| Followers | 9 |

| Posts | 1597 |

| Boards Moderated | 1 |

| Alias Born | 01/27/2014 |

Friday, August 18, 2017 4:59:46 AM

Future Of Manufacturing

From the Summary paragraph - GE’s vote of confidence in Arcam is a strong one, and Arcam has positioned itself well in the metal components space that will prove most game-changing and essential over the long run.

At seekingalpha.com - Future Of Manufacturing - Aug. 18, 2017

Selections of the text:

Summary

Advancements in materials have potentially life-changing (or saving) implications for customers in healthcare sectors.

Automobile & Aerospace parts can be customized and brought to market quicker and more efficiently than ever before.

Industry participants face challenges in cost reduction and scalability.

Shift from prototyping and retail applications to AM industrialization offers solid underlying demand for machines.

Industry Analysis:

Overview & History

Additive Manufacturing, a term used interchangeably with 3D printing, is defined by ASTM International as “a process of joining materials to make objects from 3D model data, usually layer upon layer, as opposed to subtractive manufacturing methodologies.”[1] When thinking of the difference between additive manufacturing and traditional manufacturing methods, it helps to visualize that additive builds up from nothing (adding material), while traditional shapes existing material into the needed form (subtracting material).

Additive manufacturing requires the aid of CAD software (computer-aided design) which helps create a three-dimensional model of the product and saves the design as a standard tessellation language (.STL) file. The 3D printer creates the product by reading the file one layer at a time and creating a physical object based upon those blueprints. Following the manufacturing process, the product may need to be sanded, filed, polished, cured, painted, or material filled.[2]

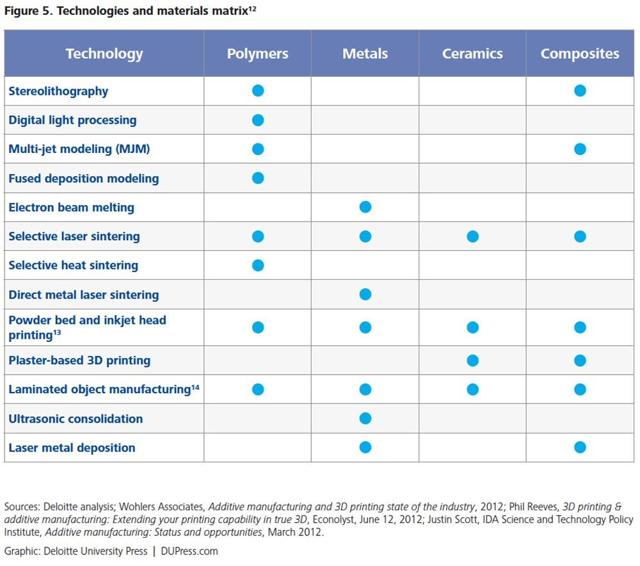

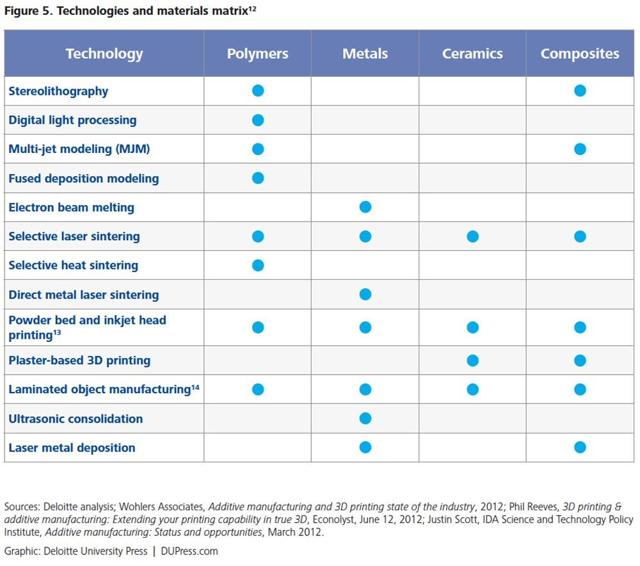

1987 saw the birth of stereolithography from 3D manufacturing systems, which solidifies thin layers of UV light-sensitive liquid polymer using a laser, and was the first system that enabled a 3D object to be printed from CAD data. Three additional AM technologies were commercialized in 1991: Fused Deposition Modeling (Stratasys (NASDAQ:SSYS)), Solid Ground Curing (Cubital), and Laminated Object Manufacturing (Helisys). Stratasys is the only company of those three to remain in business. Since 1987, dozens of innovations have appeared in AM technologies and the materials used for printing objects.[3]

While originally thought to be useful for prototyping applications, additive manufacturing has seen a growing number of applications in commercial aerospace & defense, space, automotive, healthcare, and consumer products industries. The additive manufacturing industry is ripe for explosive growth, especially as industrial customers begin to differentiate both the pros and cons of AM processes when compared to traditional manufacturing. Manufacturers will find a multitude of benefits in supplementing their traditional processes with additive processes, including lesser waste and higher productivity, rapid product development and deployment, and unprecedented design flexibility.

Developments

New file formats: Additive Manufacturing file format (as opposed to .STL)

Stylus-based design technologies

Metal and ceramic materials

Printable materials now include: stainless steel, steel, titanium, gold, silver, metal compounds, thermoplastics (acrylonitrile butadiene styrene, polylactic acid, polyvinyl alcohol, polycarbonate), glass, chocolate, and bio-ink created from stem cells that form new tissue[4]

Outlook

The additive manufacturing industry surpassed $5.1 billion globally in 2016 and has grown at a CAGR of 26.2% over the past 27 years. Industrial grade manufacturing systems are recently making up a larger portion of systems sold.[5] In 2013, Wohlers Report predicted that the total global value of the AM industry would reach $10.8 billion by 2021, and it appears to be on track.[6] The primary metal AM market is expected to rise from $950 million at the end of 2016 to $6.6 billion by 2026. GE alone is expected to account for 4% of the metal AM market over the next decade.[7]

Potential Long-Term Investments

3D Systems (NYSE: DDD) ..............

Stratasys Ltd. ..............

Arcam AB (OTC:ARZMY)

Arcam was founded in 1997 and is headquartered in Stockholm, Sweden, with support offices located in the United States, Italy, China, and the UK. Arcam focuses on providing a cost-efficient Additive Manufacturing solution for the production of metal components, and its market is global with customers mainly in the orthopedic implant and aerospace industries. The company offers a portfolio of EBM machines, auxiliary equipment, software, metal powders, and service and training, with ownership of 200 patent and patent applications.

In 2016, GE acquired approximately 73.57% of Arcam following a 75% acquisition of a similar additive manufacturing specialist, Concept Laser. The acquisition shows GE’s interest in the increasing role of additive manufacturing in global manufacturing processes, and is a positive signal of the quality of Arcam’s systems and patents.

The company has been profitable 4 out of the 5 previous years, as it recorded a net loss of 10.8 million Swedish krona in 2016 (about $1.3 million). On the other hand, Arcam has seen positive sales growth in each of the past five years ranging from 12.5% to 70%. The company recorded negative operating cash flow and free cash flow in 2016, but is conservatively financed with very little debt.

Summary

The common problem among the three companies mentioned appears to be that SG&A expense growth has outpaced revenue growth, with large portions of SG&A being made up of Research & Development costs. 3D Systems and Stratasys are both free-cash-flow positive and could turn the corner into profitability once again relatively soon as investments into the growing metal printing sector begin to reap benefits. GE’s vote of confidence in Arcam is a strong one, and Arcam has positioned itself well in the metal components space that will prove most game-changing and essential over the long run. Over the course of the next few weeks, I am going to work hard to figure out which opportunity in this space (if any) minimizes risk and offers the greatest chance at excess returns. I’m looking forward to additional thoughts in the comments.

From the Summary paragraph - GE’s vote of confidence in Arcam is a strong one, and Arcam has positioned itself well in the metal components space that will prove most game-changing and essential over the long run.

At seekingalpha.com - Future Of Manufacturing - Aug. 18, 2017

Selections of the text:

Summary

Advancements in materials have potentially life-changing (or saving) implications for customers in healthcare sectors.

Automobile & Aerospace parts can be customized and brought to market quicker and more efficiently than ever before.

Industry participants face challenges in cost reduction and scalability.

Shift from prototyping and retail applications to AM industrialization offers solid underlying demand for machines.

Industry Analysis:

Overview & History

Additive Manufacturing, a term used interchangeably with 3D printing, is defined by ASTM International as “a process of joining materials to make objects from 3D model data, usually layer upon layer, as opposed to subtractive manufacturing methodologies.”[1] When thinking of the difference between additive manufacturing and traditional manufacturing methods, it helps to visualize that additive builds up from nothing (adding material), while traditional shapes existing material into the needed form (subtracting material).

Additive manufacturing requires the aid of CAD software (computer-aided design) which helps create a three-dimensional model of the product and saves the design as a standard tessellation language (.STL) file. The 3D printer creates the product by reading the file one layer at a time and creating a physical object based upon those blueprints. Following the manufacturing process, the product may need to be sanded, filed, polished, cured, painted, or material filled.[2]

1987 saw the birth of stereolithography from 3D manufacturing systems, which solidifies thin layers of UV light-sensitive liquid polymer using a laser, and was the first system that enabled a 3D object to be printed from CAD data. Three additional AM technologies were commercialized in 1991: Fused Deposition Modeling (Stratasys (NASDAQ:SSYS)), Solid Ground Curing (Cubital), and Laminated Object Manufacturing (Helisys). Stratasys is the only company of those three to remain in business. Since 1987, dozens of innovations have appeared in AM technologies and the materials used for printing objects.[3]

While originally thought to be useful for prototyping applications, additive manufacturing has seen a growing number of applications in commercial aerospace & defense, space, automotive, healthcare, and consumer products industries. The additive manufacturing industry is ripe for explosive growth, especially as industrial customers begin to differentiate both the pros and cons of AM processes when compared to traditional manufacturing. Manufacturers will find a multitude of benefits in supplementing their traditional processes with additive processes, including lesser waste and higher productivity, rapid product development and deployment, and unprecedented design flexibility.

Developments

New file formats: Additive Manufacturing file format (as opposed to .STL)

Stylus-based design technologies

Metal and ceramic materials

Printable materials now include: stainless steel, steel, titanium, gold, silver, metal compounds, thermoplastics (acrylonitrile butadiene styrene, polylactic acid, polyvinyl alcohol, polycarbonate), glass, chocolate, and bio-ink created from stem cells that form new tissue[4]

Outlook

The additive manufacturing industry surpassed $5.1 billion globally in 2016 and has grown at a CAGR of 26.2% over the past 27 years. Industrial grade manufacturing systems are recently making up a larger portion of systems sold.[5] In 2013, Wohlers Report predicted that the total global value of the AM industry would reach $10.8 billion by 2021, and it appears to be on track.[6] The primary metal AM market is expected to rise from $950 million at the end of 2016 to $6.6 billion by 2026. GE alone is expected to account for 4% of the metal AM market over the next decade.[7]

Potential Long-Term Investments

3D Systems (NYSE: DDD) ..............

Stratasys Ltd. ..............

Arcam AB (OTC:ARZMY)

Arcam was founded in 1997 and is headquartered in Stockholm, Sweden, with support offices located in the United States, Italy, China, and the UK. Arcam focuses on providing a cost-efficient Additive Manufacturing solution for the production of metal components, and its market is global with customers mainly in the orthopedic implant and aerospace industries. The company offers a portfolio of EBM machines, auxiliary equipment, software, metal powders, and service and training, with ownership of 200 patent and patent applications.

In 2016, GE acquired approximately 73.57% of Arcam following a 75% acquisition of a similar additive manufacturing specialist, Concept Laser. The acquisition shows GE’s interest in the increasing role of additive manufacturing in global manufacturing processes, and is a positive signal of the quality of Arcam’s systems and patents.

The company has been profitable 4 out of the 5 previous years, as it recorded a net loss of 10.8 million Swedish krona in 2016 (about $1.3 million). On the other hand, Arcam has seen positive sales growth in each of the past five years ranging from 12.5% to 70%. The company recorded negative operating cash flow and free cash flow in 2016, but is conservatively financed with very little debt.

Summary

The common problem among the three companies mentioned appears to be that SG&A expense growth has outpaced revenue growth, with large portions of SG&A being made up of Research & Development costs. 3D Systems and Stratasys are both free-cash-flow positive and could turn the corner into profitability once again relatively soon as investments into the growing metal printing sector begin to reap benefits. GE’s vote of confidence in Arcam is a strong one, and Arcam has positioned itself well in the metal components space that will prove most game-changing and essential over the long run. Over the course of the next few weeks, I am going to work hard to figure out which opportunity in this space (if any) minimizes risk and offers the greatest chance at excess returns. I’m looking forward to additional thoughts in the comments.

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.