| Followers | 604 |

| Posts | 24107 |

| Boards Moderated | 3 |

| Alias Born | 12/06/2009 |

Monday, January 30, 2017 1:42:01 AM

I am not the best at financials, and if anyone wants to correct me feel free, but just out of curiosity I'd like to examine other Stem Cell companies and compare them to USRM. I took all these numbers from the most recent 10q's of each company, and most up to date info I could find. This is open for discussion, and imo a very complex situation. Let's just take a glance and ponder, but be mindful that NONE of these companies have FDA approval for their Stem Cell therapies/products... They are ALL going through Clinical Trials. Each company displays a tremendous risk/reward and unique situation. Which companies will be among some of the first to receive FDA approval for Stem Cell therapies? Could USRM become one of the first? With the recent passing of The Cures Act, will USRM be a major benefactor?

Some of the share structures from the other stem cell companies are not that different from USRM as to where they are trading in dollars and USRM is trading sub-penny with such a small market value. We can begin to make our case as to why USRM is undervalued with the advancement of the most recent clinical trials for degenerative disc disease, and the wealth of developments throughout the years since the inception of US Stem Cell Inc.

Once again I refer to this part of the most recent filing as a potential clue of what could be possible here trading this stock:

1. US. Stem Cell Inc. (USRM)

http://us-stemcell.com/en/home-2/

Summary:

U.S. Stem Cell’s discoveries include multiple cell therapies in various stages of development that repair damaged tissues throughout the body due to injury or disease so that patients may return to a normal lifestyle. U.S Stem Cell is focused on regenerative medicine. While most stem cell companies use one particular cell type to treat a variety of diseases, U.S Stem Cell utilizes various cell types to treat different diseases. It is our belief that the unique qualities within the various cell types make them more advantageous to treat a particular disease.

Market Value1 $250,209 a/o Jan 27, 2017

Authorized Shares: 2,000,000,000 a/o Aug 02, 2016

Outstanding Shares: 59,573,684 a/o Nov 09, 2016 (Most Estimate 80-90million now)

Current Price: $.0042

Current liabilities: $6.96M in Q3 2016

Assets: $413,316

Revenue: $729K in Q3 2016

Net loss improved: $219K in Q3 2016

Cash used in operating activities: $62k in Q3 2016

Cash at end of period: $245,991

Sources:

http://us-stemcell.com/ceo-blog-november2016/

https://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=11674975

2. Athersys, Inc. (ATHX) Nasdaq

http://www.athersys.com

Summary:

We currently have six clinical stage programs – including a pending Phase 3 study in ischemic stroke, an ongoing Phase 2 clinical study for the treatment of damage from acute myocardial infarction, an ongoing exploratory clinical study in Acute Respiratory Distress Syndrome, and several others. We also have a portfolio of preclinical programs that we are advancing toward clinical stage development.

Current Price: $1.12

Net Loss: (6,004)

Assets: $23,319.00

Current Liabilities: $23,319.00

Revenue: $150.00 (yes 150 dollars)

Cash used in operating activities: (4,647) (yes that is negative $4,647.00)

Cash at end of period: $8,309

Source:

https://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=11678481

3. Cytori Therapeutics, Inc. (CYTX )Nasdaq

http://www.cytori.com

Upcoming merger: CYTORI TO ACQUIRE AZAYA THERAPEUTICS

Summary:

Cytori Therapeutics, Inc. is dedicated to enhancing lives through novel cell therapies. To realize this mission, Cytori defines, develops, and delivers specialty therapeutics that address poorly met medical needs. Through constantly balancing a blend of creativity, rigor, focused energy, and agility, we deliver meaningful results that create exceptional value for our patients, partners, employees, shareholders, and society.

Authorized: 75 million

Outstanding Shares 20,500,553 a/o Oct 31, 2016

Current Price: $1.59

Assets: $36,842,000

Current Liabilities: $23,172,000

Revenue: $731,000

Cash used in operating activities: (15,372,000)

Cash at end of period: $14,924,000

https://www.otcmarkets.com/stock/CYTX/filings

4. Cesca Therapeutics Inc. (KOOL) Nasdaq

http://cescatherapeutics.com/blood-marrow-processing/

Summary: Cesca has developed a complete suite of BioProcess technologies to cater to the needs of the Bio-banking, and regenerative medicine market. Our technology is designed specifically for the following groups:

Clinical Development Companies (integrating GMP compliant technologies for manufacturing and storage process control)

Commercialization stage companies upgrading their process to include GMP compliant...

Biobanking Facilities

Authorized Share Count: 350,000,000

Outstanding Shares: 9,790,500 a/o Sep 16, 2016

Net Loss: (22,445)

Current Price: $2.96

Assets: $49,185

Current Liabilities: $12,858

Revenue: $3,767

Cash used in operating activities: (2,009)

Cash at end of period: $5,835

https://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=11678481

5. Capricor Inc. (CAPR) Nasdaq

Summary:

"This is an adult stem-cell company; they are going after big-ticket items like the cardiovascular space, and the data to date has shown some promise," Benjamin said. "And J&J (Johnson & Johnson (JNJ)) actually has option to potentially move forward with the company and the therapeutic if they like the next set of data that comes out, probably sometime next year."

https://www.thestreet.com/story/13238523/1/four-stem-cell-stocks-with-promise.html

Market Value $48,361,783 a/o Jan 27, 2017

Authorized Shares 50,000,000 a/o Nov 12, 2014

Outstanding Shares 21,399,019 a/o Nov 11, 2016

Current Price: $2.26

Assets: $24,471,820

Current Liabilities: $6,670,268

Total Income: $746,781

Net Loss: (5,333,413)

Cash at end of period: $18,020,875

https://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=11687134

6. Pluristem (PSTI) Nasdaq Israeli based

http://www.pluristem.com

Summary:

Pluristem Therapeutics Inc. is a clinical-stage biotherapy company using placental cells and a unique, proprietary, three-dimensional (3D) technology platform to develop cell therapies for conditions such as inflammation, ischemia, hematological disorders, or exposure to radiation.

Market Value $89,122,095 a/o Jan 27, 2017

Authorized Shares Not Available

Outstanding Shares 81,020,086 a/o Nov 02, 2016

Current Price: $1.10

Operating loss: (6,562)

Net loss: $(6,324)

Revenue: 0

Net cash used by operating activities: $(3,923)

Assets: $40,209

Current Liabilities: $40,209

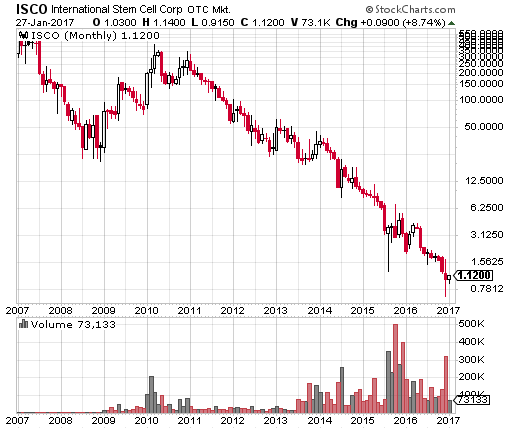

7. International Stem Cell Corporation (ISCO)

http://internationalstemcell.com/company/

Summary:

International Stem Cell Corporation (ISCO) is a publicly traded clinical stage biotechnology company with a powerful new stem cell technology called human parthenogenetic activation that promises to significantly advance the field of regenerative medicine.

Market Value $4,079,820 a/o Jan 27, 2017

Authorized Shares 120,000,000 a/o Sep 30, 2016

Outstanding Shares 3,642,696 a/o Nov 12, 2016

Current Price: $1.12

Cash on hand: $733

Operating loss: (6,562)

Net loss: $414

Revenue: (1,262)

Loss from operating activities (1,262)

Assets: $7,540

Current Liabilities: $7,540

https://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=11686960

8. Stemline Therapeutics, Inc. (STML)

http://www.stemline.com

Summary:

Stemline Therapeutics, Inc. is a clinical-stage biopharmaceutical company developing novel therapeutics that target both cancer stem cells (CSCs) and tumor bulk.

Current Price: $10.20

Grant revenue $299,401

Outstanding Share Count: 19,151,652

Total liabilities 9,275,544

Net loss$ (9,923,222)

https://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=11675126

9. Asterias Bio therapeutics Inc., (AST) AMEX

http://asteriasbiotherapeutics.com

Summary:

Asterias is conducting a clinical study to evaluate the safety and activity of AST-OPC1 in patients with cervical spinal cord injury. AST-OPC1 consists of cells known as oligodendrocyte progenitor cells (OPCs). The purpose of the study is to evaluate the safety of AST-OPC1 administered once between 14 & 30 days after injury. Researchers will also assess the impact on patient hand & arm function.

Current Price : $4.35

Market Value $201,937,666 a/o Jan 27, 2017

Authorized Shares Not Available

Outstanding Shares 46,422,452 a/o Nov 10, 2016

TOTAL ASSETS $70,303

TOTAL LIABILITIES $27,577

Total gross profit: 2,017

10. BioTime Inc. (BTX) (embriotic stem cells controversial studies with fetus stem cells)

Summary:

Macular degeneration affects approximately 11 million people in the U.S. It is the leading cause of blindness in people over the age of 60. Approximately 90 percent of these patients suffer from the dry form, for which there are no FDA-approved therapies.

Current Price: $3.18

Share Structure

Market Value1 $328,787,349 a/o Jan 27, 2017

Authorized Shares Not Available

Outstanding Shares 103,392,248 a/o Aug 05, 2016

http://www.businesswire.com/news/home/20170119005455/en/Additional-Data-BioTime’s-OpRegen®-Clinical-Trial-Dry-AMD

11. Oncomed (OMED) (Cancer research)

http://www.oncomed.com

Summary:

OncoMed Pharmaceuticals is a clinical-stage biotechnology company dedicated to improving cancer treatment by creating novel medicines that address the fundamental biologic pathways critical to tumor initiation, growth, metastases and recurrence.

Outstanding Shares: 33,758,423

Current Price: $8.02

Total assets $218,188

Total Liabilities: 221,369

Revenue: 5,279

FEATURED NanoViricides Reports that the Phase I NV-387 Clinical Trial is Completed Successfully and Data Lock is Expected Soon • May 2, 2024 10:07 AM

ILUS Files Form 10-K and Provides Shareholder Update • ILUS • May 2, 2024 8:52 AM

Avant Technologies Names New CEO Following Acquisition of Healthcare Technology and Data Integration Firm • AVAI • May 2, 2024 8:00 AM

Bantec Engaged in a Letter of Intent to Acquire a Small New Jersey Based Manufacturing Company • BANT • May 1, 2024 10:00 AM

Cannabix Technologies to Deliver Breath Logix Alcohol Screening Device to Australia • BLO • Apr 30, 2024 8:53 AM

Hydromer, Inc. Reports Preliminary Unaudited Financial Results for First Quarter 2024 • HYDI • Apr 29, 2024 9:10 AM