| Followers | 1077 |

| Posts | 90220 |

| Boards Moderated | 7 |

| Alias Born | 07/26/2007 |

Sunday, May 01, 2016 9:25:32 PM

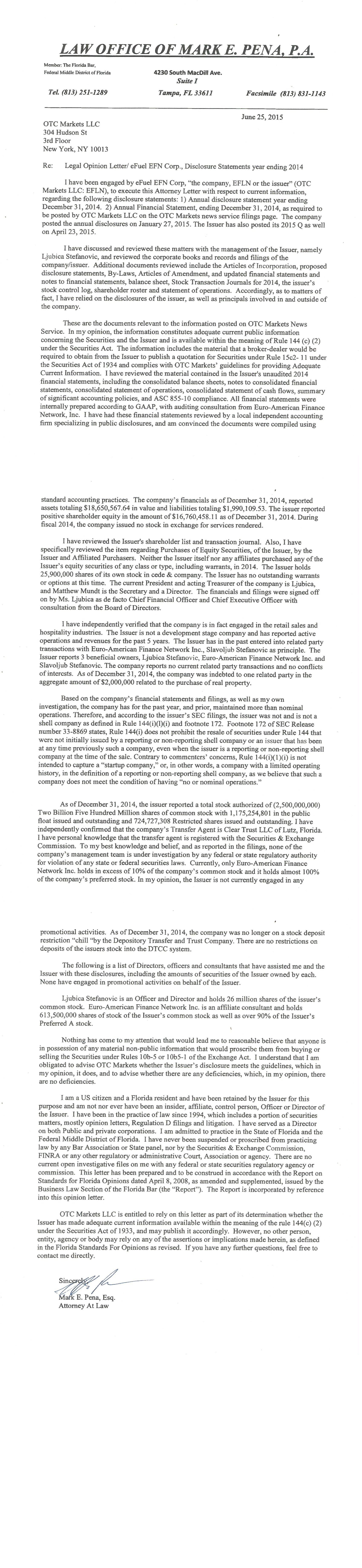

By the way how many OTC stock's financial reports were audited among ten thousands of OTC companies? The answer is: only a few of them! Keep in mind: EFLN is a OTC stock, not NYSE/NASDAQ/AMEX stock. I think you should know the big difference between both before you buy any OTC stock. Just ask yourself: if EFLN were a NYSE/NASDAQ/AMEX stock with the Same audited balance sheet then how much its MV would be now? I bet it should be at least trading at $10M MV currently v.s. EFLN is trading at measly $0.7M MV now! Per my decade-plus USA stock investment experience the investor can only find such good deal from the OTC market, not any chance from NYSE/NASDAQ/AMEX market!

Another quick question is: among ten thousands of OTC stocks how many of them have the Huge Positive-BookValue-Over-Trading-Price Ratio as high as EFLN's (currently 20, it was 60/30 when EFLN at 0.0001/0.0002)? The answer is: measly 0.1% or less!

OTC-Killers-Club has spot 332 stock killers from 5100-bagger to 2.2-bagger since 03/05/2011

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM