| Followers | 680 |

| Posts | 141062 |

| Boards Moderated | 36 |

| Alias Born | 03/10/2004 |

Wednesday, February 08, 2017 8:20:02 AM

By Almanac Trader

* February 7, 2017

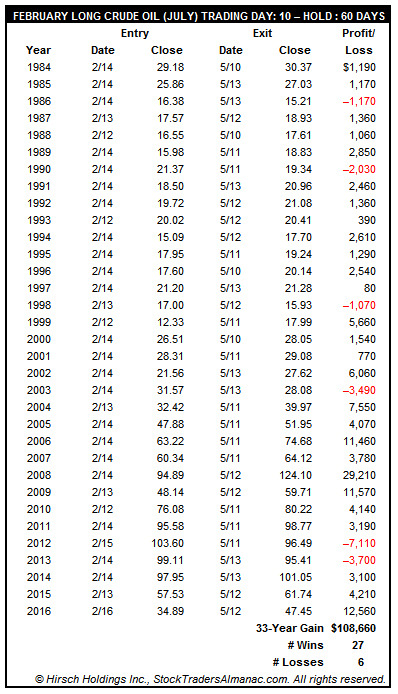

Crude oil has a tendency to bottom in mid-February and then rally through July with the bulk of the seasonal move ending in late April or early May. It is that early February low that can give traders an edge by buying ahead of a seasonally strong period. Going long crude oil’s July contract on or about February 14 and holding for approximately 60 days has been a profitable trade 27 times in 33 years, including the last three years straight, for an 81.8% win ratio with a cumulative profit of $108,660 (based upon trading a single crude oil futures contract excluding commissions and taxes).

Crude oil’s seasonal tendency to move higher in this time period is partly due to continuing demand for heating oil and diesel fuel in the northern states and partly due to the shutdown of refinery operations in order to switch production facilities from producing heating oil to reformulated unleaded gasoline in anticipation of heavy demand for the upcoming summer driving season. This has refiners buying crude oil in order to ramp up production for gasoline. Last year, crude bottomed in mid-February and that bottom was the end of crude’s multi-year bear market that began in earnest in 2014. The result was the second best performance in this trade’s history going back to 1984. Only 2008 was better.

http://jeffhirsch.tumblr.com/post/156948232753/crude-rallies-818-of-the-time-from-mid-february

• DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Your Due Dilegence is a must!

• DiscoverGold

NanoViricides Reports that the Phase I NV-387 Clinical Trial is Completed Successfully and Data Lock is Expected Soon • NNVC • May 2, 2024 10:07 AM

ILUS Files Form 10-K and Provides Shareholder Update • ILUS • May 2, 2024 8:52 AM

Avant Technologies Names New CEO Following Acquisition of Healthcare Technology and Data Integration Firm • AVAI • May 2, 2024 8:00 AM

Bantec Engaged in a Letter of Intent to Acquire a Small New Jersey Based Manufacturing Company • BANT • May 1, 2024 10:00 AM

Cannabix Technologies to Deliver Breath Logix Alcohol Screening Device to Australia • BLO • Apr 30, 2024 8:53 AM

Hydromer, Inc. Reports Preliminary Unaudited Financial Results for First Quarter 2024 • HYDI • Apr 29, 2024 9:10 AM