| Followers | 1447 |

| Posts | 13605 |

| Boards Moderated | 3 |

| Alias Born | 09/16/2015 |

Wednesday, April 05, 2017 2:53:12 AM

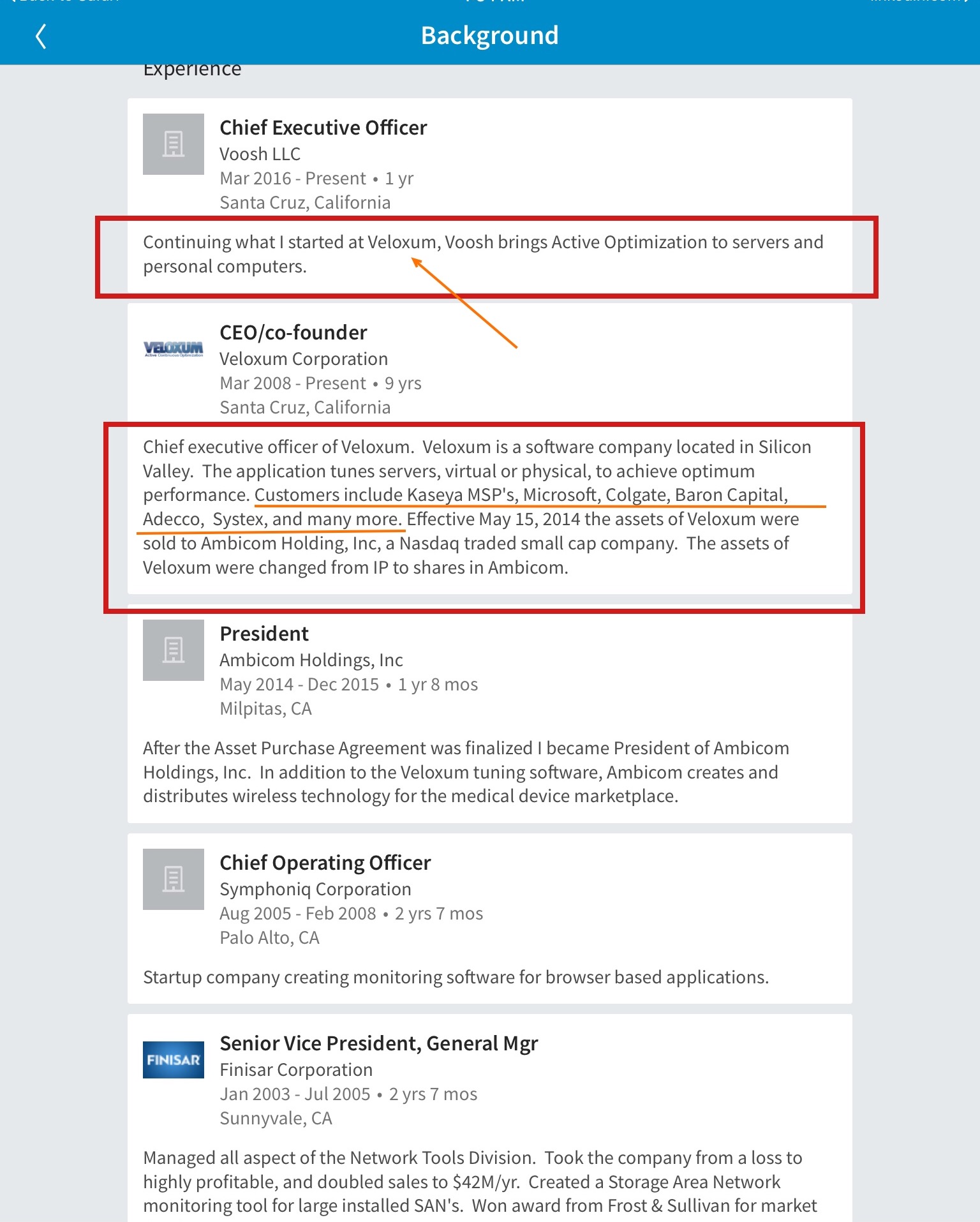

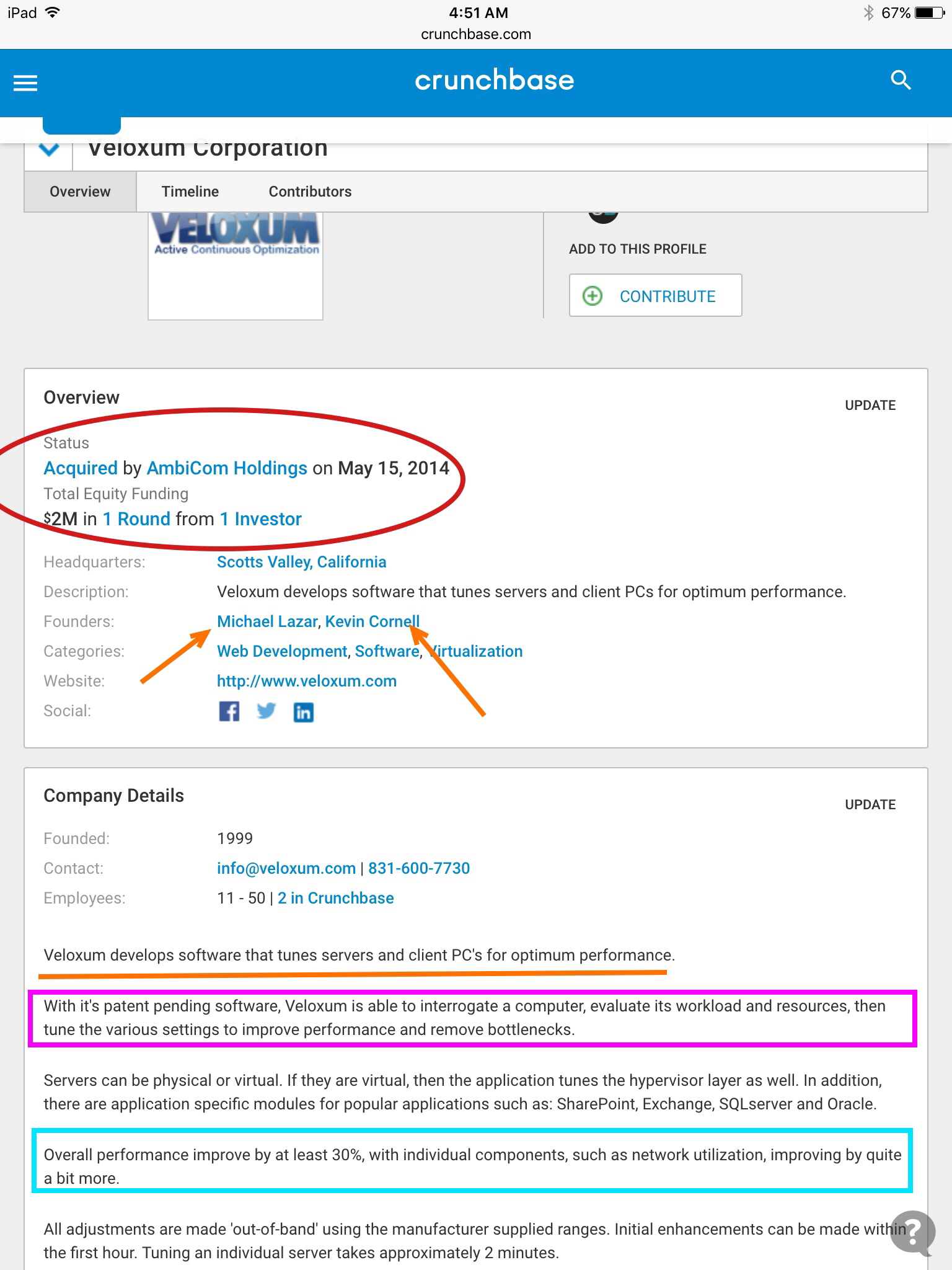

It is my opinion, that to best understand the potential that presents itself with $ABHI, one must first research the events that have occurred over the past year, and of more recent, the new management/CEO change announcement in early Feb 2017. AmbiCom Holdings had been run by John Hwang and they made three acquisitions - the last for the private company Veloxum, Inc. - of which was the Silicon Valley Optimization brainchild of Kevin Cornell. What we have learned the last few weeks, is quite telling. Hwang has been replaced by Alain Lewand CEO and now we learn that Kevin Cornell has apparently decided to take a more active role here in advancing the Veloxum optimization through a rebrand naked Voosh LLC. In more recent updates, it appears that the Lawsuit against PC Headquarters is going in the favor of Ambicom so far and this would result in a HUGE $10 mil settlement for infringement. Waiting for PACER updates for 4/4 conference.

Let's start our DD Journey by reviewing the most recent OTCMarkets profile of $ABHI. The CEO needs to be changed BUT...the reflected changes from 1/30 were made. This remains to be seen what else the CEO eill change and WHAT MAY BE COMING IN THE NEXT 8K.

HERE Is the first of two Press Releases this one to 2/1 when Lewand announces new CEO, management, a HUGE LINE OF CREDIT BY PRIVATE INVESTOR who will help pay the debt and get Abicom current as well as help with the legal fees. If those weren't enough - they announce the re pursuit of a huge lawsuit against PC Drivers Headquarters, a case initially closed 5/2016 but now reopened

AND The second release is where Lewand Announces deal with Voosh LLC to license and distrbute the Optimization software. Now here is where it's very interesting. We know that Hwang and Cornell obviously didn't see eye to eye and now we have a new CEO who announces a major deal. The description of what Voosh LLC does is exactly what the highly successful industry leader Veloxum, Inc. The reality is, Kevin Cornell NOW APPEARS TO BE TAKING A DIRECT HANDS ON APPROACH TO MASS MARKET HIS patented optimization software. Together with Alain Lewand, they are also pressing forward on a legal case that is also expected to bring in tremendous revenues $25-30 mil estimate. (Sourced later)

Two huge STATEMENTS from the PR that must be RE READ...

With AmbiCom's innovative and industry leading software, the agreement will allow AmbiCom to expand its growing client base to the Enterprise and SMB markets and increase revenues."

Currently installed on over 4,000,000 PC's and servers in the Consumer Market space and used by companies like Deutsche Bank, Colgate, Maimonides Hospital, IBM, UNHCR, and TPG Axon, Voosh improves overall performance by at least 30%. and, single application procedure can increase network utilization by over 400% with no additional hardware or software.

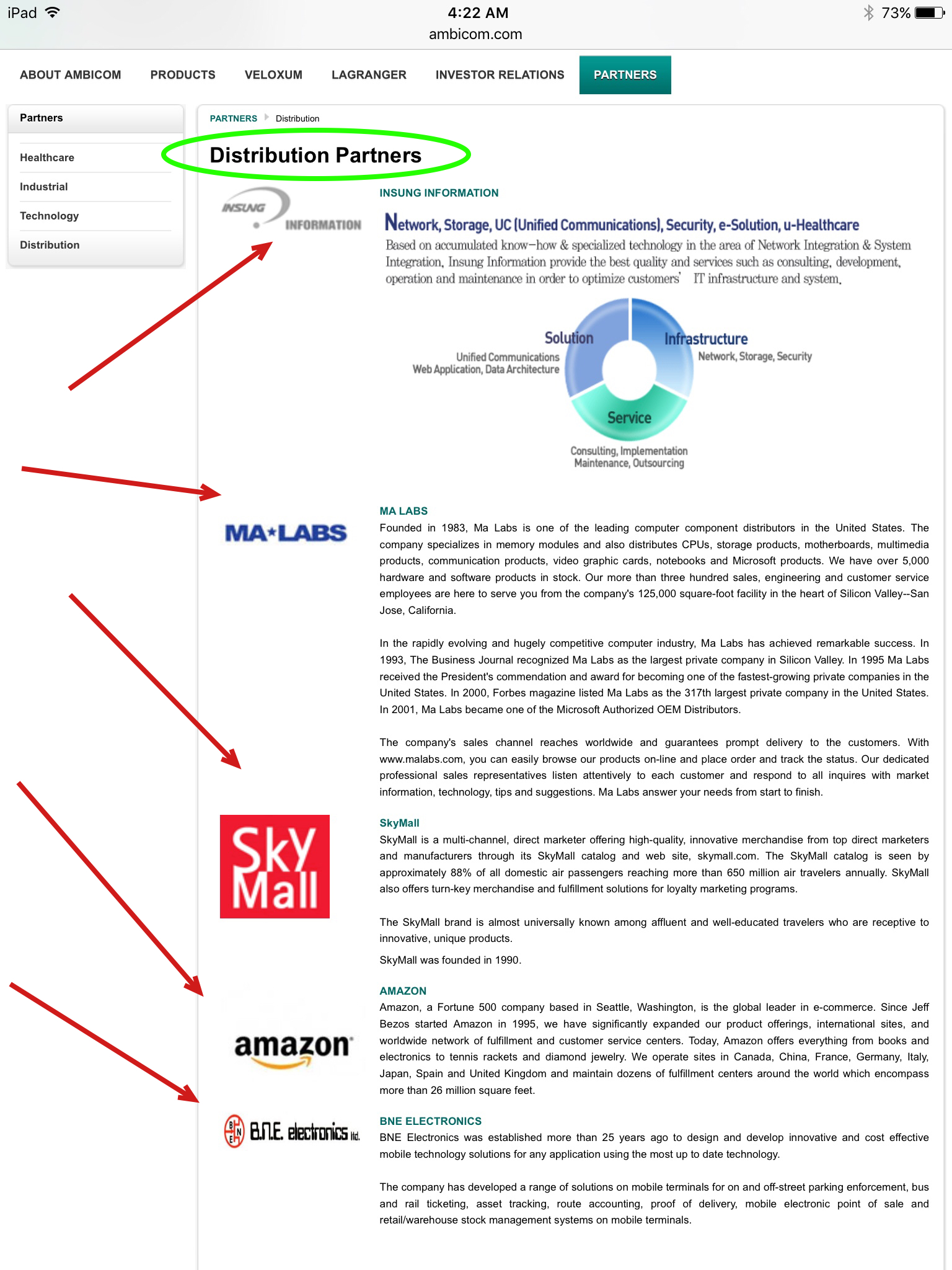

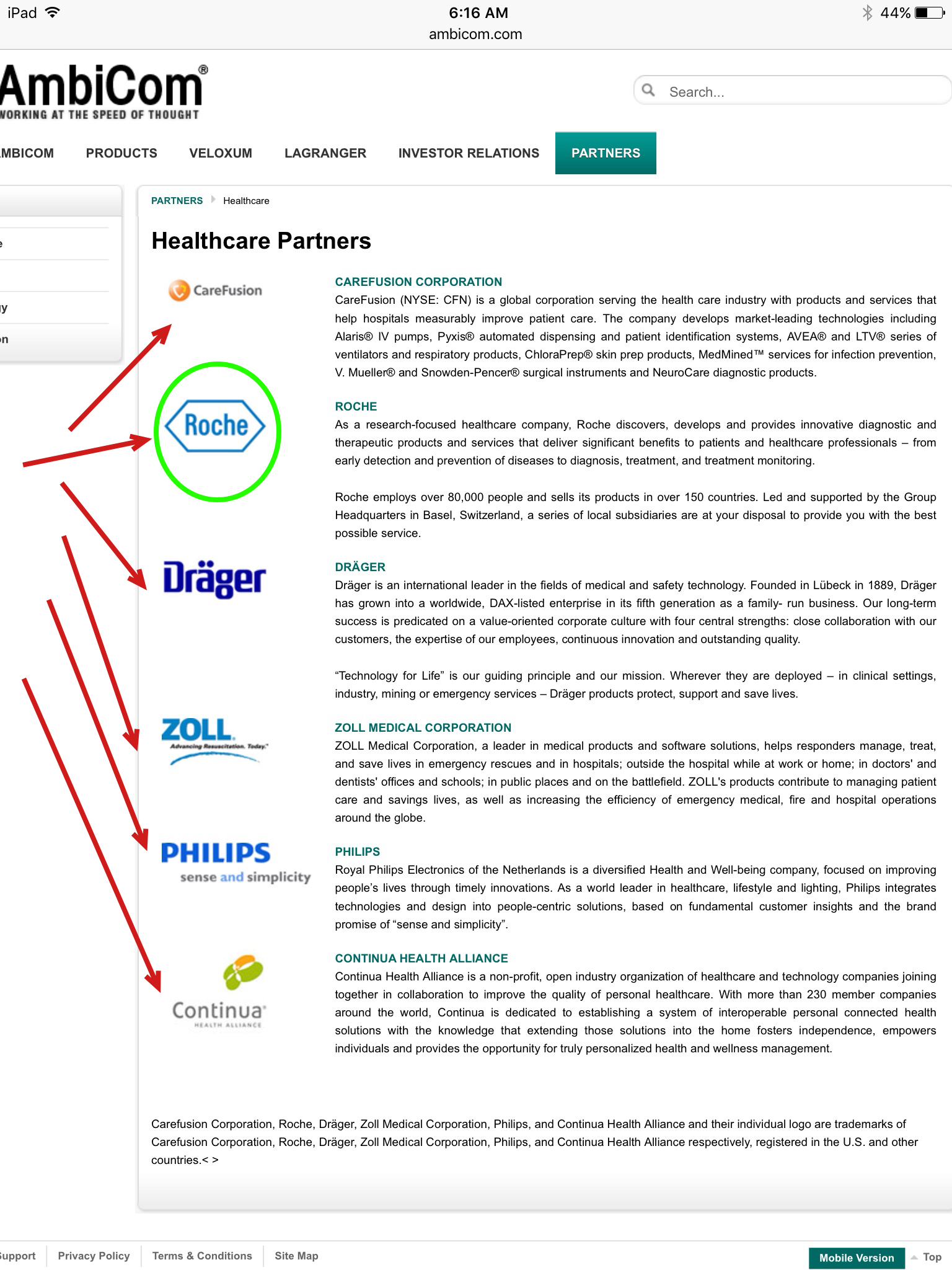

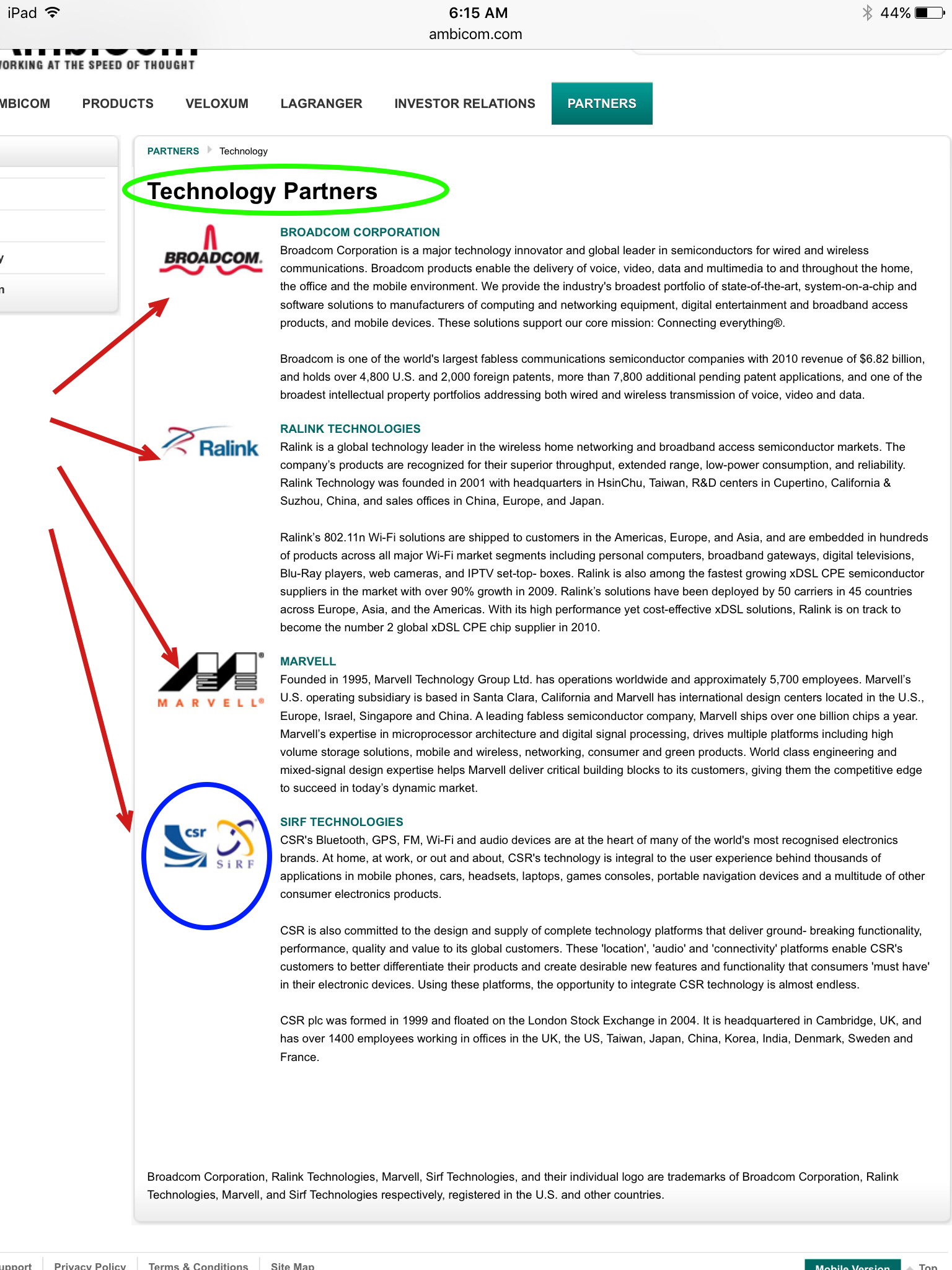

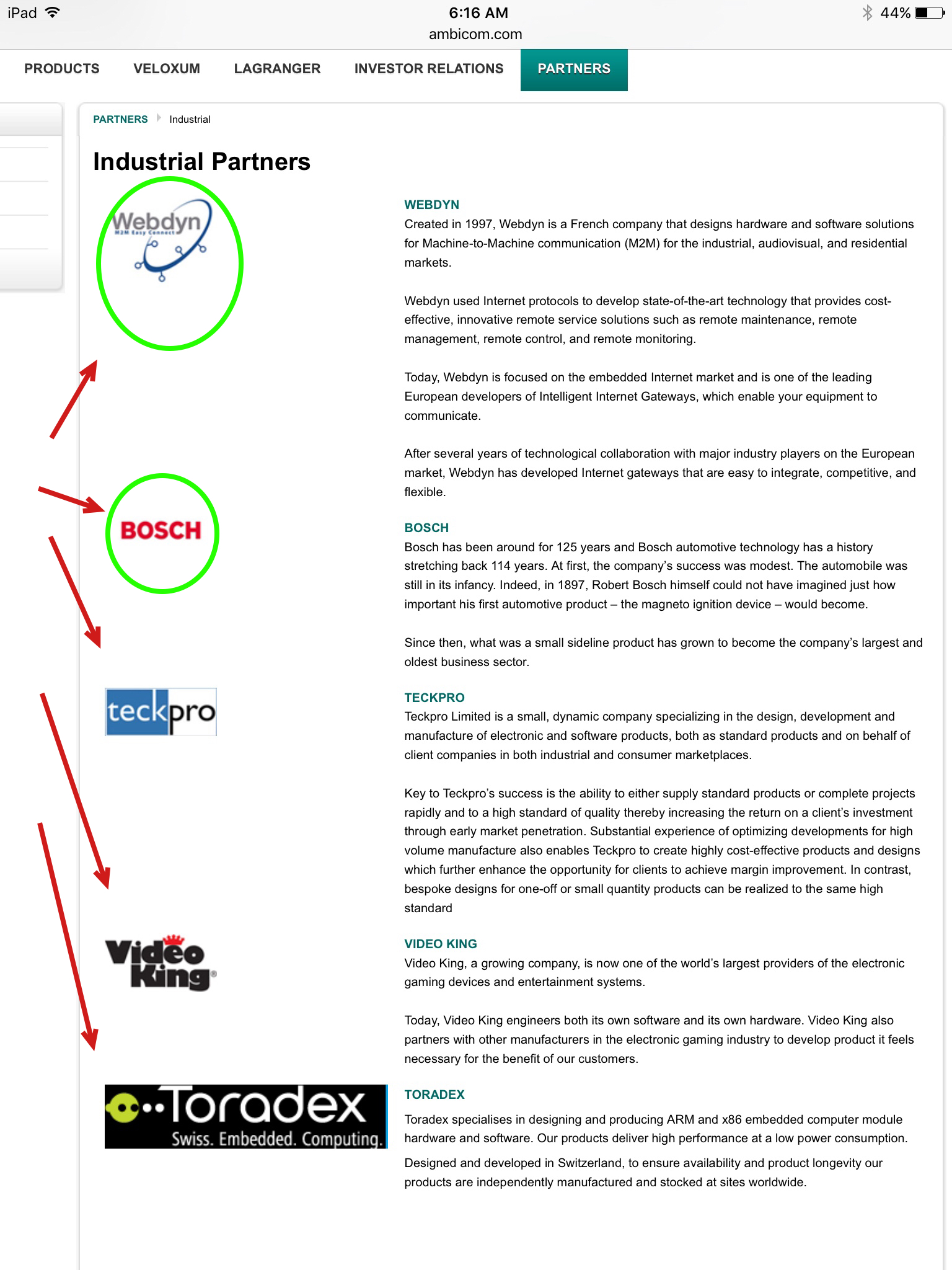

Already impressive list of EXISTING AMBICON Distributon partners

WHY $ABHI pps is now set up to move substantially

It now makes perfect sense why Kevin Cornell's LinkedIn page listed him running Voosh and director at Ambicom. And those connections Voosh has to Fortune 500 companies is every reason to believe this is just the beginning here.

Revenues revenues revenues.

The only reason you announce a licensing and marketing deal.....is because you intend to START Mass selling a branded product ....and you need to meet a higher capacity.

Love this by new CEO...

Under new management, Ambicom will focus on existing relationships and look to expand our market share in the technology fields. We will be looking to bring in new revenue, along with focusing on agreements with other technology partners to license and distribute their products.

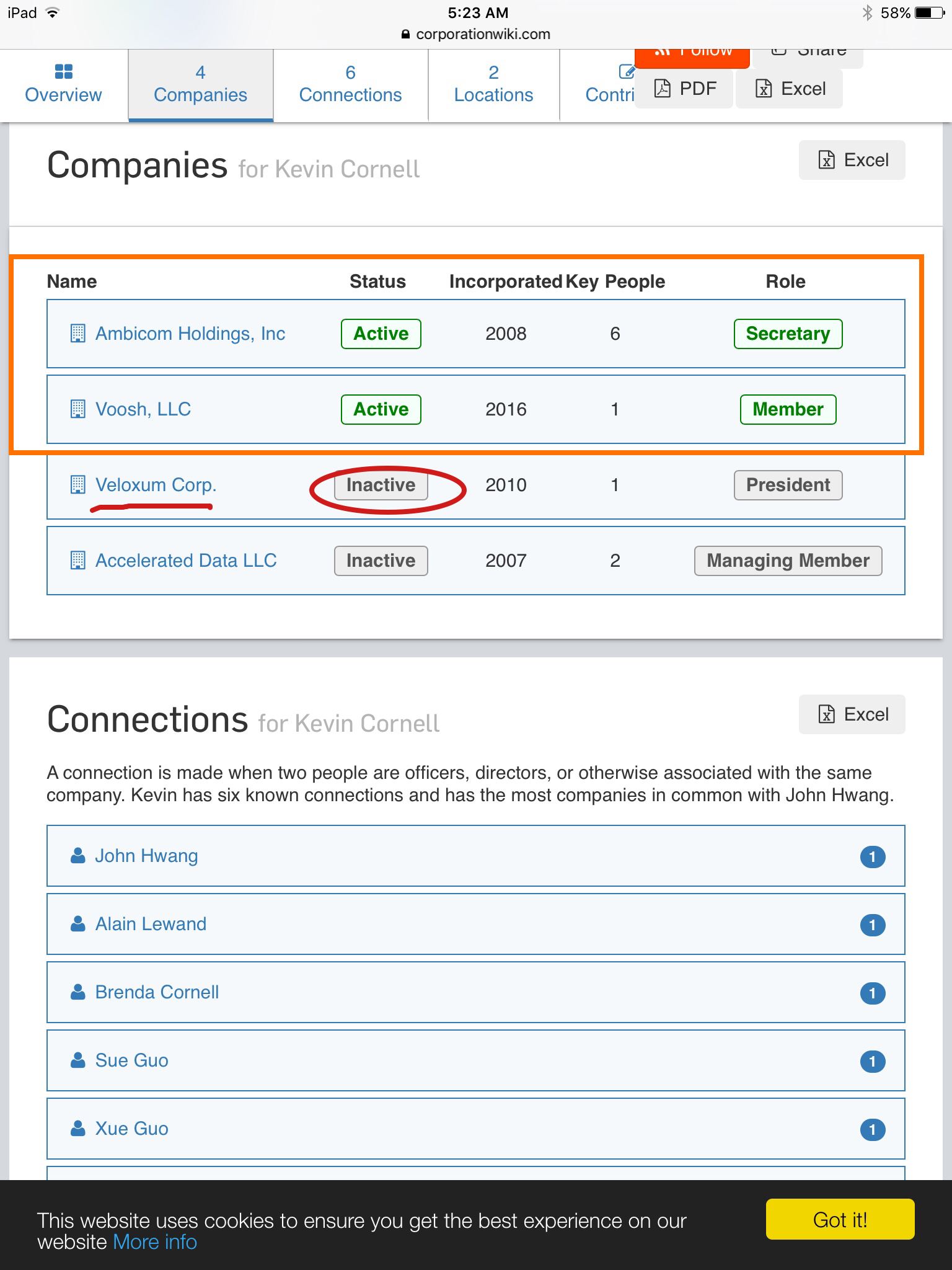

SO LETS TAKE A DD AND RESEARCH JOURNEY through pictures and analysis of what's going on here now with $ABHI

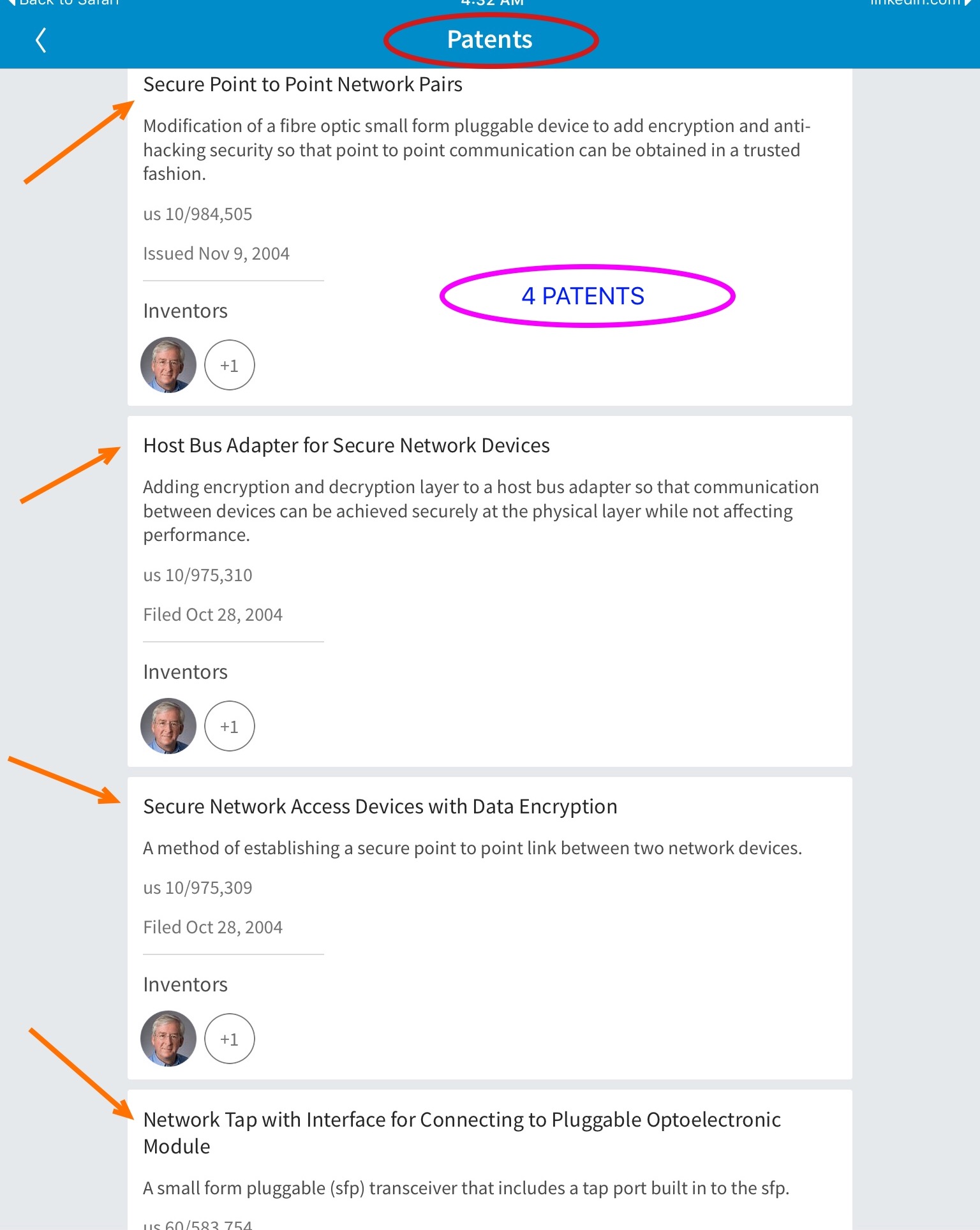

Kevin Cornell -- LinkedIn page and 4 patents

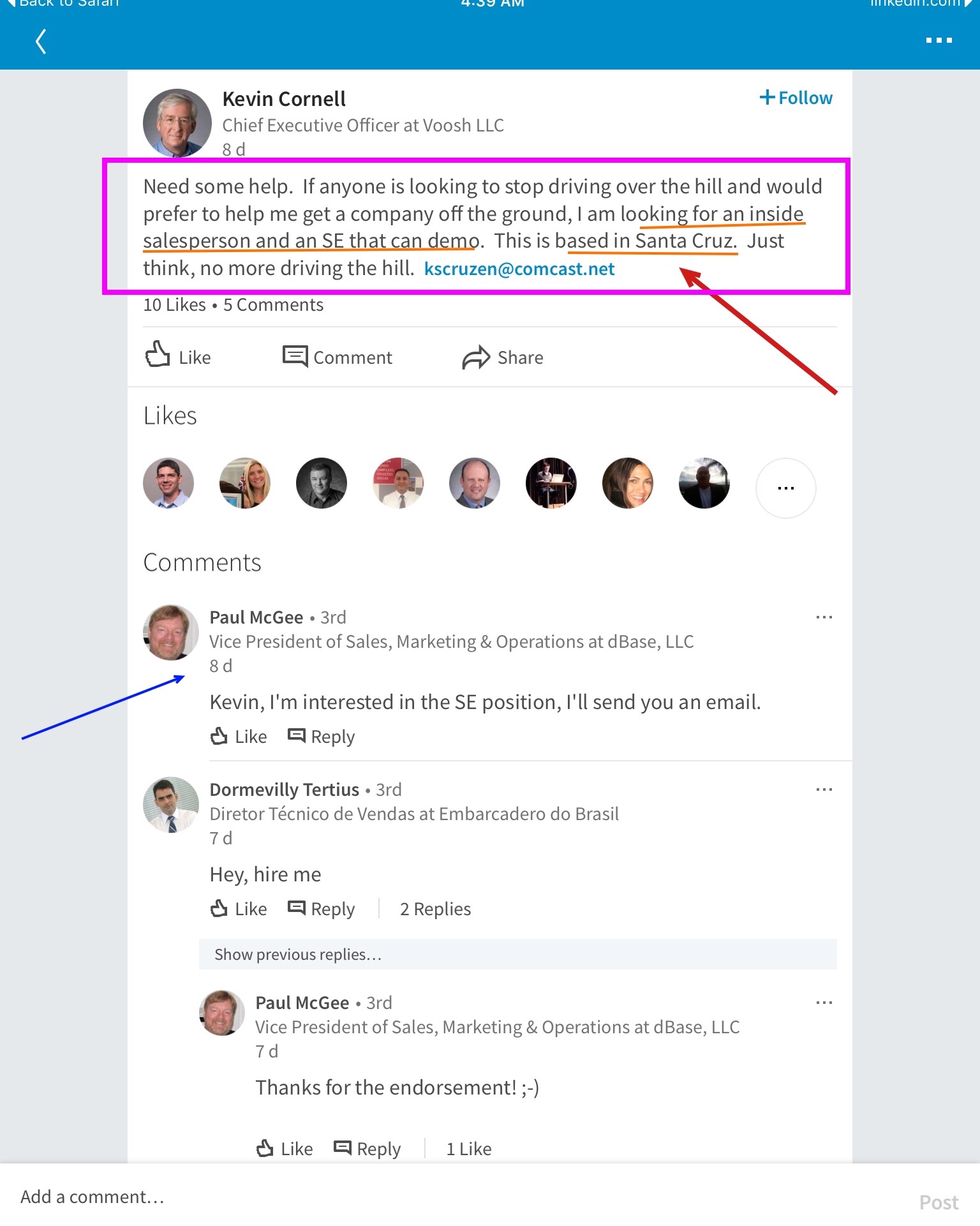

Very Interesting dialogue on Cornell's LinkedIn proving this is VERY REAL, he is soliciting for a SE to be able to Demo and senior software salesman who wants to be on other side of Silicon valley. Cornell is as real as it gets. Clearly he is putting a team together to distribute his long standing patented optimatizarion software across small business and enterprise PC's. This can also be crops applied to the medical industry and with Lewand in charge and his connection to a few MJ companies - it wouldn't surprise me that there is some further correlation.

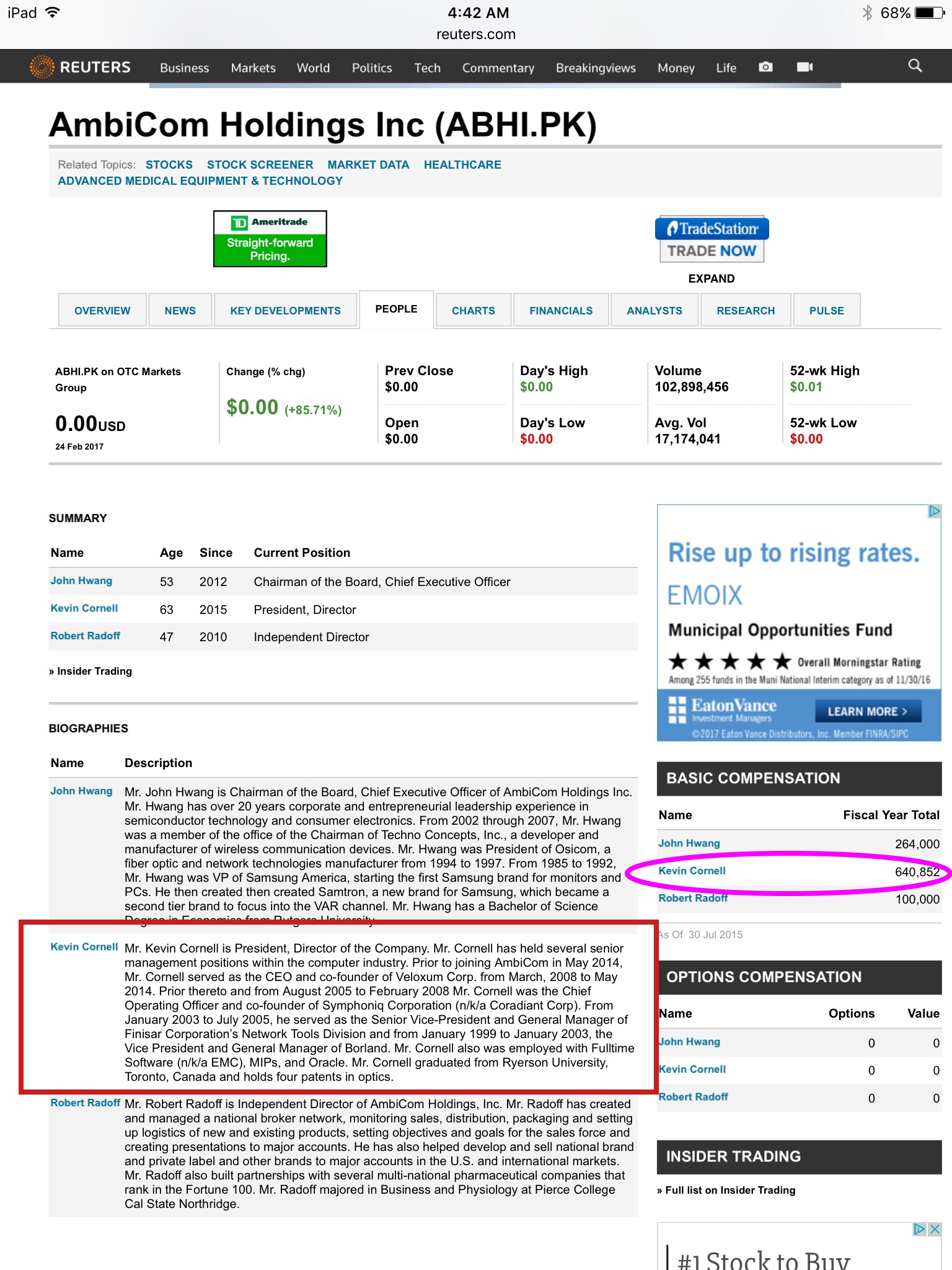

One will notice, Kevin Cornell was ALWAYS The one who made the big money - he was the real Silicon Valley computer OEM optimatization star here and it was never Hwang

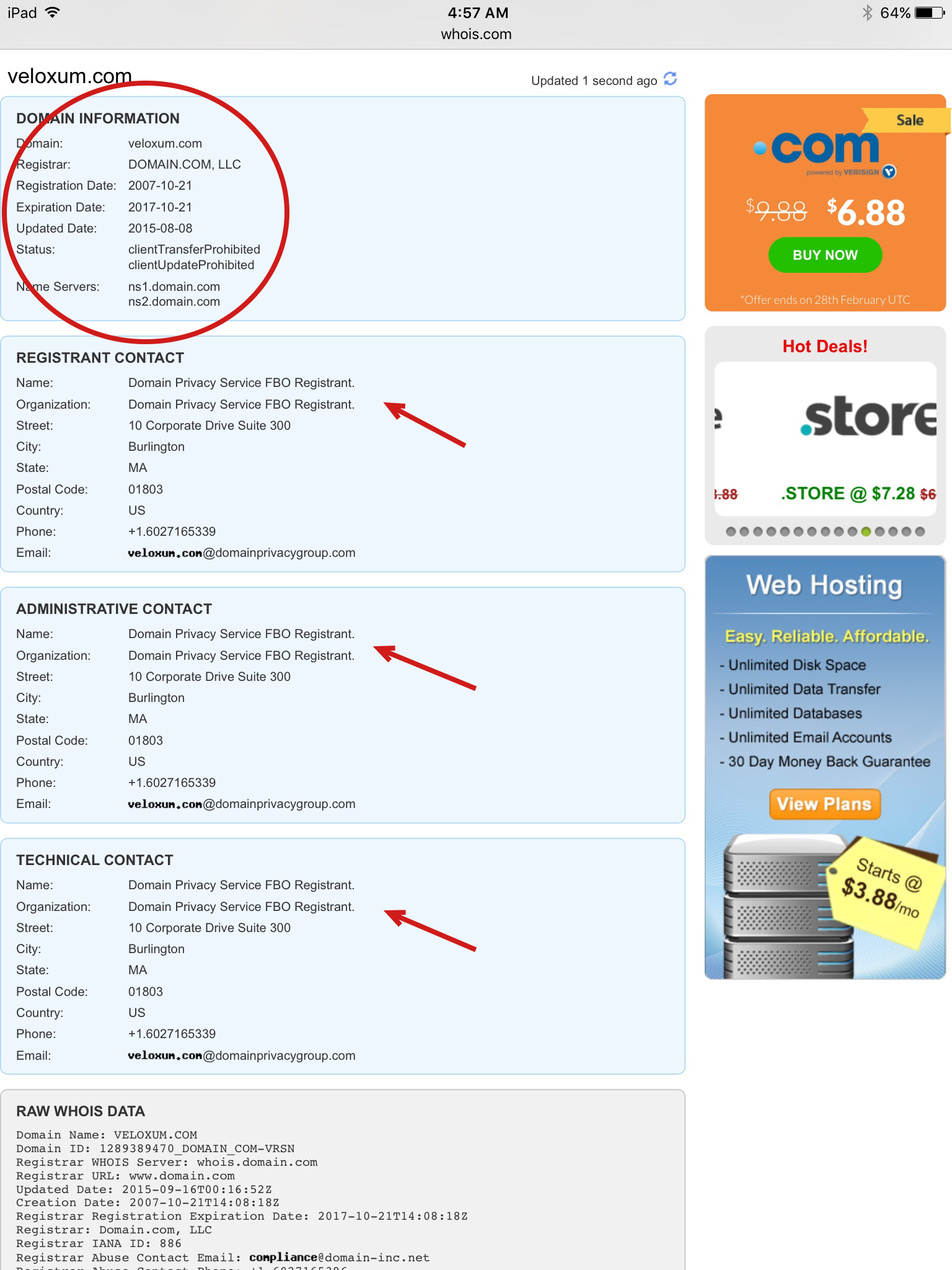

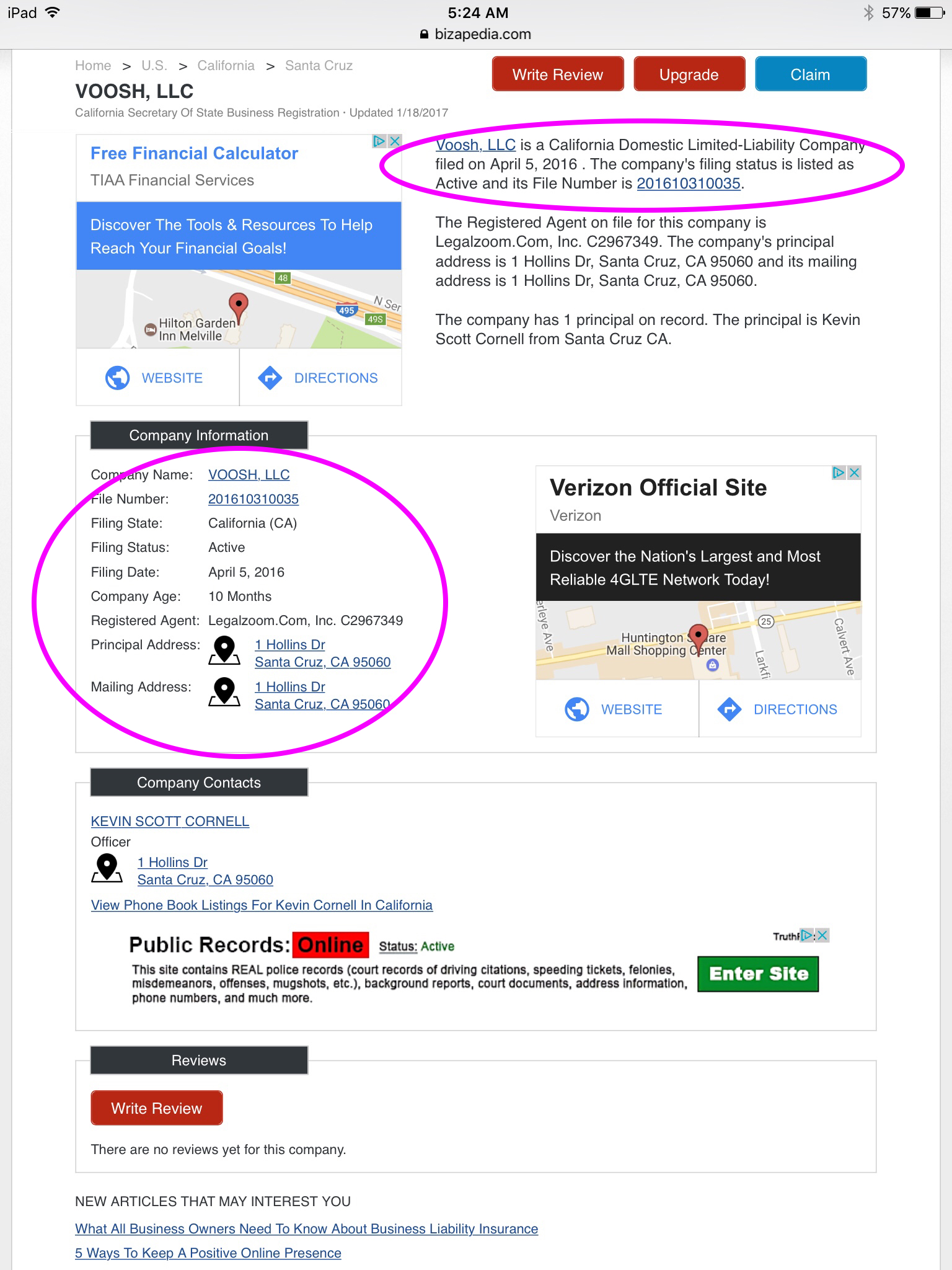

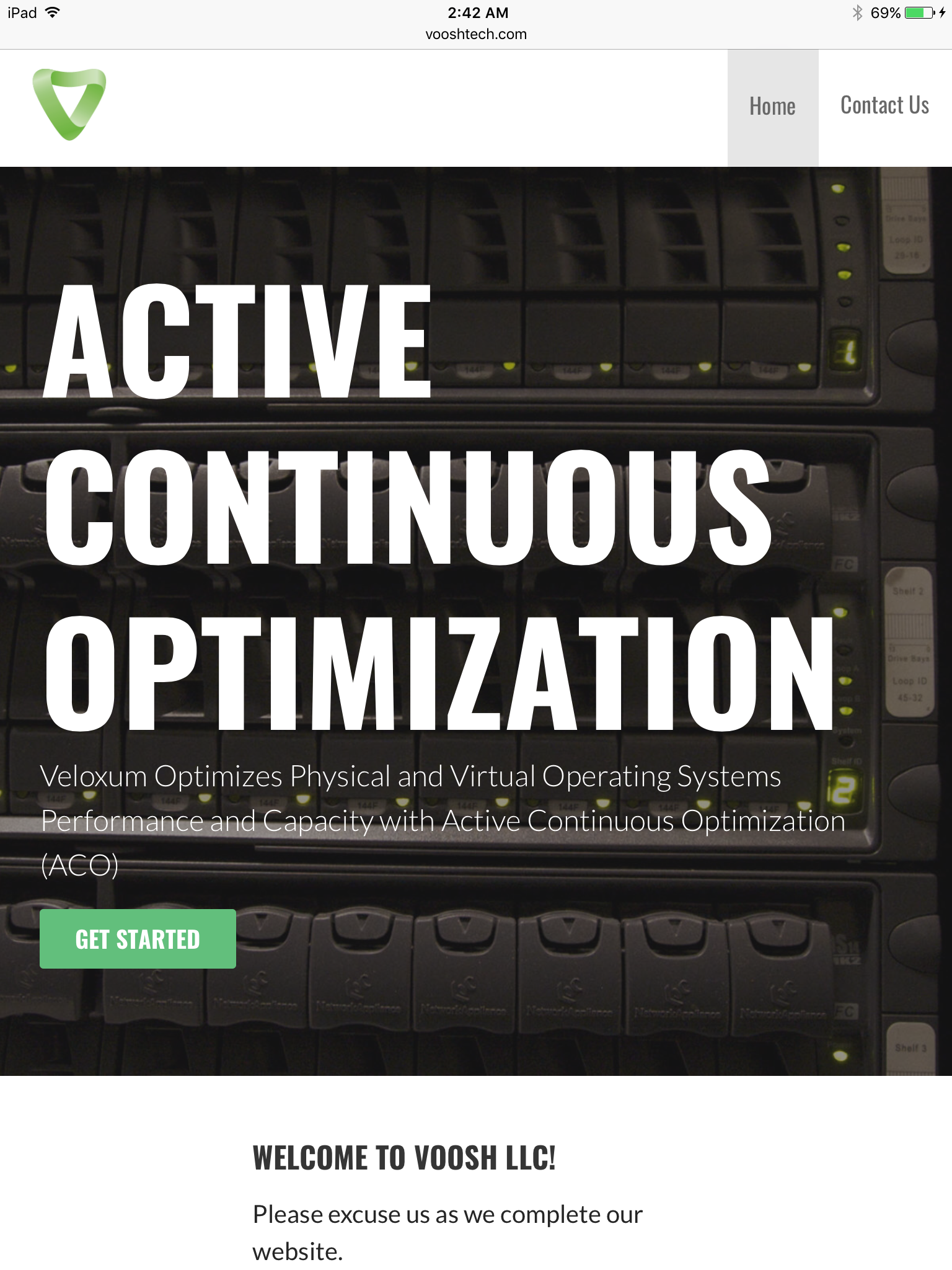

So what's the deal then? Veloxum is no longer lasted as an active company! It also has no website HOWEVER- the website is owned and held privately. Then recently, Voosh LLC website was released with a coming soon message. It is my opinion, the patents were issued and this optimization software is now ready to be marketed and distributed in a more mainstream way. There is further evidence toward bottom of this research

FROM BIZPEDIA.... Voosh has been around for about a year! Hmmmmmm

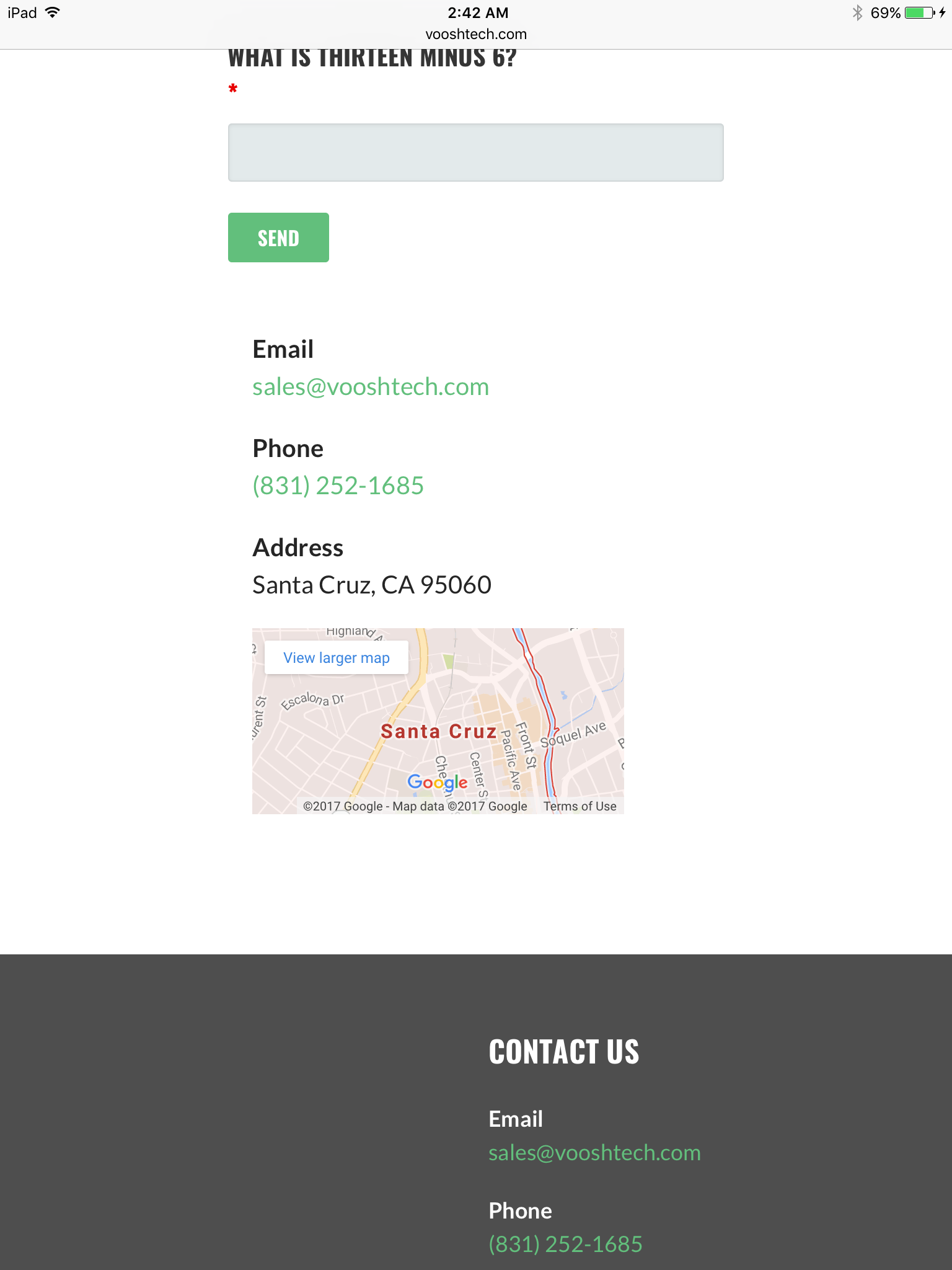

Here is the Voosh Website just released to public -

Check it here --> http://vooshtech.com

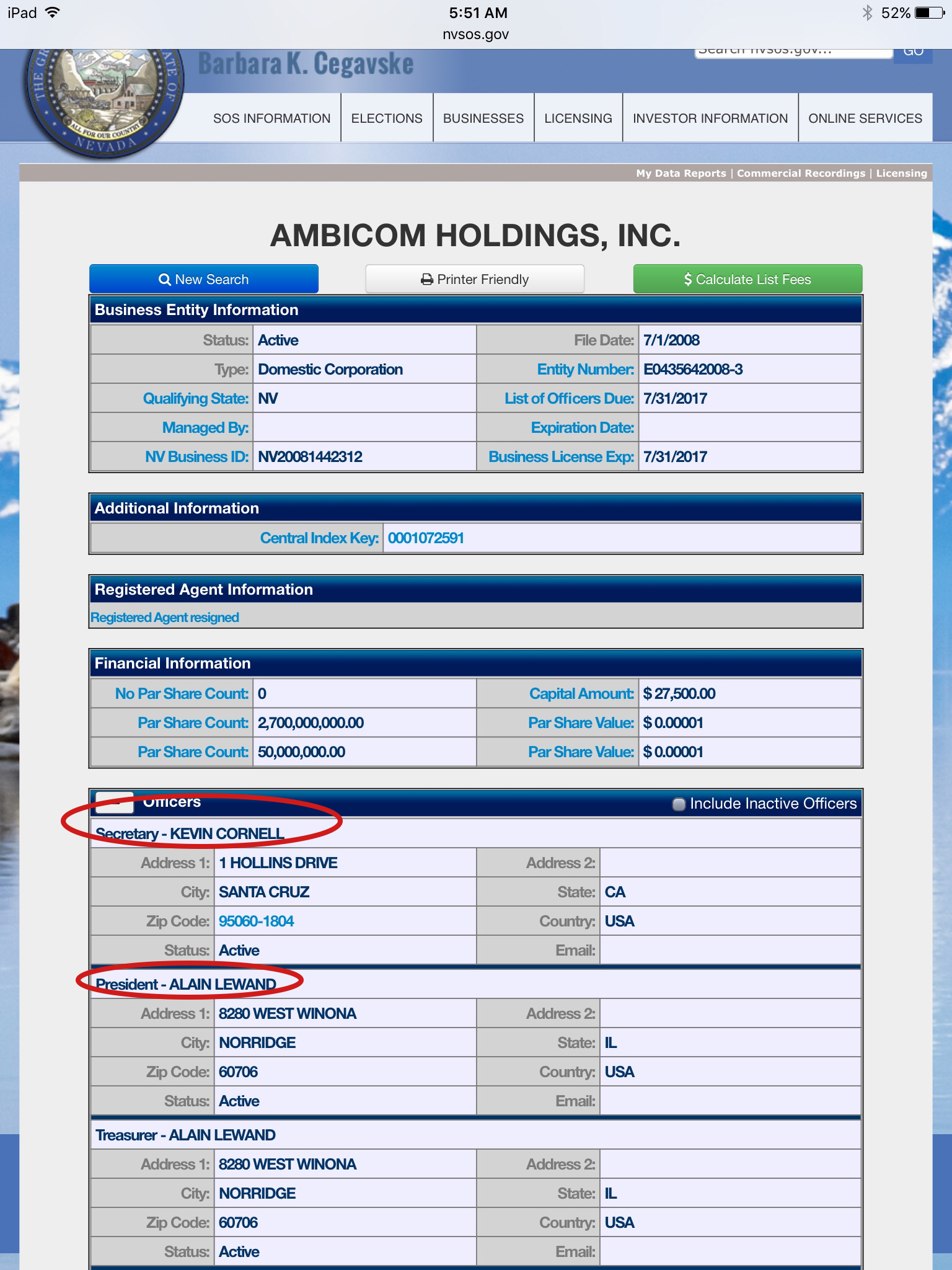

now HERE IS THE RECENT CHANGE MADE TO THE NVSOS...very telling. Now Cornell is listed as A DIRECTOR! Huge news and benefit to shareholders here IMO.

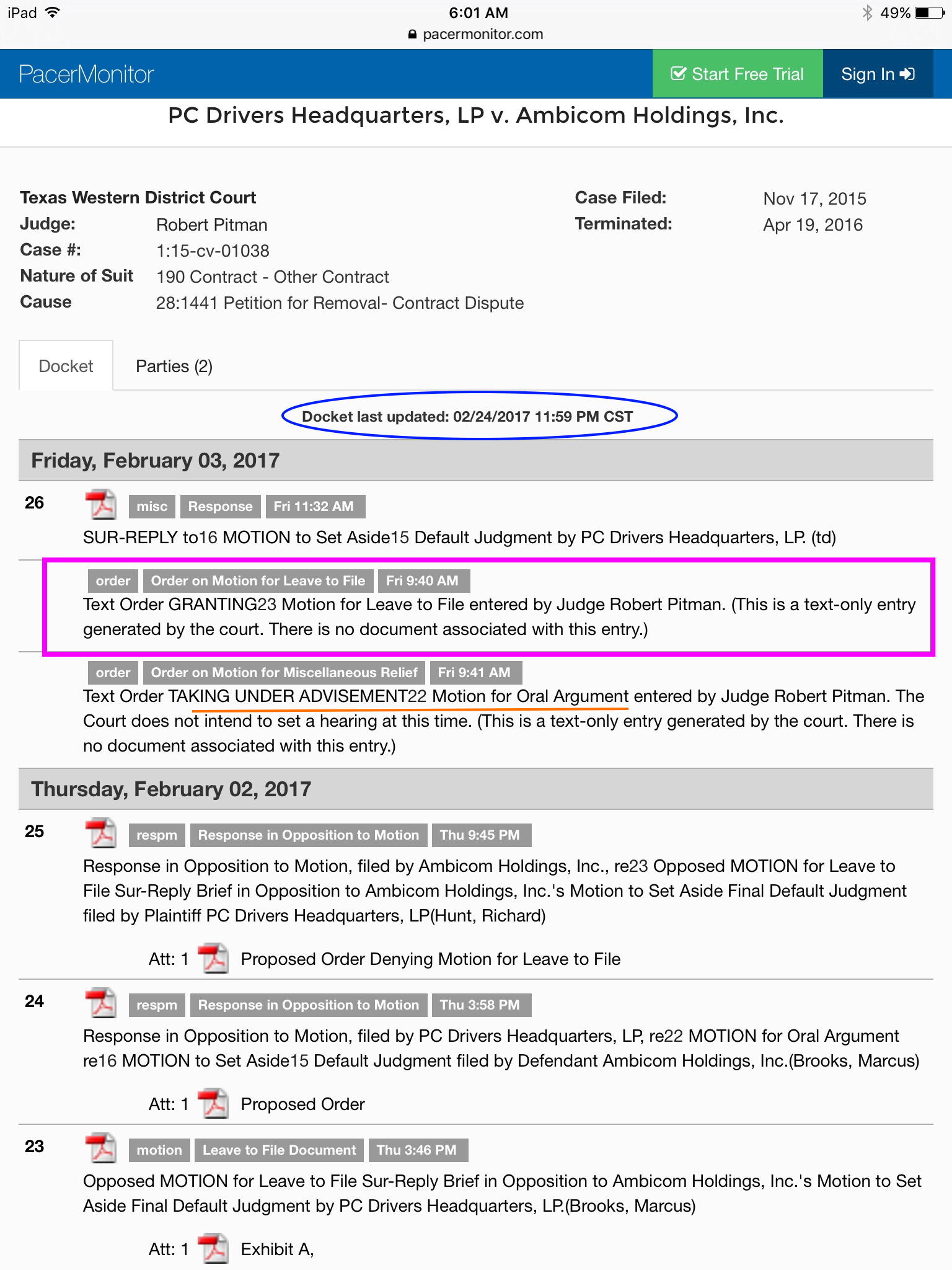

NOW LETS ADDRESS THE OTHER REVENUE POTENTIAL ...the pending lawsuit that many thought was closed last May 2016. Well checkout this PROOF from Pacer - this case is definitely reopened and well underway. Beat part- Kevin Cornell appears to be taking the Agressor role to protect his patented software and to recoup revenues OWED since they are using his product for 18 months now and haven't paid.

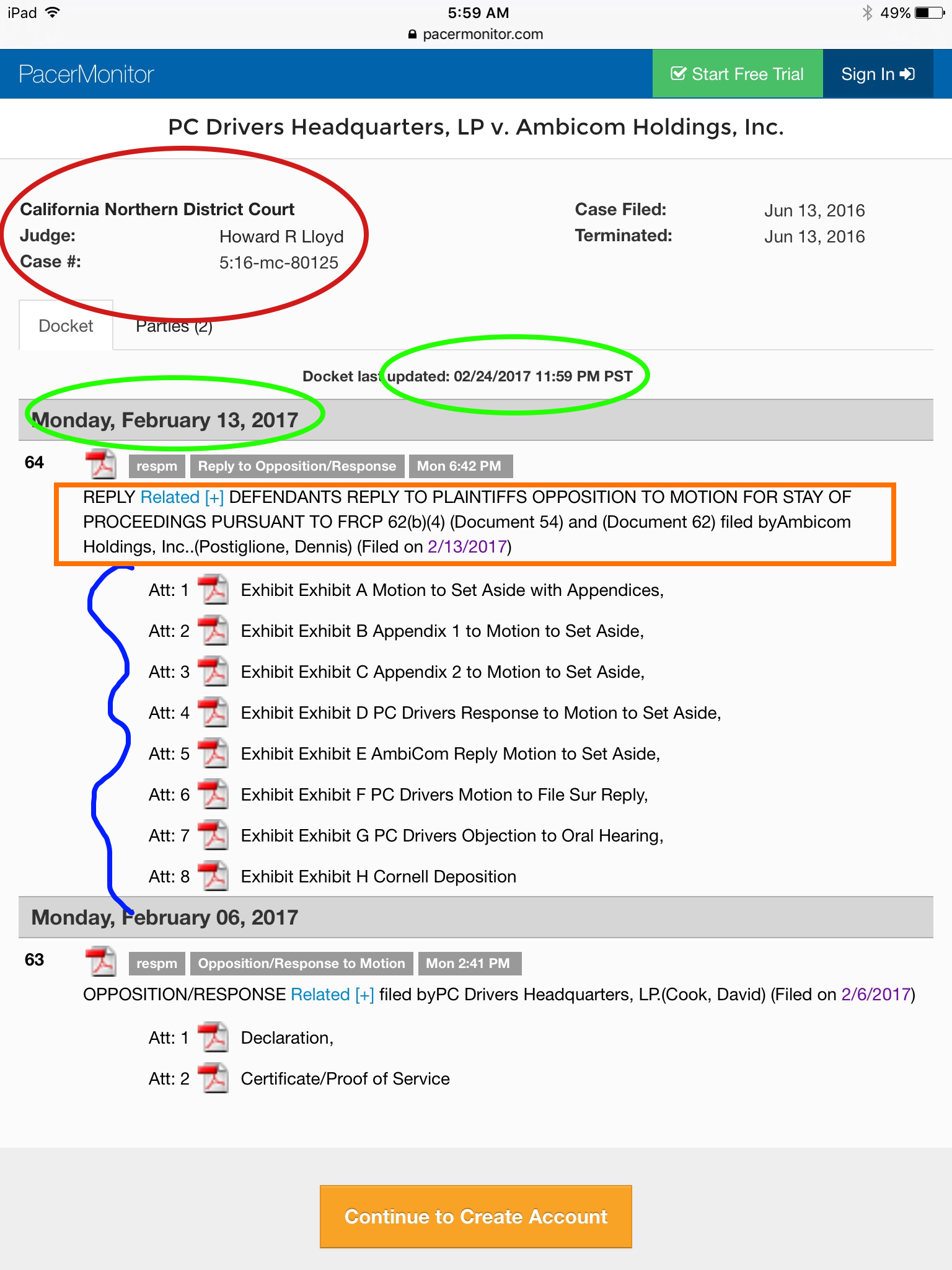

NOW GET THIS...here is another lawsuit being conducted in CALIFORNIA and this is huge proof this case is being aggressively pursued....

Therefore, it is my opinion, that $ABHI is at the precipice of a major breakout due to all of these aforementioned material events. With a line of credit and private investment - shareholders will have NO DILUTION. They plan to use this money to pay down debt and go CURRENT- which means SEC audited. As well, they already have an impressive list of painters and clients across myriad industry and plenty of Fortune 500 names

The AmbiCom Holdings website appears to be under construction too with this reference to changing management --

In conclusion, it does appear that Kevin Cornell, who used to run AmbiCom and Veloxum - has decided to return back to a leadership role. He has become very active in the lawsuit against PC Drivers as evidenced above by his deposition last week. It appears he intends to create Veloxum 2.0- mass marketed for sale and distribution to small businesses, and not just large enterprises but all. The software capability has always been there and it appeared that timing and patent approvals have paved the way for this potential to show through

HERE WAS AN ARTICLE FROM MID 2015-

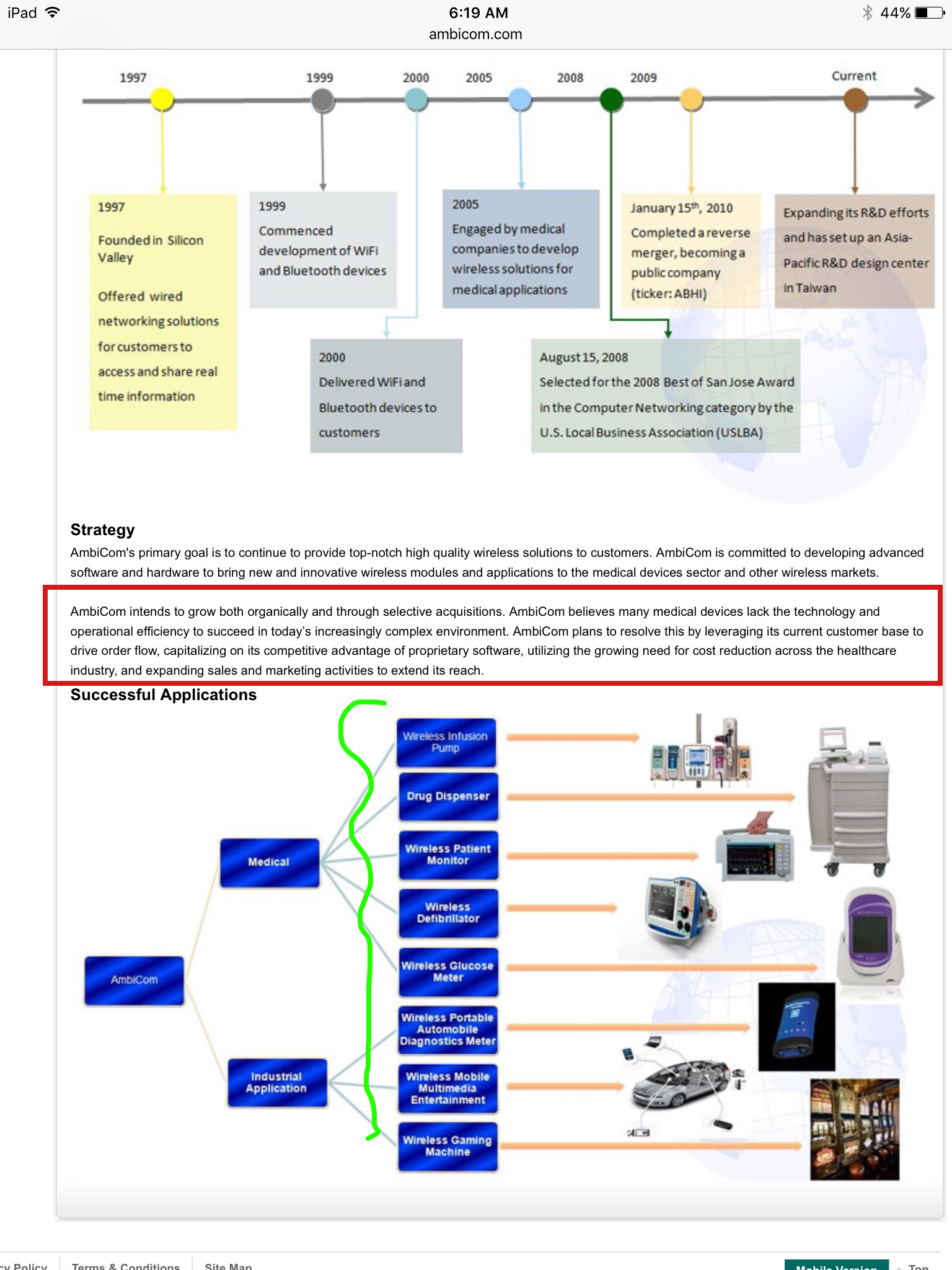

The Veloxum PC active optimization software, which was released in April 2015, is a cloud-based offering that provides consumers with performance features that were previously only available to large enterprises. By automatically evaluating a computer’s workload and assets, the innovative software is able to tweak the manufacturer’s supplied settings in order to deliver enhanced performance. The current addressable market for AmbiCom’s PC offering includes more than 2.3 billion individual devices around the globe.

Earlier this week, AmbiCom expanded upon the potential marketability of its product portfolio by announcing Veloxum AO, a cloud-based active optimization solution for managed service providers (MSPs). This product, which is expected to be available for installation in August, will deliver the same performance features of AmbiCom’s previous solutions with added remote capability. There are currently an estimated 30,000 MSP firms worldwide generating approximately $251 billion in revenue, according to a report by Channeleyes.com.

“Every single computer, be it a PC or a server, can benefit from proper tuning,” stated Kevin Cornell, president of AmbiCom.

For prospective shareholders, AmbiCom’s continued growth in the computer optimization market should provide a strong platform for sustainable financial growth in the months to come.

THUS - it's very telling since in- AmbiCom appeared to be going through Management struggles and the initial loss of the lawsuit against PC Drivers likely caused a divide. But this article proves that the software and revenue potential. ALWAYS EXISTED! THE CEO Was also recently asked via email whether he knew the value of revues now owed if they won the case. The number revealed appeared to be $20-30 mil. THATS HUGE ! Massive value potential! Please see the email exchange below -- we will have it screenshot for better verification.

Email from Alain Lewand to a shareholder -

From: alain lewand <@yahoo.com>

Sent: Friday, February 24, 2017 9:45:16 AM

To: David

Subject: Re: Questions Recent Company Events

David,

Thanks for reaching out.

The revenue potential from Voosh is unlimited. It's really a great product, having been endorsed by IBM and Microsoft, we are in current talks with some bigger clients to have them use the product system wide, which will bring in needed revenue to AmbiCom on a monthly basis. Hard to put an intrinsic value on it

The lawsuit I inherited, but as I looked at everything and saw the blatant disregard for the contract as was written, I saw the lawsuit as something AmbiCom needed to do as they continue to use the product and have not paid AmbiCom a penny. Over a year and a half period, rough estimate would be $20-30mm or more. It's substantial.

Everyone from previous management is gone. It had to be as they were the main cause of where the company currently is.

My responsibility first and foremost is to put value back into the stock for the shareholders. They make a company what it is.

Next step is to get current which were working on and hope to start quickly on the process.

Hope that helps.

Alain Lewand

CEO

AmbiCom Holdings

312-339-3017

IMO, enough potential exists here with $ABHI to run well into pennies. The chart has no long term resistance so it really could run hard with no dilutive trend and continued interest that it presents a viable prospect at it's current and projected valuations.

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.