Thursday, February 16, 2017 3:09:23 PM

1) Jean "Richard" Charbit - As you pointed out Charbit was/is a pretty major stock holder in NEWC because of the 7,599,256 shares he owns/owned through Yorktown Consultancy. The most recent NEWC filings list Ingrid Charbit as the owner of those shares, but Yorktown Consultancy (which is an offshore entity registered in Samoa) is in fact controlled by Richard Charbit

https://offshoreleaks.icij.org/nodes/10002849

Charbit set up Yorktown Consultancy with the help of the now famous money laundering firm Mossack Fonseca

https://www.yahoo.com/news/panama-detains-mossack-fonseca-founders-corruption-charges-235953306--finance.html

Richard Charbit set-up/controlled a bunch of offshore entities in places like the British Virgin Islands, Seychelles, Panama, and the Bahamas all using Mossack Fonseca

https://offshoreleaks.icij.org/nodes/11012917

YORKTOWN CONSULTANCY SERVICES LIMITED

NITEX SERVICES LIMITED

REYDALE CONSULT S.A.

MURLEY INDUSTRIES LIMITED

REYDALE CONSULT TWO, SA

TECHWOOD INTERNATIONAL GROUP CORP.

VALENCIA TECHNOLOGY S.A.

ENDER COMPANY ASSETS INC.

RICHMOND GLOBAL FOUNDATION

ALPHERY HOLDINGS S.A.

ALTRAN, INC

BLUEBERRY FIELDS, SOCIEDAD ANONIMA

EMPRESAS CHARBIT S.A.

Panadorph, S.A.

RHODOS ASSETS S.A.

FAR EAST HOLDINGS LTD.

GOLD HILL HOLDINGS LTD.

Charbit also used Yorktown Consultancy to own shares in Baltia Air Lines (BLTA) way back in 2001. BLTA doesn't have the best reputation

http://onemileatatime.boardingarea.com/2016/03/18/baltia-airlines-sec/

As you pointed out, Richard Charbit was Indicted in 2010 because of his involvement in an illegal share selling/kick back scheme in ZNext Mining Corp (ZNXT).

https://promotionstocksecrets.com/wp-content/uploads/2017/02/Charbit.pdf

https://archives.fbi.gov/archives/miami/press-releases/2010/mm110110.htm

He was also charged by the SEC

https://www.sec.gov/litigation/complaints/2010/comp-pr2010-187-charbit.pdf

The ZNXT kickback bust was part of a large FBI sting that got many others including Scott R. Sand and Anthony Mellone Jr which I believed used Richard Epstein as the FBI Cooperating Individual to help set up the marks.

https://www.sec.gov/litigation/litreleases/2010/lr21691.htm

In 2011, Charbit was sentenced to 9 months in prison followed by 2 years supervised release plus a $40,000 fine.

Reviewing the NEWC filings, it looks like Yorktown Consultancy received 5,599,256 shares in early 2011 (After Charbit was Indicted but before Charbit went to prison) for services provided as part of the Colombian mining company acquisition that brought in Juan "John" Campo as a new executive.

The other 2,000,000 shares were received by Yorktown Consultancy in the fourth quarter of 2013 (it looks like for a small amount of cash in some sort of funding arrangement).

Richard Charbit was involved in NEWC before that though. Through Ender Company Assets Inc he was a major shareholder starting in the 2nd quarter of 2010 (just before his Indictment).

https://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=7831964

Ender Company Assets, Inc. 20,000,000 30.9%

Irishmist Consultants Limited 20,000,000 30.9%

I wouldn't be surprised if Irishmist Consultants Limited was Richard Charbit also. The NEWC filings never disclose why those 40,000,000 shares were issued during the 2nd quarter of 2010. Around the same time, NEWC issued two $100,000 Notes to two separate unnamed entities for future financing to be received. It appears that the 40,000,000 shares were later returned to the treasurer as no financing was ever received. At one point in the filings, it said that those 40,000,000 shares were stock options owned by former officers of the company. Confusing to say that least.

Bottom line is that Richard Carbit and Kyle Gotshalk go back at least to early 2010 (soon after Kyle Gotshalk first got involved in the NEWC shell), and Richard Carbit was intimately involved in bringing the Colombian mining property into NEWC. It is very possible that Charbit is continuing to get paid discounted NEWC stock as an anonymous consultant or an anonymous financier.

2) Kyle Gotshalk was a long time executive of NEWC going back to 2009. Since stepping down as an executive in 2014, Gotshalk has remained a shareholder through various entities and has remained on the NEWC payroll as a consultant.

Kyle Gotshalk was Indicted for his involvement in an illegal kickback scheme on December 11, 2008.

https://promotionstocksecrets.com/wp-content/uploads/2017/02/Gotshalk.pdf

Despite a warrant being issued for his arrest the same day, Gotshalk wasn't taken into custody until May 21, 2010 (a few weeks after he started doing filings as the new CEO of the NEWC shell).

Once in custody the Indictment was made public and charges also came from the SEC

http://www.courthousenews.com/2010/09/28/30616.htm

https://www.sec.gov/litigation/litreleases/2010/lr21663.htm

The undercover FBI sting that got Gotshalk was part of a large operation that also busted several others individuals in other tickers

https://www.sec.gov/litigation/litreleases/2008/lr20828.htm

https://www.sec.gov/litigation/litreleases/2009/lr20899.htm

https://www.sec.gov/litigation/litreleases/2010/lr21426.htm

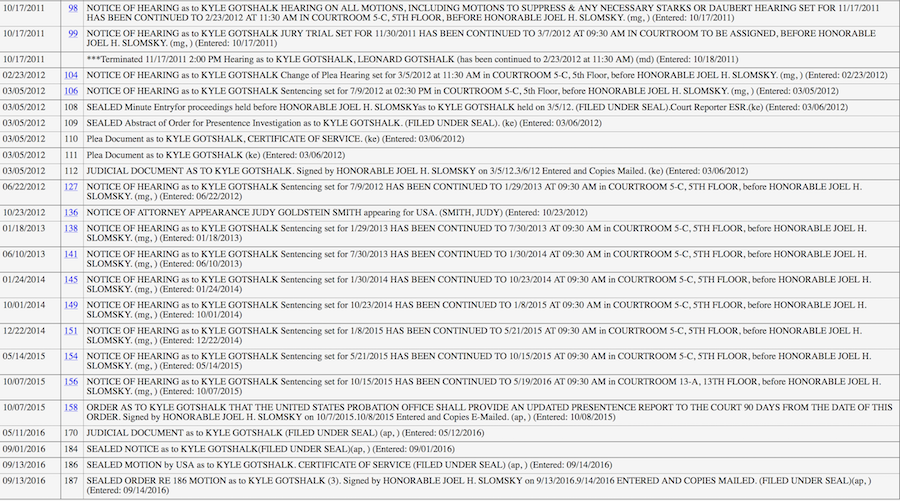

Kyle Gotshalk's case is interesting. Gotshalk decided to plead guilty in March of 2012 (Plea documents are all sealed), but to date he still hasn't been sentenced. His sentencing was delayed for more then 4 years and now there are a bunch of sealed motions and orders in the case from 2016. It certainly looks like Gotshalk decided to become a cooperating individual with the FBI.

Others busted with Gotshalk - Mark Johnson and Mark Manoff - I recognize from some research I did for ticker UCSO. UCSO was a super dirty ticker with lots of interest names involved through out its history - Randall J Lanham, MacDonald Tuskey, Clark Wilson LLP, Konrad Ackermann, Michael Anthony, Laura Anthony, Mark T Johnson, Marc D Manoff, Kelly Black, Roger W Malik, Gerald Parker, Christopher Wheeler, Regis Possino, Sherman Mazur, David Rushing, Harold "BJ" Gallison, James Wheeler, Carl Marciniak, Jeffrey Weinfurter, and Jonathan D Leinwand.

How is it that Gotshalk was allowed to continue to be the CEO of NEWC for more than 2 years after being arrested and agreeing to plead guilty? How is it that he is still involved as a paid consultant?

3) KBM Worldwide, Inc - that is a Curt Kramer company. Kramer has been a toxic financier for penny stocks going back more than a decade first using entities like XXR Group and Mazuma Holdings (which was named in SEC litigation) and Hope Capital (also named in SEC litigation) then moving on to Asher Enterprises (until that entity was black listed by FINRA) then moving on to KBM Worldwide, Vis Viras Group, Power Up Lending Group, and others.

Curt Kramer has been involved in hundreds of dirty penny stocks going back more than 10 years now. He first got involved in NEWC back in February of 2012 with Asher Enterprises then later with KBM Worldwide after Asher Enterprises was Black Listed.

Kramer was still receiving stock from NEWC when it went dark in late 2015. It's impossible to know if they are still involved or not today since NEWC is a delinquent SEC flier now almost 2 years behind on its filings.

4) Another interesting name involved in NEWC is Joe Poe who controls Bold Leego Enterprises, Inc. On March 25, 2015, NEWC issued 3,125,000 shares of common stock to Bold Leego Enterprises, Inc. for the conversion of $12,500 of debt originating from a Promissory Note dated September 18, 2014.

Joe Poe was sanctioned by the Oklahoma Securities Commission in 2006 for selling a bunch of unregistered shares in old scam ticker BCIT

https://promotionstocksecrets.com/wp-content/uploads/2017/02/JoePoe_OrderImposingSanctions_06-054.pdf

http://investorshub.advfn.com/BOARDS/read_msg.aspx?message_id=9163425

5) Secret Info

NEWC also issued a bunch of other super cheap shares to unnamed individuals and entities for cash or services through out all of 2015

https://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=10765362

https://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=10714307

On January 9, 2015, the Company entered into a Stock Purchase Agreement with a third party for the purchase of 2,500,000 shares of common stock for a purchase price of $15,000 ($.006/share).

On January 21, 2015, the Company entered into a Stock Purchase Agreement with a third party for the purchase of 500,000 shares of common stock for a purchase price of $5,000 ($.01/share).

On January 26, 2015, the Company entered into a Stock Purchase Agreement with a third party for the purchase of 600,000 shares of common stock for a purchase price of $4,800 ($.008/share).

On February 11, 2015, the Company entered into a Stock Purchase Agreement with a third party for the purchase of 2,500,000 shares of common stock for a purchase price of $15,000 $.006/share).

On March 2, 2015, the Company entered into a Stock Purchase Agreement with at third party for the purchase of 1,500,000 shares of common stock for a purchase price of $9,000 ($.006/share).

On March 17, 2015, the Company entered into a Stock Purchase Agreement with a third party for the purchase of 2,000,000 shares of common stock for a purchase price of $10,000 ($.005/share).

March 19, 2015, the Company entered into a Stock Purchase Agreement with a third party for the purchase of 1,000,000 shares of common stock for a purchase price of $9,000 $.009/share).

On April 7, 2015, the Company entered into a stock purchase agreement with a third party for the purchase of 2,500,000 shares of the Company’s common stock for a purchase price of $12,500 ($.005/share).

On April 30, 2015, a third party converted $12,500 of principal of a note dated September 18, 2014 into 3,968,253 shares of the Company’s common stock $.00315/share).

Also on April 30, 2015, a third party converted $12,000 of principal of a note dated September 5, 2014 into 3,157,895 shares of the Company’s common stock ($.0038/share).

On May 1, 2015, the Company entered into a consulting agreement with a third party. Pursuant to the agreement, the Company shall issue to the consultant 2.5 million shares of the Company’s common stock as full consideration for all services to be performed

Also on May 1, 2015, the Company entered into a stock purchase agreement with a third party for the purchase of 1,000,000 shares of the Company’s common stock for a purchase price of $5,000 ($.005/share), of which $2,000 was paid directly to Sannabis SAS, and the remaining $3,000 was received by the Company.

On May 7, 2015, the Company entered into a stock purchase agreement with a third party for the purchase of 1,636,364 shares of the Company’s common stock for a purchase price of $4,500 $.00275/share).

6) More than a little suspicious

Besides NEWC's history of hiring known securities violators, there is also a bunch of red flags surrounding the parade of press releases put out by NEWC since going dark during the last half of 2015.

When NEWC went dark in 2015 they had no revenues ever in their history and were showing no real progress with their Colombian coal mining operations. Suddenly after going dark they are putting out a bunch of press release about huge coal orders and even an entry into the super popular cannabis industry. Those press release are more than just a little suspicious.

https://www.otcmarkets.com/stock/NEWC/news

You've done a nice job here. Keep it up. It's a bit of an embarrassment for the FBI that Gotshalk and Charbit are here running such an obvious scam, but some how it wouldn't surprise me if Gotshalk's likely cooperation with the FBI might have given him a free pass of sorts to run NEWC as a scam without any fear of repercussions.

Even if NEWC doesn't get suspended for the obvious fraud going on here, NEWC runs the risk of getting suspended as a delinquent SEC flier. NEWC is now getting close to being 2 years delinquent in its required filings. The longer NEWC goes without catching up on its required SEC filings the greater the risk becomes of being suspended as a delinquent flier.

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.