| Followers | 603 |

| Posts | 24109 |

| Boards Moderated | 3 |

| Alias Born | 12/06/2009 |

Saturday, February 18, 2017 4:03:12 PM

Right now USRM is FDA Approved for Phase 2/3 Trials of MYOCELL

in a 10 Year ongoing trial study named: MARVEL

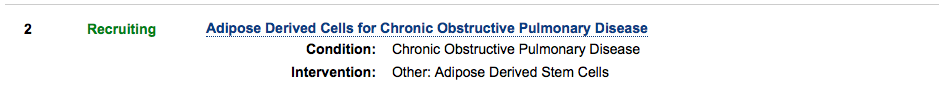

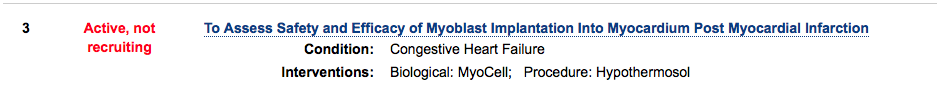

The Clinicaltrials.gov website is showing a total of

3 Clinical Trials as Active for USRM (formerly Known as Bioheart):

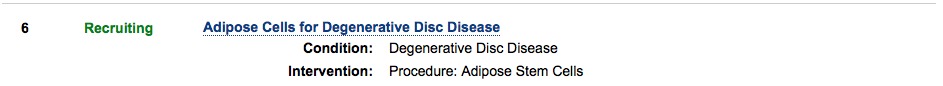

My opinion of why MYOCELL could be be a Multi Million, or even Billion Dollar opportunity are explained in research about biotech companies that have been acquired by Big Pharma

Recently, A significant number of biotech companies in preclinical development were acquired for between $400 million and $600 million, and two phase 3 companies were acquired for less than $450 million. Surprisingly, when deals were structured (a portion paid up front, with additional consideration for achieving milestones), the development stage did not seem to influence the upfront-to–earn out ratio: for all phases the upfront was roughly half of the total deal value. Also, 75% (12 of 16) of the preclinical stage companies and 83% (5 of 6) of market stage companies were acquired in all-upfront deals....

the most attractive companies for acquisition are those developing products in chronic inflammation, oncology, cardiovascular disorders and infectious diseases...

The Average Total Deal Value for companies that treated Cardiovascular Disorders was 561 Million.

http://www.nature.com/bioent/2013/130301/full/bioe.2013.3.html

Cash poor Stem Cell companies similar to USRM that actually traded on the OTCBB have actually been acquired by BIG PHARMA in the recent past with as little as positive phase 2 results.

one in particular is OCATA Therapeutics (formerly ACTC)

See OCATA was involved with MACULAR DEGENERATION,

(Stem Cell Treatment to reversing Blindness) and a few other trials..

They had positive results:

"Positive Stem Cell Clinical OCATA Trial Results"

"Although the primary goal of this small early-stage clinical trial was to assess the safety of the transplanted stem cells, the treatment also had unexpected positive benefits: Ten out of 18 study participants reported improvements in vision, with some subjects reporting dramatic improvements. In addition, the treatment appears to have halted the progression of the disease in 17 of the 18 subjects."

https://www.thestreet.com/story/12914059/1/act-announces-positive-results-from-two-clinical-trials-published-in-the-lancet-using-differentiated-stem-cell-derived-retinal-pigment-epithelium-rpe-cells-for-the-treatment-of-macular-degeneration.html

See guys all it takes is a little bit of positive results...

and then they were approached by BIG PHARMA

Astellas a Japanese pharmaceutical company

Headquarters: Chuo, Tokyo, Japan

Revenue: 11.06 billion USD (2013)

Founded: 2005

Total assets: 14.86 billion USD (2016)

and look what happened...

Astellas Pharma Inc. announced that it has successfully completed, through its indirect wholly-owned subsidiary Laurel Acquisition Inc. (“Laurel”), a tender offer to purchase all issued and outstanding shares of common stock of Ocata Therapeutics, Inc. (NASDAQ: OCAT) for a price of US$8.50 per share net to the stockholder in cash (“Tender Offer”)

http://www.streetinsider.com/Corporate+News/Astellas+Pharma+Announces+Successful+Completion+of+Ocata+Therapeutics+(OCAT)+Tender+Offer/11299120.html

OCATA is now; Astellas Institute of Regenerative Medicine

https://www.astellas.us/therapeutic/rnd/airm.aspx

Now here we are with USRM

O/S approximately 100 million Shares

a company with FDA Phase 2/3 Trials for MYOCELL with positive results

PUBLISHED in the Journal of Translational Medicine.

https://www.ncbi.nlm.nih.gov/pubmed/27255774

and recent positive results with their Degenerative Disc Disease study:

CSO Kristin Comella Publishes Paper on the Implantation of Stromal Vascular Fraction in Patients with Degenerative Disc Disease

https://finance.yahoo.com/news/cso-kristin-comella-publishes-paper-173400284.html

and the former CEO (a medical device inventor and USRM minority shareholder according to his website) has this in mind when it comes to selling a company involved in trials:

Leonhardt:

And this was USRM's most recent Facebook Post:

On the business front, our financial indicators continue to trend positive with revenues up and liabilities down. Here is a summary of U.S. Stem Cell’s most recent financial figures for Q3:

Current liabilities down $734K or 9.5% from $7.69M in Q3 2015 to $6.96M in Q3 2016

Revenue up by 31% to from $557K in Q3 2015 to $729K in Q3 2016

Net loss improved 17% from $264K in Q3 2015 to $219K in Q3 2016

Cash used in operating activities down $322k or 84% from $384K in Q3 2015 to $62k in Q3 2016

We will continue to develop pioneering regenerative medicine techniques and technologies as we work to bring regenerative therapies to patients around the world. Our focus has always been, and will continue to be, on new life-changing treatments.

With USRM turning the corner, and FDA APPROVED Phase 2/3 results coming due for MYOCELL, and positive clinical results up to date, one could place a value on U.S. Stem Cell Inc. on the higher end of the buyout scale. This is why USRM is highly undervalued and could possibly be worth Multi-Millions or even Billions of Dollars.

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM