Monday, March 21, 2016 11:35:30 AM

Before reading any further within this post, please understand that whatever I believe does not matter for what is worthy of being the true value of CGRA. It matters what the market sees as its true value. That will be predicated upon the substance that is delivered by the company. Given by the facts that we know, I believe that that CGRA could easily be trading somewhere north of .15+ per share. To explain this, I will break these thoughts down into a few sections. Let’s go over a few facts first:

Fact: CGRA owns approximately 47 net acres of industrial land property as well as over 1000 acres of mineral rights & leases (the “Assets”), located in Stevens County, Washington (Chewelah Properties):

http://www.cgrowthcapital.com/#!dolomite/c755

Fact: CGrowth has one hundred percent (100%) operational control over all production from its ”wholly owned subsidiary” Chewelah Properties:

http://www.cgrowthcapital.com/#!dolomite/c755

Fact: CGRA combined ”Net” Revenue Interests are 100% working interest in all operations and mineral leases:

http://www.cgrowthcapital.com/#!dolomite/c755

Fact: The 5-year Lease Agreement from its marijuana operational tenants in the state of Washington anticipates payments in excess of $2,000,000 annually, to include base rent, tenant improvements, common area maintenance charges, ancillary rentable areas, and administration fees:

http://finance.yahoo.com/news/cgrowth-capital-inc-executes-commercial-133000700.html

Fact: CGRA has its Chewelah Properties listed within the Washington State Government database under the Washington State Liquor and Cannabis Board website being leased by the following companies; WILDFIRE CANNABIS COMPANY, RANDOLPH AND MORTIMER, and WONDER WEST GROUP:

(Click on the section titled “Marijuana License Applicants” then click on the spreadsheet that pops up to view.)

http://www.liq.wa.gov/records/frequently-requested-lists

Fact: Confirmation that from the Washington state tax website proving that CGRA owns the land which consists of three tax parcels reference from the Chewelah Properties:

http://propertysearch.trueautomation.com/PropertyAccess/Property.aspx?cid=0&year=2014&prop_id=47404

Fact: CGRA Authorized Shares (AS) amount is 500,000,000 Shares

Fact: CGRA Outstanding Shares (OS) amount is 391,597,994 Shares

Fact: CGRA Restricted Shares amount is 132,534,002 Shares

Fact: CGRA Float Shares amount is 259,063,992 Shares

(The numbers above are per the CGRA Transfer Agent (TA) Pacific Stock Transfer

800-785-7782.)

Fair Speculation: If the Lease Agreement that CGRA has with Wildfire Cannabis Company is expected to generate over $2 Million per year, then it is ”fair speculation” to presume that the total of now ”three” companies now having Leasing Agreements with CGRA will generate over $6 Million per year.

Fair Speculation: I think it’s also fair to presume that since each company will be taking on all of the risk, all of the expenses, and of the debt, and etc. towards the maturation of any and all of those marijuana operations, the over $6 Million generated to be given to CGRA as a lease payment, should be considered as ”Net Income” for CGRA. Even as a worse cast scenario, half would be ”Net Income” for CGRA in my opinion.

Important to note, CGRA indicated from a recent update on their Facebook page that obtaining the Tier 3 Marijuana License in the state of Washington is very near with no more delays since as of March 17, 2016, there were no negative comments regarding their application. The last date to dispute anything to prevent the issuance of the Marijuana License was March 17, 2016:

https://www.facebook.com/CGrowthCapital

The Company would like to update investors on events taking place at our Chewelah, Washington facility. As was previously announced, we executed a lease at that facility with Wildfire Cannabis Company for their production of legalized cannabis in Washington state. As part of this process, the Company filed a SEPA with Stevens County Planning Department to change the usage of the property and to position for further development at the site. As of March 17, 2016, there were no negative comments regarding our application, therefore, we are awaiting the written Determination of Non Significance from the county allowing us to move forward with our plans. Based on our knowledge of the timing of events, we expect the county website to be updated and the written documentation to be issued to us by the end of next week. At that time we will be able to provide further details as to events taking place on the site.

Now let’s derive a ”potential” valuation by deriving an Earnings Per Share (EPS) to multiply by a Price to Earnings (P/E) Ratio from the variables that we know to exist from the info above.

Net Income ÷ OS = EPS

EPS X P/E Ratio = Share Price Valuation

Key Variables to Derive a Fundamental Valuation

** Net Income = $6,000,000

** OS = 391,597,994 Shares

** P/E Ratio for Marijuana Industry = 20.00 (Presumably)

$6,000,000 ÷ 391,597,994 Shares (OS) = .0153 EPS

.0153 EPS x 20 P/E Ratio = .306 Per Share Price Valuation

In my opinion, this means that the approval of the Marijuana License is going to signify a new beginning for CGRA which should very easily lead the company in the direction to obtain the level I have indicated above. Just in case I forgot any key variables that are unknown for whatever the reason or even if I am only half right with the thoughts above regarding the $6 million in Net Income, CGRA should easily have a fair value at .15+ per share.

Company filed below a Notice of Application (NOA) under the State Environmental Policy Act (SEPA) with the Stevens County Planning Department in the state of Washington to change the usage of the Chewelah Properties to 1502 Marijuana Production and Processing Facility:

https://jumpshare.com/v/YGM00cO2nH9ZdHg2Dqj2

Something else important to note is that the above valuation only refers to their marijuana operations. This does not include their 500,000,000 cubic yards of Magnesium Dolomite:

http://finance.yahoo.com/news/cgrowth-capital-inc-updates-shareholders-153000344.html

500,000,000 cubic yards of Magnesium Dolomite converts to be 135,000,000 tons:

http://www.unitconversion.org/volume/cubic-yards-to-ton-registers-conversion.html

Courtesy of MFI within the post below, from someone that is on the dolomite site,the FOB Cost breakdown from their Chewelah Industrial Facility for Magnesium Dolomite is $12.00 per ton per bulk 3/8 -1/8 waste rock retail or wholesale:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=112458324

135,000,000 tons of Magnesium Dolomite x $12.00 = $1,620,000,000 worth of Magnesium Dolomite

Now consider the CGRA potential from its oil & gas resources/wells of which they have 100% Operational Control working interest in all leases over all their production in the West Salt Creek Field with an 80% Net Revenue Interests (NRI) for 3,038 net acres as indicated within the CGRA Business Plan for Oil & Gas below:

http://www.cgrowthcapitalbond.com/files/3414/4778/4745/Powder_River_Resources_Inc_-_Business_Plan_and_Detail_Aug_2015_Update.pdf

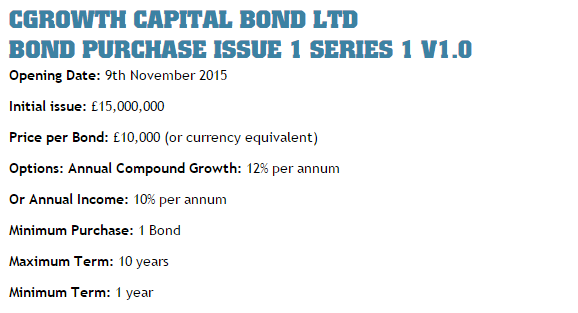

Now consider their potential if they are awarded the bond. Obtaining funding through a bond would be non-dilutive in nature and would probably be enough to fund their entire operations that requires funding. Funding from a completed/approved bond is how the major market stocks or companies obtain funding because of some huge company or organization understanding and believing just how huge the operations would be if funding was available. Courtesy of the post made by MFI below, it appears that CGRA is in the process of obtaining approval of some kind of huge bond funding:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=121201841

http://www.cgrowthcapitalbond.com/

Again, the valuation of .306 per share is only from their relationships with their connected marijuana operations within the state of Washington. The valuation does not include any growth to come from their Dolomite or their Oil & Gas operations or the Bond that some have been expecting to receive an update on. Given the share structure below, I believe that CGRA is setting up for something major:

Fact: CGRA Authorized Shares (AS) amount is 500,000,000 Shares

Fact: CGRA Outstanding Shares (OS) amount is 391,597,994 Shares

Fact: CGRA Restricted Shares amount is 132,534,002 Shares

Fact: CGRA Float Shares amount is 259,063,992 Shares

(The numbers above are per the CGRA Transfer Agent (TA) Pacific Stock Transfer

800-785-7782.)

More significant posts to help one in researching more info regarding CGRA are below courtesy of Sibware, MFI, and Tom1323:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=121260161

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=119131737

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=121258509

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=121186808

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=121290684

CGRA Press Releases:

http://finance.yahoo.com/q/p?s=CGRA+Press+Releases

v/r

Sterling

Sterling's Trading & Investing Strategies:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=39092516

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.