| Followers | 587 |

| Posts | 31647 |

| Boards Moderated | 1 |

| Alias Born | 03/08/2006 |

Friday, March 24, 2017 1:27:15 PM

BE SURE AND READ THIS WHOLE POST WITH BACK UP LINKS

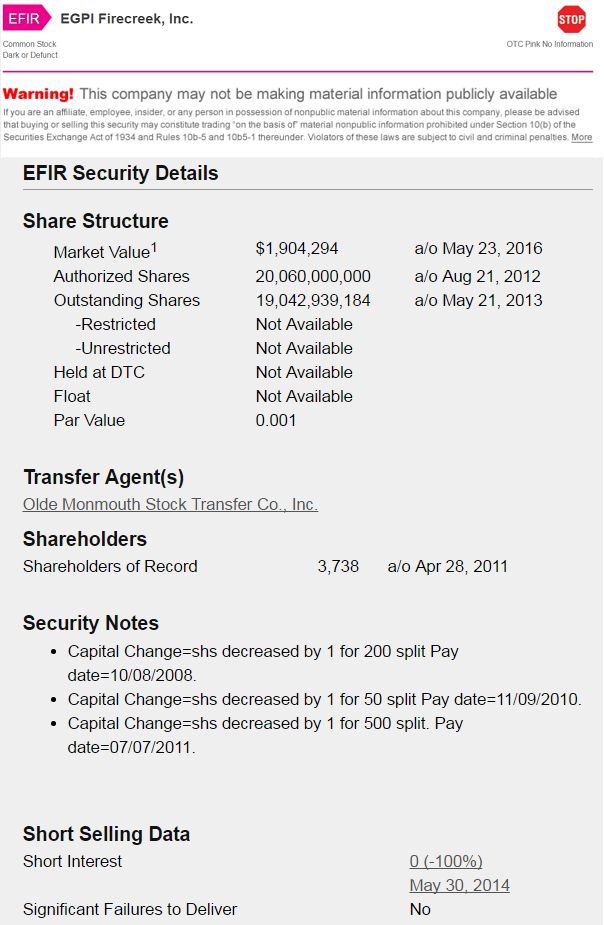

In the 8k dated January 29, 2013 he applied to Finra for a 1 to 4000

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=9040591

Item 8.01 Other Information

On January 24, 2013 the Company’s Majority Board of Directors and Shareholders effectively being the beneficial owners of approximately 54.29% of the issued and outstanding voting shares of the Company’s $0.001 par value common and preferred voting stock (the “Common and Preferred Stock”) have voted affirmatively for a reverse stock split. The Company has received their executed Written Consents, effective on January 24, 2013 to effect a One (1) for Four Thousand (4,000) reverse stock split (1:4000), whereby, as of a date to be not less than ten (10) days following the Company’s submission to FINRA of which its submission to FINRA is expected to be no later than January 31, 2013, for every four thousand shares of Common Stock then owned, each stockholder shall receive one share of Common Stock.

Background

The Company currently has 20,000,000,000 shares of Common Stock, and 60,002,500 shares of Preferred Stock authorized. Approximately 19,042,939,184 shares of Common Stock are issued and outstanding, along with 2,000,000,000 shares of Common Stock additionally subscribed for issuance, 1,087,142 shares of Series C Voting Only Preferred Stock are issued and outstanding, and 2,484 shares of its Series D Preferred Stock are issued and outstanding as of , respectively. The Board of Directors believes that the price of the Common Stock is too low to attract investors to buy the stock. In order to proportionally raise the per share price of the Common Stock by reducing the number of shares of the Common Stock outstanding, the Board of Directors believes that it is in the best interests of the Company’s stockholders to implement a reverse stock split. In addition, the Board of Directors believes that the share price of the Common Stock is a factor in whether the Common Stock meets investing guidelines for certain institutional investors and investment funds. Finally, the Board of Directors believes that the Company’s stockholders will benefit from relatively lower trading costs for a higher priced stock. The combination of lower transaction costs and increased interest from institutional investors and investment funds may ultimately improve the trading liquidity of the Common Stock. The Board of Directors is not implementing the reverse stock split in anticipation of any future transaction or series of transactions, including any “going private” transaction.

FEATURED Cannabix's Breath Logix Alcohol Device Delivers Positive Impact to Private Monitoring Agency in Montana, USA • Apr 25, 2024 8:52 AM

Bantec Reports an Over 50 Percent Increase in Sales and Profits in Q1 2024 from Q1 2023 • BANT • Apr 25, 2024 10:00 AM

Kona Gold Beverages, Inc. Announces Name Change to NuVibe, Inc. and Initiation of Ticker Symbol Application Process • KGKG • Apr 25, 2024 8:30 AM

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM