| Followers | 368 |

| Posts | 5333 |

| Boards Moderated | 1 |

| Alias Born | 05/09/2013 |

Friday, July 07, 2017 12:24:32 PM

$QSIM ~ Alerted for Buy in late afternoon July 6 to e-mail subscribers.

If it ever goes under .001, I'll add a 2nd time at some point if necessary (as a standard contingency plan).

In the eventual short term, I see it heading back likely toward .0019 or much higher, maybe to .003+

It has good short term history for trade-able volatility & the O/S is relatively low for a .001 area stock.

{Just Buy the Dips, Sell the rips}

>>>>See Alert Copy Below

-----------------------------------------------------------------------------

From: THREE-DAY-TRADER <three_day_trader@yahoo.com>

Sent: Thursday, July 6, 2017 3:17 PM

Subject: ***$QSIM = New (OTC) SUBPENNY TRADE***

-----------------------------------------------------------------------------

Alerted Trading @ .0011-.0012 on 7/06/2017 after Market Closed

(With a close of .00115)

$QSIM:

****Suggestion is to initially set limit orders of .0013 or less based on latest trading.

****Also be ready for possibility of adding a 2nd time as a standard contingency plan.

If perhaps .0007-.0009 would occur, it will be considered for adding a 2nd time down toward that area, but realize that we never know for certain in advance when these trades will pop upward. Sometimes an avg down does not need to happen & they move up soon within a few days, so it's always best to plan a scale-in strategy contingency. Many of the past successful trades here have involved an average down (scaling in approx 2 times).

****There's a reasonably decent chance this could achieve higher to .0019-.0025+, or possibly much more in the near future.

(While keeping in mind .0019+ for a 'Minimum Upside Speculation Target')

------------------------------------------------------------------------------

Alerted Trading @ .0012-.0016 on 6/15/2017

(on early Morning during a one day pop upward with suggestion to wait for a pullback of .0014 or less for first entry)

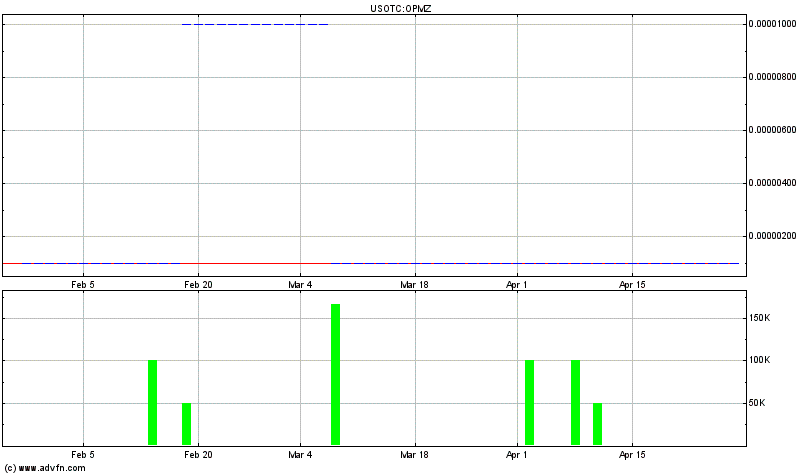

$OPMZ:

****Suggestion has been to initially set limit orders of .0014 or less based on latest trading.

****Limit Orders for .0007 to add a 2nd time have been suggested (ever since June 27).

The resulting average cost on $OPMZ should be approx .0009-.001 (or less).

****There's a reasonably decent chance this could achieve higher to .0019-.0025+, or possibly much more in the near future.

(While keeping in mind .0019+ for a 'Minimum Upside Speculation Target')

------------------------------------------------------------------------------

****Keep in mind, that with OTC subpenny stocks it is always best to apply a proper 'Risk/Reward Strategy'. Which means risking low amounts of $$$ per trade while seeking goal of a higher proportional reward % result.

$300-$2,000 is typical range for each subpenny stock trade for most people; All depending on % of your portfolio & personal risk tolerance.

****Also keep in mind that these types of plays are intended for Short Term Trade Flips based upon anticipation of 'Oversold Technical Reversals'.

Stocks like this can be very volatile and move for any reason, but the standard goal is to take short term profits on these technically oversold opportunities (typically caused by share dilution) & to thereby exit in the short term once the upside has shown technical resistance.

****Intended Goal here is to alert Buys & Sells on a timely basis, but a trader should always be mindful & ready to apply a good strategy in the event that a stock could make a surprising move (up or down).

>>>Entry Strategy:

Applying low range Limit entry orders is a crucial part of these trades.

>>>Exit Strategy:

When it comes to an exit strategy you should also be vigilant & responsible for your own stock position when ever it would gap up higher as a profit (not just depending on Sell Alerts).

Carefully scaling-out of your position (2-3 parts at a time) is a strategy you typically may want to independently consider later on whenever your trade becomes profitable, and one main reason for that is because no one knows for certain 100% of the time where a short term top will be.

------------------------------------------------------------------------------

If it ever goes under .001, I'll add a 2nd time at some point if necessary (as a standard contingency plan).

In the eventual short term, I see it heading back likely toward .0019 or much higher, maybe to .003+

It has good short term history for trade-able volatility & the O/S is relatively low for a .001 area stock.

{Just Buy the Dips, Sell the rips}

>>>>See Alert Copy Below

-----------------------------------------------------------------------------

From: THREE-DAY-TRADER <three_day_trader@yahoo.com>

Sent: Thursday, July 6, 2017 3:17 PM

Subject: ***$QSIM = New (OTC) SUBPENNY TRADE***

-----------------------------------------------------------------------------

Alerted Trading @ .0011-.0012 on 7/06/2017 after Market Closed

(With a close of .00115)

$QSIM:

****Suggestion is to initially set limit orders of .0013 or less based on latest trading.

****Also be ready for possibility of adding a 2nd time as a standard contingency plan.

If perhaps .0007-.0009 would occur, it will be considered for adding a 2nd time down toward that area, but realize that we never know for certain in advance when these trades will pop upward. Sometimes an avg down does not need to happen & they move up soon within a few days, so it's always best to plan a scale-in strategy contingency. Many of the past successful trades here have involved an average down (scaling in approx 2 times).

****There's a reasonably decent chance this could achieve higher to .0019-.0025+, or possibly much more in the near future.

(While keeping in mind .0019+ for a 'Minimum Upside Speculation Target')

------------------------------------------------------------------------------

Alerted Trading @ .0012-.0016 on 6/15/2017

(on early Morning during a one day pop upward with suggestion to wait for a pullback of .0014 or less for first entry)

$OPMZ:

****Suggestion has been to initially set limit orders of .0014 or less based on latest trading.

****Limit Orders for .0007 to add a 2nd time have been suggested (ever since June 27).

The resulting average cost on $OPMZ should be approx .0009-.001 (or less).

****There's a reasonably decent chance this could achieve higher to .0019-.0025+, or possibly much more in the near future.

(While keeping in mind .0019+ for a 'Minimum Upside Speculation Target')

------------------------------------------------------------------------------

****Keep in mind, that with OTC subpenny stocks it is always best to apply a proper 'Risk/Reward Strategy'. Which means risking low amounts of $$$ per trade while seeking goal of a higher proportional reward % result.

$300-$2,000 is typical range for each subpenny stock trade for most people; All depending on % of your portfolio & personal risk tolerance.

****Also keep in mind that these types of plays are intended for Short Term Trade Flips based upon anticipation of 'Oversold Technical Reversals'.

Stocks like this can be very volatile and move for any reason, but the standard goal is to take short term profits on these technically oversold opportunities (typically caused by share dilution) & to thereby exit in the short term once the upside has shown technical resistance.

****Intended Goal here is to alert Buys & Sells on a timely basis, but a trader should always be mindful & ready to apply a good strategy in the event that a stock could make a surprising move (up or down).

>>>Entry Strategy:

Applying low range Limit entry orders is a crucial part of these trades.

>>>Exit Strategy:

When it comes to an exit strategy you should also be vigilant & responsible for your own stock position when ever it would gap up higher as a profit (not just depending on Sell Alerts).

Carefully scaling-out of your position (2-3 parts at a time) is a strategy you typically may want to independently consider later on whenever your trade becomes profitable, and one main reason for that is because no one knows for certain 100% of the time where a short term top will be.

------------------------------------------------------------------------------

***Go to my 'Profile' for more information on following me***

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.