Sunday, May 01, 2016 5:10:30 PM

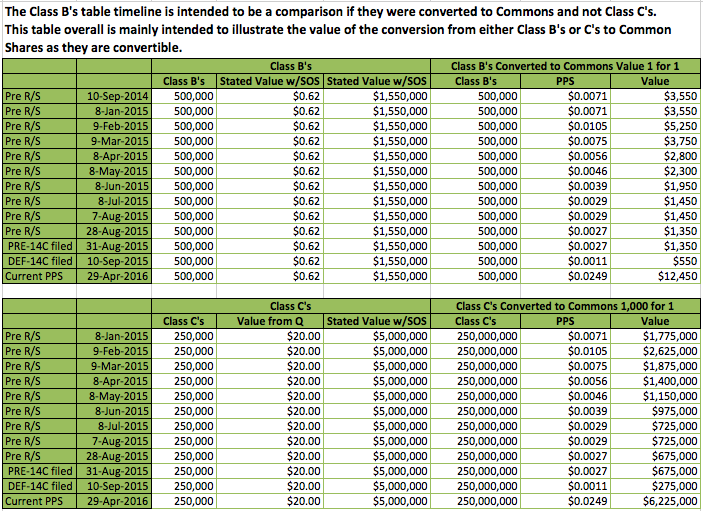

I did not see anything that said the Class B's converted 1 share into 1,000 shares until the announcement of the B's being converted to C's . Subsequently the Q's are saying that the C's are convertible from 1 into 1,000. More DD in this link http://investorshub.advfn.com/boards/read_msg.aspx?message_id=122318827

Also, I didn't use the 125% for the Commons conversion up-value, I used the straight-up PPS.

"On January 7, 2015... Each share of Series C Preferred is convertible into 1,000 shares of common stock; however the conversion price is subject to adjustment... The Company has the right to redeem the shares of Series C Preferred at any time after the date of issuance at a per share price equal to 125% of the stated value. The Series C Preferred automatically converts to common stock upon certain specified events."

Same for Messina's 250,000 Class C's.

Invest on your own DD! Information I post is generally my opinions, subject to errors and omissions!

VitaminFIZZ Store Locator Unofficial Spreadsheet https://docs.google.com/spreadsheets/d/1BIN_16oxZu7jWed0HUrslmt19YCAxrqqDG794lpooF8/edit?usp=sharing

FEATURED Cannabix's Breath Logix Alcohol Device Delivers Positive Impact to Private Monitoring Agency in Montana, USA • Apr 25, 2024 8:52 AM

Bantec Reports an Over 50 Percent Increase in Sales and Profits in Q1 2024 from Q1 2023 • BANT • Apr 25, 2024 10:00 AM

Kona Gold Beverages, Inc. Announces Name Change to NuVibe, Inc. and Initiation of Ticker Symbol Application Process • KGKG • Apr 25, 2024 8:30 AM

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM