Friday, May 12, 2017 9:07:08 AM

This is huge for DVMED of which FINRA/SEC has approved the $18,500,000 merger to come into the company with the approved new ticker to be PEDE effective in 20 days from April 25, 2017. It looks like something huge is transpiring here that I think some investors should begin to start paying attention. Here's why...

The last reposted Outstanding Shares (OS) was 11,620,312,500 shares. When FINRA approved the name, CUSIP #, and ticker changes... they also approved a 1-4000 reverse split. I must admit... normally I would suggest that such would be a bad thing, but the price of the stock post-split actually should prove to be the new bottom. Here's why...

With the previous OS above, the 1-4000 reverse split would make the new OS to be roughly 2,905,078 shares. I'm guessing that the new management will issue themselves some shares, but will keep the share structure tight as it appears that they are positioning the stock to trade on the NASDAQ or NYSE/AMEX if I had to guess considering the value of the company that has been approved to merge into the stock. As a worst case scenario, I think the post-split OS will probably increase to be no higher than double which would be roughly 6,000,000 shares.

The Supplemental Agreement filed below indicated that the company coming into DVMED/PEDE will be StroiTekhSnab LLC as its core operations generating $18,500,000 in Revenues and is on track to be generating over $22,500,000 for 2017 based on its exponential growth that is indicated per year since 2014:

http://www.otcmarkets.com/financialReportViewer?symbol=DVMED&id=170510

http://www.sttsnab.com/

If you consider a 25% Net Profit Margin, that would equate to $5,625,000 in Net Income. Now let's derive a "potential valuation" for the stock by deriving an Earnings Per Share (EPS) with using a conservative Price to Earnings (P/E) Ratio of 15 per the formulas below:

Net Income ÷ Outstanding Shares (OS) = EPS

$5,625,000 Net Income ÷ 6,000,000 OS = .9375 EPS

EPS x P/E Ratio = Share Price Valuation

.9375 EPS x 15 Conservative P/E Ratio = $14.06 Per Share Valuation

Use the Substitution Property for any variable that might prove to later be different.

This means that the new PEDE could fundamentally be trading in the area of $14.06 per share. I believe that is significant considering the post-split initial price will be .40 per share. Even if I'm half right, the stock should fundamentally be justified to exist trading well over the $4.00 per share minimum requirements to trade on the major markets. Below is the confirmation of FINRA approval and more regarding the merger for those who have not seen this yet:

(For inquiring minds... FINRA coordinates with the SEC to make sure that the company is in good standing before ever approving a merger like this.)

http://www.otcmarkets.com/financialReportViewer?symbol=DVMED&id=170510

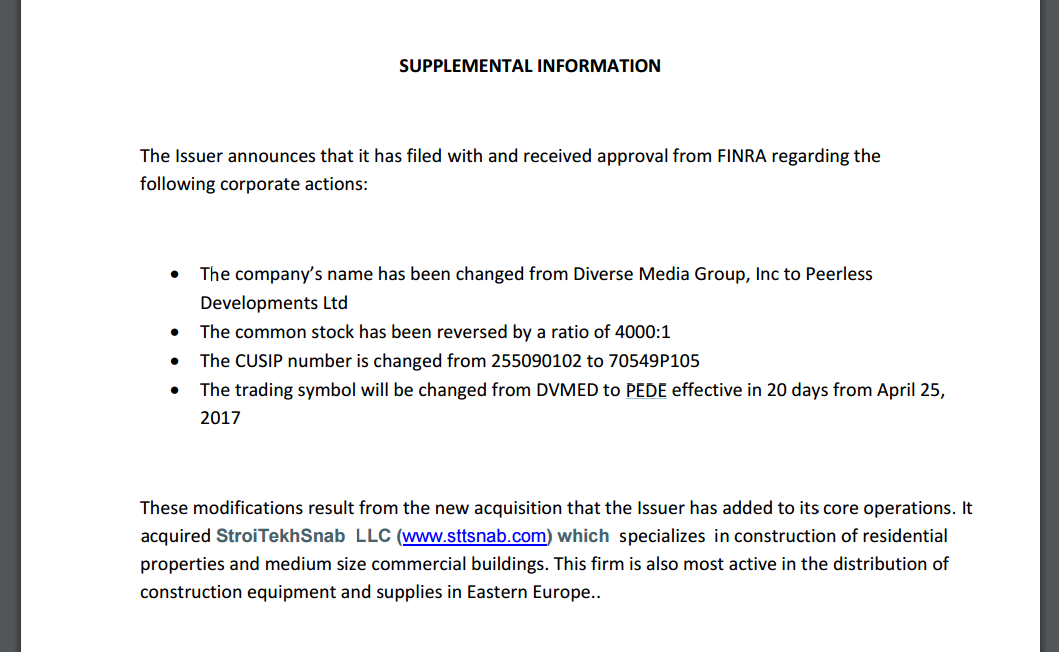

SUPPLEMENTAL INFORMATION

The Issuer announces that it has filed with and received approval from FINRA regarding the following corporate actions:

• The company’s name has been changed from Diverse Media Group, Inc to Peerless Developments Ltd

• The common stock has been reversed by a ratio of 4000:1

• The CUSIP number is changed from 255090102 to 70549P105

• The trading symbol will be changed from DVMED to PEDE effective in 20 days from April 25, 2017

These modifications result from the new acquisition that the Issuer has added to its core operations. It acquired StroiTekhSnab LLC (www.sttsnab.com) which specializes in construction of residential properties and medium size commercial buildings. This firm is also most active in the distribution of construction equipment and supplies in Eastern Europe.

http://www.sttsnab.com/

“StroiTekhSnab” LLC is a construction company, provides a full range of construction works, from zero cycle to a full construction facility. The company was founded in 2013. Over the years, it implemented more than 200 projects. Limited Liability Company “StroiTekhSnab” have the right to enter into contracts for the implementation of the organization of works on construction, reconstruction and repair of capital construction projects. The high professional level of construction management, the use of innovative engineering solutions and construction technologies, experienced staff and modern material and technical base ensured the company’s success in the regional construction market and beyond, and its customers – high quality construction, compliance with established construction time and optimize the financial costs.

The annual turnover of the company:

On Dec. 31, 2014 is $7.380.952

On Dec. 2015 is $11.919.825

On June 30, 2016 is $15.637.365

Expected annual turnover of the company on Dec. 2016 is $18.500.000

It is expected in 2017 and the completion of the expansion, also for 2017 is discussed several large contracts and there are already reports of intentions.

v/r

Sterling

Exit Strategy & Etiquette Thoughts for a Stock

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=128822531

FEATURED Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM

North Bay Resources Announces Mt. Vernon Gold Mine Bulk Sample, Sierra County, California • NBRI • Sep 11, 2024 9:15 AM

One World Products Issues Shareholder Update Letter • OWPC • Sep 11, 2024 7:27 AM

Kona Gold Beverage Inc. Reports $1.225 Million in Revenue and $133,000 Net Profit for the Quarter • KGKG • Sep 10, 2024 1:30 PM