Saturday, February 25, 2017 9:43:06 AM

February 17, 2017

Link: Bullish On Copper And You Should Be Too

-> Copper bottomed in 2016 and the outlook remains bullish in the long term.

-> The short term could also offer positives due to strikes and political issues.

-> The long term balance for copper should be above $3.5 per pound and that price will be increasing due to lower copper ore grades and higher mining costs.

Introduction

The last time I wrote exclusively on copper was in April 2016. The bullish article is available here. Since then, copper prices have increased 22%, from $2.22 per pound to the current $2.73. As the dollar has also strengthened by 7% since then, we should add 7% to the current copper price to show the real appreciation in copper. Thus, copper would be at $2.92 in real terms.

In today’s article, I’ll discuss copper from the new, higher price perspective and share a very important fact that gave me confidence to write positively about copper back in April of 2016 even though at that moment in time it seemed that copper would continue to fall amid China slowing down and additional production coming online.

Figure 1: 2016 has marked the bottom of the 5-year copper price slump. Source: Bloomberg.

Let’s start with what’s currently going on with copper.

Copper Spiked In The Last Few Months

Copper prices have surged in the last few months, not because of Trump’s infrastructure promises but because there is a copper deficit in the market and there have been some problems at the world’s largest mines.

According to the International Copper Study Group (ICSG) the world’s refined copper balance for the first ten months of 2016 indicated a deficit of around 64,000 tons. If there is more demand than supply, it’s logical that prices go up. Apart from the structural imbalance, bad news from the biggest global mines has added fuel to the fire.

The beginning of 2016 was an extremely quiet period for copper with mine outages at historical lows. As mining isn’t a very socially and environmentally responsible activity, issues constantly arise. Recent protests in Peru have blocked road access to Las Bambas, a mine that produced 300,000 tons of copper in the first 11 months of 2016, or 1.9% of global production. The issues are related to the government helping miners with infrastructure while other basic services like running water and paved roads are scant. Further political turmoil could decrease supply coming from Peru and push copper prices up.

Figure 2: Copper production by country. Source: Index Mundi.

Apart from Las Bambas in Peru, there’s also trouble at the largest copper mine in the world, Escondida, in Chile. Workers are on strike and production at Escondida has been stopped for more than a week already. This is of huge importance for copper as Escondida puts 5% of global copper production on the table.

Currently, there is no communication between BHP Billiton (NYSE: BHP), the operator of the mine, and the workers. The workers want pay increases, no cuts to bonuses, and better shift hours. On the other hand, the company is blaming employees for damages to equipment and installations. This issue will be solved eventually, but it can develop into a lengthy process. Whatever the outcome, one thing is certain, mining costs will increase as other miners will demand better working conditions too.

As global copper ore grades are declining, miners have to search for it in unfavorable business jurisdictions. Freeport McMoRan Inc. (NYSE: FCX) has been banned from exporting copper from Indonesia which forced the company to stop production at its Grasberg mine. Grasberg produces 500,000 tons of copper per year, or 2.7% of global supply.

To sum things up, 9.7% of global copper production is currently idled. If the situation remains, I wouldn’t be surprised to see copper at $4 as demand is constantly rising and is expected to rise 1% in 2017. Even if production at the world’s top three mines resumes, what will see in the future are political and environmental issues, and higher labor and mining costs.

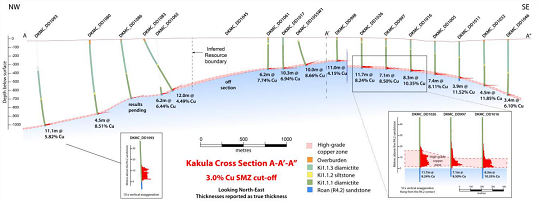

An excellent example of how copper mining costs will increase in the future is the Kamoa-Kakula project which is regarded as one of the top five copper deposits in the world with copper grades close to 3% and 125 million tons of inferred resources. However, that copper is more than 350 meters below the surface, with some of it more than 1,000 meters below the surface.

Figure 3: Ivanhoe mines Kakula deposit. Source: Ivanhoe.

In addition to the depth, the project is located in the Democratic Republic of Kongo which isn’t such a safe jurisdiction.

Most new copper projects have lower grades and are metallurgically more complex, like the Kamoa-Kakula project described above.

Figure 4: Global copper ore grades. Source: Codelco.

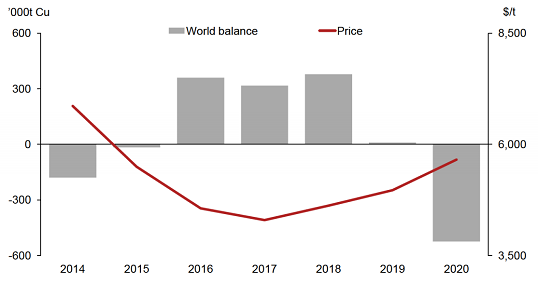

The lower grades and complexity of new projects will make it more expensive to mine and lower supply. A supply gap is expected to open in 2020 but given the issues at the world’s top mines, we might see deficits in 2017 and higher copper prices sooner than expected.

Figure 5: Expected copper market balance. Source: CRU.

In 2020, copper prices are expected to be higher than $6,000 per ton as mining costs will be higher and demand will be higher.

The copper example is a great example to explain how to invest in cyclical commodities. The main clue to know when we are close to a bottom are costs.

Copper Confirms My Theory On How To Play Cyclicals

The price of a commodity can go below the marginal production cost for a while, but can’t stay there for long as sooner or later marginal producers start to idle production or go bankrupt. Therefore, the safest way to invest in cyclical commodities is to look at the cost curve. Copper was an easy call back in April 2016 as about 20% of global copper output had cash costs above $2 per produced pound of copper. And these are only cash costs that don’t include mine depletion costs, exploration costs, equipment depreciation costs, etc.

Figure 6: Copper cash cost curve. Source: BHP.

In such an environment, copper prices below $3 per pound are unsustainable as companies aren’t incentivized to invest in new projects. Lack of investments leads to future supply deficits and to higher copper prices. Higher prices eventually incentivize new investments and lead to an oversupplied market, and so the cycle continues. The positive with copper is that the low fruit has been picked and the remaining copper to be mined is deeper, scarcer, and much more expensive to mine.

As we’re already at $2.75 and the supply gap has just started to open, I expect copper prices to be above $3.5 in 2020. Therefore, I’m still bullish on copper. However, if a recession happens or China slows down, we could see copper temporarily below $2 again. So, the margin of safety for investing in copper remains $2 per pound. If copper prices fall to $2 per pound, you can bet big on miners that can survive a period with lower copper prices.

Conclusion

It’s funny how few of us understand how cyclicality works. Higher prices lead to more investments and an oversupply. Oversupplied markets bring down commodity prices to an unsustainable level that cuts investments, leading to supply issues in the future.

With Wall Street always focused on the next quarter, many miss the incredible opportunities that cyclical investing offers. When prices are high, people replicate past price increases into future projections and get excited. When prices are low, people panic and sell. In July 2015, Goldman Sachs was extremely bearish on copper, stating that we would see low copper prices up to 2019. Now that copper prices have already increased, Goldman is extremely bullish on the metal.

The first pick for my new Global Growth Stocks newsletter is a mid-tier copper miner that stands to see huge gains from the coming supply deficit we discussed today.

Global Growth Stocks officially launches this coming Tuesday, so stay tuned to Investiv Daily for information on signing up.

NanoViricides Reports that the Phase I NV-387 Clinical Trial is Completed Successfully and Data Lock is Expected Soon • NNVC • May 2, 2024 10:07 AM

ILUS Files Form 10-K and Provides Shareholder Update • ILUS • May 2, 2024 8:52 AM

Avant Technologies Names New CEO Following Acquisition of Healthcare Technology and Data Integration Firm • AVAI • May 2, 2024 8:00 AM

Bantec Engaged in a Letter of Intent to Acquire a Small New Jersey Based Manufacturing Company • BANT • May 1, 2024 10:00 AM

Cannabix Technologies to Deliver Breath Logix Alcohol Screening Device to Australia • BLO • Apr 30, 2024 8:53 AM

Hydromer, Inc. Reports Preliminary Unaudited Financial Results for First Quarter 2024 • HYDI • Apr 29, 2024 9:10 AM