Cameco Corp will fight after Tokyo Electric cancels $1.3 billion contract

http://business.financialpost.com/news/mining/cameco-corp-vows-to-fight-back-as-japans-tepco-cancels-1-3-billion-uranium-contract

Cameco Corp. said Wednesday it has rejected a key Japanese customer’s attempt to cancel its contract — a move that would mean $1.3 billion in lost revenue — as the Saskatoon-based uranium giant works to protect deals signed with customers before the market tanked.

Tokyo Electric Power Company Holdings Inc. issued a termination notice for a uranium supply contract on Jan. 24. On Monday, the Japanese power company said it would not accept a delivery scheduled for Tuesday.

Cameco shares plunged 11.29 per cent to end the day at $14.70 on the Toronto Stock Exchange.

Tepco alleges a “force majeure” event — or an act of God — has occurred because it has been unable operate its generating plants for the past 18 months due to government regulations enacted after the disastrous Fukushima nuclear accident of 2011.

“We’re confident that Tepco’s force majeure complaint is without merit,” said Cameco CEO Tim Gitzel on a last-minute conference call with investors Wednesday morning.

“It appears to us and it is our opinion that Tepco simply doesn’t like the terms they agreed to, particularly the price and want to escape from the agreement.”

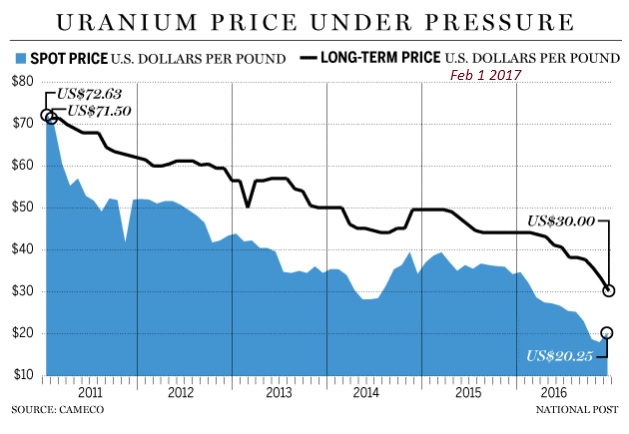

The entire nuclear industry is still feeling the aftershock of that disaster, with prices in the doldrums and customers re-evaluating contracts as they eye prices much lower than those in deals previously struck with Cameco.

Recent CCJ News

- Cameco annonce le dépôt de documents • Business Wire • 03/23/2024 03:41:00 PM

- Cameco Reports Document Filings • Business Wire • 03/23/2024 12:36:00 AM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 02/28/2024 11:57:49 PM

- Form SC 13G - Statement of acquisition of beneficial ownership by individuals • Edgar (US Regulatory) • 02/09/2024 08:54:32 PM

- Cameco annonce ses résultats 2023 ; positionnement stratégique pour augmenter la production de niveau un à mesure que le cycle des contrats de sécurité de l’approvisionnement progresse ; maintien de la discipline financière et de la croissance... • Business Wire • 02/09/2024 08:38:00 PM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 02/08/2024 12:26:01 PM

- Cameco Announces 2023 Results; Strategically Positioned to Increase Tier-One Production as Security of Supply Contracting Cycle Advances; Maintaining Disciplined Financial Management and Growth; Improving Westinghouse Outlook • Business Wire • 02/08/2024 11:40:00 AM

- U.S. Index Futures Dip Slightly, Oil Prices Climb • IH Market News • 02/08/2024 10:56:39 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 01/19/2024 09:38:49 PM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 01/12/2024 02:50:06 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 12/05/2023 10:17:54 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 12/05/2023 10:03:28 PM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 12/01/2023 02:56:28 PM

- Le conseil d'administration de Cameco nomme une nouvelle présidente • Business Wire • 12/01/2023 01:37:00 AM

- Cameco Board Appoints New Chair • Business Wire • 11/30/2023 10:02:00 PM

- News Brief: Lexston Mining Corporation • AllPennyStocks.com • 11/28/2023 01:35:00 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 11/21/2023 12:36:26 AM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 11/17/2023 10:35:46 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 11/13/2023 09:40:17 PM

- Cameco et Brookfield finalisent l'acquisition de Westinghouse Electric Company et créent ainsi une puissante plateforme pour la croissance stratégique • Business Wire • 11/09/2023 04:44:00 PM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 11/08/2023 04:14:56 PM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 11/03/2023 05:30:58 PM

- Cameco et Brookfield ont reçu l’approbation réglementaire nécessaire pour acquérir Westinghouse • Business Wire • 11/03/2023 03:44:00 PM

- Cameco and Brookfield Receive Regulatory Approval to Acquire Westinghouse • Business Wire • 11/03/2023 12:28:00 PM

Bantec Reports an Over 50 Percent Increase in Sales and Profits in Q1 2024 from Q1 2023 • BANT • Apr 25, 2024 10:00 AM

Cannabix's Breath Logix Alcohol Device Delivers Positive Impact to Private Monitoring Agency in Montana, USA • BLO • Apr 25, 2024 8:52 AM

Kona Gold Beverages, Inc. Announces Name Change to NuVibe, Inc. and Initiation of Ticker Symbol Application Process • KGKG • Apr 25, 2024 8:30 AM

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM