| Followers | 689 |

| Posts | 143817 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Friday, August 19, 2016 11:41:59 AM

By Greg Schnell

* August 19, 2016

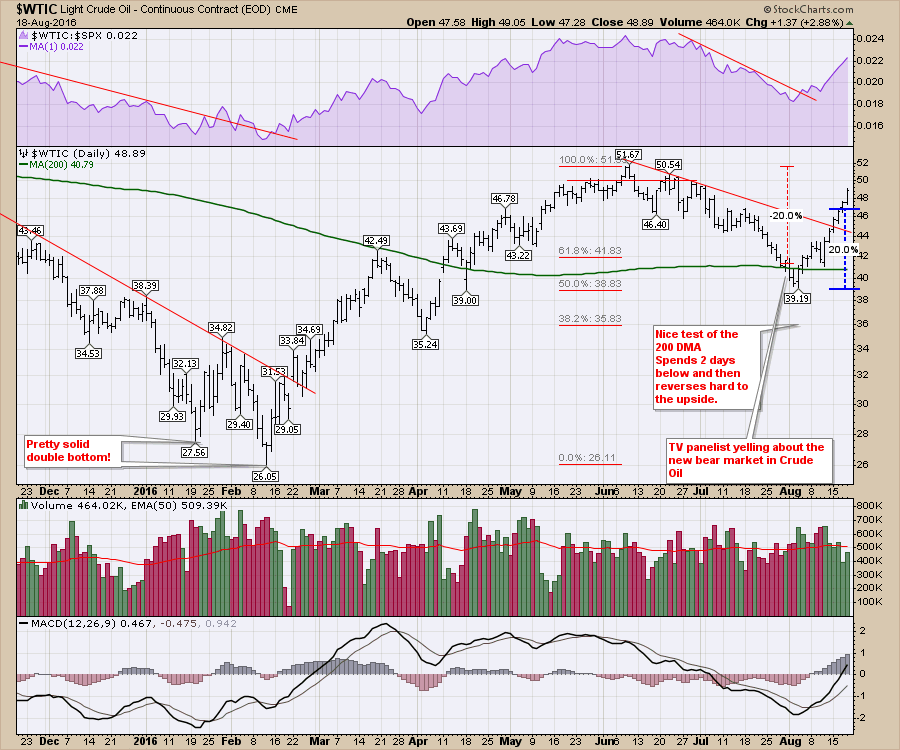

Well, that was fast! Oil makes strides towards $50 so the bear market in oil from 12 days ago is officially over. A business news channel announced a new bull market in oil because it is up 20% off the lows. Best to ignore hype reporting that leads us into and out of trades. This same news network had everyone bearish 2 days before oil bottomed by talking about the new bear market in oil starting August 1. Maybe we'll just use the $WTIC charts and look for support and resistance levels!

We have been covering Oil's pull back and we wanted to watch for how it handles the test of the 200 DMA. Sure enough, that was a nice place to expect a bounce and we got one. Now we have to watch how it handles overhead resistance around $50.

I also wrote a blog on Thursday about all the technical information on the crude oil chart. You can find that article here. Will Crude Oil Break Out to New 2016 Highs? I expect crude to move higher through the fall and into the spring. If the resistance at $51 is broken, a measurement of the basing pattern would suggest oil at $75. It doesn't really matter what I expect, but my trading bias is higher. The good news is we get information every day to help update expectations! The key is getting out if your bias is wrong.

My guiding theme is outright bullish, but the weakness in the SPY chart suggests a little caution for index traders. We have had 2 of the last 3 weeks extend lower and higher than the previous week. We call that an "outside week". The implication is that the market is testing lower and higher so a little indecision. Placed neatly between our outside bars is an extremely low volume week from last week. I showed another example of this condition in 2015, but the volume was Thanksgiving week. Last week we had a 5 day trading week with very low volumes. None of these are compellingly bearish, but they are cumulative signs of a weakening uptrend. Perhaps all of our Hamptons traders will come back from the shoreside and start trading to rejuvenate the market here.

I mentioned that index traders should be cautious, but there are some beautiful pockets of enthusiasm setting up for those who are looking. The energy trade is looking great with Natural Gas, Coal, Oil and Wind Energy all rallying. As a broad measure, look at the XLE. That is a nice move above resistance. All the talk is about OPEC and their next meeting. Try and spot where the meeting was on the chart and scroll below for the answer.

http://stockcharts.com/articles/commodities/2016/08/oil-makes-strides-towards-50---webinar-skim-2016-08-18.html

• DiscoverGold.

Click on "In reply to", for Authors past commentaries.

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Your Due Dilegence is a must!

• DiscoverGold

North Bay Resources Commences Operations at Bishop Gold Mill, Inyo County, California; Engages Sabean Group Management Consulting • NBRI • Sep 25, 2024 9:15 AM

CEO David B. Dorwart Anticipates a Bright Future at Good Gaming Inc. Through His Most Recent Shareholder Update • GMER • Sep 25, 2024 8:30 AM

Cannabix Technologies and Omega Laboratories Inc. Advance Marijuana Breathalyzer Technology - Dr. Bruce Goldberger to Present at Society of Forensic Toxicologists Conference • BLOZF • Sep 24, 2024 8:50 AM

Integrated Ventures, Inc Announces Strategic Partnership For GLP-1 (Semaglutide) Procurement Through MedWell USA, LLC. • INTV • Sep 24, 2024 8:45 AM

Avant Technologies Accelerates Creation of AI-Powered Platform to Revolutionize Patient Care • AVAI • Sep 24, 2024 8:00 AM

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM