| Followers | 689 |

| Posts | 143817 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Monday, October 10, 2016 1:11:04 PM

By Avi Gilburt

* October 10, 2016

The investing world has a wide perspective on the value of gold and mining stocks.

You have those who are what many consider to be "gold bugs," who say you have to buy gold with every penny you own, no matter what the price. They basically believe the financial system as we know it is going to collapse tomorrow, and they will be the only ones left standing since they were "smart enough" to buy gold.

You then have those like Warren Buffett who view no investment purpose to gold:

"Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head."

Then there are those of us who actually view it like any other market and want to make money efficiently and prudently. We do not view this market as black and white as the gold bugs or Buffett do. We recognize that there are appropriate times to buy it and appropriate times to sell it. So, in September of 2011, we correctly noted that it was time to sell it, and at the end of 2015 into early 2016, we correctly noted it was time to buy it. Many who bought mining stocks when we suggested it at the end of last year have more than doubled their money already.

Right now, I believe we are being given another low-risk opportunity to buy gold mining stocks and potentially double our investment again over the next year.

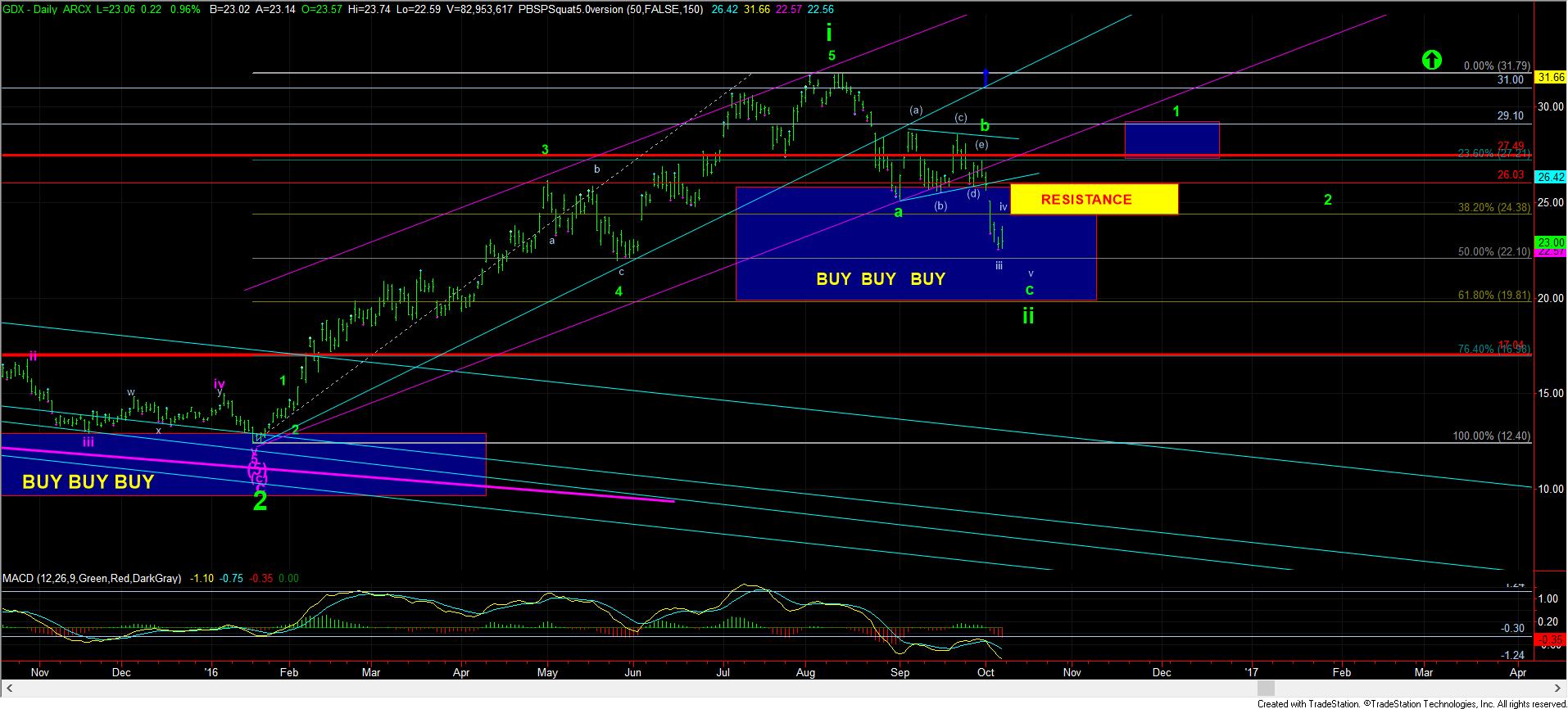

In using the VanEck Vectors Gold Miners ETF GDX, +0.17% as the representative chart for this market, I view the rally off the lows earlier this year as a wave i in the initial phase of a new bull market. That would mean this current pullback would be classified as a wave ii. Targets for these second waves are often the .500-.618 retracement region of the prior wave i rally. That places our bottoming region between the 19.80-22.10 region in the GDX.

As long as this region holds as support, I am looking for wave iii alone to be taking us to at least the 51.00 region in the GDX over the next year, with the potential to even extend toward the 60.00 region.

As I have said many times before, we deal in probabilities in markets rather than absolutes. Therefore, the first test the market must pass is to remain over the 19.80 support within the next week or two. A break down below that region significantly lowers the probabilities for this pattern set up.

However, if we do hold that support, and strongly break out over the August highs, the probabilities increase that we will be heading over 50.00 quite quickly. So, rather than believing in certainties, I suggest you approach the market from a perspective of probabilities so that you can make the appropriate investment decisions once you see how the market reacts over the next two months, no matter which way it moves.

http://www.marketwatch.com/story/how-gold-mining-stocks-could-potentially-double-in-12-months-2016-10-10

• DiscoverGold

Click on "In reply to", for Authors past commentaries

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Your Due Dilegence is a must!

• DiscoverGold

Recent GOLD News

- Barrick Continues to Unlock Value Embedded in Its Asset Base • GlobeNewswire Inc. • 09/17/2024 05:00:29 PM

- Feasibility Study on Lumwana Super Pit Expansion Expected by Year-End • GlobeNewswire Inc. • 09/11/2024 09:00:00 PM

- Key Projects Advance as Barrick Keeps Tight Focus on Value Creation and Growth • GlobeNewswire Inc. • 08/12/2024 10:00:00 AM

- Barrick Declares Q2 Dividend and Buys Back Shares • GlobeNewswire Inc. • 08/12/2024 09:59:00 AM

- U.S. Futures Steady as Markets Await Key Inflation Data, Oil Prices Climb • IH Market News • 08/12/2024 09:47:41 AM

- Mining Plays a Vital Role in Advancing the UN’s Sustainable Development Goals, says Barrick • GlobeNewswire Inc. • 08/02/2024 06:45:39 PM

- Porgera Remains On Track Despite Mulitaka Landslide Challenges • GlobeNewswire Inc. • 07/25/2024 11:00:00 AM

- Higher Q2 Production Puts Barrick On Track to Deliver 2024 Targets • GlobeNewswire Inc. • 07/16/2024 11:00:00 AM

- Barrick Continues to Invest in Mali • GlobeNewswire Inc. • 07/09/2024 07:00:00 PM

- Exploration Success, Capital Investment and Reserve Growth to Sustain Kibali’s Production Profile • GlobeNewswire Inc. • 07/02/2024 04:00:00 PM

- Barrick and Zijin Contribute $1 Million to Support Papua New Guinea Landslide Victims • GlobeNewswire Inc. • 06/07/2024 11:18:39 AM

- Form SD - Specialized disclosure report • Edgar (US Regulatory) • 05/29/2024 08:01:04 PM

- Barrick’s Sustainability Strategy Delivers Real Value to Stakeholders • GlobeNewswire Inc. • 05/15/2024 11:00:00 AM

- Barrick Announces Extensive Exploration Partnership with Geophysx Jamaica • GlobeNewswire Inc. • 05/01/2024 10:15:00 AM

- Barrick to Ramp Up Production As It Remains On Track to Achieve 2024 Targets • GlobeNewswire Inc. • 05/01/2024 10:00:00 AM

- Barrick Declares Q1 Dividend • GlobeNewswire Inc. • 05/01/2024 09:59:00 AM

- Barrick Announces Election of Directors • GlobeNewswire Inc. • 04/30/2024 08:15:55 PM

- Barrick On Track to Achieve 2024 Targets • GlobeNewswire Inc. • 04/16/2024 11:00:00 AM

- Notice of Release of Barrick’s First Quarter 2024 Results • GlobeNewswire Inc. • 04/09/2024 11:00:00 AM

- Strategy-Driven Barrick Builds on Value Foundation • GlobeNewswire Inc. • 03/28/2024 09:20:38 PM

- Barrick Hunts New Gold and Copper Prospects in DRC From Kibali Base • GlobeNewswire Inc. • 03/20/2024 02:00:00 PM

- Barrick Opens Academy at Closed Buzwagi Mine • GlobeNewswire Inc. • 03/18/2024 08:00:00 AM

- Barrick to Grow Production and Value on Global Asset Foundation • GlobeNewswire Inc. • 03/15/2024 11:53:01 AM

- Loulo-Gounkoto Delivers Another Value-Creating Performance • GlobeNewswire Inc. • 03/10/2024 10:00:00 AM

- Passing of the Right Honorable Brian Mulroney • GlobeNewswire Inc. • 03/02/2024 01:17:35 AM

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM