Saturday, October 22, 2016 8:34:58 AM

futures price must converge on the expected future spot price

Trading NaturalGaZ with Contango vs Bacwardation

Suppose we entered into a December 2012 futures contract, today, for $100. Now go forward one month. The same December 2012 future contract could still be $100, but it might also have increased to $110 (this implies normal backwardation) or it might have decreased to $90 (implies contango). The definitions are as follows:

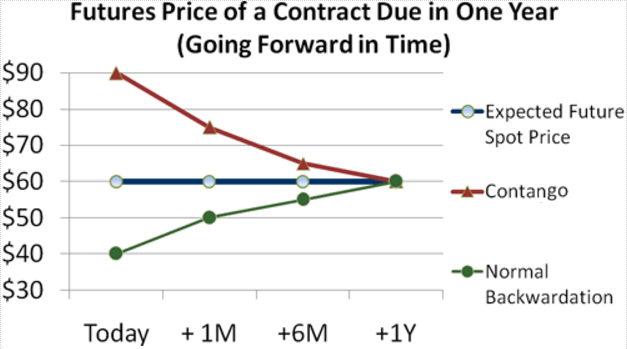

Contango is when the futures price is above the expected future spot price. Because the futures price must converge on the expected future spot price, contango implies that futures prices are falling over time as new information brings them into line with the expected future spot price......(weather could affect future spot price bringing it down because of lack of demand for future ng needs)....or price increases in backwardation as need for NaturalGaZ increases

Normal backwardation is when the futures price is below the expected future spot price. This is desirable for speculators who are "net long" in their positions: they want the futures price to increase. So, normal backwardation is when the futures prices are increasing.

Consider a futures contract that we purchase today, due in exactly one year. Assume the expected future spot price is $60 (see the blue flat line in Figure 2 below). If today's cost for the one-year futures contract is $90 (the red line), the futures price is above the expected future spot price. This is a contango scenario. Unless the expected future spot price changes, the contract price must drop. If we go forward in time one month, note that we will be referring to an 11-month contract; in six months, it will be a six-month contract.

Futures Prices Plunging? Buy A Put! or go into DGAZ

As you become more informed about the options market, you will need to learn how to use a long or short position in either a rising or falling market. Going long on a call is a profitable strategy when the underlying stock price rises in value, but how can you make money on a falling stock? By going long on a put ( or go into DGAZ ).

Read more: Prices Plunging? Buy A Put! | Investopedia http://www.investopedia.com/articles/optioninvestor/120401.asp#ixzz4NogwLXPN

Follow us: Investopedia on Facebook

http://www.investopedia.com/articles/07/contango_backwardation.asp

cc

which ever way the HERD goes....GO the other way

Lingerie Fighting Championships Signs Broadcast Deal With Maybacks Global Entertainment • BOTY • Sep 26, 2024 9:00 AM

Maybacks Global Entertainment and Lingerie Fighting Championships Enter Into Broadcast And Revenue Sharing Agreement • AHRO • Sep 26, 2024 8:30 AM

North Bay Resources Commences Operations at Bishop Gold Mill, Inyo County, California; Engages Sabean Group Management Consulting • NBRI • Sep 25, 2024 9:15 AM

CEO David B. Dorwart Anticipates a Bright Future at Good Gaming Inc. Through His Most Recent Shareholder Update • GMER • Sep 25, 2024 8:30 AM

Cannabix Technologies and Omega Laboratories Inc. Advance Marijuana Breathalyzer Technology - Dr. Bruce Goldberger to Present at Society of Forensic Toxicologists Conference • BLOZF • Sep 24, 2024 8:50 AM

Integrated Ventures, Inc Announces Strategic Partnership For GLP-1 (Semaglutide) Procurement Through MedWell USA, LLC. • INTV • Sep 24, 2024 8:45 AM