Global Stocks Decline With Oil Prices

DOW JONES & COMPANY, INC. 9:08 AM ET 5/26/2017

U.S. stocks were poised to edge back from record highs Friday after losses in energy companies dragged down bourses in Europe and Asia.

Futures pointed to a 0.1% opening decline for the S&P 500 on the final trading day before a long weekend, while the Stoxx Europe 600 fell 0.4%, led lower by the oil and gas sector.

Brent crude oil shed 0.8% to $51.07 a barrel, on track to end the week 5% lower. Oil prices accelerated declines after European and Asian markets closed Thursday amid disappointment that the Organization of the Petroleum Exporting Countries didn't take more aggressive measures to cut production at a meeting in Vienna.

Although OPEC members agreed to extend production cuts through March 2018, "the market had been speculating in deeper cuts and a longer commitment," said Martin Enlund, analyst at Nordea.

Energy companies account for roughly 6% of the S&P 500 and the Stoxx Europe 600, according to FactSet.

Futures held steady after the U.S. Commerce Department said economic growth in early 2017 was stronger than initially thought. Gross domestic product expanded at an inflation- and seasonally adjusted annual rate of 1.2% in the first quarter, up from last month's estimated 0.7%. Economists surveyed by The Wall Street Journal had expected a more modest upward revision to 0.8% growth.

Major U.S. indexes remained on track to end the week over 1% higher. On Thursday the S&P 500 notched its 19th record closing high of the year, surpassing the 18 records reached in 2016.

The S&P 500, Dow Jones Industrial Average and Nasdaq Composite have risen for six straight sessions, supported by stronger-than-expected first-quarter earnings, expectations for the Federal Reserve to move only gradually and continued signs of a steady economy.

"Better growth and inflation is translating into better revenues: this kind of environment is good for stocks and bad for bonds," said Jeff Knight, global head of investment solutions at Columbia Threadneedle Investments, which manages $467 billion in assets.

While the market is looking expensive and there may be better opportunities overseas, low volatility and high investor confidence suggest there might be a bit further for the market to climb, he said. "We think we're heading toward a period of time when it might be wise to de-risk, but we're not there yet."

In currencies, the WSJ Dollar Index edged down 0.1%, deepening this month's losses. The dollar fell 0.7% against the yen, which tends to benefit in times of market stress.

The British pound fell 0.8% to $1.2845 in a move analysts attributed to a poll showing a narrowing lead for the Conservative Party in June elections. Jordan Rochester, currency strategist at Nomura, said the pound is likely to face pressure if polling continues to indicate a tighter race.

"For the market the worst outcome is if we have further uncertainty with the chances of a hung parliament," he said.

London's export-heavy FTSE 100 index rose 0.1% Friday as the pound weakened, on track for a record high.

Earlier, Australian and Japanese stocks lagged behind other Agdpsian equities on Friday amid pressure from oil's recent pullback and losses in iron-ore and steel prices.

Australia's S&P/ASX 200 shed 0.7% amid broad weakness in commodities-focused companies, while Japan's Nikkei was off 0.6% as a stronger yen also weighed on Japanese stocks. Both bourses ended the week with gains.

South Korea's Kospi Composite Index and India's Sensex hit record highs.

Lucy Craymer contributed to this article.

Write to Riva Gold at riva.gold@wsj.com

(END) Dow Jones Newswires

05-26-170908ET

Copyright (c) 2017 Dow Jones & Company, Inc.

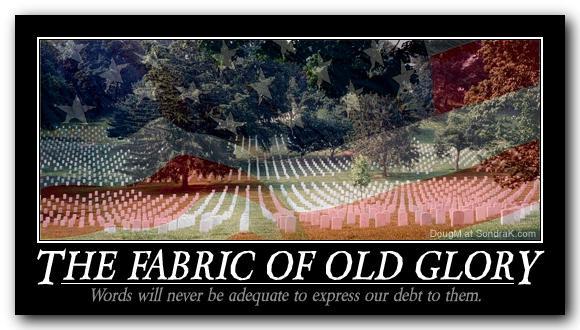

Salute!