Sunday, May 22, 2016 1:01:12 PM

GRNE - Green Endeavors, Inc. - COMPILED DD (05/22/2016)

http://www.green-endeavors.com/

http://www.landissalon.com/

http://www.avedaatcitycreek.com/

https://twitter.com/OTC_GRNE

https://www.facebook.com/GreenEndeavors/

https://www.facebook.com/pages/Landis-Lifestyle-Salon/48757046353

https://www.facebook.com/AvedaAtCityCreek

http://sacklunchproductions.com/ (Parent Company)

Share Structure from TA as of 05/20/2016

Issued and Outstanding: 1,689,024,989

Restricted: 679,026,893

Authorized: 10B

per 10k:

Richard Surber may be deemed a beneficial owner of 679,891,150 shares of the Company's common stock by virtue of his position as an officer and director of Sack Lunch Productions Inc.

Revenue based on audited SEC filings:

Revenue Q1 2016 = $792k ($149k cash + $152k notes receivable)

Revenue 10k 2015 = $2.2 mln (10k shows $150k cash!)

Revenue 10k 2014 = $2.3 mln

Also per Q1 2016 company reported only $107k loss which is outstanding improvement from $278k loss last year and currently being very close to be profitable...

GRNE owns and operates two Landis Aveda™ Lifestyle Salons and an Aveda™ retail store located in City Creek Center in Salt Lake City, Utah. Green Endeavors' parent company is Sack Lunch Productions (SAKL), a diverse holding company.

As of December 31, 2015, Landis employed 74 individuals, with approximately 66 providing salon and support services and 8 in management, administration and finance.

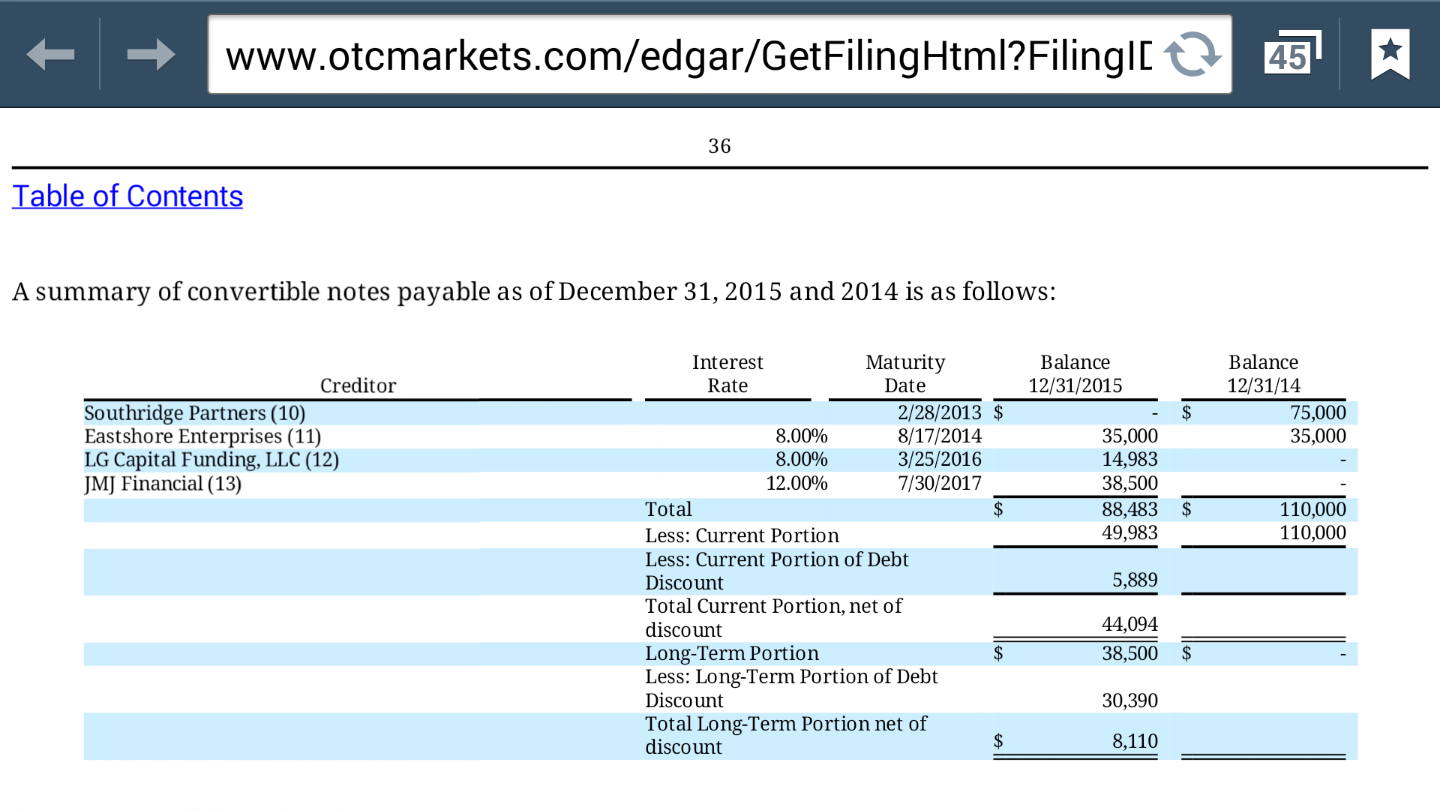

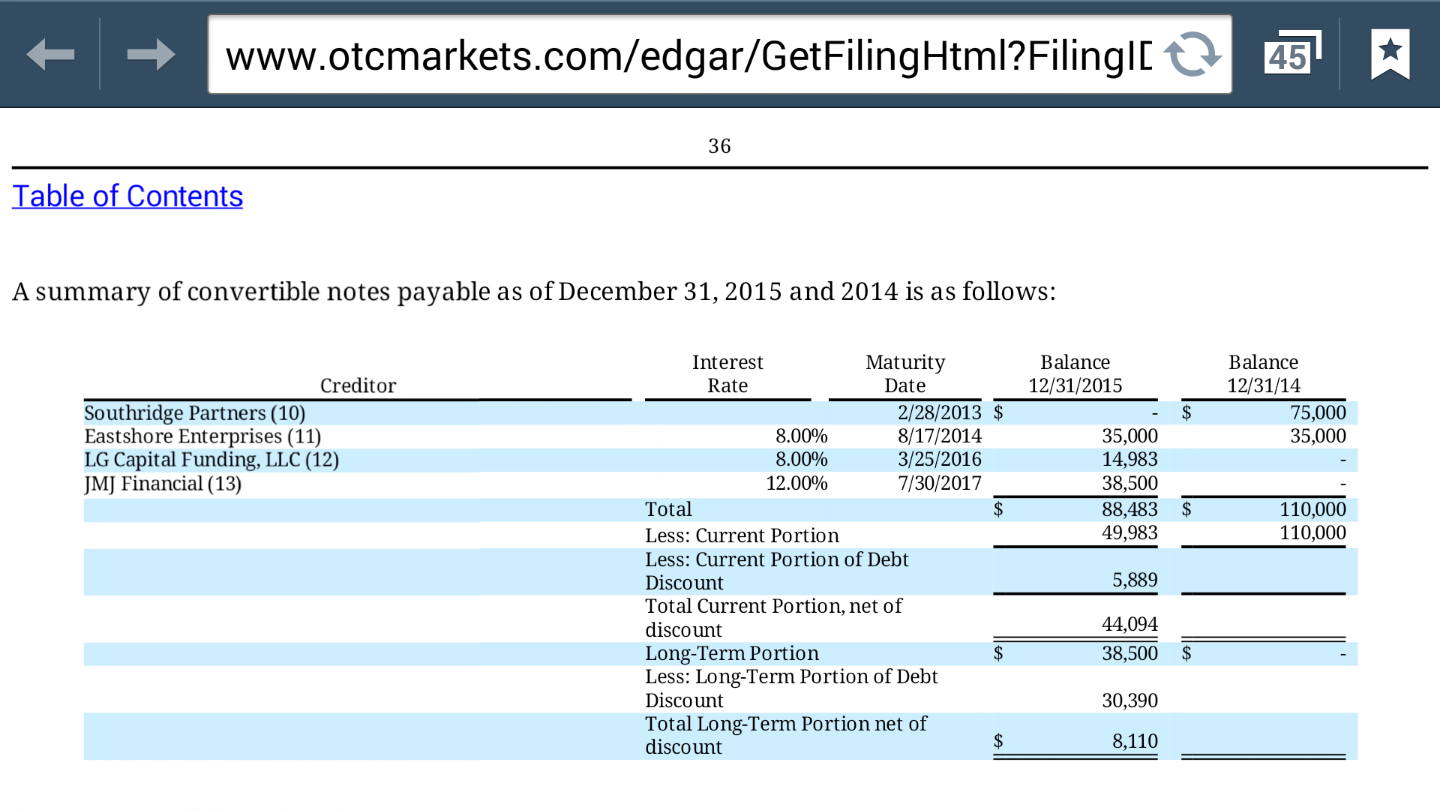

Short term Convertible notes per 10k:

JMJ and LG notes were converting through January and Febraury. However recent PR dated 04/01/2016 stated that the remaining amount of JMJ and LG were paid off with cash. (They also paid of remaining amount of KBM note with cash at the begining of December).

Q1 filing confirms that JMJ and LG notes + interest fully paid off.

per Q1:

Eastshore Enterprises, Inc. for $35k. is dated 2012 so hasn't been converting for years now and it is small enough amount that most likely they would pay it off with cash same as LG, JMJ, and KBM.. Q1 shows that they had $150k cash.

Other payable notes are related parties. GRNE owns various amounts to CEO, SAKL, and its other subsidiaries. They are making monthly payements to repay debt.

Q1 Report shows that there was NO new convertible note added.

Instead company obtained a couple of credit lines (total $462k) secured by CEO.

per Q1:

On March 1, 2016, Landis Salons II, Inc. entered into a loan agreement with American Express Bank, FSB in the amount of $62,000. The note is a merchant account financing arrangement wherein Landis repays the loan through the American Express credit card sales receipts that are collected. The loan requires a prepaid interest charge that is 6% ($3,720) of the $62,000 loan amount. These financing costs are being amortized monthly to interest expense during the one year term of the loan. The total amount due at the inception date is $65,720.

On March 22, 2016, Landis Salons Inc. entered into a loan agreement with OnDeck Capital, Inc. in the amount of $400,000. The loan agreement provides for weekly payments in the amount of $6,953.85 for a period of 65 weeks, final payment due on June 22, 2017. Interest on the loan is at the rate of 13% per annum. Richard Surber has provided his personal guaranty on the loan.

NEWS 04/01/2016:

GRNE Reports Revenues of $780,569 for Q1 '16, an Increase of 11%

SALT LAKE CITY, UT--(Marketwired - Apr 1, 2016) - Green Endeavors, Inc. ( OTC PINK : GRNE ), a majority owned subsidiary of Sack Lunch Productions, Inc. ( OTC PINK : SAKL ) announces preliminary revenue estimates from its salon operations for the first quarter of 2016 of $780,569.

Revenues for the three months ended March 31, 2016, were $780,569 compared to $701,478, an increase of 11% over the comparable period in 2015. GRNE also noted that it has made cash payments totaling over $40,000 settling all convertible debentures that remained with JMJ Financial and LG Funding, LLC.

Richard D. Surber, CEO of GRNE, commented, "We are on track to have our Form 10Q issued in record time this year. The initial revenue results show that all 3 locations are posting improvements over last year that range from 13% to 3% improvements in topline revenues."

https://beta.finance.yahoo.com/news/grne-reports-revenues-780-569-190025653.html

NEWS 02/11/2016

GRNE Reports January Revenues of $256,888; a 7% Increase Over 2015

SALT LAKE CITY, UT -- (Marketwired) -- 02/11/16 -- Green Endeavors, Inc. (OTC PINK: GRNE), announced an uptick in revenues for the month of January. Combined sales were $256,288 compared to $239,045, a $17,243 increase or 7% system wide over the comparable period in 2015.

Richard Surber, CEO of GRNE, commented, "The increase in revenues is a direct result of our hiring efforts. Our training and hiring machine is beginning to pay dividends. Over the next 11 months I expect sales to continue to trend up as we continue to bring on new staff members. In addition, we have substantially improved accounting efficiencies which will allow for better planning. We expect to significantly cut accounting related expenses, as well as interest expense, in 2016 as our cash flow improves. Our goal is to have our Form 10K for 2015 filed by the end of February, well ahead of schedule."

http://www.reuters.com/article/idUSnMKWwzFfla+1c8+MKW20160211

NEWS 12/08/2015

GRNE Settles Convertible Note Holder

SALT LAKE CITY, UT--(Marketwired - Dec 8, 2015) - Green Endeavors, Inc. ( OTC PINK : GRNE ), announces that it has settled all outstanding convertible notes with KBM Worldwide, Inc. for a cash payment of $20,486.

CEO of Green Endeavors, Richard Surber, stated, "GRNE entered into an agreement for a financing that totaled $64,000. Today, I am happy to confirm that we wired out a cash payment that satisfies the outstanding balance in full. The cash satisfaction of the note will result in the derivative liability and the underlying liability being removed from our balance sheet. Active shareholders will be happy to know that the last conversion of debt into shares occurred over a week ago and no further discounted shares will be coming into the market pursuant to KBM convertible note."

https://beta.finance.yahoo.com/news/grne-settles-convertible-note-holder-152358413.html

NEWS 11/30/2015

GRNE Reports October Revenues of $265,874; an 8.4% Increase Over 2014

SALT LAKE CITY, UT--(Marketwired - Nov 30, 2015) - Green Endeavors, Inc. ( OTC PINK : GRNE ), announced an uptick in revenues for the month of October. Combined sales were $265,874 compared to $243,665, a $22,208 increase or 8.4% system wide. All three locations showed increases in revenues for October that ranged from 7.8% to 15% per location.

Richard Surber, CEO of GRNE, commented, "I believe that the increase in revenues amongst all locations in October is a prelude of things to come. Over the last 12 months our sales have been down relative to the prior year periods because of insufficient staff. As result of hiring and training efforts, all locations are on track for improved financial performance for the last quarter of 2015 and beyond."

https://beta.finance.yahoo.com/news/grne-reports-october-revenues-265-120000184.html

http://www.green-endeavors.com/

http://www.landissalon.com/

http://www.avedaatcitycreek.com/

https://twitter.com/OTC_GRNE

https://www.facebook.com/GreenEndeavors/

https://www.facebook.com/pages/Landis-Lifestyle-Salon/48757046353

https://www.facebook.com/AvedaAtCityCreek

http://sacklunchproductions.com/ (Parent Company)

Share Structure from TA as of 05/20/2016

Issued and Outstanding: 1,689,024,989

Restricted: 679,026,893

Authorized: 10B

per 10k:

Richard Surber may be deemed a beneficial owner of 679,891,150 shares of the Company's common stock by virtue of his position as an officer and director of Sack Lunch Productions Inc.

Revenue based on audited SEC filings:

Revenue Q1 2016 = $792k ($149k cash + $152k notes receivable)

Revenue 10k 2015 = $2.2 mln (10k shows $150k cash!)

Revenue 10k 2014 = $2.3 mln

Also per Q1 2016 company reported only $107k loss which is outstanding improvement from $278k loss last year and currently being very close to be profitable...

GRNE owns and operates two Landis Aveda™ Lifestyle Salons and an Aveda™ retail store located in City Creek Center in Salt Lake City, Utah. Green Endeavors' parent company is Sack Lunch Productions (SAKL), a diverse holding company.

As of December 31, 2015, Landis employed 74 individuals, with approximately 66 providing salon and support services and 8 in management, administration and finance.

Short term Convertible notes per 10k:

JMJ and LG notes were converting through January and Febraury. However recent PR dated 04/01/2016 stated that the remaining amount of JMJ and LG were paid off with cash. (They also paid of remaining amount of KBM note with cash at the begining of December).

Q1 filing confirms that JMJ and LG notes + interest fully paid off.

per Q1:

Eastshore Enterprises, Inc. for $35k. is dated 2012 so hasn't been converting for years now and it is small enough amount that most likely they would pay it off with cash same as LG, JMJ, and KBM.. Q1 shows that they had $150k cash.

Other payable notes are related parties. GRNE owns various amounts to CEO, SAKL, and its other subsidiaries. They are making monthly payements to repay debt.

Q1 Report shows that there was NO new convertible note added.

Instead company obtained a couple of credit lines (total $462k) secured by CEO.

per Q1:

On March 1, 2016, Landis Salons II, Inc. entered into a loan agreement with American Express Bank, FSB in the amount of $62,000. The note is a merchant account financing arrangement wherein Landis repays the loan through the American Express credit card sales receipts that are collected. The loan requires a prepaid interest charge that is 6% ($3,720) of the $62,000 loan amount. These financing costs are being amortized monthly to interest expense during the one year term of the loan. The total amount due at the inception date is $65,720.

On March 22, 2016, Landis Salons Inc. entered into a loan agreement with OnDeck Capital, Inc. in the amount of $400,000. The loan agreement provides for weekly payments in the amount of $6,953.85 for a period of 65 weeks, final payment due on June 22, 2017. Interest on the loan is at the rate of 13% per annum. Richard Surber has provided his personal guaranty on the loan.

NEWS 04/01/2016:

GRNE Reports Revenues of $780,569 for Q1 '16, an Increase of 11%

SALT LAKE CITY, UT--(Marketwired - Apr 1, 2016) - Green Endeavors, Inc. ( OTC PINK : GRNE ), a majority owned subsidiary of Sack Lunch Productions, Inc. ( OTC PINK : SAKL ) announces preliminary revenue estimates from its salon operations for the first quarter of 2016 of $780,569.

Revenues for the three months ended March 31, 2016, were $780,569 compared to $701,478, an increase of 11% over the comparable period in 2015. GRNE also noted that it has made cash payments totaling over $40,000 settling all convertible debentures that remained with JMJ Financial and LG Funding, LLC.

Richard D. Surber, CEO of GRNE, commented, "We are on track to have our Form 10Q issued in record time this year. The initial revenue results show that all 3 locations are posting improvements over last year that range from 13% to 3% improvements in topline revenues."

https://beta.finance.yahoo.com/news/grne-reports-revenues-780-569-190025653.html

NEWS 02/11/2016

GRNE Reports January Revenues of $256,888; a 7% Increase Over 2015

SALT LAKE CITY, UT -- (Marketwired) -- 02/11/16 -- Green Endeavors, Inc. (OTC PINK: GRNE), announced an uptick in revenues for the month of January. Combined sales were $256,288 compared to $239,045, a $17,243 increase or 7% system wide over the comparable period in 2015.

Richard Surber, CEO of GRNE, commented, "The increase in revenues is a direct result of our hiring efforts. Our training and hiring machine is beginning to pay dividends. Over the next 11 months I expect sales to continue to trend up as we continue to bring on new staff members. In addition, we have substantially improved accounting efficiencies which will allow for better planning. We expect to significantly cut accounting related expenses, as well as interest expense, in 2016 as our cash flow improves. Our goal is to have our Form 10K for 2015 filed by the end of February, well ahead of schedule."

http://www.reuters.com/article/idUSnMKWwzFfla+1c8+MKW20160211

NEWS 12/08/2015

GRNE Settles Convertible Note Holder

SALT LAKE CITY, UT--(Marketwired - Dec 8, 2015) - Green Endeavors, Inc. ( OTC PINK : GRNE ), announces that it has settled all outstanding convertible notes with KBM Worldwide, Inc. for a cash payment of $20,486.

CEO of Green Endeavors, Richard Surber, stated, "GRNE entered into an agreement for a financing that totaled $64,000. Today, I am happy to confirm that we wired out a cash payment that satisfies the outstanding balance in full. The cash satisfaction of the note will result in the derivative liability and the underlying liability being removed from our balance sheet. Active shareholders will be happy to know that the last conversion of debt into shares occurred over a week ago and no further discounted shares will be coming into the market pursuant to KBM convertible note."

https://beta.finance.yahoo.com/news/grne-settles-convertible-note-holder-152358413.html

NEWS 11/30/2015

GRNE Reports October Revenues of $265,874; an 8.4% Increase Over 2014

SALT LAKE CITY, UT--(Marketwired - Nov 30, 2015) - Green Endeavors, Inc. ( OTC PINK : GRNE ), announced an uptick in revenues for the month of October. Combined sales were $265,874 compared to $243,665, a $22,208 increase or 8.4% system wide. All three locations showed increases in revenues for October that ranged from 7.8% to 15% per location.

Richard Surber, CEO of GRNE, commented, "I believe that the increase in revenues amongst all locations in October is a prelude of things to come. Over the last 12 months our sales have been down relative to the prior year periods because of insufficient staff. As result of hiring and training efforts, all locations are on track for improved financial performance for the last quarter of 2015 and beyond."

https://beta.finance.yahoo.com/news/grne-reports-october-revenues-265-120000184.html

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.