Tuesday, July 12, 2016 8:14:21 AM

Got a PR, BPC Upgrades paper Mill with two C-1000s. The results on trading were a big fat meh! In fact, it very nearly looked like my call here from yesterday for { All in, just more consolidation but still with a mild bullish bias thanks to the slightly higher volume and higher low } and over on stocktwits I said weaker Monday because the buy percentage was weak all day long. I've not done the VWAP yet, but weaker wouldn't surprise me (answer below).

Answer: +0.03%, barely eking out a third consecutive positive day.

Well, somewhere in the deep dim past (three or four days ago?) I was expecting a move "in a couple days". Here I sit still awaiting it. A couple things suggest it's near: increased volume, time in consolidation, and depth into the minimal chart's descending triangle. Countering that is the compressing spread, reducing VWAP movements and short and buy percentage movements reducing and being low while being "in agreement".

In aggregate, unless some "Investors in Waiting" from yesterday's PR exist and decide to jump in, I'm still holding at consolidating with a mild bullish bias.

Anyway, moved up to $1.37 from the open through 9:50ish and then started sagging, getting back down to the open of $1.34 by 10:28, went low-volume $1.34/5 through 11:23, low-volume $1.34xx/$1.36 through 15:57, low-volume $1.35/6 through 13:44 (interrupted briefly with a few $1.34/5 minutes), and ended the day with $1.34/5 the last few minutes, closing at $1.34.

There were no pre-market trades even though we got a PR that was positive in two regards: an order from BPC, and with the 15% overpayment applied to their debt, and sale to a European entity even though the US $ has been somewhat stronger recently.

Just before the open b/a was 300:100 $1.30/41.

09:30-10:17 opened the day with a 1,792 sell for $1.35 and b/a became 12.1K:40.7K $1.34/7. Then came 9:32's 3K $1.3619, 9:33's 2K $1.3388, 9:35's ~2.1K #1.35 and 9:37 had b/a 1.4K:43.4K $1.35/7. After 9:36-:45's no-trades, 9:46's 15.4K $1.35 and 9:47's 100 $1.3550 left 9:48's b/a at 1.5K:200 $1.35/6. Then came 9:49's 2.8K $1.3550/$1.36, 9:50's 3K $1.3667/$1.37, b/a became 2.5K:45.3K $1.36/6, 9:54 did 230 $1.37, 9:55 2K $1.3601, 9:57 did 165 $1.37, 9:58 ~18.6K $1.36/7 (w/16K $1.37 block), and b/a went 2.8K:28K $1.36/7. After that came very low/no-volume (e.g no trades 9:59-10:05 & 10:07-:16) $1.36/7. At 10:07 b/a was 2K:27.8K $1.36/7 and 10:17's 3.7K $1.36/$1.3601 ended the period.

10:18-11:55, after three no-trades minutes, did a drop and began very low/no-volume $1.34/5 on 10:21's 200 $1.36, b/a at 10:19 of 1.7K:7.2K $1.35/6, 10:24 7K:7.2K $1.35/6, and hit $1.34 on 10:28's ~8.2K $1.35->$1.34. Then 10:30 did 150 $1.35 and put 10:34's b/a to ~7.7K:4.4K $1.34/5. At 10:50 b/a was ~8K:4.9K $1/34/5, 11:12 8.1K:5.1K $1.34/5. The period was interrupted by 11:25-:26's 300 $1.36, 11:30's 102 $1.3583 & 11:34's ~1.3K $1.35/6. B/a at 11:45 was 9.7K:800 $1.34/5, 11:53 10.2K:200 $1.34/5. 11:55's 200 $1.35 ended the period.

11:56-15:57, after three no-trades minutes, began very low/no-volume $1.35/$1.36 on 11:59's 100 $1.36. 12:11 b/a was 900:3.5K $1.35/6, 12:29 2.5K:3.4K $1.35/6, and 12:44 1.9K:3.6K $1.35/6. The period was interrupted by 13:34-35's 10.9K $1.35->$1.34->$1.35. At 13:45 b/a was 400:6.6K $1.35/6, 15:41 6.1K:~500 $1.35/6. 15:57's 100 $1.36 ended the period.

15:58-16:00 began with a drop on 15:58's ~8.3K $1.35->$1.3501->$1.34->$1.3501->$1.35->$1.3599->$1.34 and ended the day and period on 15:59's ~2.5K $1.34->$1.35 (100) and 16:00's 300 $1.34.

There were no AH trades.

Excluding the opening and closing trades (didn't qualify), there were 4 larger trades (>=5K & 1 4K+) totaling 41,520, 22.94% of day's volume, with a $1.3577 VWAP. In light of the rise in volume, and especially considering the sales PR, these larger trades metrics are very anemic.

Considering the PR these are particularly weak metrics too.Ending Period Period Period __Per. Trade_ Period_ % Day_ Per. End

Period Volume Low High _Dollar Val._ VWAP___ Volume Buy ~%

10:17 55634 $1.3400 $1.3700 $75,662.76 $1.3600 30.74% 45.87% Incl 09:46 $1.3500 13,600 09:58 $1.3700 16,020

11:55 50835 $1.3400 $1.3600 $68,567.33 $1.3488 28.09% 45.61% 10:28 $1.3500 4,500

15:57 61617 $1.3400 $1.3600 $83,417.65 $1.3538 34.04% 42.53% 12:30 $1.3501 7,400

16:00 10870 $1.3400 $1.3599 $14,645.75 $1.3474 6.01% 44.44%

On the traditional TA front, movements were:

Can you say "consolidation"? Even a decent PR that will accrue to Q1 can't shake this symbol out of it's doldrums.__Open_ ___Low_ __High_ _Close_ Volume_

Today -0.74% 0.00% 0.00% -0.74% 56.01%

Prior 0.00% 1.52% 0.00% 0.00% 27.19%

On my minimal chart we do have one piece of good news - we bottomed and closed at the known $1.34 support, confirming the break back into this range. We also have a piece of neutral news - the high and low were flat with yesterday, continuing the "consolidation" behavior. All that is also the bad news as when we get a piece of positive PR we like to see some bullish behavior. That was completely lacking today (see intra-day breakdown above and the buy percentages there and below).

The continued trading so deeply into the descending triangle (descending green line and horizontal blue line) tells me we are well into medium-term consolidation, as well as short-term, and should be making a break of some kind "soon". One possibility though is just breaking out sideways. During this wait increasing "compression" of range seems likely.

The candlestick today is the "Gravestone Doji", an indicator of indecision or a bearish reversal. Bulkowski says it reverses only 51% of the time though, making it essentially random.

On my one-year chart the 10, 20 and 50-day SMAs continue declining. If we hold here we'll see a small tick up in the 10-day tomorrow while the 20 and 50-day continue falling.

The oscillators I watch, mixed yesterday, became a bit weaker today as RSI and Williams %R moved from flat to weakening, accumulation/distribution continued to weaken, momentum rolled over to weaken and fell below neutral, and ADX-related weakened. Only MFI (untrusted by me) and full stochastic had improvement. In aggregate this makes today more negative than was seen yesterday.

The 13-period Bollinger limits, $1.2764 and $1.4365 ($1.2786 and $1.4445 yesterday) continue converging as the upper limit falls faster than the lower limit. Our trading range is just below the falling mid-point.

All in, "no good this way comes" based on this conventional TA and the lack of response to the positive PR. Maybe tomorrow some folks will respond to the PR? Maybe some wanted to wait and make sure we didn't tank on the positive PR, as was so common over the last 12 - 18 months?

Percentages for daily short sales and buys moved in opposite directions but by negligible amounts. So I don't read any positive or negative signs into this. I do read negatives into the short percentage being below my desired range (needs re-check) and the buy percentage moving further below what I think is needed for sustained appreciation. This seems more significant because a positive PR was essentially ignored, resulting in an essentially flat VWAP even though volume was up substantially.

The spread, as with yesterday, is in "pinched" territory. Also as with yesterday, { Sans volume I just see it as continued consolidation with MMs' bots generating volume and playing the narrow spread more effectively than real market participants are able to do. } Although volume was higher today, it's still no great shakes. I will add that having this condition a second consecutive day does suggest a move is nearer. Adding in the "compression" suggested by the minimal chart's trend lines makes this seem an even stronger likelihood.

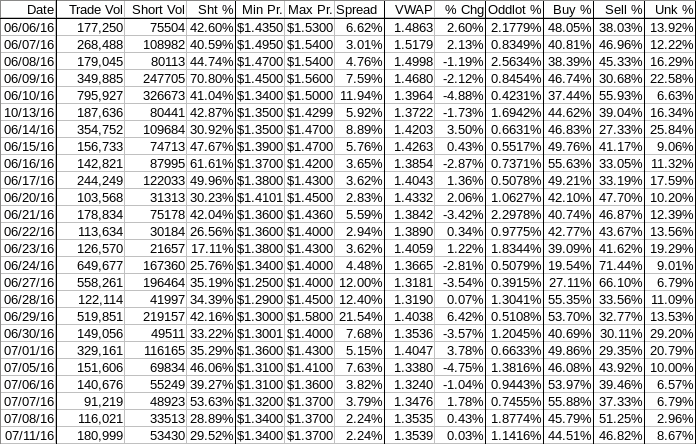

VWAP has the last twenty-four readings above neutral now at eleven negatives and thirteen positives. Change since 06/06 is -$0.1324, -8.91%. The percentage will be entering a period of "bumpiness" for a couple weeks. I'd like to see the three-day positive trend extend with an increased change. This reducing rate of improvement reflects the "compression" occurring before a potential break and we don't have a strong indication of direction. Continued positive movement with increasing rate would give us a signal I think.

All in, mixed signals here - negative short and buy percentages but combined spread and VWAP movement being a wee bit positive (or at least not negative) leave me still at "consolidating with a mild bullish bias".

As always, much is experimental and should be treated as such.

Bill

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.