Friday, July 01, 2016 6:43:08 AM

The day initially looked like it was going to be one of the typical tank-big-days as we opened "high" and fell on low volume to 10:35's 8.7K $1.33->$1.30. But it was a "head fake", likely to shake the bushes, and a long slow low-volume grind up followed, hitting $1.35 by 11:22 and going sideways $1.33/4 through 12:51. Then after about an hour diddling from $1.36 to $1.33, and again going flat $1.33/4 through ~13:49, another long slow low-volume climb began that topped at $1.38 at 15:20. Flatness $1.37/8 through 15:52 was followed by the customary, but low-volume today, volatility at $1.37/40 into the close at $1.38.

Buy percentages held reasonably well, hitting ~61.5% at 11:45, stayed near that until 13:15's ~62%, and then weakened slowly to hit ~42% at 15:30 and finish at 15:59's &:16:00's ~40.7% and ~39.9% respectively. The degree of weakening was larger than in recent days and suggests we are back to what's normal for this symbol.

Combined with the volume and the close above the $1.34 support and above the ascending medium-term support, ~1.38, I think we are re-entering short-term consolidation as predicted.

We need to pull up and away from the rising support to get going. I suspect near-term we'll just sidle along in the current range and be below the rising medium-term support again.

I do think $1.34 will be the floor for at least a few days.

Tomorrow is Friday and the typical pre-weekend low-volume and flattish behavior into a shortened trading week may appear and reinforce that assessment. But Friday effects are always suspect and into a short week even more so.

This increases the chances I could be off the mark here.

There were no pre-market trades.

09:30-10:03 opened the day with a 207 sell for $1.36 & 149 more at $1.36 and b/a became 650:2.1K $1.35/9. That was followed by 9:31-:45's no trades, 9:46's 258 $1.37/8, 9:47's 955 $1.35/$1.3550, 9:49's 200 $1.35, 9:51's 400 $1.35, 9:51-:58's no-trades, and 9:59's 300 $1.3470/$1.36. B/a at 9:42 was 650:2.1K $1.35/8, 9:52 1K:2.9K $1.34/6, 9:58 1.1K:200 $1.34/6. 10:03's 100 $1.36 ended the period.

10:04-10:35, after twelve no-trades minutes, began a quick step down on 10:16's 543 $1.333, 10:17's ~2.9K $1.3301, 10:19's ~1.3K $1.34/$1.3476, 10:21's 2K $1.3499, 10:22's 600 $1.34/$1.3450, 10:28's 600 $1.33, 10:29's 2.5K $1.31, 10:30's 100 $1.33, 10:34's 1K $1.3260, and 10:35's 8.7K $1.3260->$1.32->$1.31->$1.32->$1.30 (the bottom) ended the period.

10:36-11:06, after two no-trades minutes, began a very low/no-volume $1.3080/$1.32 with a small step up on 10:38's 1.5K $1.3199 and 10:40's 2K $1.3199 that put b/a 8.4K:3.2K $1.30/2. B/a at 11:00 was 800:2.3K $1.31/2. 11:06's 2K $1.3259 moved b/a to ~1.5K:2K $1.32/3 and ended the period.

11:07-11:32, after fourteen no-trades minutes, got 11:20's b/a of 2.6K:2.5K $1.32/3 and did a step up on 11:21's ~1.1K $1.33 and 11:22's ~2.8K $1.34->$1.35->$1.34->$1.3480->$1.33. Trading became very low/no-volume $1.32/3 and 11:26 had b/a 3.5K:2.5K $1.32/4. 11:32's 300 $1.33 ended the period.

11:33-12:53, after nine no-trades minutes, began very low/no-volume $1.33/4 on 11:42's ~9.1K $1.3326/99. B/a at 11:52 was 700:3.5K $1.33/4, 12:07 7.2K:2.4K $1.32/3 and we got a 12:08 125 $1.3280 trade. 12:11 b/a went 9K:3.9K $1.32/4. 12:50-:51 traded 5K $1.34 and b/a went 1.9K:2K $1.33/5. 12:53's 100 $1.3450 ended the period.

12:54-13:14 began with b/a 3.4K:4.3K $1.34/6 and began very low/no-volume $1.34/$1.36 (only 400 $1.36 though) on 12:54's 400 $1.36. 13:05's b/a was 2.3K:3K $1.34/5. 13:14's 1.6K %1.35->$1.3499 ended the period.

13:15-13:47, after three no-trades minutes, began very low/no-volume $1.33/4 on 13:18's 3.5K $1.34->$1.33. B/a at 13:22 was ~600:3.8K $1.33/4, 13:33 ~2K:2.7K $1.33/4. 13:47's 2.9K $1.34 ended the period.

13:48-14:16, after two no-trades minute, began verylow/no-volume $1.3420/$1.35 on 13:50's 200 $1.36. After 13:54's 100 $1.35, b/a at 13:55 was 4.1K:4.4K $1.34/6, 14:02 4K:1.6K $1.34/5. 14:10's 401 $1.36 moved trade range to $1.35/6. 14:16's 100 $1.35 ended the period.

14:17-14:51 began with b/a 4.5K:3.5K $1.34/6 and after two no-trades minutes stepped up on 14:19's 33.5K $1.35->$1.36->$1.37 to begin very low/no-volume $1.35/7. At 14:23 b/a was 1.7K:500 $1.35/7, 14:36 ~1.1K:1.6K $1.35/6. 14:51's 300 $1.36 ended the period.

14:52-15:51, after four no-trades minutes, began a very low/no-volume climb, first $1.38/9 on 14:56's 503 $1.37->$1.39 fast pop up, and topped on 15:20's 100 $1.40. Very low/no-volume $1.39/40 ensued, with a couple trades $1.3850. B/a at 15:12 was 1.6K:5.3K $1.38/40, 15:14 1.2K:5.3K $1.38/40, 15:23 1K:5.9K $1.38/40, 15:43 800:5.7K $1.39/40. 15:51's 252 $1.3950/$1.40 ended the period.

15:52-16:00, after a no-trades minute, began the EOD volatility on 15:53's ~10.5K $1.39->$1.38->$1.37->$1.38 and traded the rest of the period on low-volume $1.38/9-$1.40 and ended the period and day on 16:00's 3,054 sell for $1.38.

There were no AH trades.

Excluding the opening and closing trades (didn't qualify), there were 3 larger trades (>=5K & 1 4K+) totaling 33,550, 22.51% of day's volume, with a $1.3630 VWAP.

On the traditional TA front, movements were:Ending Period Period Period __Per. Trade_ Period_ % Day_ Per. End

Period Volume Low High _Dollar Val._ VWAP___ Volume Buy ~%

10:03 2468 $1.3470 $1.3800 $3,341.88 $1.3541 1.66% 9.13%

10:35 20171 $1.3001 $1.3499 $26,722.14 $1.3248 13.53% 28.75%

11:06 9700 $1.3080 $1.3259 $12,800.85 $1.3197 6.51% 49.85%

11:32 4390 $1.3248 $1.3500 $5,876.93 $1.3387 2.95% 53.36%

12:53 17304 $1.3280 $1.3450 $23,128.90 $1.3366 11.61% 60.73%

13:14 2200 $1.3400 $1.3600 $2,971.85 $1.3508 1.48% 62.15%

13:47 8000 $1.3300 $1.3400 $10,701.00 $1.3376 5.37% 57.87%

14:16 2009 $1.3420 $1.3600 $2,719.28 $1.3535 1.35% 54.56%

14:51 44027 $1.3500 $1.3700 $59,871.20 $1.3599 29.54% 43.70% Incl 14:19 $1.3600 23,400 $1.3700 4,000

15:51 17952 $1.3700 $1.4000 $24,970.04 $1.3909 12.04% 43.11%

16:00 19061 $1.3700 $1.4000 $26,259.32 $1.3776 12.79% 39.86% Incl 15:53 $1.3700 6,150

Don't be spooked by the high's movement - yesterday had the high-volume pre-market that made a high way out of our normal range. The volume movement is worth notice - it fits with my thoughts that we would re-enter consolidation. With the price range where it's at and the closes holding above both $1.34 and the rising medium-term support/resistance on my minimal chart (rising white line), we have added evidence that we won't fall hard but are likely re-entering consolidation.__Open_ ___Low_ __High_ _Close_ Volume_

Today -1.45% 0.01% -11.39% 0.00% -71.33%

Prior 6.98% 0.78% 16.18% 2.22% 325.71%

On my minimal chart, as already mentioned, we closed above both the $1.34 and the rising medium-term support, ~$1.38, on falling volume. I think this confirms the re-entry into short-term consolidation. As mentioned elsewhere, we need to begin to pull up and away from that rising support/resistance to begin to make progress. Not likely going into a Friday before a holiday-shortened weekend.

Another good note is that we have the second close above the short-term descending resistance (descending green line) so that it now should act as support if we do try and go lower. Tomorrow it will be just above the $1.34 price-point support.

On my one-year chart the 10, 20 and 50-day SMAs continue falling. The 10-day will begin small flattening if we hold here and then rise in a couple days.

The oscillators I watch has RSI flat at just below neutral and improvement in accumulation/distribution, MFI (untrusted by me), both just below neutral. Improvement also occurred in Williams %R and full stochastic, both just below overbought. ADX-related weakened.

The 13-period Bollinger limits, $1.2932 and $1.4822 ($1.2932 and $1.4822 yesterday). This is the third day these have been flat.

All in it does look like we are back in short-term consolidation but with a slight positive bias. Seeing price pull up and away from the minimal sharts rising medium-term support would be a decent indication we would be leaving consolidation. Moving sideways, leaving us again below it, would be a sign of continued consolidation.

Percentages for daily short sales and buys moved in the same direction, good, and by roughly the same amount, -21.21% and -24.22% for shor and buy percentages respectively. This magnitude change being similar is also goo. It suggests "normalcy". Short percentage is barely below my desired range (needs re-check) but the buy percentage moved far below what's need for sustained appreciation. This fits with my thoughts we would re-enter consolidation.

The spread finally narrowed after three days of excess and although still a bit wide is moving towards a level consistent with consolidation.

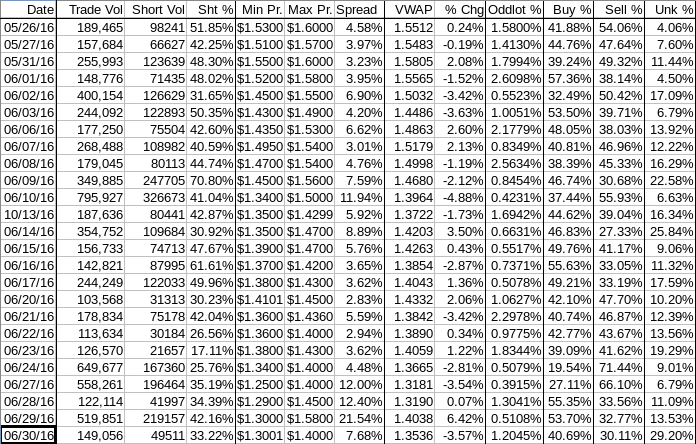

VWAP has the last twenty-four readings deteriorated to thirteen negatives and eleven positives. Change since 05/26 is -$0.1976, -12.74%. The semi-regular changes in the negative vs. positive readings is consistent with consolidation.

All in, I'm neutral because I think we've re-entered consolidation. I do see a mild bullish bent to it.

As always, much is experimental and should be treated as such.

Bill

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.