Saturday, January 28, 2017 1:21:33 AM

Let me explain something to you.

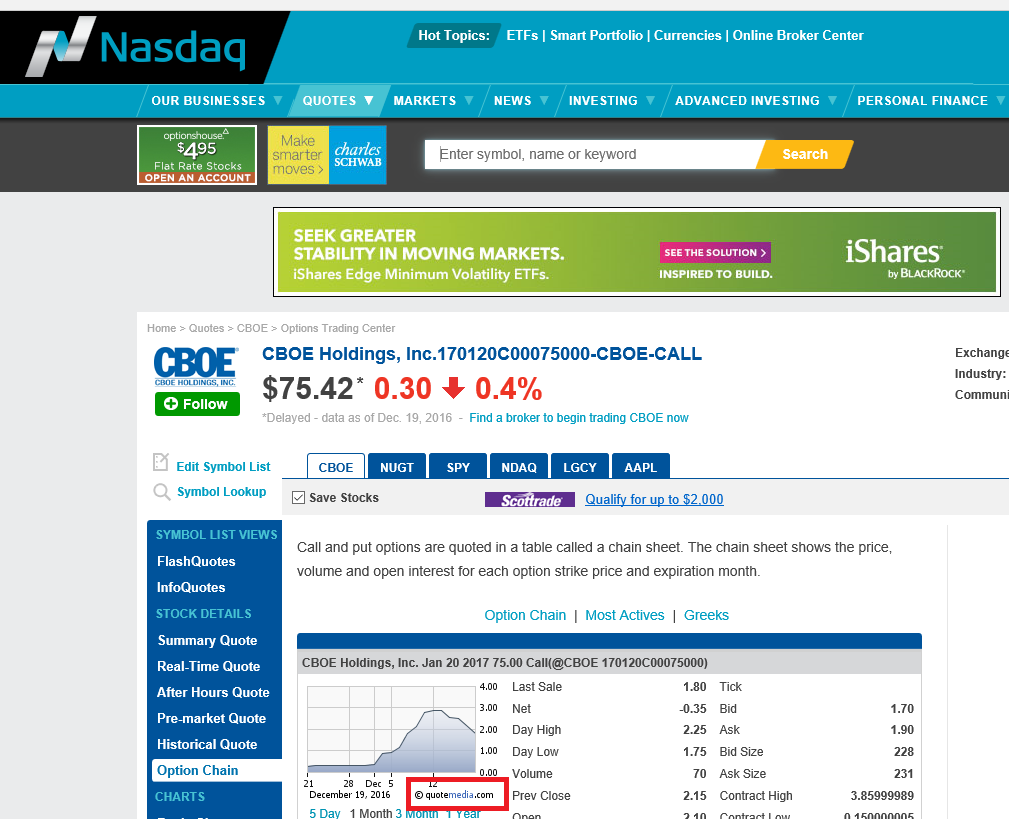

When you say “crapmedia,” you might as well say crapNASDAQ or crapDowJones or crapS&P, since they all rely on quotemedia in one form or another.

I invite anyone here to do a google search for the NASDAQ.

Go to nasdaq.com and enter any big board stock into the ticker search field (AAPL, GOOG, MSFT, GE etc.)

From there, click the “Option Chain” tab to bring up the option contract strike page.

Click on any current option contract and you will see something similar to this screen shot that I have taken from the NASDAQ, CBOE options detail page.

There is no debate on this. It is a simple fact that anyone can see for themselves.

There are several potential FLEs for QMCI moving forward in the new year. A new pricing structure for 2017 has been implemented that could improve quotemedia’s financials. New products are currently being offered and improved upon and there are potentially new clients that could be announced at any time.

There are also several “black swan” events that could happen for QMCI.

First, is the Donald Trump presidency. Trump has stated that the $USD is too strong and if his actions as POTUS weaken the $USD, the $CAD could move higher providing a tipping point that leads to QMCI profitability.

Recent consolidation of market data providers also show more potential for quotemedia.

The CBOE has recently acquired BATS in a transaction worth $3,200,000,000.

http://fortune.com/2016/09/26/cboe-acquires-bats/

E-trade has recently acquired the parent company of optionshouse for $725,000,000.

http://fortune.com/2016/07/25/etrade-buying-online-brokerage/

When taking into account that quotemedia only has current market capitalization of $4,500,000, anyone can see the potential.

With the NASDAQ, Dow Jones, and Standard and Poor’s already relying on QMCI, Warren Buffet and Berkshire Hathaway are also aware of QMCI.

QMCI testimonial from the CEO of a Berkshire/Hathaway company.

“With thousands of member companies and organizations depending on Business Wire to transmit their full-text news releases and multimedia content to journalists, financial professionals, in or services, and the general public worldwide, it is vital that we provide the best possible analytical market data content to our clients. We were impressed with the quality of QuoteMedia's products, the depth of their market coverage, and particularly the level of support they provide. QuoteMedia has shown us tremendous dedication and top quality service since day one, and we look forward to the improvement in our client offerings”.

-Business Wire President, Cathy Baron Tamraz

About Cathy Baron Tamraz.

newsroom.businesswire.com/leadership/executive-committee/cathy-baron-tamraz

Cathy Baron Tamraz, Chairman and Chief Executive Officer of Business Wire, oversees the company's long-term strategic planning, Internet strategy and global branding. She serves as chair of Business Wire's executive committee.

Under her stewardship, the company has grown to be the leading global commercial news wire, significantly expanding into new markets, including the United Kingdom, France, Germany, Canada and Japan, among others.

With a pioneering background in corporate news disclosure, Cathy lead the newswire industry into providing equal access to material news for all market participants in 2000 as the Internet gained commercial traction.

Regulatory authorities, including the Securities and Exchange Commission, have sought her input as they develop and refine disclosure rules. In 2000, Cathy was invited to meet with the SEC as they developed their landmark Regulation FD provisions. In 2008, she presented to the SEC's Advisory Committee (CIFiR) reviewing policies on the use of Internet technologies in the disclosure of market-moving material information.

She joined Business Wire in San Francisco in 1979 and opened the New York office in 1980. Cathy was named head of the company's New York region in 1987 and in 1990 she was named a vice president and appointed to the company's executive committee. In 1994 she was named senior vice president, executive vice president in 1998, chief operating officer in 2000, president in 2003 and CEO in 2005.

Prior to joining Business Wire, Cathy worked in the travel industry in Hawaii. She holds a master's degree from Stony Brook University. She participates in conferences and seminars in the investor relations and public relations industries and has published articles on financial disclosure and new technology.

Cathy was the main architect in selling Business Wire to Berkshire Hathaway. Her November 2005 letter to Warren Buffett detailing the synergies between the two firms resulted in the company being acquired on March 1, 2006.

About QuoteMedia

QuoteMedia is a leading software developer and cloud-based syndicator of financial market information and streaming financial data solutions to media, corporations, online brokerages, and financial services companies. The Company licenses interactive stock research tools such as streaming real-time quotes, market research, news, charting, option chains, filings, corporate financials, insider reports, market indices, portfolio management systems, and data feeds. QuoteMedia provides data and services for companies such as the NASDAQ Stock Exchange, TMX Group (TSX Stock Exchange), Dow Jones & Company, FIS, U.S. Bank, Broadridge Financial Systems, Ridge Clearing, JP Morgan, CIBC, JitneyTrade, Southwest Securities, HD Vest, Intrinsic Research Systems, ING Investment Management, Stockhouse, Zacks Investment Research, General Electric, Dow Chemical, Boeing, Bombardier, Business Wire, PR Newswire, Marketwired, FolioFN, Regal Securities, ChoiceTrade, Qtrade Financial, Mackie Research Capital, CNW Group, Schaeffer's Investment Research, Brean Capital, TradeKing, Suncor, Virtual Brokers, Equities.com, Leede Jones Gable, Divy Inc., Motif Investing, First Financial, Stock-Trak and others. Quotestream®, QModTM and Quotestream ConnectTM are trademarks of QuoteMedia. For more information, please visit: www.quotemedia.com."

IMO and FWIW.

Recent QMCI News

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 08/14/2024 05:08:46 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 05/13/2024 07:38:44 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 11/13/2023 06:55:12 PM

FEATURED Cannabix Technologies and Omega Laboratories Inc. Advance Marijuana Breathalyzer Technology - Dr. Bruce Goldberger to Present at Society of Forensic Toxicologists Conference • Sep 24, 2024 8:50 AM

FEATURED Integrated Ventures, Inc Announces Strategic Partnership For GLP-1 (Semaglutide) Procurement Through MedWell USA, LLC. • Sep 24, 2024 8:45 AM

Avant Technologies Accelerates Creation of AI-Powered Platform to Revolutionize Patient Care • AVAI • Sep 24, 2024 8:00 AM

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM