| Followers | 374 |

| Posts | 16841 |

| Boards Moderated | 4 |

| Alias Born | 03/07/2014 |

Thursday, December 01, 2016 10:12:25 AM

EXACTLY.

There's BEEN ESSENTIALLY NONE, none in any amount that would make a hill of bad beans difference to the amount of STEEPLY DISCOUNTED DILUTION common shares being issued essentially CONTINUOUSLY for all intents and purposes, due to MASSIVE ON-GOING convertible, toxic debt DILUTION.

The common shares have been DOUBLING or more in each 3 month period approx (not linear increasing, but "geometric like doubling", as in 14 million doubles to approx 30 million the following qtr which then doubles again to about 60 million this most recent qtr, which will likely surpass 100 MILLION in the next qtr reporting period making a hockey-stick vertical trending graph, because THAT is how death spiral, floorless convertible debt toxic financing "works". From just approx Nov 2015 when USRM enacted the MASSIVE 1-for-1000 REVERSE SPLIT, their shares issued and outstanding have INCREASED BY A FACTOR OF APPROX 60, SIXTY TIMES, in approx a short ONE YEAR period. From about 1 MILLION shares O/S to now 60 MILLION and rising rapidly....non stop...no sign of slow down in sight....at this pace of dilution...one can/could likely expect USRM to be back at several HUNDRED MILLION shares issued/outstanding in less than the next approx 1 yr period IMO, IF they're even still public traded by then (IN MY OPINION ONLY), given the serious allegations and explanation(s) of the company's dire financial condition as spelled out primarily the Northstar Biotech LLC lawsuit now moving ahead in Broward County, and given the potential outcome and costs from that mess.

When "toxic" convertible debt is used (which is what finances USRM and has kept them out of BK, along w/ "factoring" aka selling-off/borrowing against ALL future incoming revenues, and has for years and years; see their own SEC filed "GOING CONCERN" warnings in EVERY 10-Q or 10-K they file), THE LOWER THE SHARE PRICE GOES, the MORE COMMON SHARES GET ISSUED and then INSTANTLY SOLD AND DUMPED to the sell-side, see the SEC letter to USRM and USRM's response, where they were required to state just that, when "registering" their latest round of dilution shares to issue to Magna), and thus post/after the massive 1-for-1000 REVERSE SPLIT of Nov 2015, the devastated common shares (approx 99% TOTAL LOSSES to common share price) now stand at a split corrected approx 60 BILLION shares issued (60 million X 1000 to correct for the split) and a split corrected share price of about .0000025 per share. DILUTION LIKE WATER OVER A DAM, from some of the most well known toxic debt, floorless convertible debt hedge lenders in the biz. (SEE any recent SEC filing 10-Q or 10-K, and Magna, Fourth Man, Daniel James, etc)

https://www.sec.gov/Archives/edgar/data/1388319/000000000016060760/filename1.pdf

https://www.sec.gov/Archives/edgar/data/1388319/000118518516003574/filename1.htm

https://www.sec.gov/Archives/edgar/data/1388319/000118518516003620/filename1.htm

Magna currently holds the largest amount of USRM's convertible, toxic, floorless "steeply discounted formula adjustment based" debt. Here's a Bloomberg financial journalism piece about who Josh Sason, aka Magna, is and what they "do" and their reputation "on the street" in giving desperation "convertible" loans to cash broke penny, even SUB PENNY stocks, using what's known at the SEC and on Wall Street as "DEATH SPIRAL FINANCING" explained in detail in the Bloomberg piece, one of the most reputable financial journalism sources on planet earth:

https://www.bloomberg.com/news/articles/2015-03-12/josh-sason-made-millions-from-penny-stock-financing

I guess the guy touting the supposed "big insider buying" nonsense doesn't read the SEC FILINGS or does not understand what they mean?

Further, the CEO/BOD granted themselves a BUTT LOAD of "insta-vest" options because they were sued and are being sued presently (Plaintiff Northstar Biotech LLC, their largest shareholders and several former BOD members suing the company, asking for a RECEIVERSHIP to be appointed by the court to step-in and take over day to day operation of the company, and labeling the company as INSOLVENT in their lawsuit)- those butt load of options are now part of the dispute in that major lawsuit.

Granting oneself options by the dump truck full, is NOT "insider buying", LOL !! Again, SEC FILINGS, they're there for a good reason.

ALL of USRM/Biohearts SEC filings are found here, on the U.S. Govt SEC EDGAR database, where one will find little to no "insider buying" of any meaningful amount:

https://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0001388319&type=&dateb=&owner=include&count=40

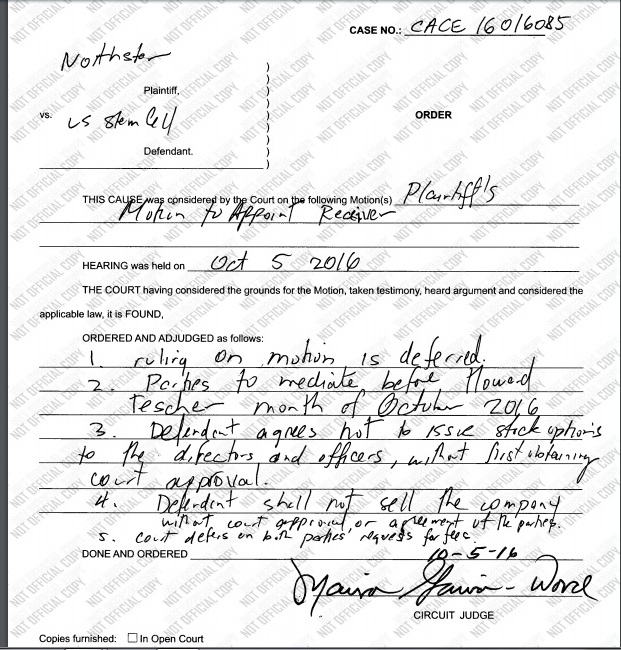

A bunch of Form 4's for OPTIONS GRANTED, again, which now became part of the Northstar Biotech LLC, with the judge stepping in and telling the company "NO GRANTING OF OPTIONS WITHOUT HER, the COURT'S APPROVAL" - see the court document she wrote below:

You'll NOTICE she states "NO MORE ISSUING OPTIONS" w/o her and the court's approval. THAT was triggered by a massive insta-vest option grant (an attempt by Miguel to maintain voting control over the company, OBVIOUSLY, LOL ! And the judge obviously saw it that way too, IMO only), after Northstar Biotech LLC sued the company recently. Those options are NOT "insider's buying", LOL !!

Posts are only my amateur opinions, personal views and thoughts. They are not any type of investment advice. Do one's own due diligence.

Avant Technologies Equipping AI-Managed Data Center with High Performance Computing Systems • AVAI • May 10, 2024 8:00 AM

VAYK Discloses Strategic Conversation on Potential Acquisition of $4 Million Home Service Business • VAYK • May 9, 2024 9:00 AM

Bantec's Howco Awarded $4.19 Million Dollar U.S. Department of Defense Contract • BANT • May 8, 2024 10:00 AM

Element79 Gold Corp Successfully Closes Maverick Springs Option Agreement • ELEM • May 8, 2024 9:05 AM

Kona Gold Beverages, Inc. Achieves April Revenues Exceeding $586,000 • KGKG • May 8, 2024 8:30 AM

Epazz plans to spin off Galaxy Batteries Inc. • EPAZ • May 8, 2024 7:05 AM