| Followers | 680 |

| Posts | 141212 |

| Boards Moderated | 36 |

| Alias Born | 03/10/2004 |

Saturday, January 21, 2017 9:21:15 AM

* January 21, 2017

Following futures positions of non-commercials are as of January 17, 2017.

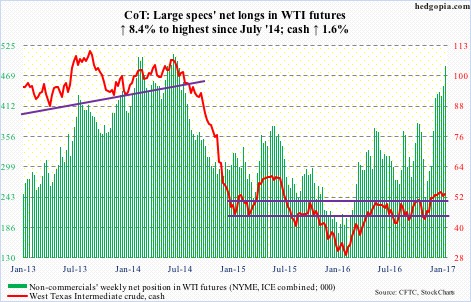

Crude oil: For the sixth straight week, oil bulls have now been rejected at $54-plus on spot West Texas Intermediate crude. This week produced another doji – 6th in last seven weeks. Thus far, $52 has been defended, but it is probably only a matter of time before this gives way.

The crude has essentially gone sideways since December, even as non-commercials’ net longs in WTI futures went up 62 percent – now highest since July 2014. This raises the risk that these traders lose patience at some point – particularly if $52 is lost.

A rising trend line drawn from the February lows (2016) converges around $47-$48.

The latest EIA report was mixed at best.

For the week of January 13, crude stocks went up by 2.3 million barrels to 485.5 million barrels. Gasoline stocks rose by six million barrels to 246.4 million barrels – the highest since March last year. And, refinery utilization fell by 2.9 percentage points to 90.7; the prior week was a four-month high.

Distillate stocks dropped by 968,000 barrels to 169.1 million barrels; the prior week was the highest since October 2012. Crude imports fell by 674,000 barrels/day to 8.4 million b/d. Similarly, crude production inched down 2,000 b/d to 8.9 mb/d; the prior week was the highest since April last year.

Currently net long 487.7k, up 37.8k.

http://www.hedgopia.com/cot-peek-into-future-through-futures-79/

• DiscoverGold

Click on "In reply to", for Authors past commentaries

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Your Due Dilegence is a must!

• DiscoverGold

Avant Technologies Equipping AI-Managed Data Center with High Performance Computing Systems • AVAI • May 10, 2024 8:00 AM

VAYK Discloses Strategic Conversation on Potential Acquisition of $4 Million Home Service Business • VAYK • May 9, 2024 9:00 AM

Bantec's Howco Awarded $4.19 Million Dollar U.S. Department of Defense Contract • BANT • May 8, 2024 10:00 AM

Element79 Gold Corp Successfully Closes Maverick Springs Option Agreement • ELEM • May 8, 2024 9:05 AM

Kona Gold Beverages, Inc. Achieves April Revenues Exceeding $586,000 • KGKG • May 8, 2024 8:30 AM

Epazz plans to spin off Galaxy Batteries Inc. • EPAZ • May 8, 2024 7:05 AM