| Followers | 689 |

| Posts | 143817 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Monday, June 06, 2016 9:23:16 AM

By Carl Swenlin

* June 5, 2016

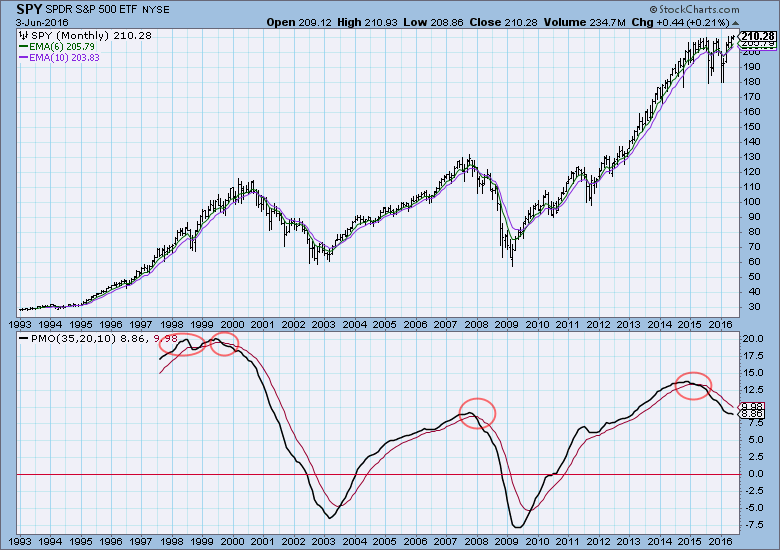

While our timing models remain bullish, and the market continues to make marginal new highs, I have been looking for a bull market top since the monthly PMO topped in late 2014 and then crossed down through its signal line in early-2015. Well, that price top has not yet materialized, but the market has not really gone anywhere either. There have been a series of price tops for about a year-and-a-half, but at the worst, only corrections have resulted, and a trading range established.

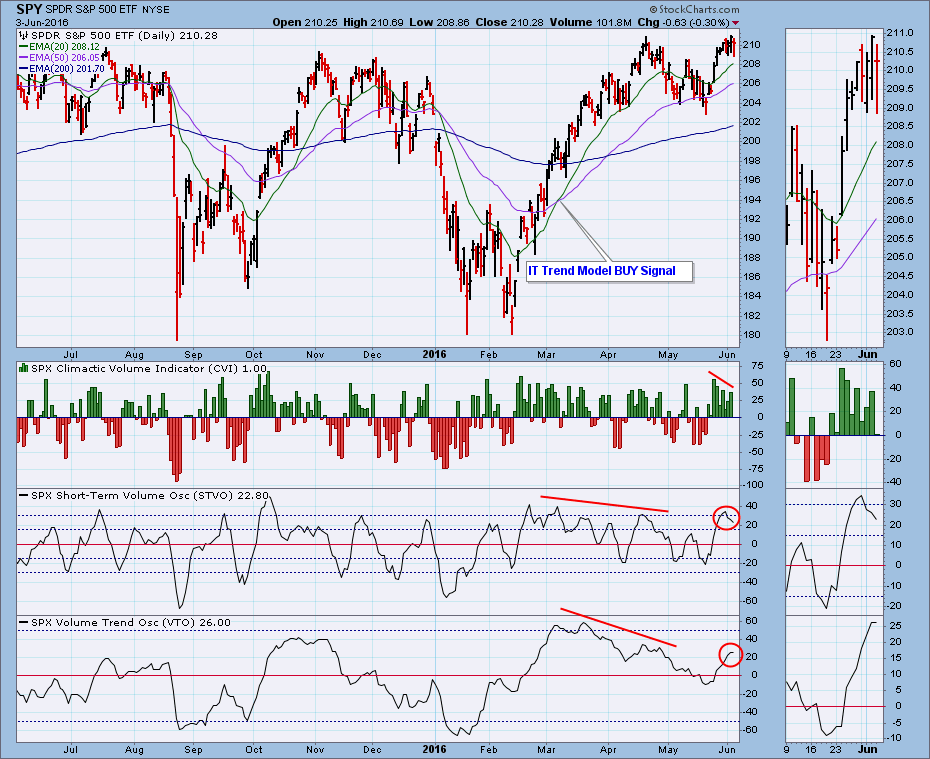

Moving to the daily chart, note that an ITTM BUY signal was generated when the 20EMA crossed up through the 50EMA. We can see the internal deterioration that preceded the April price top (negatively diverging STVO and VTO), but that only resulted in a small pullback. Now, as price is once more pushing at the top of the trading range, we again see some internal weakness: (1) the CVI has faded as price pushed higher; (2) the STVO has topped in overbought territory; and (3) the VTO in topping and has failed to confirm the recent price highs.

CONCLUSION: We are on an ITTM BUY signal, but I am once again looking for a correction. I know that this conflict between the mechanical signal and my analysis of the technicals can be confusing, but remember that the Trend Model is an ON/OFF switch and does not incorporate the nuance of other technical indicators. The Trend Model tells us we should be long the market, but the indicators suggest that that position may be vulnerable.

Technical analysis is a windsock, not a crystal ball.

http://stockcharts.com/articles/decisionpoint/2016/06/spy-still-wary-of-the-advance.html

• DiscoverGold.

Click on "In reply to", for Authors past commentaries.

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Your Due Dilegence is a must!

• DiscoverGold

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM