| Followers | 1446 |

| Posts | 13730 |

| Boards Moderated | 4 |

| Alias Born | 09/16/2015 |

Thursday, October 26, 2017 10:28:21 AM

MUST READ THIS DD - $ATPT .002 pps. No Convertible debts and liabilities only 26k total and No Preferred shares issued as of 21 filings issued 10/17/17-10/18/17. Yes. 21 audited filings. This is headed multi penny on continued company validations and verifications. This connections are incredible and it behooves an investor to take a look here at the fundamentals :::

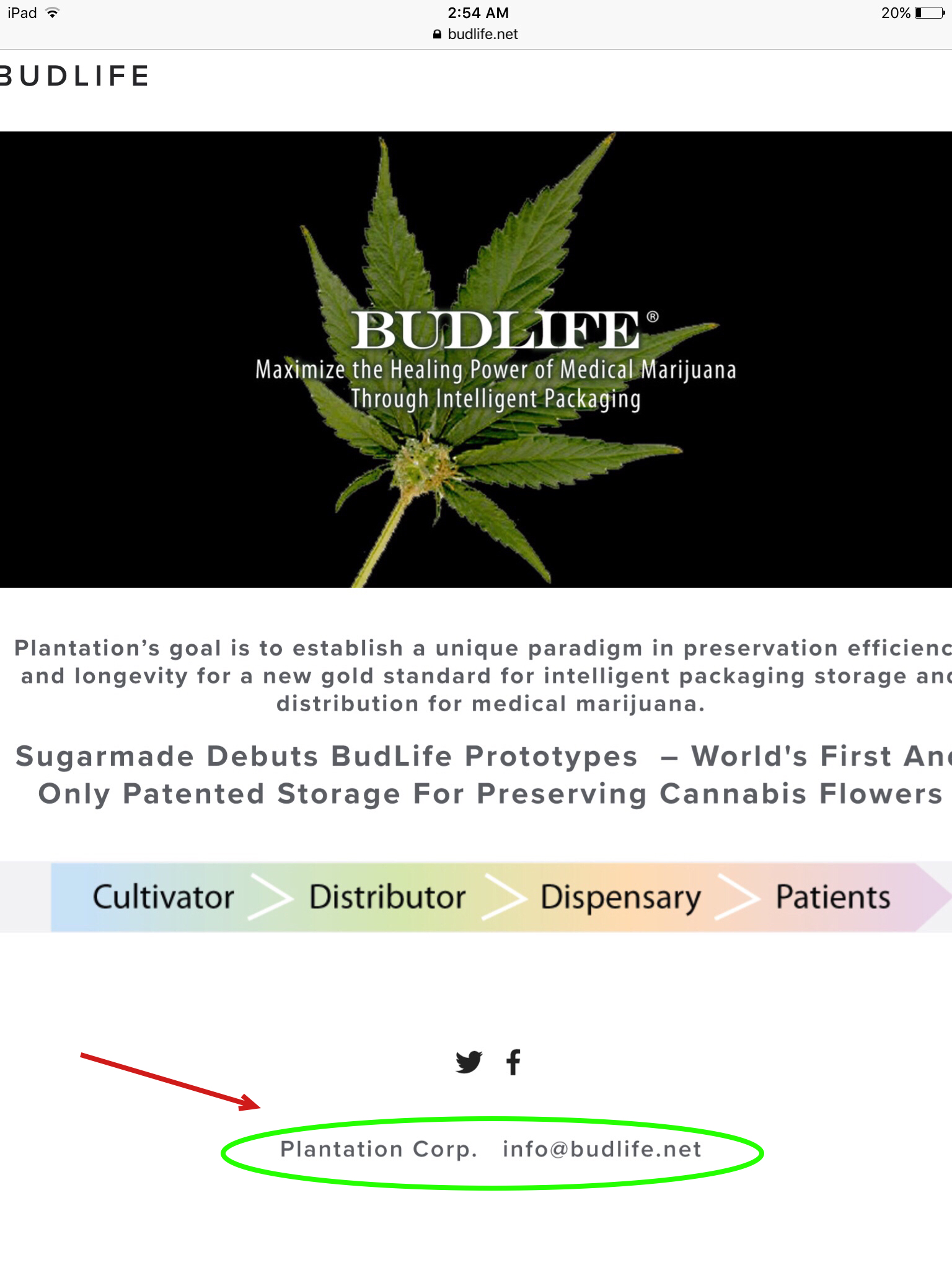

Clear Connections to private company - and recently merged MJ company Plantation Corp. aka www.budlife.net - who has a huge patented MJ packaging deal with OTC stock- SugarMade- $SGMD announced 8/24/17.

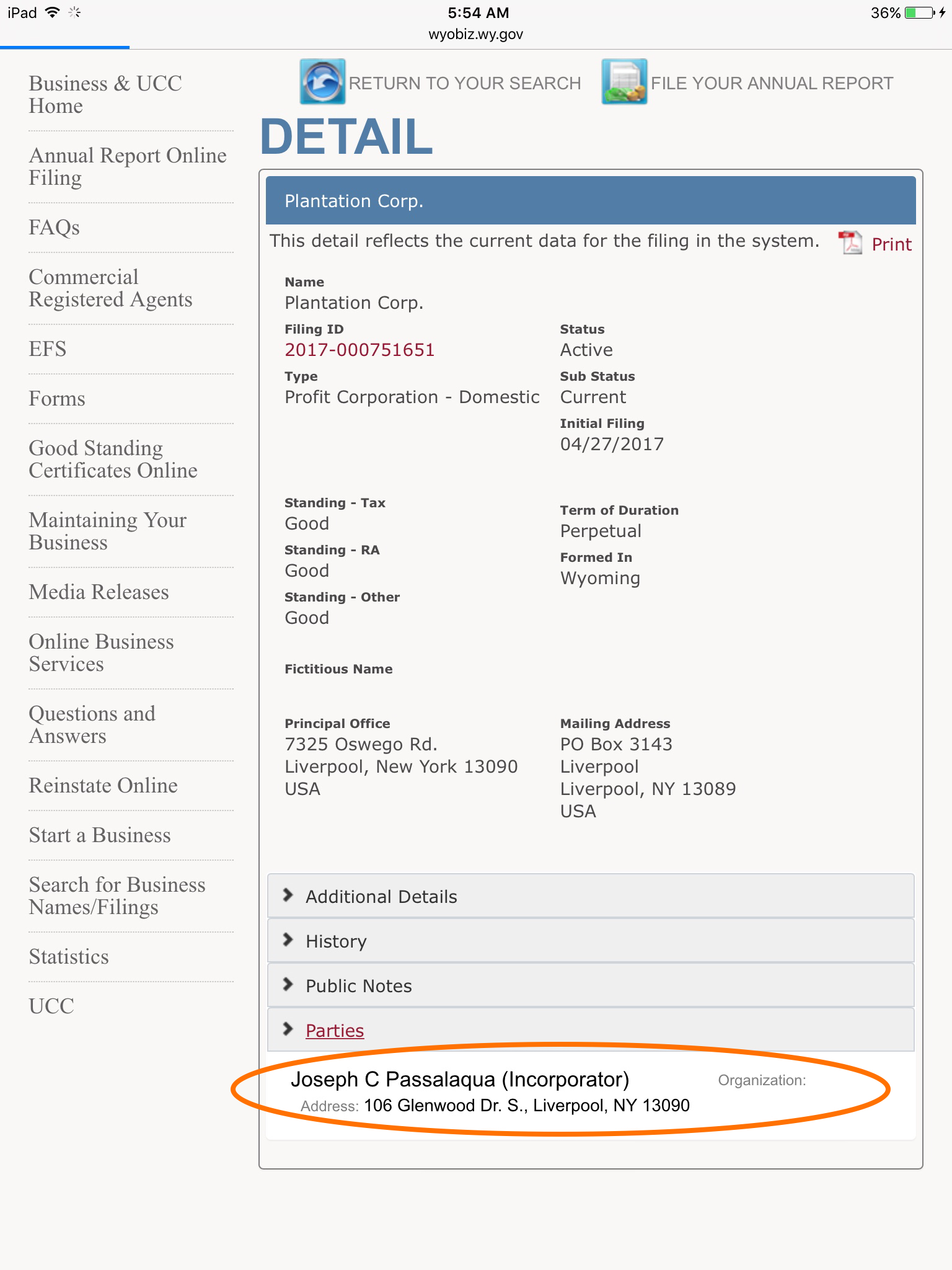

Plantation Corp, and Budlife.net via Joseph Passalaqua- the CEO of All state Properties Holdings - has multiple patents that are very substantial for MJ packaging demands.

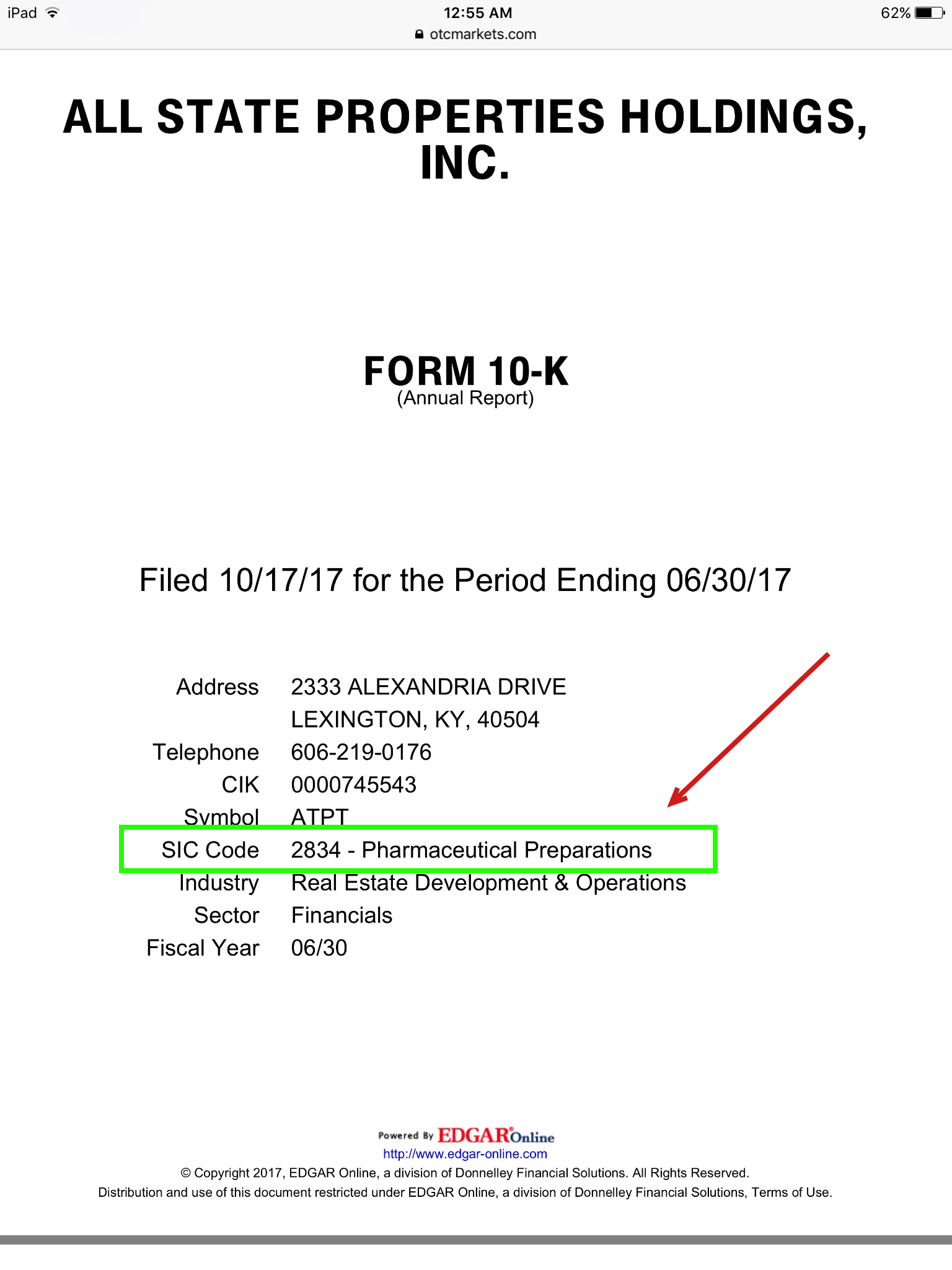

FOLKS- it now makes sense why ATPT is listed as a SIC code of "Pharmaceutical preparations" !!! Things may have just taken longer and we all know real business just takes longer!

Also makes sense why there is still the All State Properties Holdings listed on Nevada - even if not active- it won't have to be if effectuating a merger deal. I bet that the Wyoming All State Properties Holdings registration doesn't renew on 10/28 too!

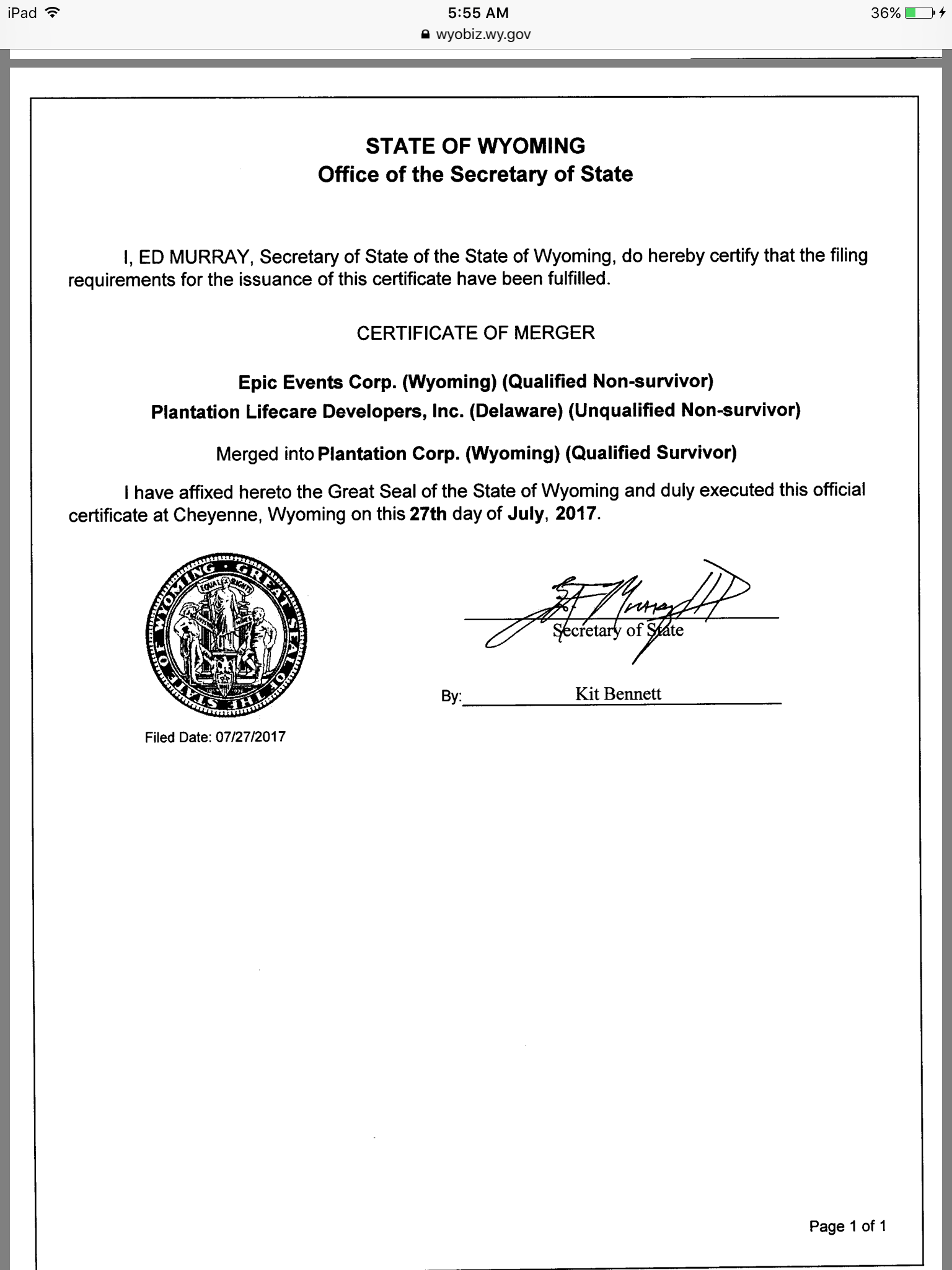

WHY? It appears that a major merger of a private Pharma packaging entity that focuses on patented MJ packaging -- that company --Plantation Corp- is fully active now in Wyoming- listing Passalaqua as the director of contact and has come about from Late April to August 2017!

This is massive. $SGMD is trading around .03-.04 pps and has traded much higher in the past year.

READ THE DESCRIPTION FOR PLANTATION CORP deals with Sugarmade- They are providing patented packaging for MJ across myriad states. Huge deals already announced. Much more below!

About Plantation Corp.

[color=Green]Plantation Corp., a Wyoming Company, is a technology-driven organization with the goal to establish a unique paradigm in preservation efficiency and longevity that sets a new gold standard for the intelligent packaging industry. While still a privately-held corporation, Plantation is currently accepting investments only from accredited investors. Additional information can be seen at the new website at www.BudLife.net

https://budlife.net.cutestat.com

HERE IS much more evidence that Joseph Passalaqua played a very large part in orchestrated this merger involving two of his private corps -one being Henderson Investors Corp. aka Plantation Corp this year a few months after getting full control over $ATPT again. Let's pay careful attention to this private MJ company in Nevada!!!!!!

After putting $ATPT in motion, Passalaqua next worked on changing the name of another Corp he partly owned that dealt with MJ packaging and held various patents.

HERE ARE FURTHER VALIDATIONS Of his close involvement as Secretary orchestrating a merger between three corps in preparation for its huge NEWS and partnership with $SGMD- Sugarmade OTQB.

PATENT NEWS and $SGMD - SUGARMADE (OTCQB) direct partnership ----

FINANCIALS PROVE NO DEBT- MERGER/ACQUISITION PENDING ---

It is my opinion, that we are going to see the attorney letter to go CURRENT as well as company communications to help explain what has been going on here since Mid August 2017. THERE IS A MAJOR MERGER / ACQUISITION IN PLAY and it Appears that it may STILL involve the REAL ESTATE OPERATIONS for the burgeoning "pharmaceutical " industry.

Regardless- Passalaqua is very connected to many Executives and holds quite a few board spots on public companies. There is definitely a reason he went to great lengths to audit and go current again-- and the way this control block is structured - Passalaqua is not going to risk losing control over the company and thus, he can't sell more then 6% - (read below). HE ALSO CANT SELL More than 1% of the total outstanding of 2.6 bil or 26 mil over a 3 month period! This is HUGE value added for shareholders.

NOTE TOO- the ownership block is owned by Sea Alive, LLC, a Wyoming company as of Feb 2017. That is also a company run by Passalaqua. ATPT appears to have had a KY address, but it's a NV company and can be checked via NVSOS. It's not active - and even with those filings that would have made it active with NV - it might not need too if it's a merger announced!!

There are many reasons to be VERY INTRIGUED with $ATPT along with the 21 financials filed last week and the aforementioned.

1- The CEO owns 57% of the common shares here and MUST MAINTAIN 51% of the control block to be considered OWNERSHIP as deemed below u see the Tax Reform Act of 1986. Therefore, IMO - even though the shares are COMMON and could be free trading (beyond 6 months of ownership since feb 3) - he wouldn't be able to give up more than 6% of the total o/s - or 175mil shares EVER! HE can only , by RULE 144- give up 1% of the total O/S over a 3 month period - which is 26 mil! TOTAL!

RULE 144- plays a huge role here because the OWNER has only Common shares and there are laws as to how much he may put to the market!! Since this has no dent- there is NO DILUTION!!!!!!!

TOTAL. Therefore, the CEO would not have spent $80k and $5k to get audited fins all done and set to go CURRENT just to sell his 26mil shares this cheap. No way. I will go into more detail below.

In the 10k---

4.- Capital Stock

The Company has 10,000,000 shares of Preferred Stock authorized at a par value of $0.0001 and none has been issued at June 30, 2017 and 2016.. NO PREFERRED STOCK ISSUED!

2- This stock is listed being in the Pharmaceutical Preperations ONLY since 2010 when the company was taken over by Passalaqua again. But why list Pharma preparations? Hmmm

SIC Code 2834 - Pharmaceutical Preparations

Industry : Real Estate Development & Operations

Financials: 06/30

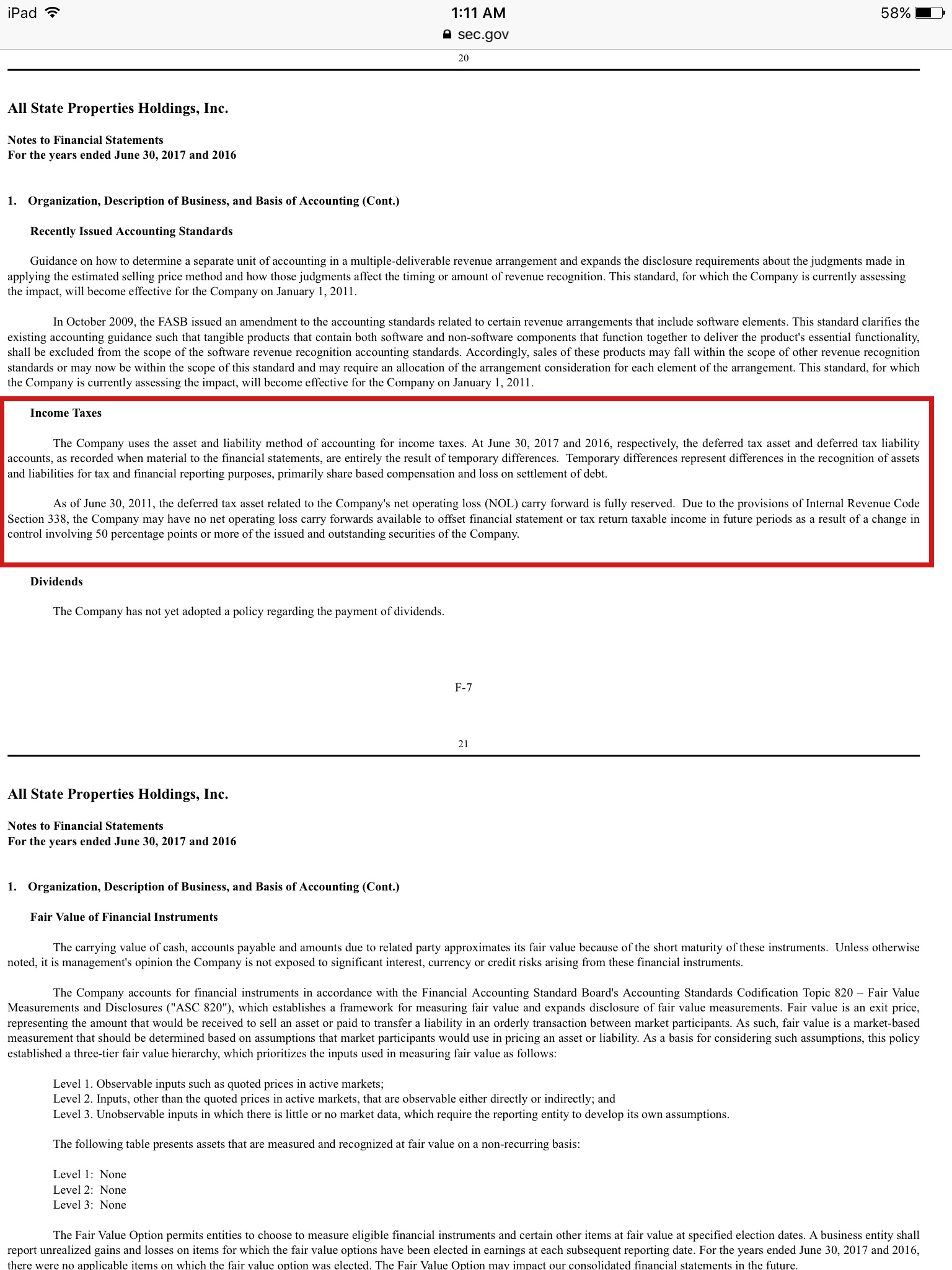

3-NET CARRY OVER LOSS PROVISION--

-The Company has a net operating loss carryover of $659,249 as of June 30, 2011 which expires in 2026. This net carry over provision is still in place. Due to the change in ownership provisions of the Tax Reform Act of 1986, net operating loss carry forwards for federal income tax reporting purposes are subject to annual limitations. Should a change in ownership occur net operating loss carry forwards may be limited as to use in future years.

The Company has net operating loss carry forwards that were derived solely from operating losses from prior years. These amounts can be carried forward to offset future taxable income for a period of 20 years for each tax year's loss.

At June 30, 2017 and 2016, the Company has established a valuation allowance equal to the deferred tax assets as there is no assurance that the Company will generate future taxable income to utilize these assets.

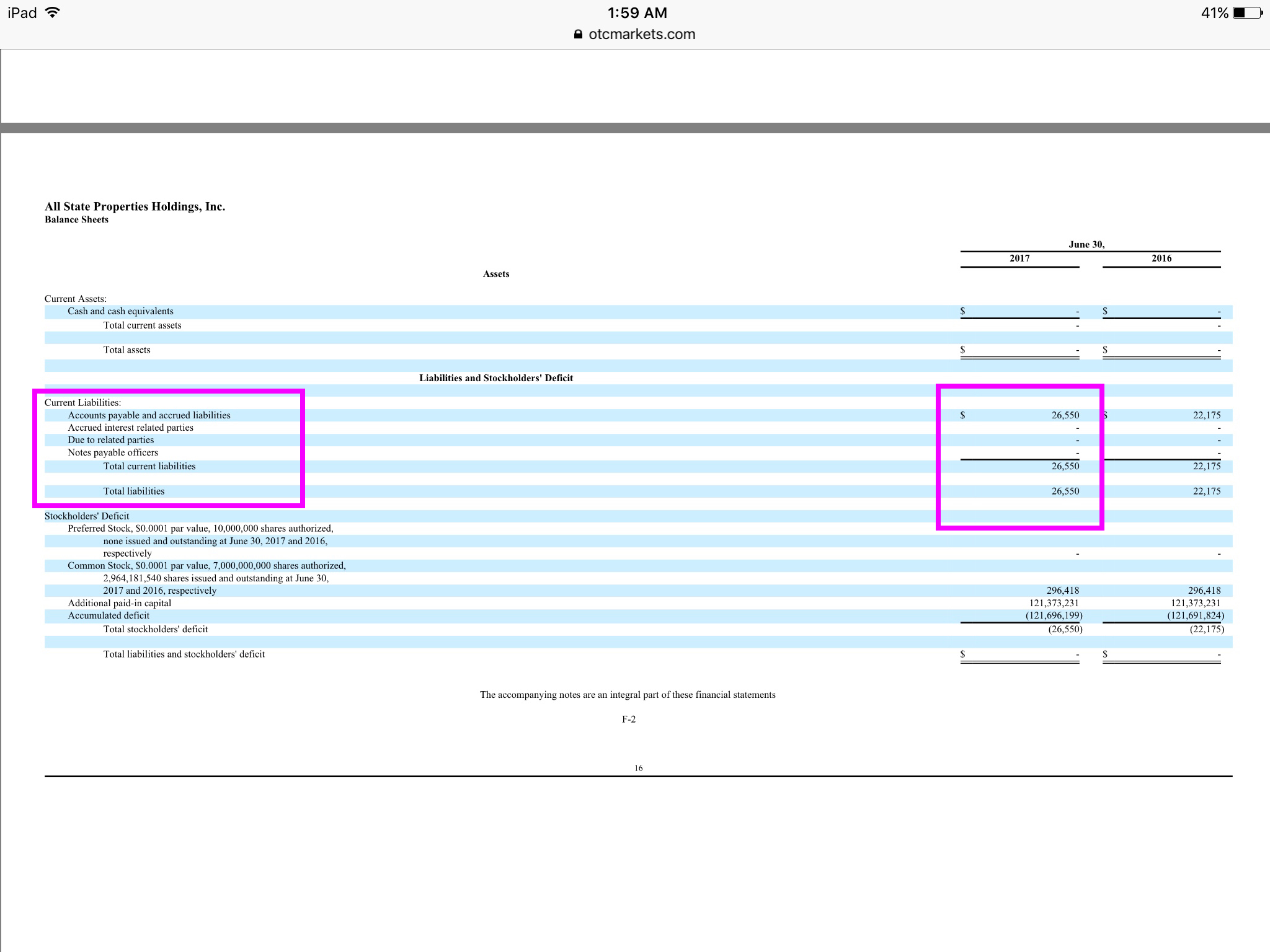

4- NO ACCRUED BIZ EXPENSES AND CONVERTIBLE DEBENTURES -- the listed debt here is $26k TOTAL and no convertible debts.

Total Current Liabilities --

ACCOUNTS PAYABLE and accrued Liabilites TOTAL -- $26,550

See the rest here in the latest 10K here---- https://www.otcmarkets.com/edgar/GetFilingPdf?FilingID=12327439

5-- THE ADDITION OF THE SPECIFIC SECTION regarding the actual purpose of ATPT Holding company -- to actively engage in a merger, acquisition etc.

It is my opinion, that the more one looks into the substantive filings and the peripheral findings and associations for $ATPT- the more it appears that a major MJ MERGER involving several private companies that had merged into one company a few months prior - are headed into the shell $ATPT. Deals existing with $SGMD translate into REVENUES and the MJ sector especially this type of affiliated necessity for MMJ and MJ- and tinctures for folks in Cali- and one can only imagine the necessity for this product line as recreational MJ becomes LEGAL in states like Cali on 1/1/18.

Recent PBAJ News

- Form 10-Q/A - Quarterly report [Sections 13 or 15(d)]: [Amend] • Edgar (US Regulatory) • 02/27/2024 10:30:04 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 02/21/2024 07:58:17 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 02/20/2024 10:13:25 PM

- Form NT 10-Q - Notification of inability to timely file Form 10-Q or 10-QSB • Edgar (US Regulatory) • 02/14/2024 05:29:19 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 11/17/2023 09:26:13 PM

- Form NT 10-Q - Notification of inability to timely file Form 10-Q or 10-QSB • Edgar (US Regulatory) • 11/14/2023 05:55:24 PM

- Form 10-K - Annual report [Section 13 and 15(d), not S-K Item 405] • Edgar (US Regulatory) • 10/13/2023 05:46:12 PM

- Form NT 10-K - Notification of inability to timely file Form 10-K 405, 10-K, 10-KSB 405, 10-KSB, 10-KT, or 10-KT405 • Edgar (US Regulatory) • 10/02/2023 08:23:59 PM

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM