Thursday, January 26, 2017 6:08:52 AM

IMO, what influences the price of RINs the most, is the amount of gasoline produced by refiners. The more they produce, the more RINs they need. But also the blending wall set by the EPA is of very large influence.

They can buy these RINs separately (Excess RINs), or get them when they buy and blend in renewable fuels into the Gasoline.

Getting the RINs by blending is seems the cheapest way, because the amount of separated RINs available is limited, however RINs can be held for a longer time, so you can buy them when they are cheap, and sell them, or use them when they are more expensive.

"These excess RINs can be sold or purchased by refiners and other blenders and used at a as credits against the mandates either in the current year or at a later time. Alternatively, current owners of the RINs can hold them for future use. When blending is unprofitable at some locations, some individual blenders may use their own excess RINS or buy excess RINs from anther firm and turn them in to EPA as a credit against their mandatory obligations. This process at times allows blenders to meet their mandate requirements while not actually blending ethanol or biodiesel into motor fuel. When it is profitable to use RINs for this purpose, it may allow industry-wide ethanol or biodiesel blending to temporarily drop below the mandated levels."

If PEIX sells ethanol to a refiner, the RIN is connected to the ethanol. If PEIX exports ethanol, they can sell it without the RIN and sell the RIN as a Excess RIN.

Refiners can buy ethanol to meet their mandate, but also just buy RINs. Sometimes they might buy more ethanol, which drives the price up on ethanol, sometimes just more RINs, which drive the price up on RINs. If they have a higher demand on gasoline, they may need more RINs and/or more ethanol. It drives up the price of gasoline. Nut it can also be tat they have bought these RINS at a different time, or think about buying the RINs at a later time, when they are less expensive.

And there are also traders, which just want to trade RINs. They want to buy low and sell high.

If the price of ethanol is higher, due to higher demand, because refiners are producing more fuel, it might be that the demand for RINs is also higher...but at the same time, more RINs are produced.

If the price of ethanol is higher due to higher costs of for instance Corn, but the demand stays low, it might be that there are a lot of excess RINs or RINs bought at a different moment are still available in the market or already owned by the refiners, so that the price of RINs stay low anyway.

Off course there are some ways that connect the price. Lower ethanol price makes it cheaper to buy ethanol, and that generates new RINs which will be cheaper also. The same goes for a lower demand (which usually means a lower price) for gasoline.

But since they don't need to buy RINs at the same moment as they produce gasoline and they don't need to buy ethanol but can buy the RINs separately, and the EPA has a way of changing or setting the blending wall later on, it makes RINs sensitive to speculation and behave like a product on its own.

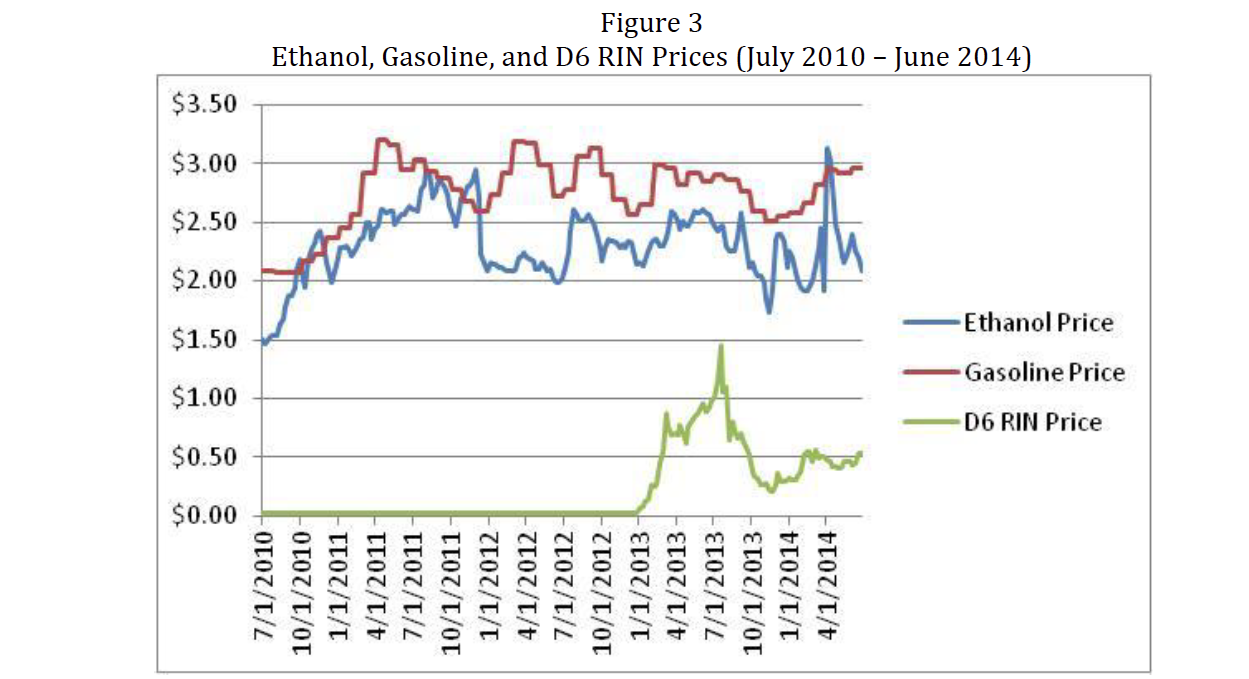

You can see that in this image:

Recent ALTO News

- Alto Ingredients, Inc. to Present in the 26th Annual H.C. Wainwright Global Investment Conference • GlobeNewswire Inc. • 09/03/2024 12:30:00 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 08/08/2024 08:35:14 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 08/06/2024 08:21:10 PM

- Alto Ingredients, Inc. Reports Second Quarter 2024 Results • GlobeNewswire Inc. • 08/06/2024 08:05:20 PM

- Alto Ingredients, Inc. to Release Second Quarter 2024 Financial Results on August 6, 2024 • GlobeNewswire Inc. • 07/30/2024 12:30:00 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 05/08/2024 08:15:43 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 05/06/2024 08:13:30 PM

- Alto Ingredients, Inc. Reports First Quarter 2024 Results • GlobeNewswire Inc. • 05/06/2024 08:05:21 PM

- Alto Ingredients, Inc. to Release First Quarter 2024 Financial Results on May 6, 2024 • GlobeNewswire Inc. • 04/29/2024 12:30:15 PM

- Alto Ingredients, Inc. Appoints Todd E. Benton as Chief Operating Officer; Michael D. Kandris to Continue to Serve as Director • GlobeNewswire Inc. • 03/21/2024 12:30:49 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 03/11/2024 08:18:04 PM

- Alto Ingredients, Inc. Reports Fourth Quarter and Year-end 2023 Results • GlobeNewswire Inc. • 03/11/2024 08:05:08 PM

- Alto Ingredients, Inc. Enters Letter of Intent with Vault to Advance Carbon Capture and Storage Initiative • GlobeNewswire Inc. • 03/11/2024 08:02:21 PM

- Alto Ingredients, Inc. to Participate in the 36th Annual Roth Conference • GlobeNewswire Inc. • 03/05/2024 01:30:06 PM

- Alto Ingredients, Inc. to Release Fourth Quarter 2023 Financial Results • GlobeNewswire Inc. • 03/04/2024 01:30:24 PM

- Alto Ingredients, Inc. Publishes Sustainability Summary • GlobeNewswire Inc. • 12/11/2023 01:30:04 PM

- Alto Ingredients, Inc. Extends Term Loan Commitment Period • GlobeNewswire Inc. • 12/06/2023 01:30:00 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 11/08/2023 09:32:32 PM

- Alto Ingredients, Inc. to Participate in Upcoming Conferences • GlobeNewswire Inc. • 11/08/2023 01:30:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 11/06/2023 09:19:10 PM

- Alto Ingredients, Inc. Reports Third Quarter 2023 Results • GlobeNewswire Inc. • 11/06/2023 09:05:29 PM

- Alto Ingredients, Inc. to Release Third Quarter 2023 Financial Results • GlobeNewswire Inc. • 10/30/2023 12:30:00 PM

- Alto Ingredients, Inc. to Present at the LD Micro Main Event XVI • GlobeNewswire Inc. • 09/27/2023 12:30:00 PM

Lingerie Fighting Championships Signs Broadcast Deal With Maybacks Global Entertainment • BOTY • Sep 26, 2024 9:00 AM

Maybacks Global Entertainment and Lingerie Fighting Championships Enter Into Broadcast And Revenue Sharing Agreement • AHRO • Sep 26, 2024 8:30 AM

North Bay Resources Commences Operations at Bishop Gold Mill, Inyo County, California; Engages Sabean Group Management Consulting • NBRI • Sep 25, 2024 9:15 AM

CEO David B. Dorwart Anticipates a Bright Future at Good Gaming Inc. Through His Most Recent Shareholder Update • GMER • Sep 25, 2024 8:30 AM

Cannabix Technologies and Omega Laboratories Inc. Advance Marijuana Breathalyzer Technology - Dr. Bruce Goldberger to Present at Society of Forensic Toxicologists Conference • BLOZF • Sep 24, 2024 8:50 AM

Integrated Ventures, Inc Announces Strategic Partnership For GLP-1 (Semaglutide) Procurement Through MedWell USA, LLC. • INTV • Sep 24, 2024 8:45 AM