| Followers | 840 |

| Posts | 120476 |

| Boards Moderated | 18 |

| Alias Born | 09/05/2002 |

Thursday, October 27, 2016 9:21:47 AM

[Emphasis added.]

http://finance.yahoo.com/news/cliffs-natural-resources-inc-reports-120000071.html

›Cliffs Natural Resources Inc. (CLF) today reported third-quarter results for the period ended September 30, 2016. The Company reported consolidated revenues of $553 million during the third quarter of 2016, a decrease of 7 percent compared to the prior year's third-quarter revenues of $593 million. Cost of goods sold decreased by 13 percent to $468 million compared to $538 million reported in the third quarter of 2015.

The Company recorded a net loss of $28 million compared to net income of $6 million recorded in the prior-year quarter. The net loss during the third quarter of 2016 included an $18 million loss on extinguishment/restructuring of debt, primarily attributable to the full redemption of the Senior Notes due January 2018 (the "2018 Notes"), compared to a $79 million gain on extinguishment/restructuring of debt in the prior-year third quarter.

Cliffs redeemed the entirety of its 2018 Notes during the quarter, of which $284 million was outstanding. The total payment to holders of the 2018 Notes was approximately $304 million, including accrued and unpaid interest. The debt extinguishment was funded primarily from the proceeds of the August 2016 common share issuance, a $288 million net cash inflow.

Total debt at the end of the third quarter of 2016 was $2.2 billion, approximately $500 million lower than $2.7 billion at the end of the prior-year quarter. The year-over-year reduction is attributable to the exchange offers completed in the first quarter of 2016 and the redemption of the 2018 Notes in the third quarter of 2016. The Company had no borrowings on its asset-based lending facility at the end of the third quarter of 2016 or 2015. Cliffs had net debt of $2.0 billion at the end of the third quarter of 2016, compared to $2.5 billion of net debt at the end of the third quarter of 2015.

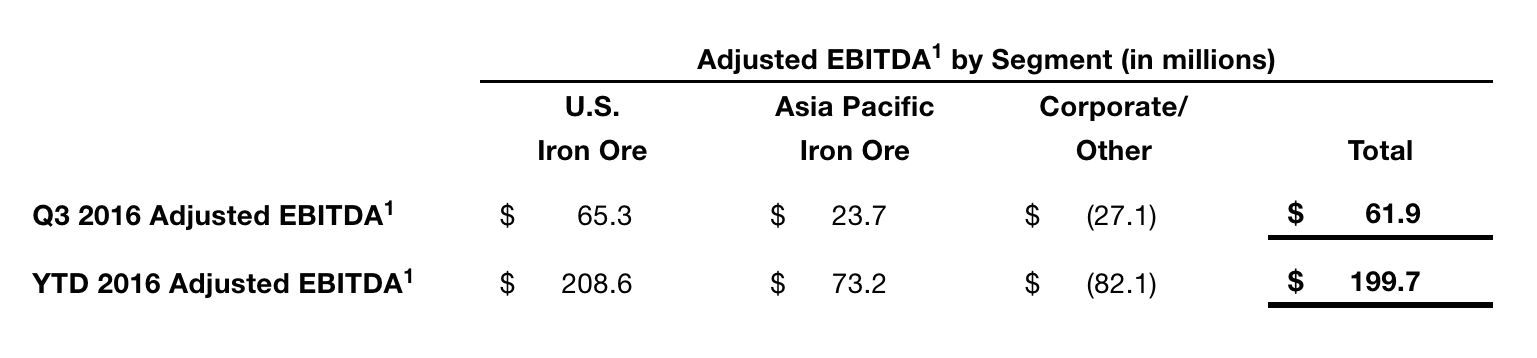

For the third quarter of 2016, adjusted EBITDA was $62 million, compared to $60 million reported in the third quarter of 2015. Cliffs noted that third-quarter 2016 adjusted EBITDA includes $20 million in expenses related to idled mines, a $12 million non-cash accrual as a reserve for potential retroactive electric power surcharges, and a one-time $4 million charge associated with the new labor contract signing bonus. Excluding these expenses, Cliffs adjusted EBITDA would have been $98 million.

Lourenco Goncalves, Cliffs' Chairman, President and Chief Executive Officer, said, "In the third quarter, we reduced our debt by another $500 million, bringing our net debt down to $2 billion. Our flawless operational performance, commercial accomplishments and financial execution during the last two years have earned the respect of investors and banking institutions, allowing us to execute in Q3 another important transaction: the early repayment of the 2018 Notes. With that, we have eliminated the last obstacle in our way to better times." Mr. Goncalves added, "We look forward to finishing out the year strong in Q4, in what we anticipate to be a quarter with substantial cash-flow generation."

Cliffs' third-quarter 2016 SG&A expenses were $31 million, of which $8 million were non-cash. This represents a 39 percent increase when compared to the third-quarter 2015 expenses of $22 million. The increase was driven primarily by a $4 million bonus agreed to as part of the United Steelworkers (USW) ratified contract signing, as well as increased external services costs.

Cliffs' 2016 net interest expense during the third quarter was $49 million, a 21 percent decrease when compared to a third-quarter 2015 expense of $62 million. The Company noted that of the $49 million expense, $40 million was a cash expense and the remainder was non-cash.

Miscellaneous-net expense of $20 million in the third quarter of 2016 included a non-cash expense related to a September order from FERC supporting retroactive surcharges for power at the Michigan operations, for which the Company recorded a $12 million charge as a reserve. Miscellaneous-net expense also included $8 million in charges related to the indefinite idle at Empire mine.

U.S. Iron Ore

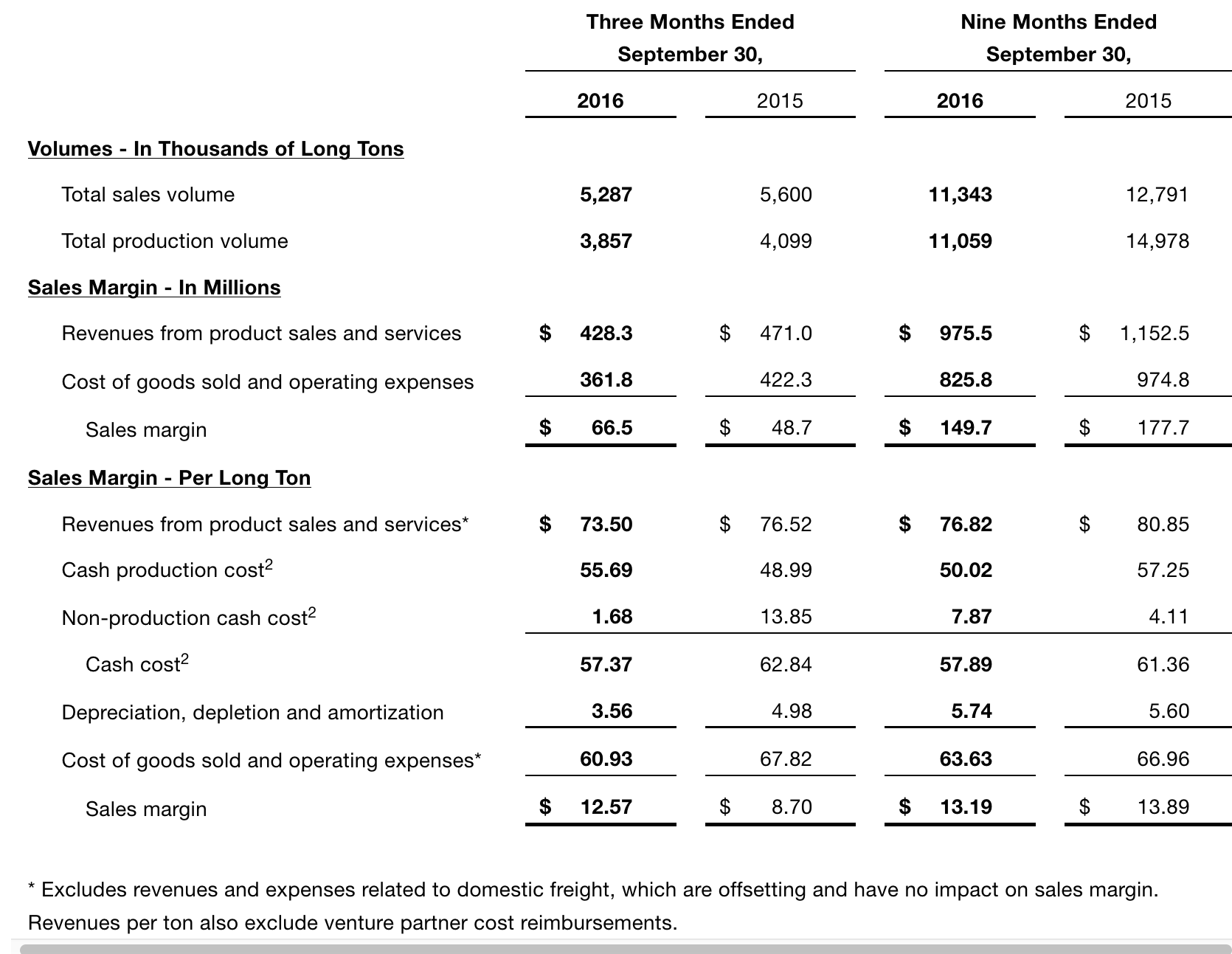

U.S. Iron Ore pellet sales volume in the third quarter of 2016 was 5.3 million long tons, a 6 percent decrease when compared to the third quarter of 2015. The decrease was driven principally by the termination of a customer contract in the fourth quarter of the prior year that was reinstated in June 2016 for fewer nominated tons. In addition, there was a negative impact as a result of a customer's inventory capacity limitations in which the customer could not mix varying iron ore grades coming from different mine sites. This decrease was partially offset by additional sales in the third quarter of 2016 that resulted from a short-term contract with a customer that had no sales in 2015.

As Cliffs' management previously guided, third-quarter revenues per ton of $73.50 were lower than the full-year average as a result of customer mix. This result was expected and was included within the full-year Revenues-Per-Ton Table in the "Outlook" Section of the previous quarter's earnings release.

Cash production cost per long ton in U.S. Iron Ore was $55.69, up 14 percent from $48.99 in the prior year's third quarter. The increase was driven by the additional costs associated with the restart of the United Taconite mine and timing of maintenance activity at the Tilden mine.

Non-production cash cost per long ton of $1.68 primarily consisted of $12 million of idle costs.

Asia Pacific Iron Ore

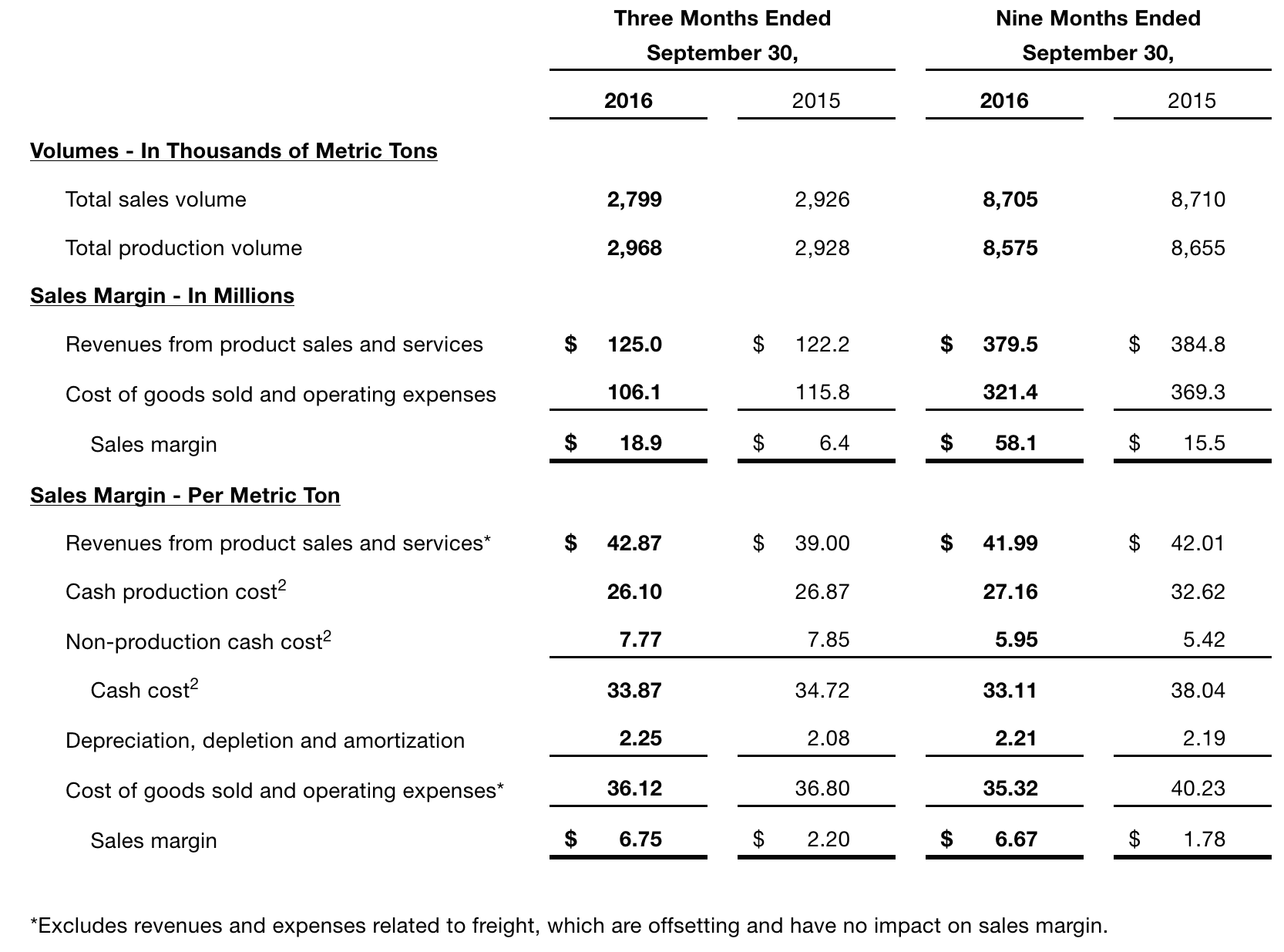

Third-quarter 2016 Asia Pacific Iron Ore sales volume decreased 4 percent to 2.8 million metric tons, from 2.9 million metric tons in the third quarter of 2015. The volume decrease was driven by the timing of shipments related to adverse weather conditions at the port at the end of September.

Cash production cost per metric ton2 in Asia Pacific Iron Ore was $26.10, down 3 percent from $26.87 in the prior year's third quarter. The decrease was driven by reduced logistics costs and decreased site administrative expenses, partially offset by an unfavorable exchange rate variance of $1 per ton.

Cash Flow

Capital expenditures during the quarter were $26 million, compared to $24 million in the third quarter of 2015. This was driven primarily by spending related to the Mustang Project at the United Taconite mine.

Cliffs also reported depreciation, depletion and amortization of $27 million in the third quarter of 2016.

Outlook

Cliffs provides full-year expected revenues-per-ton ranges based on different assumptions of seaborne iron ore prices. Cliffs indicated that each different pricing assumption holds all other assumptions constant, including customer mix, as well as industrial commodity prices, freight rates, energy prices, production input costs and/or hot-rolled coil prices (all factors contained in certain of Cliffs' supply agreements).

The U.S. Iron Ore table further assumes full-year hot-rolled coil pricing of approximately $470 per short ton. The Company notes that this estimate is based on its customers' realized prices and not an index or spot market price, valid through the end of 2016. This represents a $10 decrease from the previous full-year price estimate of $480 per short ton. For every $50 per short ton change in the customers' full-year hot-rolled coil prices, Cliffs U.S. Iron Ore revenue realizations per long ton in 2016 would be expected to increase or decrease $2.00 if steel prices increase or decrease, respectively.

The table below provides certain Platts IODEX averages for the remaining three months of 2016 and the corresponding full-year realization for the U.S. Iron Ore and Asia Pacific Iron Ore segments. The estimates consider actual Platts IODEX rates and Cliffs' actual revenue realizations for the first nine months of 2016.

U.S. Iron Ore Outlook (Long Tons)

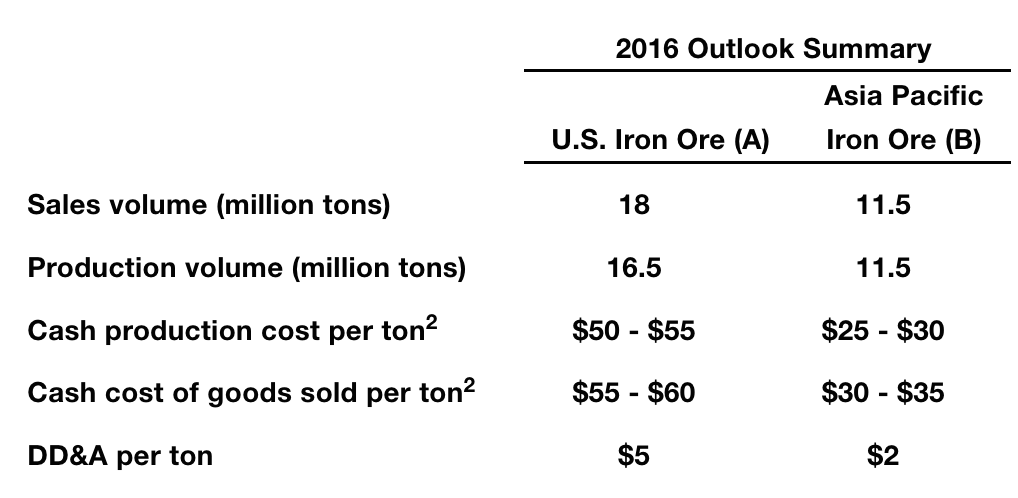

Cliffs is maintaining its full-year sales volume expectation of 18 million long tons. The Company's 2016 production volume guidance of 16.5 million long tons is also maintained.

Cliffs is maintaining its cash production cost per long ton expectation of $50 - $55 and the cash cost of goods sold per long ton expectation of $55 - $60.

Cliffs anticipates depreciation, depletion and amortization to be approximately $5 per long ton for full-year 2016.

Asia Pacific Iron Ore Outlook (Metric Tons, F.O.B. the port)

The Company is maintaining its full-year 2016 Asia Pacific Iron Ore sales and production volume forecast of approximately 11.5 million metric tons. The product mix is expected to contain 50 percent lump and 50 percent fines.

Based on a full-year average exchange rate of $0.75 U.S. Dollar to Australian Dollar, the Company is maintaining its full-year 2016 Asia Pacific Iron Ore cash production cost per metric ton expectation of $25 - $30. Cliffs' cash cost of goods sold per metric ton is also unchanged at $30 - $35. Cliffs indicated that for every $0.01 change in this exchange rate for the remainder of the year, the Company's full-year cash cost of goods sold is impacted by approximately $2 million.

Cliffs anticipates depreciation, depletion and amortization to be approximately $2 per metric ton for full-year 2016.

The following table provides a summary of Cliffs' 2016 guidance for its two business segments:

S&A Expenses and Other Expectations

Cliffs' full-year 2016 SG&A expenses expectation is $104 million, a $4 million increase from the previous expectation, primarily driven by the un-forecasted $4 million USW labor contract signing bonus.

The Company's full-year 2016 interest expense is expected to be approximately $200 million. Of the $200 million expectation, approximately $170 million is considered cash and $30 million is considered non-cash.

Consolidated full-year 2016 depreciation, depletion and amortization is expected to be approximately $120 million.

Capital Budget Update

Cliffs is maintaining its full-year 2016 capital expenditures expectation of $75 million.

Conference Call Information

Cliffs Natural Resources Inc. will host a conference call this morning, October 27, 2016, at 10 a.m. ET. The call will be broadcast live and archived on Cliffs' website: www.cliffsnaturalresources.com.‹

“The efficient-market hypothesis may be

the foremost piece of B.S. ever promulgated

in any area of human knowledge!”

Recent CLF News

- Form SD - Specialized disclosure report • Edgar (US Regulatory) • 09/20/2024 08:23:00 PM

- Cleveland-Cliffs Announces Shareholder Approval of Arrangement to Acquire Stelco • Business Wire • 09/16/2024 08:15:00 PM

- Cleveland-Cliffs Reaffirms Commitment to Middletown Works Decarbonization Project and Ongoing Partnership with the U.S. Department of Energy • Business Wire • 09/16/2024 06:15:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 09/13/2024 08:33:33 PM

- Cleveland-Cliffs Successfully Amends Asset-Based Lending Facility • Business Wire • 09/13/2024 12:31:00 PM

- Cleveland-Cliffs Commends President Biden’s Reported Decision to Block Foreign Ownership of U.S. Steel by Japan’s Nippon Steel • Business Wire • 09/05/2024 08:46:00 PM

- Cleveland-Cliffs Announces Promotion of Michael Hrosik to Senior Vice President, Commercial • Business Wire • 08/21/2024 04:16:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 08/16/2024 09:17:13 PM

- Cleveland-Cliffs’ New 4-Year Labor Contract with the UAW Ratified at Dearborn Works • Business Wire • 08/16/2024 05:38:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 08/13/2024 09:14:47 PM

- Cleveland-Cliffs Inc. Announces Upsizing and Pricing of an Additional $600 Million Senior Guaranteed Notes due 2032 • Business Wire • 08/13/2024 08:11:00 PM

- Cleveland-Cliffs Inc. Announces Proposed Offering of an Additional $500 Million Senior Guaranteed Notes due 2032 • Business Wire • 08/13/2024 01:07:00 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 08/01/2024 07:12:56 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 07/24/2024 08:19:46 PM

- SAP Shares Surge 6%, NXP Declines 8% on Lower-than-Expected Profits, and More Earnings Highlights • IH Market News • 07/23/2024 10:02:34 AM

- Form 8-K - Current report • Edgar (US Regulatory) • 07/22/2024 08:47:27 PM

- Cleveland-Cliffs Reports Second-Quarter 2024 Results • Business Wire • 07/22/2024 08:05:00 PM

- Cleveland-Cliffs Announces Its New State-of-the-Art Electrical Transformer Production Plant in Weirton, West Virginia • Business Wire • 07/22/2024 11:00:00 AM

- US Index Futures Advanced, Oil Prices Inch Higher • IH Market News • 07/22/2024 10:06:47 AM

- Match Group Soars 8% Amid Potential Sale Pressure; Deutsche Bank Anticipates 2Q Loss, and More • IH Market News • 07/16/2024 10:10:09 AM

- Form 8-K - Current report • Edgar (US Regulatory) • 07/15/2024 09:00:49 PM

- Cleveland-Cliffs Announces the Acquisition of Stelco • Business Wire • 07/15/2024 10:00:00 AM

- Cleveland-Cliffs to Announce Second-Quarter 2024 Earnings Results on July 22 and Host Conference Call on July 23 • Business Wire • 07/01/2024 06:38:00 PM

- Cleveland-Cliffs Posts Press Conference and Q&A with U.S. Senator Sherrod Brown and USW International President David McCall on Website • Business Wire • 06/26/2024 07:09:00 PM

- Cleveland-Cliffs to Host U.S. Senator Sherrod Brown and USW International President David McCall at Cleveland Works • Business Wire • 06/24/2024 08:49:00 PM

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM