| Followers | 219 |

| Posts | 247348 |

| Boards Moderated | 2 |

| Alias Born | 04/06/2006 |

Friday, October 06, 2017 6:38:09 AM

Posted by Raúl Ilargi Meijer at 8:41 am

• China’s Economic Boom Is About To Be Cut Short By Peak Oil (Ahmed)

• A Volatility Trap Is Inflating Market Bubbles (BBG)

• China Is In ‘Lock-down’ Ahead Of Its Most Important Meeting In Years (CNBC)

• Bitcoin’s Rise Happened in Shadows of Finance. Now Banks Want In (BBG)

• HSBC Traders Used Code Words to Trigger Front-Running (BBG)

• US Rounds On Britain Over Food Quotas As Post-Brexit Trade Woes Deepen (Pol.)

• Few Tears Are Being Shed In Quebec Over The Energy East Pipeline’s Demise (BBG)

• Onshore Fracking To Begin In UK ‘Within Weeks’ (Ind.)

• Catalan Separatists Squeezed Further as Spain Tightens Its Grip (BBG)

• Apple Gave Uber ‘Unprecedented’ Access To Secret iPhone Backdoor (BI)

• Tropical Storm Nate Kills 22 In Central America, Heads For US (R.)

• Pesticides That Pose Threat To Humans And Bees Found In Honey (Ind.)

• Tiny Pacific Island Nation Of Niue Creates Huge Marine Sanctuary (AFP)

• China’s Economic Boom Is About To Be Cut Short By Peak Oil (Ahmed)

A new scientific study led by the China University of Pet

roleum in Beijing, funded by the Chinese government, concludes that China is about to experience a peak in its total oil production as early as next year. Without finding an alternative source of ‘new abundant energy resources’ , the study warns, the 2018 peak in China’s combined conventional and unconventional oil will undermine continuing economic growth and ‘challenge the sustainable development of Chinese society’. This also has major implications for the prospect of a 2018 oil squeeze – as China scales its domestic oil peak, rising demand will impact world oil markets in a way most forecasters aren’t anticipating, contributing to a potential supply squeeze. That could happen in 2018 proper, or in the early years that follow.

There are various scenarios that follow from here – China could: shift to reducing its massive demand for energy, a tall order in itself given population growth projections and rising consumption; accelerate a renewable energy transition; or militarise the South China Sea for more deepwater oil and gas. Right now, China appears to be incoherently pursuing all three strategies, with varying rates of success. But one thing is clear – China’s decisions on how it addresses its coming post-peak future will impact regional and global political and energy security for the foreseeable future. The study was published on 19 September by Springer’s peer-reviewed Petroleum Science journal, which is supported by China’s three major oil corporations, the China National Petroleum Corporation (CNPC), China Petroleum Corporation (Sinopec), and China National Offshore Oil Corporation (CNOOC).

“Zombie companies that would otherwise fail continue to be in business, refinancing at near-zero interest rates in bond markets.”

• A Volatility Trap Is Inflating Market Bubbles (BBG)

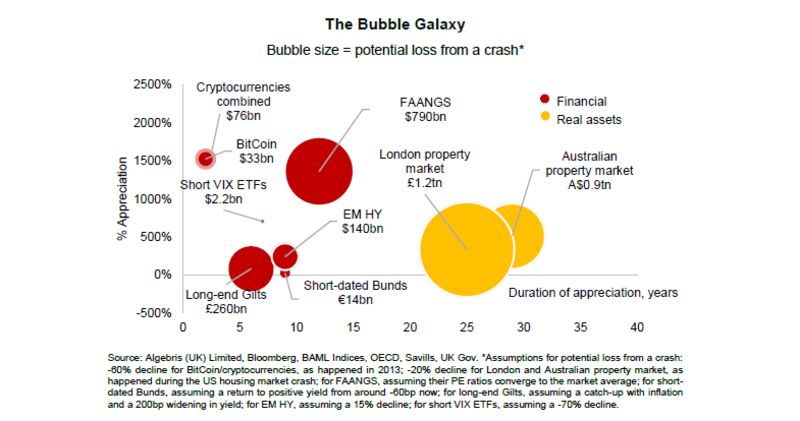

A number of markets show not only elevated valuations, but also irrational behavior on the part of investors, including a suspension of traditional valuation models, an increase in trading volumes or “flipping” in the hopes of quick gains, and financial engineering. Potential bubbles can be found in emerging-market debt, technology stocks, U.S. high yield bonds, some sovereign debt, cryptocurrencies, properties — even art and collectibles. It is becoming clearer to economists and central bankers that even though we may be experiencing a long phase of growth, stretching the cycle with monetary stimulus inspired by crisis-era toolkits may be bringing several collateral effects. These include not only asset bubbles, but also a worsening of wealth inequality and a misallocation of resources.

Persistent low interest rates in the past have helped to roll forward an increasing amount of private and public debt to future generations, but this is no longer working. Economic fundamentals are different from the post-war period. Technology is deflationary. Demographics are no longer a tailwind, as there are fewer young people able to carry a higher debt burden in the future. The generation of so-called millennials is the first that will likely be poorer than their parents in the post-war period. Productivity is low as the economy suffers from hysteresis: a financial boom-bust cycle that can leave large swathes of the workforce out of the job market. The longer the debt cycle, the longer companies and workers develop business and skills in leverage-heavy sectors (e.g. finance, real estate, energy), the deeper the scars when the bust comes.

Often the misallocation is so large that low rates are necessary to keep people in their jobs: Zombie companies that would otherwise fail continue to be in business, refinancing at near-zero interest rates in bond markets.

https://www.bloomberg.com/view/articles/2017-10-05/a-volatility-trap-is-inflating-market-bubbles

Read More Briefs or use link to access full articles and images

https://www.theautomaticearth.com/2017/10/debt-rattle-october-6-2017/

Pray for A Pain Free Day!

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.