MONTH: 57 NOTICE(S) FOR 5700 OZ.

TOTAL NOTICES SO FAR: 766 FOR 76,600 OZ (2.382TONNES)

For silver:

NOVEMBER

261 NOTICE(S) FILED TODAY FOR

1,305,000 OZ/

Total number of notices filed so far this month: 828 for 4,140,000 oz

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

Bitcoin: $7243 bid /$7262 offer up $489.00 (MORNING)

BITCOIN CLOSING;$7027 BID:7047. OFFER UP $273.00

end

LADIES AND GENTLEMEN:

THERE ARE MAJOR FORCES AT WORK CORNERING THE SILVER MARKET ESPECIALLY AT THE COMEX.

Let us have a look at the data for today

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

In silver, the total open interest ROSE BY A HUMONGOUS SIZED 5050 contracts from 198 ,853 UP TO 203,903 WITH YESTERDAY’S DRAMATIC TRADING IN WHICH SILVER ROSE BY A HUGE 48 CENTS. THE CROOKS ARE STILL HAVING AN AWFUL TIME TRYING TO COVER THEIR MASSIVE SILVER SHORTS SO THEY TRY TO CONTINUE WITH THEIR TORMENT. NEWBIE SPEC LONGS ENTERED THE ARENA TO WHICH THE CROOKS SUPPLIED THE NECESSARY SHORT PAPER

RESULT: A GOOD SIZED RISE IN OI COMEX WITH THE 48 CENT PRICE GAIN. OUR BANKERS COULD NOT COVER ANY OF THEIR HUGE SHORTFALL. THEY NEEDED TO SUPPLY THE NECESSARY SHORT PAPER AS NEWBIE LONGS ENTERED THE ARENA

In ounces, the OI is still represented by just OVER 1 BILLION oz i.e. 1.019 BILLION TO BE EXACT or 146% of annual global silver production (ex Russia & ex China).

FOR THE NEW FRONT OCT MONTH/ THEY FILED: 261 NOTICE(S) FOR 1,305,000 OZ OF SILVER

In gold, the open interest SURPRISINGLY FELL BY A TINY 787 CONTRACTS DESPITE THE GOOD SIZED RISE IN PRICE OF GOLD ($6.60) . The new OI for the gold complex rests at 531,131. DID SOME OF THE BANKERS CAPITULATE AND COVER?

NO EFP’S WERE ISSUED FOR THE UPCOMING NOVEMBER CONTRACT MONTH.

Result: A SMALL SIZED DECREASE IN OI DESPITE THE RISE IN PRICE IN GOLD ($6.60). WE MAY HAVE HAD A TINY AMOUNT OF GOLD SHORT COVERING BY THE BANKS. IT DOES NOT LOOK LIKE ANY EFP’S WERE ISSUED FOR NOVEMBER.

we had: 57 notice(s) filed upon for 5700 oz of gold.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

With respect to our two criminal funds, the GLD and the SLV:

GLD:

Strange! with gold up $6.60 yesterday and $1.55 today, we still had a huge withdrawal of 3.55 tonnes of gold from inventory at the GLD/

Inventory rests tonight: 846.04 tonnes.

SLV

TODAY WE HAD A TINY 137,000 OZ LEAVE THE SLV AND THIS WAS TO PAY FOR FEES ETC.

INVENTORY RESTS AT 319.018 MILLION OZ

end

.

First, here is an outline of what will be discussed tonight:

1. Today, we had the open interest in silver ROSE BY A HUGE 5050 contracts from 198,853 UP TO 203903 (AND now A LITTLE CLOSER TO THE NEW COMEX RECORD SET ON FRIDAY/APRIL 21/2017 AT 234,787) DESPITE THE FALL IN SILVER PRICE (GAIN OF 48 CENTS). OUR BANKERS WERE AGAIN UNSUCCESSFUL IN THEIR ATTEMPT TO COVER ANY OF THEIR SILVER SHORTS. NEWBIE LONGS IN SILVER ENTERED THE ARENA TO WHICH THE BANKERS WERE OBLIGED TO SUPPLY THE NECESSARY SHORT PAPER

RESULT: A GOOD SIZED INCREASE IN SILVER OI AT THE COMEX WITH THE 48 CENT GAIN IN PRICE (WITH RESPECT TO YESTERDAY’S TRADING). OUR BANKER FRIENDS WERE UNSUCCESSFUL IN THEIR ATTEMPT TO COVER ANY OF OUR SILVER SHORTS . .NO EFP’S WERE ISSUED FOR THE UPCOMING NOVEMBER CONTRACT. HOWEVER THE BANKERS DID SUPPLY NEWBIE LONGS AS THE BANKERS CONTINUED TO GO NET SHORT AS THEY FELT THEY HAD TO OBLIGE SUPPLYING THE PAPER. SILVER IS BECOMING THE NEW BITCOIN.

(report Harvey)

.

2.a) The Shanghai and London gold fix report

(Harvey)

2 b) Gold/silver trading overnight Europe, Goldcore

(Mark O’Byrne/zerohedge

and in NY: Bloomberg

3. ASIAN AFFAIRS

i)Late WEDNESDAY night/THURSDAY morning: Shanghai closed DOWN 12.60 points or .37% /Hang Sang CLOSED DOWN 75.42 pts or 0.26% / The Nikkei closed UP 119.04 POINTS OR 0.53%/Australia’s all ordinaires CLOSED DOWN 0.06%/Chinese yuan (ONSHORE) closed UP at 6.6112/Oil DOWN to 54.32 dollars per barrel for WTI and 60.23 for Brent. Stocks in Europe OPENED IN THE RED . ONSHORE YUAN CLOSED UP AGAINST THE DOLLAR AT 6.612. OFFSHORE YUAN CLOSED AT VALUE OF THE ONSHORE YUAN AT 6.613 //ONSHORE YUAN STRONGER AGAINST THE DOLLAR/OFF SHORE STRONGER TO THE DOLLAR/. THE DOLLAR (INDEX) IS WEAKER AGAINST ALL MAJOR CURRENCIES. CHINA IS VERY HAPPY TODAY.

3a)THAILAND/SOUTH KOREA/NORTH KOREA

i)North Korea//South Korea

South Korea states that there is considerable activity around North Korea’s launch site and so expect another test

(courtesy zerohedge)

b) REPORT ON JAPAN

c) REPORT ON CHINA

Rising interest costs will play a major role as bonds start to default in China. We now have our first Chinese default since the Congress: Ding Dong Dandong..a port operation located in North East China. The company is controlled by billionaire Wang WenLiang. Is Xi ready to let many of these zombies default with no rescue?

( zerohedge)

4. EUROPEAN AFFAIRS

i)Greece

Greece’s 10 yr bond yield drops to 5.05% as the Government entertains a 30 billion euro debt swap with existing bonds with their attempt at providing greater liquidity. With a debt to GDP ratio of 280%, this will become a future nightmare for those holding these bonds

( zerohedge)

ii)There is anger in the UK as sit seems the Kingdom now wishes to compromise on its divorce bill with the EU by offering more money. Citizens are furious as they do understand why they are offering even a penny

( zerohedge)

iii) As expected the Bank of England hikes rates to 0.5% with the vote at 7-2 in favour of the hike. This is the first rate hike in over 10 years

( zerohedge)

ivSpain

The Spanish public prosecutor ordered the High Court to jail the top eight members of the Catalan government.

Not good:

( zerohedge)

5. RUSSIAN AND MIDDLE EASTERN AFFAIRS

This may present itself as a problem as Bahrain has now begged its neighbours for a bailout as it ran out of dollars. They may be forced to devalue their dinar which may set off a domino effect in the region

( zerohedge)

6 .GLOBAL ISSUES

7. OIL ISSUES

Nick Cunningham discusses the breakeven position for Saudi Arabia. Although they have lowered their B/E they still have a long way to go

( Nick Cunningham OilPrice.com)

8. EMERGING MARKET

9. PHYSICAL MARKETS

i)Base metal prices along with Bitcoin are surging this week with the hottest being nickel, copper, cobalt, and lithium

( zerohedge)

ii)Once the futures market comes into play, the crooks will knock the price of Bitcoin down and manipulate it to no end just like gold and silver( Dave Kranzler/IRD)iii)We have been highlighting this to you over the past several years: Russia and China are joined at the hip and they intend to shake the dollar’s dominance. Now they join forces on a national payment system which would be a huge dagger into the heart of USA hegemony( Sharkov/Newsweek)

iv)Bitcoin explodes above 7000, then crashes by 600 dollars and then rebounds back over 7000

( zerohedge)

v) Alasdair Macleod’s commentary for the week

(Alasdair Macleod)

vi)Ron Paul is warning us that Government interest in Bitcoin makes him nervous. Me too!!

( Kitco/Ron Paul)

10. USA Stories

i)This is a very important data point for the USA and the Fed: USA manufacturing worker productivity crashes by the most in 8 years:( zerohedge)

ii)In the latest Vanity Fair issue, Donald Trump is very angry at son in law Kushner for his decisions in firing Flynn and Comey. Vanity Fair has been told that Kushner is the worst political advisor ever..

Seems that the Trump team is in disarray..

( zerohedge)

iii)Despite not getting access to the DNC servers, the Dept of Justice is considering charging 6 Russian government officials in the DNC hack. This will be a criminal complaint and it will not amuse Putin. Will he reciprocate? As this is going on between these two nations all the time>>>

( zerohedge)

iv)A strange one!! Donna Brazille former interm chair of the DNC has has accused the Clinton campaign of ‘rigging” the primaries: how Hillary controlled the finances of the DNC even before her nomination

( Politico/Donna Brazille)

v)Stay tuned to 9 pm tonight at Fox News/Sean Hannity. He hints at a Obama bomshell dropping tonight

( zerohedge)

vi)Futures are sliding and gold rising with a report that the famous Trump corporate tax cuts may be just temporary or maybe they need to phased in over 10 years..markets do not like this!!

As I promised you, tax reform just will not happen

( zero hedge)

vii)The season to start signing up for Obamacare starts on Wednesday. One should expect an increase in premiums somewhere around 34% and in some states higher. Will this be the year that it fails?

( zerohedge)

viii)Very popular Michael Snyder who is running in the first district of Idaho warns us that on November 4th, the USA will be up against an Antifa insurgency with the goal to remove Donald Trump from office

( zerohedge)

ix)Trump finally lays out his new tax cut plan. It was mildly disappointing

( zerohedge)

ix b UBS has just commented on the new tax bill and highlighted stuff that will be almost impossible to pass in both the Senate and the House. UBS agrees with David Stockman that tax reform has little chance of passing in any form…

( zerohedge/UBS)

x)The Dept of Justice is now set to block the AT and T merger with Time Warner and that sent Time Warner stock tumbling

( zerohedge)

Let us head over to the comex:

The total gold comex open interest SURPRISINGLY FELL BY A TINY 787 CONTRACTS DOWN to an OI level of 531,131 DESPITE THE GOOD RISE IN THE PRICE OF GOLD ($6.60 GAIN IN YESTERDAY’S TRADING). IT SEEMS THAT WE GOT SOME NEWBIE LONGS ENTERING THE ARENA AND PROBABLY WE HAD A BIT OF SHORT COVERING BY THE BANKERS.

NO EFP’S WERE ISSUED FOR NOVEMBER YESTERDAY.

HERE IS A SUMMARY OF EFP’S ISSUED TO LONGS IN EACH OF THE PAST 3 MONTHS:

The amount of EFP’s issued for each of the past 3 months at month’s end;

Sept: 6500

Oct 7200

Nov: 8500

Result: a SMALL SIZED open interest DECREASE WITH THE RISE IN THE PRICE OF GOLD ($5.30.) WE MAY HAVE HAD A TINY AMOUNT OF BANKER SHORT COVERING DESPITE THE HIGHER PRICE.

.

We have now entered the NON active contract month of NOVEMBER.HERE WE HAD A LOSS OF ONLY 137 CONTRACTS DOWN TO 135. We had 186 notices filed upon yesterday so surprisingly we again gained 49 contracts or 4900 additional oz will stand for delivery in this non active month of November. TO SEE BOTH GOLD AND SILVER RISE IN AMOUNT STANDING (QUEUE JUMPING) IS A GOOD INDICATOR OF PHYSICAL SHORTNESS FOR BOTH OF OUR PRECIOUS METALS.

The very big active December contract month saw it’s OI LOSE 4699 contracts DOWN to 372,240. January saw its open interest rise by one contract up to 15. FEBRUARY saw a gain of 3340 contacts up to 97,120.

.

We had 57 notice(s) filed upon today for 5700 oz

VOLUME FOR TODAY (PRELIMINARY) 167682

CONFIRMED VOLUME YESTERDAY: 399,526

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

And now for the wild silver comex results. Total silver OI ROSE BY a huge 5050 CONTRACTS FROM 198,775 UP TO 203,903 WITH YESTERDAY’S HUGE 48 CENT GAIN IN PRICE. WE HAD ZERO BANKER SHORT COVERING AS THE CROOKS TRIED AND FAILED IN THEIR ATTEMPT TO LOOSEN ANY SILVER LONGS FROM THE SILVER TREE. NO SILVER EFP’S WERE ISSUED FOR NOVEMBER. NEWBIE LONGS ENTERED THE COMEX ARENA TO WHICH THE BANKERS WERE OBLIGED TO SUPPLY THE NECESSARY SHORT PAPER.

The new front month of November saw its OI fall by 115 contracts and thus it stands at 264. We had 140 notices served upon yesterday so we gained 25 contracts or an additional 125,000 oz will stand in this non active month of November. After November we have the big active delivery month of December and here the OI rose by 1794 contracts UP to 143,592. January saw A GAIN OF 28 contracts RISING TO 711.

We had 261 notice(s) filed for 1,305,000 oz for the OCT. 2017 contract

INITIAL standings for NOVEMBER

Nov 2/2017.

Gold Ounces

Withdrawals from Dealers Inventory in oz nil oz

Withdrawals from Customer Inventory in oz

1300.000

oz

Delaware

???

Deposits to the Dealer Inventory in oz nil oz

Deposits to the Customer Inventory, in oz

9376.823 oz

Delaware

Scotia

No of oz served (contracts) today

57 notice(s)

5700 OZ

No of oz to be served (notices)

78 contracts

(7,800 oz)

Total monthly oz gold served (contracts) so far this month

766 notices

76,600 oz

2.382 tonnes

Total accumulative withdrawals of gold from the Dealers inventory this month NIL oz

Total accumulative withdrawal of gold from the Customer inventory this month xxx oz

Today we HAD 0 kilobar transaction(s)/

WE HAD nil DEALER DEPOSIT:

total dealer deposits: nil oz

We had nil dealer withdrawals:

total dealer withdrawals: nil oz

we had 2 customer deposit(s):

i) Into Delaware: 8076.823 oz

ii) Into Scotia: 1300.0000 ??

very suspect! not divisible by 32.15 therefore no kilobars.

total customer deposits 9376.823 oz

We had 2 customer withdrawal(s)

i) Out of Delaware: 1300.000 oz ???

total customer withdrawals; 1300.000 oz

we had 0 adjustment(s)

For NOVEMBER:

Today, 0 notice(s) were issued from JPMorgan dealer account and 0 notices were issued from their client or customer account. The total of all issuance by all participants equates to 57 contract(s) of which 0 notices were stopped (received) by j.P. Morgan dealer and 2 notice(s) was (were) stopped/ Received) by j.P.Morgan customer account.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

To calculate the INITIAL total number of gold ounces standing for the NOVEMBER. contract month, we take the total number of notices filed so far for the month (766) x 100 oz or 76,600 oz, to which we add the difference between the open interest for the front month of NOV. (135 contracts) minus the number of notices served upon today (57 x 100 oz per contract equals 84,400 oz, the number of ounces standing in this NON active month of NOV

Thus the INITIAL standings for gold for the NOVEMBER contract month:

No of notices served (766) x 100 oz or ounces + {(272)OI for the front month minus the number of notices served upon today (57) x 100 oz which equals 79,500 oz standing in this active delivery month of NOVEMBER (2.625 tonnes)

SOMEBODY IS IN GREAT NEED OF PHYSICAL GOLD.

WE GAINED 49 ADDITIONAL CONTRACTS OR 4900 OZ OF ADDITIONAL GOLD STANDING FOR METAL AT THE COMEX

.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Total dealer inventory 553,576.101 or 17.218 tonnes (dealer gold continues to disappear)

Total gold inventory (dealer and customer) = 8,698,111.423 or 270.54 tonnes

I have a sneaky feeling that these withdrawals of gold in kilobars are being used in the hypothecating process and are being used in the raiding of gold!

The gold comex is an absolute fraud. The use of kilobars and exact weights makes the data totally absurd and fraudulent! To me, the only thing that makes sense is the fact that “kilobars: are entries of hypothecated gold sent to other jurisdictions so that they will not be short with their underwritten derivatives in that jurisdiction. This would be similar to the rehypothecated gold used by Jon Corzine at MF Global.

IN THE LAST 14 MONTHS 82 NET TONNES HAS LEFT THE COMEX.

end

And now for silver

AND NOW THE NOVEMBER DELIVERY MONTH

NOVEMBER FINAL standings

Nov 2/ 2017

Silver Ounces

Withdrawals from Dealers Inventory nil

Withdrawals from Customer Inventory

nil oz

Deposits to the Dealer Inventory

600,307.260 oz

Brinks

Deposits to the Customer Inventory

599,880.900

oz

HSBC

No of oz served today (contracts)

261 CONTRACT(S)

(1,305,000,OZ)

No of oz to be served (notices)

1 contract

(5,000 oz)

Total monthly oz silver served (contracts) 828 contracts

(4,140,000 oz)

Total accumulative withdrawal of silver from the Dealers inventory this month NIL oz

Total accumulative withdrawal of silver from the Customer inventory this month xx oz

today, we had 1 deposit(s) into the dealer account:

i) Into Brinks: 600,307.260 oz

total dealer deposit: 600,307.260 oz

we had nil dealer withdrawals:

total dealer withdrawals: nil oz

we had 1 customer withdrawal(s):

i Out of Scotia: 311,076.520 oz

TOTAL CUSTOMER WITHDRAWAL 311,076.520 oz

We had 1 Customer deposit(s):

i) Into HSBC: 599,880.900 oz

***deposits into JPMorgan have stopped again

In the month of March and February, JPMorgan stopped (received) almost all of the comex silver contracts.

why is JPMorgan bringing in so much silver??? why is this not criminal in that they are also the massive short in silver

total customer deposits: 599,880.900 oz

we had 1 adjustment(s)

Out of CNT: 607,809.180 oz was adjusted out of the customer and this landed into the dealer account of CNT

The total number of notices filed today for the NOVEMBER. contract month is represented by 261 contracts FOR 1,305,000 oz. To calculate the number of silver ounces that will stand for delivery in NOVEMBER., we take the total number of notices filed for the month so far at 828 x 5,000 oz = 4,140,0000 oz to which we add the difference between the open interest for the front month of NOV. (264) and the number of notices served upon today (261 x 5000 oz) equals the number of ounces standing.

.

Thus the INITIAL standings for silver for the NOVEMBER contract month: 828 (notices served so far)x 5000 oz + OI for front month of NOVEMBER(264) -number of notices served upon today (261)x 5000 oz equals 4,145,000 oz of silver standing for the NOVEMBER contract month. This is EXCELLENT for this NON active delivery month of November.

We gained 25 contracts or an additional 125,000 oz will stand for metal in the non active delivery month of November

ESTIMATED VOLUME FOR TODAY: 46,855

CONFIRMED VOLUME FOR YESTERDAY: 129,767 CONTRACTS

YESTERDAY’S CONFIRMED VOLUME OF 129,767 CONTRACTS EQUATES TO 648 MILLION OZ OR 92.6% OF ANNUAL GLOBAL PRODUCTION OF SILVER

Total dealer silver: 43.213 million

Total number of dealer and customer silver: 226.793 million oz

The record level of silver open interest is 234,787 contracts set on April 21./2017 with the price at that day at $18.42

The previous record was 224,540 contracts with the price at that time of $20.44

end

NPV for Sprott and Central Fund of Canada

1. Central Fund of Canada: traded at Negative 2.5 percent to NAV usa funds and Negative 2.2% to NAV for Cdn funds!!!!

Percentage of fund in gold 62.2%

Percentage of fund in silver:37.5%

cash .+.3%( Nov 2/2017)

2. Sprott silver fund (PSLV): STOCK FALLS TO -0.83% (Nov 2 /2017)

3. Sprott gold fund (PHYS): premium to NAV RISES TO -0.37% to NAV (Nov 2/2017 )

Note: Sprott silver trust back into NEGATIVE territory at -0.83%-/Sprott physical gold trust is back into NEGATIVE/ territory at -0.37%/Central fund of Canada’s is still in jail but being rescued by Sprott.

Sprott WINS hostile 3.1 billion bid to take over Central Fund of Canada

(courtesy Sprott/GATA)

Sprott Inc. to take control of rival gold holder Central Fund of Canada

by THE CANADIAN PRESS

Posted Oct 2, 2017 8:43 am PDT

Last Updated Oct 2, 2017 at 9:20 am PDT

TORONTO – Sprott Inc. (TSX:SII) says it has struck a deal to take control of rival gold-holding firm Central Fund of Canada Ltd. (TSX:CEF.A) after a protracted takeover effort.

Toronto-based Sprott said Monday it will pay $120 million in cash and stock for Central Fund of Canada Ltd.’s common shares and for the right to administer and manage the fund’s assets.

The deal, which requires approval from Central Fund shareholders, would see its class A shareholders transferred to a new Sprott Physical Gold and Silver Trust.

Sprott says the deal would add $4.3 billion to its assets under management, which are focused largely on holding physical precious metals on behalf of clients, and 90,000 investors to its client base.

In March, Sprott tried to go through the Court of Queen’s Bench of Alberta to allow Central Fund’s class A shareholders to swap their shares to Sprott after the family that controls Central Fund rebuffed their attempt to make a deal.

Last year Sprott took over Central GoldTrust, a similar fund controlled by the same family, after securing support from more than 96 per cent of shareholder votes cast.

END

And now the Gold inventory at the GLD

NOV 2/STRANGE!!! WE HAD ANOTHER WITHDRAWAL OF 3.55 TONNES FROM THE GLD DESPITE GOLD’S RISE OF $6.60 YESTERDAY AND $1.55 TODAY/INVENTORY RESTS AT 846.04 TONNES

Nov 1/a withdrawal of 1.18 tonnes of gold from the GLD/Inventory rests at 849.59 tonnes

OCT 31/no change in gold inventory at the GLD/Inventory rests at 850.77 tonnes

Oct 30/STRANGE WITH GOLD UP THESE PAST TWO TRADING DAYS, THE GLD HAS A WITHDRAWAL OF 1.18 TONNES FROM ITS INVENTORY/INVENTORY RESTS AT 850.77 TONES

Oct 27/NO CHANGES IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 851.95 TONNES

Oct 26./A WITHDRAWAL OF 1.18 TONNES OF GOLD FROM THE GLD/INVENTORY RESTS AT 851.95 TONNES

Oct 25/NO CHANGE (SO FAR) IN GOLD INVENTORY/INVENTORY RESTS AT 853.13 TONNES

Oct 24./no change in gold inventory at the GLD/inventory rests at 853.13 tonnes

OCT 23./NO CHANGE IN GOLD INVENTORY AT THE GLD/INVENTORY REMAINS AT 853.13 TONNES

OCT 20/NO CHANGE IN GOLD INVENTORY AT THE GLD/ INVENTORY REMAINS AT 853.13 TONNES

oCT 19/NO CHANGE/853.13 TONNES

Oct 18 /no change in gold inventory at the GLD/ inventory rests at 853.13 tonnes

Oct 17./no change in gold inventory at the GLD/inventory rests at 853.13 tonnes

Oct 16/A HUGE WITHDRAWAL OF 5.32 TONNES FROM THE GLD/INVENTORY RESTS AT 853.13 TONNES

0CT 13/ NO CHANGES IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 858.45 TONNES

Oct 12/NO CHANGES IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 858.45 TONNES

Oct 10/NO CHANGES IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 858.45 TONNES

Oct 9/ANOTHER DEPOSIT OF 4.43 TONNES INTO GLD/INVENTORY RESTS AT 858.45 TONNES

Oct 6/A DEPOSIT OF 2.96 TONNES OF GOLD INVENTORY INTO THE GLD/TONIGHT IT RESTS AT 854.02 TONNES

Oct 5/A LOSS OF 3.24 TONNES OF GOLD INVENTORY FROM THE GLD/INVENTORY RESTS AT 851.06 TONNES

Oct 4/NO CHANGES IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 854.30 TONNES

oCT 3/ A HUGE WITHDRAWAL OF 10.35 TONNES FROM THE GLD/INVENTORY RESTS AT 854.30 TONNES

Oct 2/STRANGE/WITH GOLD’S CONTINUAL WHACKING WE GOT A BIG FAT ZERO OZ LEAVING THE GLD/INVENTORY RESTS AT 864.65 TONNES

SEPTEMBER 29/no changes in gold inventory at the GLD/Inventor rests at 864.65 tonnes

Sept 28/NO CHANGES IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 864.65 TONNES

Sept 27/WOW!! WITH GOLD DOWN $13.25, WE HAD A HUGE 8.57 TONNES OF GOLD ADDED TO THE GLD/

Sept 26/no changes in gold inventory at the GLD/Inventory rests at 856.08 tonnes

Sept 25./Another big deposit of 3.84 tonnes into GLD/Inventory rests tonight at 856.08 tonnes

Sept 22/with gold up only 1 dollar on the day we had a massive 6.21 tonnes of gold added to the GLD/.this is a good sign that gold will advance nicely this coming week.

Sept 21/no change in gold inventory tonight/inventory rests at 846.03 tonnes

Sept 20/no change in gold inventory tonight/inventory rests at 846.03 tonnes

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Nov 2/2017/ Inventory rests tonight at 846.04 tonnes

*IN LAST 264 TRADING DAYS: 94.91 NET TONNES HAVE BEEN REMOVED FROM THE GLD

*LAST 199 TRADING DAYS: A NET 62.E37 TONNES HAVE NOW BEEN ADDED INTO GLD INVENTORY.

*FROM FEB 1/2017: A NET 31.26 TONNES HAVE BEEN ADDED.

end

Now the SLV Inventory

NOV 2/A TINY LOSS OF 137,000 OZ BUT THAT WAS TO PAY FOR FEES LIKE INSURANCE AND STORAGE/INVENTORY RESTS AT 319.018 MILLION OZ/

Nov 1/STRANGE! WITH SILVER’S HUGE 48 CENT GAIN WE HAD NO GAIN IN INVENTORY AT THE SLV/INVENTORY RESTS AT 319.155 MILLION OZ/

Oct 31/no change in silver inventory at the SLV/Inventory rests at 319.155 million oz

Oct 30/STRANGE!WITH SILVER UP THESE PAST TWO TRADING DAYS, WE HAD A HUGE WITHDRAWAL OF 1.133 MILLION OZ FROM THE SLV/INVENTORY RESTS AT 319.155 MILLION OZ/

Oct 27/NO CHANGE IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 320.288 MILLION OZ

Oct 26/NO CHANGE IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 320.288 MILLION OZ/

Oct 25/NO CHANGE IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 320.288 MILLION OZ

Oct 24/no change in inventory at the SLV/inventory rests at 320.288 million oz/

oCT 23./STRANGE!!WITH SILVER RISING TODAY WE HAD A HUGE WITHDRAWAL OF 1.039 MILLION OZ/inventory rests at 320.288 million oz/

OCT 20NO CHANGE IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 321.327 MILLION OZ

oCT 19/INVENTORY LOWERS TO 321.327 MILLION OZ

Oct 18 no change in silver inventory at the SLV/inventory rest at 322.271 million oz

Oct 17/ A MONSTROUS WITHDRAWAL OF 3.494 MILLION OZ FROM THE SLV/INVENTORY RESTS AT 322.271 MILLION OZ

Oct 16/ NO CHANGES IN SILVER INVENTORY AT THE SLV.INVENTORY RESTS AT 325.765 MILLION OZ

oCT 13/ NO CHANGES IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 325.765 MILLION OZ

Oct 12/THE LAST TWO DAYS WE LOST 1.113 MILLION OZ FROM THE SLV/INVENTORY RESTS AT 325.765 MILLION OZ

Oct 10/NO CHANGE IN INVENTORY AT THE SLV/INVENTORY RESTS AT 326.898 MILLION OZ/

Oct 9/A HUGE DEPOSIT OF 1.227 MILLION OZ INTO THE INVENTORY OF THE SLV/INVENTORY RESTS AT 326.898 MILLION OZ

Oct 6/NO CHANGE IN SILVER INVENTORY/ INVENTORY RESTS AT 325.671 MILLON OZ

Oct 5/ANOTHER WITHDRAWAL OF 944,000 OZ FROM THE SLV/INVENTORY RESTS AT 325.671 MILLION OZ

OCT 4/NO CHANGE IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 326.615 MILLION Z

Oct 3/A TINY WITHDRAWAL OF 143,000 FROM THE SLV FOR FEES/INVENTORY RESTS AT 326.615 MILLION OZ

Oct 2/NO CHANGES IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 326,757 MILLION OZ

SEPTEMBER 29/no changes in silver inventory at the SLV/inventory rests at 326.757 million oz/

Sept 28/NO CHANGES IN SILVER INVENTORY/INVENTORY RESTS AT 326.757 MILLION OZ/

Sept 27/STRANGE!! SILVER IS HIT FOR 24 CENTS YESTERDAY AND. 9 CENTS TODAY AND YET NO CHANGE IN SILVER INVENTORY/INVENTORY RESTS AT 326.757 MILLION OZ

Sept 26./no change in silver inventory at the SLV/.inventory rests at 326.757 million oz

Sept 25./ a big deposit of 1.842 million oz into the SLV/inventory rests at 326.757 million oz/

Sept 22/no change in silver inventory at the SLV/Inventory rests at 324.915 million oz/

Sept 21/no change in silver inventory at the SLV/Inventory rests at 324.915 million oz

Sept 20/no changes in silver inventory/Inventory remains at 324.915 million oz

Nov 2/2017:

Inventory 319.018 million oz

end

6 Month MM GOFO

Indicative gold forward offer rate for a 6 month duration

+ 1.43%

12 Month MM GOFO

+ 1.63%

30 day trend

end

Major gold/silver trading/commentaries for THURSDAY

GOLDCORE/BLOG/MARK O’BYRNE.

GOLD/SILVER

Why Switzerland Could Save the World and Protect Your Gold

GoldCore's picture

by GoldCore

Nov 2, 2017 8:47 AM

Why Switzerland Could Save the World and Protect Your Gold

– Precious metals advisor Claudio Grass believes Switzerland can serve as an example to rest of world

– Switzerland popular for gold storage due to understanding of the risks inherent in fiat money and gold’s value as a store of wealth.

– International investors opt to store gold in Swiss allocated accounts due to tradition of respecting private property.

– Country respects the importance of gold ownerships and 70% of world’s gold is refined there

Across Europe many voters and politicians are expressing their dislike at the bureaucratic and overarching approach of the European Union. There are also regions and countries pushing to break ties with others that they have long been associated with. Catalonia is just the most recent example, many in Scotland are also calling for independence.

It is not an understatement to say that the role and influence of government is currently at the forefront of many citizens’ minds. This is understandable given political upheaval but also thanks to decisions by authorities that are arguably not in the best interests of the electorate. Bail-ins are just one very important example.

This is a situation investors must consider when deciding where they would like to store their gold bullion. It is because of concerns regarding political stability, motive and financial decisions that there is a belief amongst many bullion owners that owning bullion in Switzerland is safer than owning it in many EU countries, the UK and the U.S.

Claudio Grass, an Swiss independent precious metals advisor, recently spoke to the Mises Institute about Switzerland. In the interview he explains why the country is so attractive for investors.

The introduction by the Mises Institute notes that Switzerland is attractive as its political approach differentiates it from other countries. By taking a subsidiary function, the result is major limitations being placed on central political power structures at the federal level.

Switzerland is no libertarian paradise. It has bureaucrats and a wayward central bank. But it remains an astonishing modern example of the principles of federalism and subsidiarity in action. In fact, it exemplifies Lew Rockwell’s daydream: nobody much knows or cares who is president. Its federal administrative state demonstrates humility instead of hubris. And virtually all political decisions, from taxes to welfare to immigration, are decided locally. Claudio Grass joins Jeff Deist to discuss what libertarians can learn from Switzerland, and how neutrality in two disastrous European wars shapes Swiss DNA today.

Readers can watch the full interview with Claudio Grass, below.

Investors interested in protecting their wealth and looking for ways to diversify their assets should consider holding allocated gold bullion in Switzerland

In our Essential Guide to Gold Storage in Switzerland we clearly explain why the country remains the preferred destination for many Western and international retail and institutional investors. It takes just three simple steps to create a GoldCore secure storage account in Switzerland.

The Swiss people understand the importance of gold in wealth management and preservation and the importance of storing bullion in a secure, independent and stable jurisdiction that specialises in discretion and confidentiality.

News and Commentary

Dollar Slips With Treasury Yields; Stocks Mixed (Bloomberg.com)

Gold prices up; focus on pick for U.S. Fed chair (Reuters.com)

Gold holds gains after Fed says it will leave rates unchanged (Reuters.com)

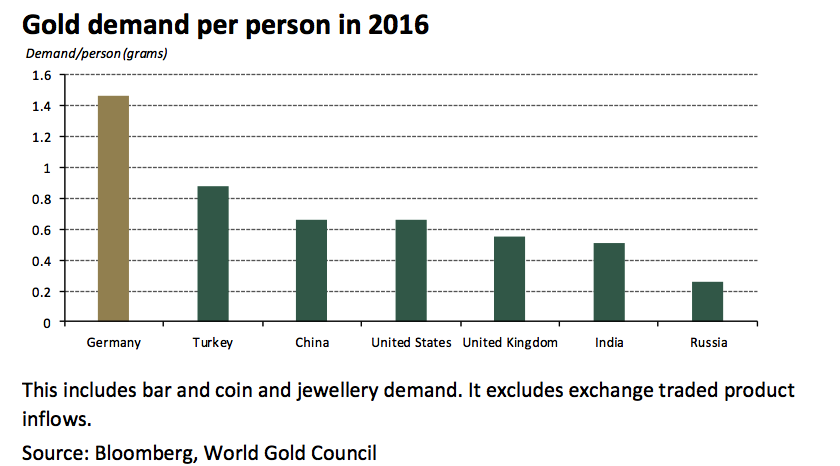

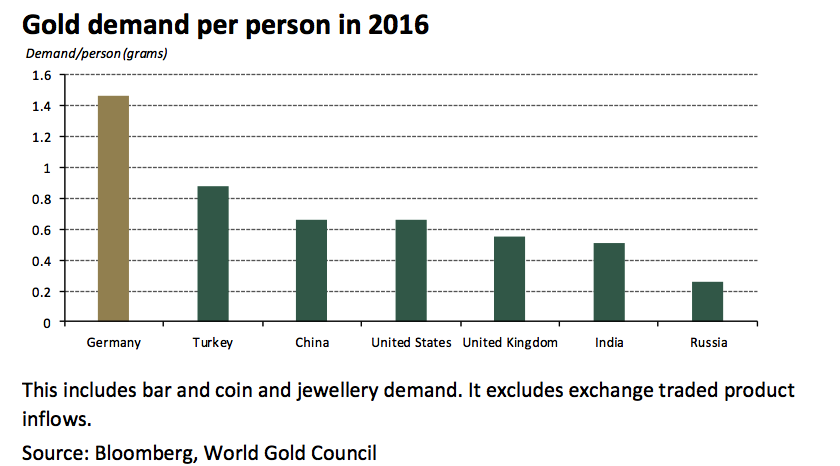

Germany fears EUROZONE MELTDOWN: German investors rush to buy gold (Express.co.uk)

Fed Signals December Hike On Track a Day Before Trump Announces Next Chair (Bloomberg.com)

Powell to Lead Fed Overseeing Trump Economy Fraught With Risks (Bloomberg.com)

What If the Bank of England Doesn’t Raise Rates? (Bloomberg.com)

The World Is Running Out of Gold, Should You Invest? (Fortune.com)

BITCOIN vs. GOLD: Which One’s A Bubble And How Much Energy Do They Really Consume (GoldSeek.com)

China’s gold consumption grows in Jan-Sept (Xinhuanet.com)

Gold Prices (LBMA AM)

02 Nov: USD 1,276.40, GBP 965.09 & EUR 1,095.92 per ounce

01 Nov: USD 1,279.25, GBP 961.48 & EUR 1,099.52 per ounce

31 Oct: USD 1,274.40, GBP 964.21 & EUR 1,095.60 per ounce

30 Oct: USD 1,272.75, GBP 966.91 & EUR 1,093.80 per ounce

27 Oct: USD 1,267.80, GBP 968.35 & EUR 1,090.18 per ounce

26 Oct: USD 1,278.00, GBP 968.34 & EUR 1,082.34 per ounce

Silver Prices (LBMA)

02 Nov: USD 17.08, GBP 12.98 & EUR 14.66 per ounce

01 Nov: USD 16.94, GBP 12.74 & EUR 14.55 per ounce

31 Oct: USD 16.82, GBP 12.72 & EUR 14.45 per ounce

30 Oct: USD 16.74, GBP 12.69 & EUR 14.39 per ounce

27 Oct: USD 16.72, GBP 12.76 & EUR 14.38 per ounce

26 Oct: USD 16.97, GBP 12.84 & EUR 14.37 per ounce

Recent Market Updates

– Invest In Gold To Defend Against Bail-ins

– Stumbling UK Economy Shows Importance of Gold

– Wozniak and Thiel Fuel Bitcoin-Gold Debate: Gold Comes Out On Top

– Russia Buys 34 Tonnes Of Gold In September

– Gold Will Be Safe Haven Again In Looming EU Crisis

– Gold Is Valuable Due to “Extreme Rarity” – Must See CNN Video

– Gold Is Better Store of Value Than Bitcoin – Goldman Sachs

– Next Wall Street Crash Looms? Lessons On Anniversary Of 1987 Crash

– Key Charts: Gold is Cheap and US Recession May Be Closer Than Think

– Gold Up 74% Since Last Market Peak 10 Years Ago

– How Gold Bullion Protects From Conflict And War

– Silver Bullion Prices Set to Soar

– Brexit UK Vulnerable As Gold Bar Exports Distort UK Trade Figures

end

Base metal prices along with Bitcoin are surging this week with the hottest being nickel, copper, cobalt, and lithium

(courtesy zerohedge)

Nickel Price Surging As Hype Escalates During LME Week

It’s LME Week and there’s cause for celebration in metal markets.European mining stocks rose to a 4-year high as the nickel price surged more than 5% intraday to a two-year high and rose by the daily limit in Shanghai trading today. Metals used in electronic vehicles, like lithium, cobalt, copper and nickel, are hot right now and a focal point of discussion at the LME gatherings. As Metal Bulletin noted, the 2017 event has seen record attendance.

The annual LME Dinner week kicked off in a positive note, with record numbers gathering for the exchange’s keynote metals seminar on Monday October 30. “We have over 900 people over the day here…which is a record attendance,” London Metal Exchange chief executive officer (CEO) Matthew Chamberlain said.

Despite relatively high inventories, big miners and metal traders are becoming increasingly bullish on nickel’s prospects. According to Bloomberg…

Glencore Plc and Trafigura Group Pte are often at loggerheads, but one thing they agree on: the nickel market will be transformed by the rise of electric cars. Nickel sulphate, a key ingredient in lithium-ion batteries, will see demand increase 50 percent to 3 million metric tons by 2030, Saad Rahim, chief economist at Trafigura, said in an interview. While other battery metals like cobalt and lithium have more than doubled since the start of last year, nickel prices have been subdued because of large inventories.

“When you look structurally, we should start to get bullish now,” Rahim said.

“Are you going to be able to meet that demand when the time comes, given underinvestment in the supply side?”

Glencore, which was devastated by the downturn in nickel, is also optimistic, as are some of the analysts, as Bloomberg notes…

(Glencore) told analysts recently that nickel production would need to increase 1.2 million tons by 2030, equal to more than half of current global output, to keep up with demand from the battery industry. Prices are currently more than double what it costs Glencore to mine the metal. It’s a surprising mood change for a market with a disastrous reputation. Nickel was long a thorn for Glencore, which was saddled with unprofitable operations following its takeover of Xstrata. It sold an Australian nickel mine, which Xstrata bought in 2007 for $2.4 billion, for just $19 million in 2015.

“The nickel industry’s been a bit of a dog since about 2007,” Oliver Ramsbottom, a partner at McKinsey & Co. in Tokyo, said by phone.

The battery industry could revive the fortunes of miners more than a decade after nickel collapsed from a peak of $51,600 a ton in 2007

Despite the hype, Bloomberg cautions that there are still naysayers highlighting elevated inventories and the potential for supply to ramp-up faster than currently expected.

Still, some analysts are skeptical that the bullish scenarios will play out. Electric cars are still a niche industry and nickel oversupply remains a threat, with current stockpiles four times bigger than since the start of 2012.

Indonesia has authorized its largest producer to export more nickel ore. The Philippines has also discussed ending a ban on open-pit mining, raising concerns that supply will spike.

“For years, the market has completely dismissed the idea that something positive could happen in nickel,” Ingrid Sternby, senior research analyst at Blenheim Capital Management LLP, said in an interview in London. “With the recent announcements about Indonesia and the Philippines, it’s easy to see why the market is still scary enough for people not to want to be involved…

“You can see the tightness ahead in the nickel market, but my concern is that we’re going to see a lot of value destroyed along the way,” said Colin Hamilton, managing director for commodities research at BMO Capital Markets Ltd.

“If the miners really believe in the EV growth story, the thing to do would be to keep the nickel in the ground until the deficit arrives.”

When assessing the prospects for nickel, it is really two separate markets, nickel alloyed with iron and nickel sulphate used in batteries. Bloomberg expects the latter to progressively trade at a premium to the former.

About half of global nickel production is in the form of ferronickel or nickel pig iron, which is nickel alloyed with iron, making it suitable for stainless steel. Battery makers, instead, use nickel sulphate, produced by dissolving pure nickel metal in sulphuric acid. One hope is that the pricing of nickel pig iron and the high-grade nickel sulphate will diverge in the coming years, improving the fortunes of miners that can produce battery-quality material.

The global nickel market is heading for a deficit once above-ground stockpiles of battery-grade metal are consumed, according to Wood Mackenzie. The question for miners is how quickly the premium for top-quality nickel will emerge.

The nickel alloy versus nickel sulphate certainly adds complexity to analysing nickel. However, while the fundamentals for the latter seem very positive, it makes us slightly nervous when record numbers of participants gather at industry jamborees.

Still, politicians and automakers are increasingly counting on a future of electric cars, attracting traders such as Trafigura.

“Will we see a real breakout in next 12 months? That’s hard to see, but beyond that, structurally this looks to be going up,” Rahim said.

END

Once the futures market comes into play, the crooks will knock the price of Bitcoin down and manipulate it to no end just like gold and silver

(courtesy Dave Kranzler/IRD)

Dave Kranzler: Will the new bitcoin CME futures contract benefit gold?

Submitted by cpowell on Wed, 2017-11-01 18:20. Section: Daily Dispatches

2:20p ET Wednesday, November 1, 2017

Dear Friend of GATA and Gold:

Dave Kranzler of Investment Research Dynamics today elaborates on the likelihood that futures contracts keyed to the price of bitcoin will facilitate price manipulation of the crypto-currency by governments and central banks that already get volume trading discounts on futures exchanges. Kranzler’s commentary is headlined “Will the New Bitcoin CME Futures Contract Benefit Gold?” and it’s posted at the IRD site here:

http://investmentresearchdynamics.com/will-the-new-bitcoin-cme-futures-c…

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

CPowell@GATA.org

END

We have been highlighting this to you over the past several years: Russia and China are joined at the hip and they intend to shake the dollar’s dominance. Now they join forces on a national payment system which would be a huge dagger into the heart of USA hegemony

(courtesy Sharkov/Newsweek)

Russia and China talk about joining forces to shake dollar’s dominance

Submitted by cpowell on Wed, 2017-11-01 23:38. Section: Daily Dispatches

By Damien Sharkov

Newsweek, New York

Wednesday, November 1, 2017

Russia and China could join forces in linking their national payment systems, to rival Western alternatives, Russian Prime Minister Dmitry Medvedev said at an event in Beijing.

Underlining the success of China’s Unionpay system and Beijing’s efforts to internationalize its currency, the yuan, Medvedev told a press conference in Beijing that Russia was developing its own payment system, known as Karta Mir

“At the moment it is being discussed whether Karta Mir should be linked to Chinese payment systems in some way,” Medvedev said Wednesday, according to Russian state news agency Itar-Tass.

Russia first began work on Karta Mir in the aftermath of its political fallout with the West over Moscow’s annexation of Crimea and ensuing war in Ukraine in 2014.

Standing next to his Chinese counterpart Li Keqiang, Medvedev said the system would allow people “to use the card in payments both on the territory of Russia and the territories of other countries.

“I think this has great prospects, which can allow to avoid problems that arise with the use of American payment systems. I am referring to Visa, MasterCard, and others like them.” …

… For the remainder of the report:

http://www.newsweek.com/russia-and-china-talk-joining-forces-shake-dolla…

END

Alasdair Macleod..

Alasdair Macleod: Gold, GoldMoney, and Mene

Submitted by cpowell on Thu, 2017-11-02 01:16. Section: Daily Dispatches

By Alasdair Macleod

GoldMoney.com, St. Helier, Channel Islands

Wednesday, November 1, 2017

Gold, ornamentation, and money: that was the sequence of events. Man discovered gold, found it malleable, durable, and attractive. It was first used for ornamentation, then as social economics evolved into the division of labour, its value as ornamentation and its physical properties made it the most enduring medium for money. Even to this day, Asians representing most of the world’s population still understand this connection between gold, ornamentation, and money.

Goldmoney has recently backed a new venture, Mene. Mene manufactures and retails gold and platinum jewellery at prices tied to market values for the physical metal, with a buy-back option, again linked to the market price. The objective is to re-establish the link between the use of precious metals as money and as a medium of exchange.

Westerners in the developed world have mostly forgotten the linkage, but this is only in relatively modern times. Nor was this some passing fancy of the Eurasian continent, where gold’s and silver’s use as money is as old as any recorded civilisation. …

… For the remainder of the commentary:

https://www.goldmoney.com/research/goldmoney-insights/gold-goldmoney-and

END

Bitcoin explodes above 7000, then crashes by 600 dollars and then rebounds back over 7000

(courtesy zerohedge)

Bitcoin Explodes Above $7000.. Then Crashes $600

If you like your volatile cryptocurrency, you can keep your cryptocurrency…

image courtesy of CoinTelegraph

Following a seemingly endless stream of ‘good news’ – Bitcoin futures, Amazon rumors, Fork dividends, multiple nations moving towards adoption – Bitcoin exploded this mornng to a new record high $7354… up 29% for the week.

Then it crashed $650 to $6700…

Once again it seems Ether is being sold to fund the Bitcoin buys..

As CoinTelegraph notes, with Bitcoin’s increasing acceptance by Wall Street financiers and traders, the sky is quite literally the limit for the digital currency. While Bitcoin’s $116 bln market capitalization is large by the cryptocurrency world’s standards, it’s minuscule in comparison to the $639 tln derivatives market. If even the tiniest fraction of those funds were to enter Bitcoin, its value would be inconceivable.

end

Ron Paul is warning us that Government interest in Bitcoin makes him nervous. Me too!!

(courtesy Kitco/Ron Paul)

Ron Paul Warns “Government Interest In Bitcoin Makes Me Nervous”

Former presidential candidate Ron Paul urged legalization of all competing cryptocurrencies to fiat during a televised phone interview with The Street’s Daniela Cambone, Editor-in-Chief for Canadian outlet Kitco News…

As Coinivore reports, Paul noted how the trend seems to be that the government waits until something grows successful enough and then attempts to severely restrict it with regulations.

“If Bitcoin is a really good deal and a good process,” he said, “rest assured the government will be looking at it very carefully.”

Government interest in Bitcoin “makes me a little bit nervous,” he added, “people should be very cautious.”

As for currency competition, “If the people want Bitcoin and want to use it, the government should stay out of it,” he told Cambone.

Paul also alluded to the IRS’s attempt to force popular Bitcoin exchange Coinbase into handing over the names of its customers in an effort to prosecute possible tax evasive clients.

He explained there is “too much surveillance already on how cryptocurrencies are transferred, and how the reports have to be made by the exchanges to the IRS.”

Paul also discussed his views on prices going forward of gold versus the dollar, warned about government involvement in cryptocurrency, specifically Bitcoin, and whether cryptocurrency was taking away from gold’s thunder.

“Are you a believer in the cryptocurrencies?” Cambone asked.

“Well,” Paul began, “I’d have to talk about the world ‘believable.’ I take some very strong political positions on competing currencies. I want to legalize all competing currencies. And if you can come up with a competing currency, and there is no fraud, I think it should be,” he stressed.

“Quite frankly,” he admitted, “I don’t understand the technology of cryptocurrencies. I just want to make sure no fraud is involved. But I am also concerned about the government involvement.”

When Paul was further pressed whether he considered Bitcoin “real money” he said no.

“Does it represent real money to you?” Cambone further asked the former presidential candidate.

“Not to me, no, it doesn’t,” Paul answered. “But if it serves the voluntary exchanges of people, and serves the purpose of exchanging wealth, … it could act as if it were money ….” he stated.

“Some say Bitcoin is stealing the thunder away from gold,” Cambone continued, “and that’s one of the reasons the yellow metal is not rallying further. Do you agree with this?”

“I think that’s a very strong possibility,” he considered. “I am amazed,” he laughed, “at all the capitalization on these cryptocurrencies. It’s a huge amount of money,” Paul emphasized.

We have definitely reached peak gold as China’s gold producing capabilities plunge a full 10%

(courtesy Steve St Angelo/SRSRocco Report)

BREAKING: China – World’s Largest Gold Producer Mine Supply Plummets 10%

by SRSrocco

Nov 2, 2017 10:50 AM

SRSrocco

By the SRSrocco Report,

The world’s top gold producer saw its mine supply plummet by 10% in the first half of 2017. According to the GFMS World Gold Survey newest update, China’s gold production in 1H 2017 fell the most in over a decade. The fall in Chinese gold production is quite significant as the country will have to increase its imports to make up the shortfall in its mine supply

The data in the GFMS 2017 Q3 Gold Survey Update & Outlook reported that Chinese gold mine supply declined 23 metric tons to 207 metric tons in the 1H 2017 versus the 230 metric tons during the same period last year:

The report stated the reason for the decline in Chinese gold production was due to the government’s increased efforts to curb pollution as well as heightened awareness of environmental protection. Furthermore, GFMS analysts forecast that Chinese gold production will continue to deteriorate for the remainder of the year as production is scaled down.

This is undoubtedly bad news for a country that is not only the world’s largest gold producer but also because China consumes all of its domestic mine supply. To get an idea just how far China is ahead of the rest of the pack, take a look at the following chart:

Last year, Chinese gold mine supply of 454 metric tons (mt), was 56% higher than second-ranked Austraila at 291 mt. These eight top gold mining countries produced 56% of the total world’s supply of 3,222 mt in 2016. Lastly, you will notice that South Africa came in last place at 150 mt. However, South Africa was the leading gold supplier in the world in 1970, when it produced a staggering 1,000 mt:

Also, isn’t it ironic that the U.S. dropped the Gold-Dollar peg (Aug. 1971) the year after South African’s gold production peaked? Regardless, South African gold production is now down 85% from its peak in 1970. For those individuals who don’t believe in the theory of Peak Gold or Peak Oil, stick around a few years… and you will become a believer.

Now, there seems to be another interesting development as it pertains to Chinese gold production. Unless China experiences a considerable rebound of its gold mine supply over the next several years, 2014 may turn out to be its ultimate production peak:

According to the figures reported in the GFMS 2017 World Gold Survey, China’s gold production reached a peak of 478 mt in 2014 and is estimated to decline to 415 mt* this year (*415 mt is my estimate based on GFMS data). If the forecast for 2017 is correct, China’s gold production will have fallen 13% from its peak in 2014. Moreover, if the world experiences a huge market correction and economic contraction in 2018, there’s a high probability that Chinese gold production will have peaked in 2014.

Lastly, the peak and decline of global gold production will likely mark the time of the peak and fall of the global economy. Now, I am not saying this occurs the very same year, but it will be a gauge to pinpointing the very time when reached the SENECA CLIFF.

Lastly, if you haven’t checked out our new PRECIOUS METALS INVESTING section or our new LOWEST COST PRECIOUS METALS STORAGE page, I highly recommend you do.

Check back for new articles and updates at the SRSrocco Report.

end

A good summary on Agnico Eagle:

(seeking alpha)

Agnico Eagle – Solid As Gold

Nov. 2, 2017 3:11 PM ET

|

About: Agnico Eagle Mines Limited (AEM), Includes: ABX, NEM

Fun Trading

Fun Trading

Special situations, contrarian, long/short equity, value

(7,535 followers)

Summary

Agnico Eagle announced a very impressive gold production of 453,847 Oz (produced). In fact, It is a multi-year record.

The company felt confident to increase the dividend by 10% this quarter, to $0.44 annually or 1% yearly.

I recommend accumulating AEM on any weakness under $43 with a long-term perspective.

Courtesy: Mining.com – Meadowbank site.

Investment Thesis:

Agnico Eagle (AEM) is one of my main investments in the “gold miner” segment, with Newmont Mining (NEM) and more recently Barrick Gold (ABX). It is a strong company who owns nine first-class mines producing, with a strong pipeline of projects that allows it, to render a reliable long-term guidance.

As we all know, owning gold works well as a hedge against inflation/US dollar and it is the traditional rationale behind why I am keeping a constant gold holding. This belief is true at least for the long-term, albeit it is highly debatable for the short and midterm.

I always have allotted about 10% of my total portfolio to precious metals (Gold, Platinum, and Palladium mainly) for this exact long-term strategy and it has been rewarding. the practical question is to select good gold stocks with limited risks and a long-term growth potential. Sean Boyd, CEO said in the conference call:

Very, very strong quarter both from a production standpoint and from a cost standpoint. We set a record quarterly production number of a little over 450,000 ounces at a total cash cost of $546 an ounce and our all-in sustaining costs continued to be below $800 an ounce. That quarterly production was driven by good solid performance on – across all of the mines,

Thus, investing in the gold majors such as Agnico Eagle makes sense, as long as the balance sheet is showing a cloudless horizon ahead.

This article explains why I believe Agnico Eagle is a perfect case.

Balance Sheet and Production in 3Q’2017.

Agnico Eagle 2Q’15 3Q’15 4Q’15 1Q’16 2Q’16 3Q’16 4Q’16 1Q’17 2Q’17 3Q’17

Total Revenues in $ Million 510.1 508.8 482.9 490.5 537.6 610.9 499.2 547.5 549.9 580.0

Net Income in $ Million 10.1 1.3 -15.5 27.8 19.0 49.4 62.7 76.0 61.9 71.0

EBITDA $ Million 196.5 163.6 194.0 190.6 210.0 269.1 286.6 254.9 218.0 241.6

Profit margin % (0 if loss) 2.0% 0.3% 0 5.7% 3.5% 8.1% 12.5% 13.9% 11.3% 12.2%

EPS diluted in $/share 0.05 0.01 -0.08 0.13 0.08 0.22 0.27 0.33 0.26 0.30

Cash from operations in $ Million 188.4 143.7 140.8 145.7 229.5 282.9 120.6 222.6 184.0 194.1

Capital Expenditure [TTM] in $ Million 453.2 450.2 449.8 467.6 479.3 482.4 516.1 544.0 613.0 744.4

Free Cash Flow (Ychart) in $ Million 76.8 21.3 7.8 45.0 106.2 157.3 -46.0 94.0 -8.3 -62.9

Cash and short term investments $ Billion 0.21 0.24 0.16 0.23 0.56 0.73 0.64 0.93 1.08 0.99

Long term Debt in $ Billion 1.20 1.22 1.13 1.08 1.20 1.20 1.20 1.20 1.37 1.37

Dividend per share in $ 0.08 0.08 0.08 0.08 0.08 0.10 0.10 0.10 0.10 0.11

Shares outstanding (diluted) in Million 216.7 217.7 218.5 222.9 225.2 227.7 227.8 229.3 233.5 233.8

Gold Production 2Q’15 3Q’15 4Q’15 1Q’16 2Q’16 3Q’16 4Q’16 1Q’17 2Q’17 3Q’17

Gold Production K Oz 443.7 441.1 422.3 411.3 408.9 416.2 426.4 418.2 427.7 454.4

AISC $/Oz 864 759 813 797 848 821 830 741 785 789

Gold price realized $/Oz 1,196 1,119 1,094 1,192 1,268 1,332 1,198 1,223 1,260 1,282

Gold Production details:

All-in sustainable cost AISC is one of the lowest in the industry and has been under $800/ Oz for the last three quarters — One of the best AISC among its peers — For example, Barrick Gold (ABX) is slightly below at $772 and Newmont Mining (NEM) indicated an AISC well over $900 per ounce, as we can see below.

Agnico Eagle announced a very impressive gold production of 453,847 Oz(produced). In fact, It is a multi-year record. La Ronde, a producing mine since 1988, did particularly well with 105,345 Oz produced this quarter. This is due mainly to the higher gold grade in the lower part of the mine.

Gold production increased 6.1% sequentially.

Production Guidance revised again this quarter:

Sean Boyd indicated in the conference call that, as the result of the record production for the third quarter the company expects to exceed 1.68 Million ounces compared to the preceding target of 1.62 Million ounces, an increase of 3.7%. The AISC for 2017 is expected to be $10 lower as well.

Agnico Eagle – Technical analysis.

AEM is yielding no clear technical analysis sign beside a weak ascending broadening wedge pattern with a debatable support line around $43-$42. This is considered a bearish pattern (80%) and it may suggest a negative breakout with a re-test of the $40 low in December.

However, it is always important to look at the gold price situation before concluding anything logical here. Gold is lightly up today in Fed-related trading and could give the support needed? The FOMC said:

On a 12-month basis, both inflation measures have declined this year and are running below 2 percent. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed, on balance.

However, this status quo situation is not lowering the risk of a rate hike in December, which may limit the upside for the gold price, trading a few dollars up today as I am writing.

Commentary:

Agnico Eagle reported its 3Q’17 results on October 25. It was another impressive quarter with strong operational performance — including a record in gold production — and a full-year production guidance increased. Production is a strong positive for the company which owns a unique pipeline of new projects that will fuel future growth.

On the negative side, Agnico Eagle is not creating free cash flow (-23.2 million yearly) assuming a realized gold price under the $1,300/ Oz threshold. A least, it is what we can see clearly for 3Q’16.

Gold Production 1Q’15 2Q’15 3Q’15 4Q’15 1Q’16 2Q’16 3Q’16 4Q’16 1Q’17 2Q’17 3Q’17

Gold price (realized)$/Oz 1,202 1,196 1,119 1,094 1,192 1,268 1,332 1,198 1,223 1,260 1,282

Nonetheless, the company felt confident to increase the dividend by 10% this quarter, to $0.44 annually or 1% yearly, which is still quite modest and represents a payout of $103 million a year.

I am expecting a gold price around $1,280-$1,290 per ounce for 4Q’17. ($1,296 as we speak) or slightly better than 3Q’17. Based on the revised 2017 production of 1.68 M Oz production for 4Q’17 will be around 380K Oz as I explained above. The company may sell some inventory and will be around 400K in gold production sold, nonetheless, I still see a gap of 5% expected for the next quarter.

Finally, on the debt front, the company has an excellent balance sheet with a low net debt of $380 million.

I believe the picture is worth a thousand words here. Agnico Eagle is a long-term investment without any doubt. However, some issues need to be addressed, especially regarding free cash flow that is less than stellar. It is quite surprising considering that AISC is under $800 per ounce and may suggest too much capital expenditures.

I recommend accumulating AEM on any weakness under $43 with a long-term perspective.

Important note: Do not forget to follow me on AEM and other gold stocks. Thank you for your support.

Your early THURSDAY morning currency, Asian stock market results, important USA/Asian currency crosses, gold/silver pricing overnight along with the price of oil Major stories overnight/9 AM EST

i) Chinese yuan vs USA dollar/CLOSED UP AT 6.612/shanghai bourse CLOSED DOWN AT 12.60 POINTS .37% / HANG SANG CLOSED DOWN 75.42 POINTS OR 0.26%

2. Nikkei closed UP 119.04 POINTS OR 0.53% /USA: YEN FALLS TO 114.08

3. Europe stocks OPENED RED EXCEPT LONDON /USA dollar index FALLS TO 94.65/Euro UP TO 1.1649

3b Japan 10 year bond yield: FALLS TO +.055/ GOVERNMENT INTERVENTION !!!!(Japan buying 100% of bond issuance)/Japanese yen vs usa cross now at 114.07/ THIS IS TROUBLESOME AS BANK OF JAPAN IS RUNNING OUT OF BONDS TO BUY./JAPAN 10 YR YIELD FINALLY IN THE POSITIVE/BANK OF JAPAN LOSING CONTROL OF THEIR YIELD CURVE AS THEY PURCHASE ALL BONDS TO GET TO ZERO RATE!!

3c Nikkei now JUST BELOW 17,000

3d USA/Yen rate now well below the important 120 barrier this morning

3e WTI:: 54.32 and Brent: 60.23

3f Gold UP/Yen UP

3g Japan is to buy the equivalent of 108 billion uSA dollars worth of bond per month or $1.3 trillion. Japan’s GDP equals 5 trillion usa./“HELICOPTER MONEY” OFF THE TABLE FOR NOW /REVERSE OPERATION TWIST ON THE BONDS: PURCHASE OF LONG BONDS AND SELLING THE SHORT END

Japan to buy 100% of all new Japanese debt and by 2018 they will have 25% of all Japanese debt. Fifty percent of Japanese budget financed with debt.

3h Oil DOWN for WTI and DOWN FOR Brent this morning

3i European bond buying continues to push yields lower on all fronts in the EMU. German 10yr bund RISES TO +.388%/Italian 10 yr bond yield UP to 1.803% /SPAIN 10 YR BOND YIELD UP TO 1.484%

3j Greek 10 year bond yield FALLS TO : 5.05???

3k Gold at $1276.50 silver at:17.10: 6 am est) SILVER NEXT RESISTANCE LEVEL AT $18.50

3l USA vs Russian rouble; (Russian rouble DOWN 4/100 in roubles/dollar) 58.23

3m oil into the 54 dollar handle for WTI and 60 handle for Brent/

3n Higher foreign deposits out of China sees huge risk of outflows and a currency depreciation (already upon us). This can spell financial disaster for the rest of the world/China forced to do QE!! as it lowers its yuan value to the dollar/GOT A TINY SIZED REVALUATION NORTHBOUND

JAPAN ON JAN 29.2016 INITIATES NIRP. THIS MORNING THEY SIGNAL THEY MAY END NIRP. TODAY THE USA/YEN TRADES TO 114.08 DESTROYING JAPANESE CITIZENS WITH HIGHER FOOD INFLATION

30 SNB (Swiss National Bank) still intervening again in the markets driving down the SF. It is not working: USA/SF this morning 0.9992 as the Swiss Franc is still rising against most currencies. Euro vs SF is 1.1641 well above the floor set by the Swiss Finance Minister. Thomas Jordan, chief of the Swiss National Bank continues to purchase euros trying to lower value of the Swiss Franc.

3p BRITAIN VOTES AFFIRMATIVE BREXIT/LOWER PARLIAMENT APPROVES BREXIT COMMENCEMENT/ARTICLE 50 COMMENCES MARCH 29/2017

3r the 10 Year German bund now POSITIVE territory with the 10 year RISING to +0.388%

The bank withdrawals were causing massive hardship to the Greek bank. the Greek referendum voted overwhelming “NO”. Next step for Greece will be the recapitalization of the banks and that will be difficult.

4. USA 10 year treasury bond at 2.370% early this morning. Thirty year rate at 2.859% /

5. Details Ransquawk, Bloomberg, Deutsche bank/Jim Reid.

(courtesy Jim Reid/Bloomberg/Deutsche bank/zero hedge)

Traders On Hold As “Super Thursday” Looms

Yesterday’s brief late night dip in ES has been promptly bought with US equity futures fractionally lower, Asian shares inching higher on Thursday and Europe unchanged ahead of today’s Super Thursday, where we get the Republican tax bill revealed shortly before noon, the BoE’s rate hike announcement, and Trump appointing Jay Powell as the next Fed chair, as well as as earnings from companies including Apple and Starbucks. With the dollar dropping slightly, markets seem to have taken a shine to the euro and EM FX, specifically your high beta currencies.

“There is some element of uncertainty about the U.S. tax bill and next Fed chief, and this is having an effect on the U.S. market, though shares in Asia appear quite resilient today,” said Ayako Sera, senior market economist at Sumitomo Mitsui Trust. “Still, it would not be surprising if some investors used the uncertainty as a reason to take profits after recent strong gains,” she said.

Among the main events today, and as widely reported yesterday, the White House plans to nominate current Fed Governor Jerome Powell as the next chair when Janet Yellen’s term expires in February, a source familiar with the matter said on Wednesday. Powell’s nomination, which would need to be confirmed by the Senate, is expected later on Thursday before President Donald Trump leaves on a trip to Asia. Rising expectations that Trump will tap Powell, who is seen as more dovish on interest rates, have pressured U.S. Treasury yields and kept the dollar on the backfoot this week, according to Reuters.

The progress toward American tax reform is also on most investors’ radars, alongside corporate earnings and Friday’s U.S. jobs report. There have been conflicting reports about when and how the U.S. tax rate on companies would be lowered. US GOP tax bill said to propose 12% repatriation tax on cash and 5% rate on non-cash holdings. US House Republicans were reported to be mulling a corporate tax phase out after 10 years, while US House Tax Committee Chairman Brady said that a permanent corporate tax reduction could require several steps.

On Wednesday, the Fed held policy steady as expected and emphasized rising economic growth as well as a strengthening labor market, while downplaying the impact of recent hurricanes. Investors took that as a sign the U.S. central bank is on track for another hike next month, with federal fund futures putting the odds of a December rate hike at about 85% according to Bloomberg calculations.

With regards to the BoE, the market prices in a 90% probability of a hike today. Our economists see the outlook for the meeting as tilted towards hawkish messaging on the outlook for rates next year, at least relative to market pricing. But they struggle to see this as credible without more certainty over Brexit and more evidence of faster wage growth.

Both the dollar and sterling lag G-10 peers as investors awaited central bank news from both sides of the Atlantic, with BOE forecast to raise rates for the first time in a decade and Trump said to nominate Powell as the next Fed Chair. Bund futures set fresh day lows after soft French, Spanish auctions drive broad EGB weakness. Gilt and Treasury futures dip, though trade in tight ranges. European stocks mostly lower, with DAX leading losses while Italy’s FTSE MIB outperforms; health care leads sector declines, Sanofi weighing after trimming the outlook for its diabetes business. Rally in base metals pauses; most metals drop on LME, led by zinc and nickel.

In global equity markets, European stocks were little changed near their highest level since 2015 amid a slew of earnings, as investors braced for the BOE’s first rate hike in more than a decade. The Stoxx 600 rose 0.1%, with real estate shares leading gains, led by Intu Properties which rose after saying it sees sustained retailer demand and rising rents. Credit Suisse climbed as its assets under management rise to a record. Playtech slumped, dragging on travel-and-leisure shares after forecasting full-year performance below the bottom end of estimates. The U.K.’s FTSE 100 holds steady ahead of the BOE rate decision on Thursday.

Asian shares were mixed as a rally that drove prices to the highest level in 10 years showed signs of tiring. Materials stocks led gains in Asia amid a surge in nickel prices this week to a two-year high. The yen strengthened against the U.S. dollar after the Powell news hit the tap.e The MSCI Asia Pacific Index gained 0.1% percent to 169.86 as of 4:19 p.m. in Hong Kong, with the materials sector gauge touching a five-year high. Nickel has jumped 10 percent this week through Wednesday to the highest level since June 2015, while some investors are betting iron ore will command higher prices next year. Honda Motor Co. was the biggest boost to the index after raising its guidance and announcing a new shareholder returns policy. News about Trump’s decision to nominate Powell, first reported by the Wall Street Journal, followed the central bank’s policy statement that reinforced expectations of a rate hike in December and said growth in the world’s largest economy was “solid.” Investors expect the appointment of Powell, the Fed’s only Republican, to be an extension of the dovish policies under Janet Yellen that have contributed to the rise in global stock markets. “The biggest factor for today’s gain is the sudden rally of nickel prices on Tuesday and Wednesday, as its surge affects miners in Indonesia, Australia and New Zealand, in the midst of recent rallies of crude and iron ore,” said Seo Sang-young, a strategist at Kiwoom Securities.

China stocks retreated as small caps fell to a one-month low. The ChiNext Index of small-cap and tech shares was the biggest loser Thursday, dropping to a one-month low, while the Shanghai Composite Index also declined and stocks in Hong Kong gave up earlier gains. The SHCOMP lost 0.3% to 3383, facing strong resistance at 3400; mid & small-caps selloff continues, Nasdaq-style Chinext down 1.3%. Tesla-related stocks tumbled as Elon Musk said Tesla would not spend major capital in China until 2019.

After initially rising following a strong ADP report, Treasury yields then fell on Wednesday and the yield curve flattened the most since 2007 after the Treasury Department said it would keep auction sizes steady in the coming months, despite the Fed’s plan to reduce its bond holdings. 10-year yields were at 2.359% in Asian trading, compared to their U.S. close of 2.376% on Wednesday, when they dipped as low as 2.349% . German 10Y yields rose one bps to 0.39 percent, the highest in a week. Britain’s 10% yield also climbed to 1.356 percent, +1bp, the highest in a week, while Japan’s 10Y declined 0.055 percent, -1bp, the lowest in four weeks.

In commodities, crude oil futures steadied, with Brent crude up 7 cents at $60.56 per barrel and U.S. crude down 1 cent at $54.29. While oil settled lower on Wednesday after weekly U.S. government inventory data showed the latest crude stock draw was not as big as an industry trade group had reported, both Brent and U.S. crude futures remain near their highest levels since July 2015 as lower global supply pushed markets higher. Gold gained 0.1% to $1,276.34 an ounce, the highest in more than a week. Copper fell 0.7% to $3.12 a pound.

Elsewhere, bitcoin extended gains for the fourth consecutive day, hitting $7,000 to establish a fresh record.

Bulletin headline Summary from RanSquawk

Markets subdued as anticipation on the BoE

USD finds some support following overnight weakness, as Trump intends to select Powell as the next Fed Chair

Looking ahead, highlights include The BoE Rate Decision and QIR, Fed’s Powell, Dudley and Bostic

Market Snapshot

S&P 500 futures down 0.2% to 2,570.25

STOXX Europe 600 up 0.02% to 396.85

MSCi Asia up 0.1% to 169.84

MSCI Asia ex Japan down 0.05% to 556.24

Nikkei up 0.5% to 22,539.12

Topix up 0.4% to 1,794.08

Hang Seng Index down 0.3% to 28,518.64

Shanghai Composite down 0.4% to 3,383.31

Sensex down 0.04% to 33,588.29

Australia S&P/ASX 200 down 0.1% to 5,931.71

Kospi down 0.4% to 2,546.36

Gold spot up 0.1% to $1,276.28

U.S. Dollar Index down 0.2% to 94.67

German 10Y yield rose 1.1 bps to 0.384%

Euro up 0.2% to $1.1636

Brent futures down 0.4% to $60.28/bbl

Italian 10Y yield fell 2.3 bps to 1.538%

Spanish 10Y yield unchanged at 1.475%

Top headline News from Bloomberg

President Donald Trump plans to nominate Federal Reserve Governor Jerome Powell to the top job at the U.S. central bank, according to people familiar with the decision. The annoucement is due at 3 p.m. Washington time.

“Not only is he the continuity candidate given he is already on the Fed board, but he also has a good working relationship with the current FOMC,” Michael Hewson, chief market analyst at CMC Markets, writes of Powell.

House Republican leaders plan to unveil a tax bill Thursday that would cut the corporate tax rate to 20 percent — though it may not stay there. The decision may come down to congressional scorekeepers who’ll assess the effect on the federal deficit

Euro-zone manufacturing PMI increased to 58.5 in October — the highest since February 2011 and the second-highest in over 17 years, as companies boost hiring to cope with a surge in orders that is set to last

Japan’s Government Pension Investment Fund posted its fifth-straight quarterly gain, the longest run in more than two years, as global stocks advanced to new highs and weakness in the yen helped boost the value of overseas investments

Bitcoin climbed past $7,000 for the first time, breaching another milestone less than one month after it tore through the $5,000 mark

North Korea is working on an advanced version of the KN-20 intercontinental ballistic missile that could potentially reach U.S., CNN reports, citing unidentified U.S. official

Tesla Inc. still hasn’t figured out how to overcome manufacturing challenges that threaten its viability as an automaker, with battery factory- line glitches pushing out production targets for the Model 3 sedan

While Credit Suisse Group AG wasn’t immune to the third- quarter trading slump, Chief Executive Officer Tidjane Thiam’s pivot to wealth management drove assets to a record as the bank predicted continued strong performance

After two rocky days in Congress, Facebook and Twitter face rising momentum for regulation of political ads to curb Russian election meddling, although some key Republicans remain skeptical and urged the companies to do a better job on their own

German Unemployment Extends Decline as Economy Powers Ahead

Sex-Harassment Storm Hits U.K. Political Elites Amid Brexit

Asian equity markets were mostly subdued as region failed to sustain the early momentum from US, where stocks printed fresh intraday record levels before some profit taking crept in. Furthermore, a deterioration in sentiment coincided amid a continued pullback in US equity futures due to tax plan uncertainty, with reports now suggesting the plan could include a phase out in corporate taxes after a decade. As such, ASX 200 (-0.1%) finished negative with financials pressured after big 4 NAB announced to drop 6,000 workers. Elsewhere, Nikkei 225 (+0.3%) was indecisive but extended on 21-year highs nonetheless, while Hang Seng (-0.2%) and Shanghai Comp. (-0.7%) were lower after the PBoC skipped its liquidity operations. Finally, 10yr JGBs saw marginal gains as they tracked upside in T-notes and amid an indecisive risk tone in Japan, while the BoJ were also in the market for JPY 710bln of JGBs in the belly to super-long end.

European Equity markets have traded mixed, with little way of direction, as participation focus moves to 12:00GMT and the BoE. Sectors also trade rangebound, with Telecoms out-performing, marginally so, up 0.30% with financials behind, as expectations are on a hike from the UK Central Bank. Healthcare and IT pull the bourses lower however, both down 0.50%. Fixed Income markets follow the subdued trading fashion, with yields relatively stagnant. Much attention was on auctions from Spain and France, particularly the former, as an increased scope has been on Spain following the recent political turmoil.

In FX, the central bank week continued yesterday evening, as the FOMC’s retained rates between 1.00% – 1.25%. Markets were seemingly unfazed, with much of the Greenback’s hinging on President Trump’s announcement of the next Fed chair, with market expectation increasingly looking toward an appointment of Governor Powell. The Dollar Index saw some selling pressure as we entered the morning’s Asian session, finding some support around the 94.40 area as Europeans came to market, aided by the rate hike expectations for Dec increasing to 92%, from a previous 83%. EUR/USD looks towards key support at last week’s low at 1.15, as GBP/USD trades in a range-bound fashion, as full focus is on the BoE interest rate decision. Sterling traders will await the MPC’s decision, followed by Carney’s 12.30 press conference 30 minutes later, with expectations on a 25bps hike (>90%) from the Central Bank. Concerns remain toward data from the UK however, with a larger trade deficit, weaker retail sales and manufacturing activity, accompanied by a slowdown in CPI growth, all possibly still on the mind of the MPC members. EUR/GBP trades around a key support level, above the 0.8750, despite the break seen yesterday, offers do remain around these levels.

In commodities, oil news has been light today, with the highlight coming from the SOMO stating Southern Iraqi Crude exports stood at 3.35mln bpd in October (3.24mln bpd in Sep). Markets are unfazed, with WTI consolidating within the day’s range.. Saudi Energy Minister Al-Falih said he expects oil market to continue proving and producers to renew resolve to normalize stockpiles. Kuwait said it sees oil output cut being announced in Vienna and that the length of extension and other alterations could be announced in Feb-Mar. (Newswires) OPEC wants to see the floor for oil prices at USD 60/bbl in 2018, according to a source familiar with Saudi oil thinking.

US Event Calendar

7:30am: Challenger Job Cuts YoY, prior -27.0%

8:30am: Initial Jobless Claims, est. 235,000, prior 233,000; Continuing Claims, est. 1.89m, prior 1.89m

8:30am: Nonfarm Productivity, est. 2.6%, prior 1.5%; Unit Labor Costs, est. 0.4%, prior 0.2%

9:45am: Bloomberg Consumer Comfort, prior 51

DB’s Jim Reid concludes the overnight wrap