Wednesday, February 08, 2017 8:13:35 PM

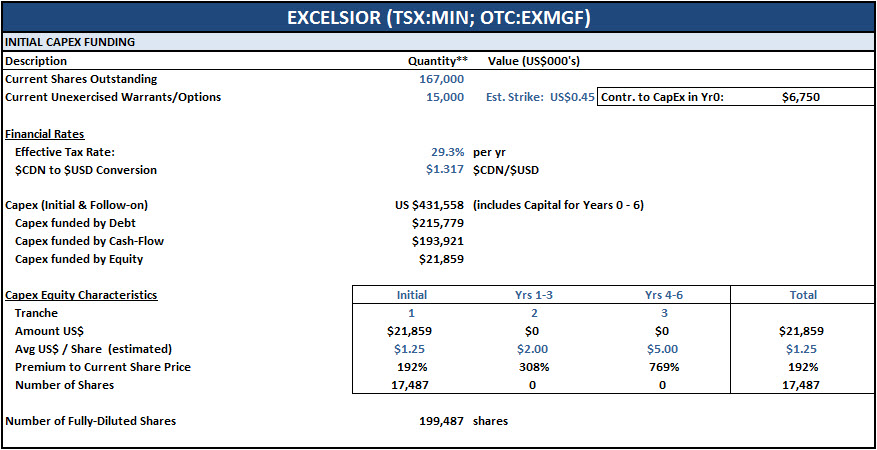

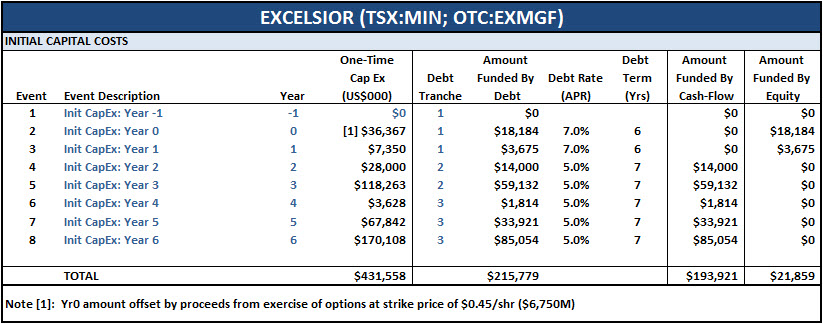

I've had more than a few PMs asking about the CapEx assumptions used in the model. I've included them in a table below the scenarios.

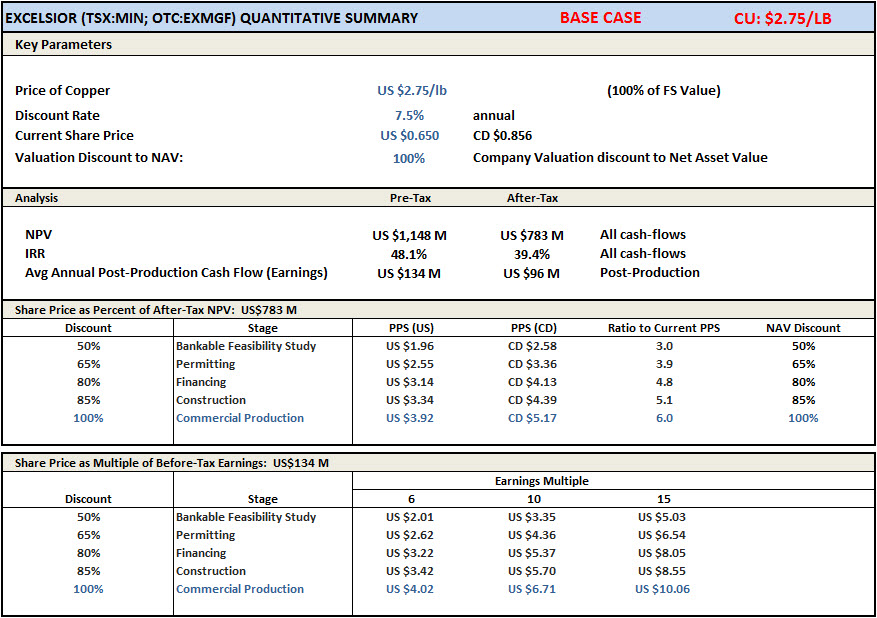

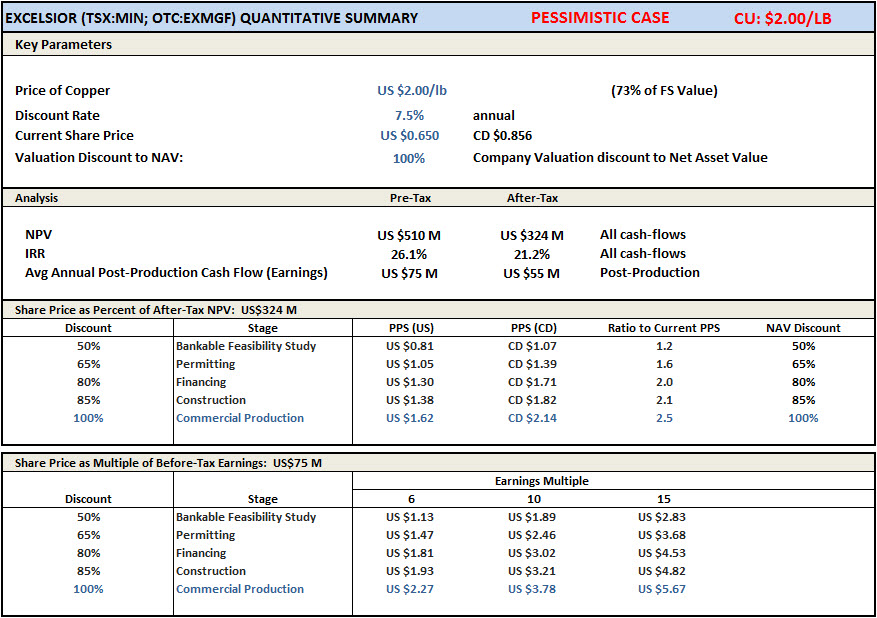

I also was using a flat tax rate for the Life of Mine (LoM), which is uber conservative. In practice there will be significant tax breaks for the first few years. I've reflected the same tax rates used in the FS in the scenarios below. This results in a significant improvement in the NPV and IRR.

Here are the assumptions and notes I've included with previous versions.

The assumptions below include setting the company valuation at 100% of NAV (NPV for companies in development). This is a valid assumption. Goldcorp recently acquired Kaminak for C$520 million. Kaminak had an NPV of C$455, which is an acquisition at 14.3% over NPV.

Assumptions:

1. 50/50 split of debt to equity financing for the initial capex raise.

2. Company valuation to 100% of Net Asset Value (NAV).

3. Includes debt repayments (principal+interest).

4. Assumes that capital improvements for Phase II and Phase III will be fully funded from a combination of debt and revenues (no equity).

Even with these very conservative assumptions, the NPV/IRR are favorable. In the unlikely event that copper goes back to the $2/lb level, the resulting valuation shows that the Gunnison project is exceptionally profitable.

Scenarios:

1. Base Case: $2.75/lb Copper

2. Optimistic Case: $3.75/lb Copper

3. Pessimistic Case: $2.00/lb Copper

North Bay Resources Commences Operations at Bishop Gold Mill, Inyo County, California; Engages Sabean Group Management Consulting • NBRI • Sep 25, 2024 9:15 AM

CEO David B. Dorwart Anticipates a Bright Future at Good Gaming Inc. Through His Most Recent Shareholder Update • GMER • Sep 25, 2024 8:30 AM

Cannabix Technologies and Omega Laboratories Inc. Advance Marijuana Breathalyzer Technology - Dr. Bruce Goldberger to Present at Society of Forensic Toxicologists Conference • BLOZF • Sep 24, 2024 8:50 AM

Integrated Ventures, Inc Announces Strategic Partnership For GLP-1 (Semaglutide) Procurement Through MedWell USA, LLC. • INTV • Sep 24, 2024 8:45 AM

Avant Technologies Accelerates Creation of AI-Powered Platform to Revolutionize Patient Care • AVAI • Sep 24, 2024 8:00 AM

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM