Friday, July 01, 2016 10:00:17 AM

Putting aside the fact you have been provided with multiple examples...lets take the analysis one step further to show how similar another stock can be shall we...

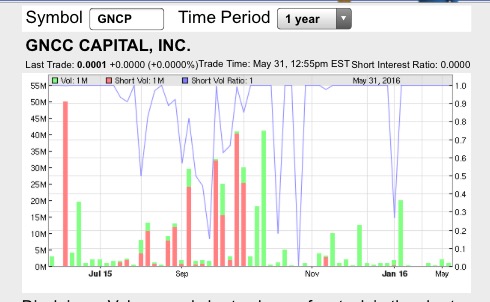

So here is a graph of the short volume percentages for GNCP over the last year. The blue line represents the ratio or percentage of short volume for a given trading day. And as always, anyone can go and check the validity of the graphed data by comparing directly to FINRA's Daily short volume reports here:

http://regsho.finra.org/regsho-Index.html

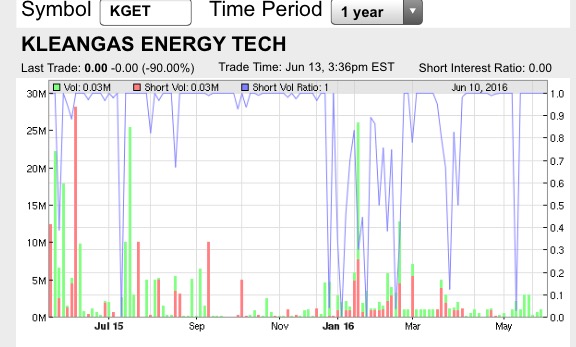

Now one of the many examples of of stocks with similar short volume percentages over the last year is KGET..so lets show its short volume %'s the same was...apples to apples

Looks pretty similar, right? Well for those that don't want to believe what their eyes are telling them, lets do a little ACTUAL analysis shall we...

You have stated a few times that GNCP "mostly" has short volume percentages above 91%....(which you did after previous statements it was always 100% were shown to be false). But 91%? Mostly?.

Well lets look at what the statistics ACTUALLY say for GNCP overall and compare it to KGET.

This is a graph of the percentage of trading days in the last year were the short volume percentage was ABOVE a given amount.

Oh my. Not only is it remarkably similar, KGET actually had short volume % on a higher percentage of days than GNCP when it was above 50% and pretty much every target above that. In fact looking at your "91%" "mostly" target for GNCP...wow...KGET had a HIGHER % of days above that target. The % of days that KGET had a short volume percentage of 100% was almost EXACTLY the same too.

GNCP unique?

It is not

Case closed.

Bantec Reports an Over 50 Percent Increase in Sales and Profits in Q1 2024 from Q1 2023 • BANT • Apr 25, 2024 10:00 AM

Cannabix's Breath Logix Alcohol Device Delivers Positive Impact to Private Monitoring Agency in Montana, USA • BLO • Apr 25, 2024 8:52 AM

Kona Gold Beverages, Inc. Announces Name Change to NuVibe, Inc. and Initiation of Ticker Symbol Application Process • KGKG • Apr 25, 2024 8:30 AM

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM