| Followers | 689 |

| Posts | 143817 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Tuesday, March 08, 2016 9:17:21 AM

* March 7, 2016

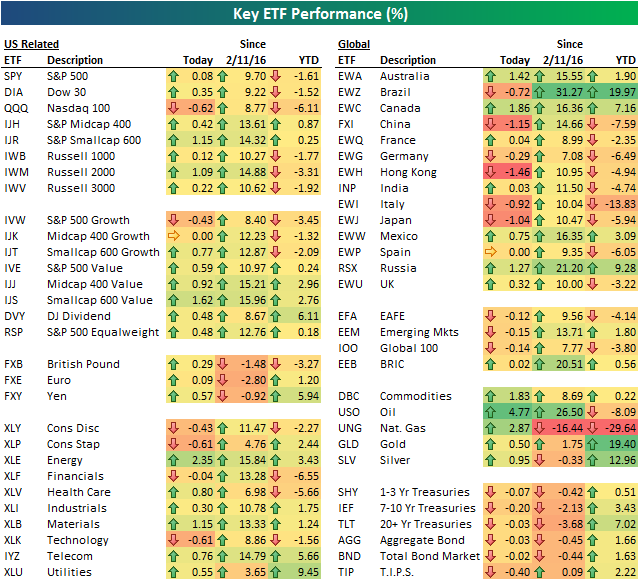

Below is a look at the performance of various asset classes today using our key ETF matrix. While the S&P 500 (SPY) was flat, the Nasdaq 100 (QQQ) finished down 62 basis points due to weakness in “FANG” stocks (FB, AMZN, NFLX, GOOGL). Small-caps outperformed large-caps significantly today, and the Energy and Materials sectors flew higher on the back of higher commodities prices. Oil rallied nearly 5%.

There was wide disparity in terms of international market performance. Australia, Canada, Mexico, Russia and the UK finished nicely higher on the day, while Brazil, China, Hong Kong, Italy and Japan finished deep in the red. Treasury ETFs finished slightly lower.

Along with today’s performance, we also include performance numbers for each ETF since the S&P’s low was made on February 11th, as well as year to date.

https://www.bespokepremium.com/think-big-blog/asset-class-performance-3716/

• George.

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Your Due Dilegence is a must!

• gtsourdinis

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM