| Followers | 38 |

| Posts | 13168 |

| Boards Moderated | 0 |

| Alias Born | 07/09/2002 |

Wednesday, January 11, 2017 5:20:33 PM

Republicans face corporate tax rebellion — Opponents from clothes makers to big retailers unite against a plan to penalize US importers

https://www.ft.com/content/d80c483a-c18a-11e6-9bca-2b93a6856354

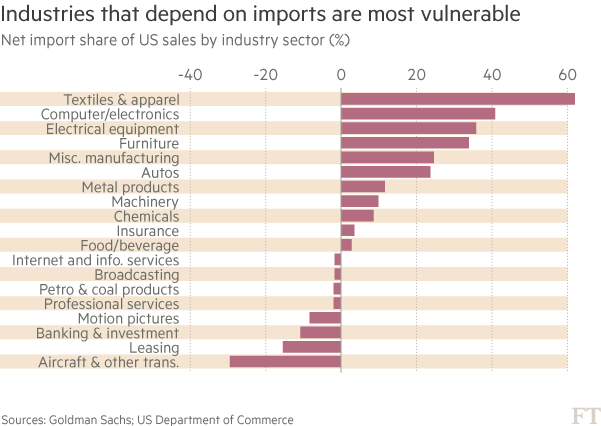

Washington Republicans are facing their first corporate tax rebellion since Donald Trump’s election victory as opponents ranging from apparel makers and big retailers to the billionaire Koch brothers unite against a plan to penalize US importers.

The revolt comes as Republicans seek to spark economic growth with the biggest overhaul of the tax code in 30 years and signals a dilemma for Mr Trump over whether to promote US-made products at the cost of crippling import-dependent businesses.

The cause of the uproar is a proposal to tax imports that is sending shock waves through global supply chains, as Republicans in the House of Representatives champion it as part of a plan to encourage US companies to buy more American goods.

Senior lobbyists who sometimes struggle to get the attention of company leaders told the Financial Times they were receiving calls from chief executives with orders to fight the tax plan, which some importers say threatens to wipe out their profits.

“This is something that has really gone all the way up to the boardroom, which doesn’t often happen in Washington,” said Stephen Lamar, executive vice-president of the American Apparel and Footwear Association, who called the import tax an “existential” threat to his industry.

With 98 per cent of clothes sold in the US made overseas, the National Retail Federation said the import tax could inflate the tax bills of some fashion chains to three to five times their pre-tax profits, jeopardizing their solvency.

Koch Industries, a conglomerate run by the brothers Charles and David whose products range from petroleum to paper towels, warned the plan would “distort” the market and raise the prices paid by consumers.

As businesses wake up to the significance of the import tax, which had been largely overlooked until this month, it has crushed post-election optimism that was founded on Republican vows to cut the corporate tax rate from 35 per cent to 20 or 15 per cent.

The House plan will provide the template for tax legislation to be negotiated next year with the president-elect, who has said fixing the tax code is a top priority. Mr Trump has not taken a position on the import tax, known by experts as a border tax adjustment.

But Reince Priebus, incoming White House chief of staff, told radio host Hugh Hewitt on Wednesday: “Our goal should be to try to make everything we can in the United States so that the money gets put in the pockets of Americans ... We want to see the potential for a change in that border adjustability so that American jobs are protected. That’s the point.”

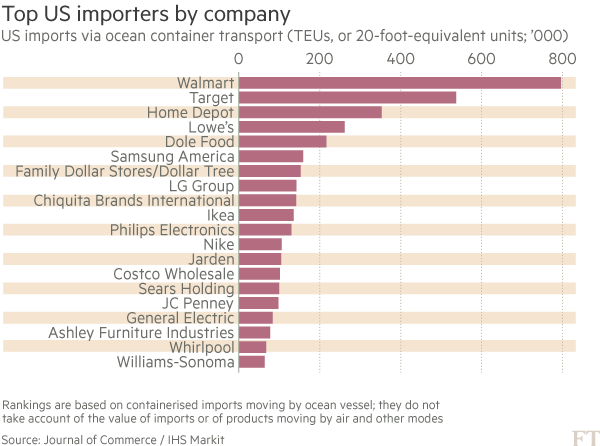

Jennifer Safavian, executive vice-president at the Retail Industry Leaders Association, which represents big chains including Walmart, Target and Best Buy, said: “There are few if any other issues over the past decade that have raised the concern of the industry higher than this one.”

Scot Ciccarelli, analyst at RBC Capital Markets, said the import tax was by far the most significant part of the House tax plan and could wipe out the benefits of a reduced tax rate for some retailers.

The measure would affect US companies importing everything from oil products and car parts to smartphones and coffee, forcing them to choose between raising prices, accepting shrunken profits or revamping supply chains that stretch from Chinese factories to Brazilian farms.

Republican tax writers led by Kevin Brady, chairman of the Ways and Means committee, want to use the import tax to foster US manufacturing and deter inversion deals that US companies have used to move to low-tax jurisdictions. One lawmaker said critics were overreacting based on faulty assumptions about its impact.

Philip Ellender, a Koch Industries executive, said his company could benefit because it produces many goods in the US. But he warned: “The proposed border tax adjustment will distort the market, increase consumer prices and create an uneven playing field for companies and consumers alike. Our tax system should encourage, not destroy, free exchange and trade.”

Kent Knutson, vice-president of government relations at Home Depot, a home improvement retailer that is the US’s third biggest importer by ocean container volumes, said: “Everyone I’m talking to either doesn’t understand border adjustability or they just plain don’t like it.

“I sure hope when all the details come out it isn’t more of the same with the government picking winners and losers. No one wants American consumers to end up the losers.”

Retailers suggested it was unrealistic to imagine that businesses could reverse decades of outsourcing and buy the bulk of their inputs from the US any time soon.

David French, top lobbyist at the National Retail Federation, said: “Insourcing, where it is viable today, is maybe the preferred way of doing business. But the fact that so many goods in so many different areas come from outside the country suggests that it hasn’t been economically viable.”

The border tax adjustment would work by denying US companies their current ability to deduct import costs from their taxable income, meaning companies selling imported products would effectively be taxed on the full value of the sale rather than just the profit.

Export revenues, meanwhile, would be excluded from company tax bases, giving net exporters the equivalent of a subsidy that would make them big beneficiaries of the change.

Mr Brady, the chief tax writer in the House, told the FT: “We’re working to deliver a globally competitive tax code built for growth that will encourage companies to invest in America and create jobs at home. Instead of focusing on one piece of our comprehensive plan, it’s important for companies to consider all of the aspects of our blueprint including lower rates for corporations and a simpler international tax code.”

Devin Nunes, a Republican member of the tax committee, said the import tax rebellion reflected how companies were looking at the results of static financial models that did not reflect “all the moving parts” of the tax plan.

“I don’t think it’s a problem at all. It’s a new system. It’s never been done like this,” he said. “So people have lots of questions to be answered, but we’re going to work through those.”

https://www.ft.com/content/d80c483a-c18a-11e6-9bca-2b93a6856354

Washington Republicans are facing their first corporate tax rebellion since Donald Trump’s election victory as opponents ranging from apparel makers and big retailers to the billionaire Koch brothers unite against a plan to penalize US importers.

The revolt comes as Republicans seek to spark economic growth with the biggest overhaul of the tax code in 30 years and signals a dilemma for Mr Trump over whether to promote US-made products at the cost of crippling import-dependent businesses.

The cause of the uproar is a proposal to tax imports that is sending shock waves through global supply chains, as Republicans in the House of Representatives champion it as part of a plan to encourage US companies to buy more American goods.

Senior lobbyists who sometimes struggle to get the attention of company leaders told the Financial Times they were receiving calls from chief executives with orders to fight the tax plan, which some importers say threatens to wipe out their profits.

“This is something that has really gone all the way up to the boardroom, which doesn’t often happen in Washington,” said Stephen Lamar, executive vice-president of the American Apparel and Footwear Association, who called the import tax an “existential” threat to his industry.

With 98 per cent of clothes sold in the US made overseas, the National Retail Federation said the import tax could inflate the tax bills of some fashion chains to three to five times their pre-tax profits, jeopardizing their solvency.

Koch Industries, a conglomerate run by the brothers Charles and David whose products range from petroleum to paper towels, warned the plan would “distort” the market and raise the prices paid by consumers.

As businesses wake up to the significance of the import tax, which had been largely overlooked until this month, it has crushed post-election optimism that was founded on Republican vows to cut the corporate tax rate from 35 per cent to 20 or 15 per cent.

The House plan will provide the template for tax legislation to be negotiated next year with the president-elect, who has said fixing the tax code is a top priority. Mr Trump has not taken a position on the import tax, known by experts as a border tax adjustment.

But Reince Priebus, incoming White House chief of staff, told radio host Hugh Hewitt on Wednesday: “Our goal should be to try to make everything we can in the United States so that the money gets put in the pockets of Americans ... We want to see the potential for a change in that border adjustability so that American jobs are protected. That’s the point.”

Jennifer Safavian, executive vice-president at the Retail Industry Leaders Association, which represents big chains including Walmart, Target and Best Buy, said: “There are few if any other issues over the past decade that have raised the concern of the industry higher than this one.”

Scot Ciccarelli, analyst at RBC Capital Markets, said the import tax was by far the most significant part of the House tax plan and could wipe out the benefits of a reduced tax rate for some retailers.

The measure would affect US companies importing everything from oil products and car parts to smartphones and coffee, forcing them to choose between raising prices, accepting shrunken profits or revamping supply chains that stretch from Chinese factories to Brazilian farms.

Republican tax writers led by Kevin Brady, chairman of the Ways and Means committee, want to use the import tax to foster US manufacturing and deter inversion deals that US companies have used to move to low-tax jurisdictions. One lawmaker said critics were overreacting based on faulty assumptions about its impact.

Philip Ellender, a Koch Industries executive, said his company could benefit because it produces many goods in the US. But he warned: “The proposed border tax adjustment will distort the market, increase consumer prices and create an uneven playing field for companies and consumers alike. Our tax system should encourage, not destroy, free exchange and trade.”

Kent Knutson, vice-president of government relations at Home Depot, a home improvement retailer that is the US’s third biggest importer by ocean container volumes, said: “Everyone I’m talking to either doesn’t understand border adjustability or they just plain don’t like it.

“I sure hope when all the details come out it isn’t more of the same with the government picking winners and losers. No one wants American consumers to end up the losers.”

Retailers suggested it was unrealistic to imagine that businesses could reverse decades of outsourcing and buy the bulk of their inputs from the US any time soon.

David French, top lobbyist at the National Retail Federation, said: “Insourcing, where it is viable today, is maybe the preferred way of doing business. But the fact that so many goods in so many different areas come from outside the country suggests that it hasn’t been economically viable.”

The border tax adjustment would work by denying US companies their current ability to deduct import costs from their taxable income, meaning companies selling imported products would effectively be taxed on the full value of the sale rather than just the profit.

Export revenues, meanwhile, would be excluded from company tax bases, giving net exporters the equivalent of a subsidy that would make them big beneficiaries of the change.

Mr Brady, the chief tax writer in the House, told the FT: “We’re working to deliver a globally competitive tax code built for growth that will encourage companies to invest in America and create jobs at home. Instead of focusing on one piece of our comprehensive plan, it’s important for companies to consider all of the aspects of our blueprint including lower rates for corporations and a simpler international tax code.”

Devin Nunes, a Republican member of the tax committee, said the import tax rebellion reflected how companies were looking at the results of static financial models that did not reflect “all the moving parts” of the tax plan.

“I don’t think it’s a problem at all. It’s a new system. It’s never been done like this,” he said. “So people have lots of questions to be answered, but we’re going to work through those.”

We've run out of other people's Social Security taxes needed to subsidize our low income tax rates.

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.