| Followers | 245 |

| Posts | 2993 |

| Boards Moderated | 0 |

| Alias Born | 06/16/2015 |

Thursday, January 28, 2016 1:22:45 PM

(latest update includes 1/25/16 discussion of "How RXMD is going to get to $1" - see below)

(last status, news and filings update was on Jan 28, 2016 - click on link provided to see all the latest good news and new developments)

Progressive Care, Inc. (RXMD)

Company Website: http://www.progressivecareus.com/

COMPANY OVERVIEW

Progressive Care Inc., through its subsidiary PharmCo, LLC, is a South Florida provider of prescription pharmaceuticals, which specializes in anti-retroviral patient management, long term care, and durable medical equipment (DME). The Company, is focused on developing the PharmCo brand and adding business elements that cater to specific under-served markets and demographics. This effort includes community and network based marketing strategies, introduction of new locations, acquisitions, and strategic collaborations with community, government, and charitable organizations.

MISSION STATEMENT

As a company that specializes in the service of patients with special needs, our mission is to treat these patients with the utmost of care, privacy and respect. Progressive Care is devoted to improving the quality of life of all patients through increasing access to vital medications and equipment, raising awareness, and providing education and other services to local communities and long term care institutions.

PharmCo website: http://www.pharmcopharmacy.com/

PharmCo, LLC is a wholly-owned subsidiary of Progressive Care, Inc.

About PharmCo

PharmCo, LLC was established in 2006 as Florida Limited Liability Corporation with the goal of becoming a premier pharmacy in the South Florida community. The past 6 years has brought about dramatic changes for the pharmacy from becoming part of a publicly traded company (Progressive Care, Inc.) in 2010 to specializing in the care and management of patients with special needs. PharmCo prides itself on the level of service it provides to individuals and institutions in need of anti-viral medications, durable medical equipment, and long term care. The company is dedicated to treating its customers with compassion, professionalism, privacy and respect with a commitment to education, support and community outreach.

Contact Info

901 N Miami Beach Blvd

Suite 1-2

North Miami Beach, FL 33162

Phone: 305-919-7399

Email: Investors@progressivecareus.com

(December 9, 2015)

SHARE STRUCTURE & CAPITALIZATION

Share Price: $0.020 (December 31, 2015)

Market Cap: $7.0M with PPS = 0.020 (December 31, 2015)

Shares Outstanding: 352,043,045

Authorized Shares: 500,000,000

Insider Shares: 45,209,107

Float Shares: 306,833,938

(December 9, 2015)

REVENUE & DEBT

Revenue (annual): $15.6M based on Nov2015 revenue of $1.3M

YoY and QoQ revenue consistently increasing by 20-30% over past 3 years

Total Debt: $25k (only debt is note kept on record for holder that cannot be reached - may be deceased)

Convertible Debt: $0

Investor Relations Contact

901 N Miami Beach Blvd

Ste 1-2

North Miami Beach, FL 33162

786-657-2060

investors@progressivecareus.com

Transfer Agent

Computershare

8742 Lucent Blvd

Suite 225

Highlands Ranch, CO 80129

303-262-0678

December 31, 2015 Chart (Click Here for 15-Minute Delay Candle Chart)

Developing News & Coming Events

- Armen (control shareholder & company IR): "We just made this purchase, and we are excited for the added efficiencies it brings. It is not fully assembled, and will take 6-8 weeks to assemble (done by manufacturer) and it will be placed in the warehouse we are currently expanding into..connected to the pharmacy...the permits are out, and once approved we will begin the work immediately...It is $150K to purchase and assemble in total." (from INSTATRADER discussion on 1/28/16, Post #29324)

- Armen (control shareholder & company IR): "This company has no conversions or debt to speak of. If we were to dilute in ANY way we would PR it first. Not only are we NOT diluting, but we expect the O/S to go DOWN when TARPON returns the 12M shares they still hold that were UNSOLD" (from INSTATRADER discussion on 1/28/16, Post #29324)

- Next expected news/update... 2nd week of February: Management typically updates shareholders on monthly performance with PR disclosure to OTC Markets (and recently to iHub news)

- Annual report due end of March, could post filing any time before then on OTC Markets.

- Surprise news expectations... many are hoping to hear sooner than later about acquisition/merger developments for expansion of core business into new market(s) - for a surprise upward price effect beyond the current price correction in progress

Current News Summary & Status

- Jan 28, 2016: "After evaluating several manufacturers of pharmacy robotic systems, PharmCo, LLC has signed an agreement to purchase ScriptPro's CRS 225 robotic prescription dispensing system, which is one of the newest additions to ScriptPro's line of compact robotic machines. The CRS 225 can hold up to 225 individual medications and fill over 1000 prescriptions per day with 99.7% counting accuracy. Under the terms of the agreement, the machine will be installed in PharmCo's facility upon completion of the site expansion build-out, which is currently in the permitting phase of completion.

"We are taking a giant leap forward in modernizing our operation by purchasing ScriptPro's robotic system. This technology will essentially eliminate human errors in the prescription filling process, and drastically increase workflow efficiency. The expansion as well as the installation of the CRS 225 will greatly increase the production capacity of the pharmacy, which will quickly produce financial benefits for the Company," stated S. Parikh Mars, CEO."

- Jan 14, 2016: "The pharmacy filled nearly 180,000 prescriptions in 2015, which is a 28% increase over last year. During the fourth quarter, PharmCo filled over 48,000 prescriptions resulting in record revenues for the quarter at $3.9 million. December marked the strongest month for the company since inception with over $1.4 million in net pharmacy revenues.

In 2015, PharmCo brought in over $13.5 million in net pharmacy revenues. This is almost a 24% increase over 2014. Revenue growth accelerated during the final month and quarter with over 61% and 35% increases in revenues, respectively, when compared to the same time periods last year. The compounded medication division is the primary driver of revenue growth in addition to major additions to company's marketing team and expanded marketing campaigns with large clinics and physicians networks.

"While I am supremely happy with the progress we have made over the past year, I know that this is merely a fraction of what the company is capable of in the future. I am excited about bringing the company into 2016 with an ambitious resolve to accomplish major goals and realize our utmost potential. Our shareholders should take this time to share in the company's joy, but ready themselves for major growth and expansion in the coming year," stated Shital Parikh Mars, CEO."

- Jan 8, 2016: "Upon review of the filings and approval from OTC Markets, Progressive Care has moved to the OTC Pink Current Information tier of listed companies which is the highest trading tier on the OTC Pink marketplace. Over the past year, the Company has been diligent with filing all disclosure documents and financial statements with OTC Markets in a timely manner. As a result the company will now trade without a yield sign for the first time since 2013. Achieving the highest tier in the OTC Pink marketplace will bring significant benefits to the Company and its shareholders by assuring the public that comprehensive information on the Company's operations and financials is readily available.

"Over the past month, our management team has worked steadily to ensure that all disclosure and document requirements of OTC Markets have been met. Becoming an OTC Pink Current company is a positive step forward for Progressive Care. By providing greater transparency and public confidence in the timeliness and accuracy of press releases, financial statements and disclosures, we believe that we will strengthen our shareholder base and build shareholder value," stated Shital Parikh Mars, CEO."

- Jan 7, 2016: Open Letter to Shareholders... "The New Year is often a time of earnest reflection on the developments of last year and ambitious goal-setting for the year ahead. I am pleased to say that 2015 was a year of transformation and tremendous progress for the Company. In the past year, we have cemented ourselves as a health services organization that goes beyond being a provider of prescription pharmaceuticals and our numerous achievements have positioned us for further growth and success in 2016." (Read More)

Recent News

Jan 28, 2016...Progressive Care: PharmCo Purchases ScriptPro Robotic Dispensing System

Jan 14, 2016...Progressive Care Revenue Soars to Over $13 Million on 180,000 Filled Prescriptions

Jan 8, 2016...Progressive Care Inc. Upgrades to OTC Pink Current Information Tier

Jan 7, 2016...Progressive Care Releases Open Letter to Shareholders

Jan 5, 2016...Progressive Care Names Shital Mars Chief Executive Officer

Dec 14, 2015...Progressive Care Reaches Record $1.3 Million in Pharmacy Revenues in November

Dec 10, 2015...Progressive Care Inc. Completes 3(a)(10) Transaction

Dec 02, 2015...Progressive Care Inc.: PharmCo Joins Fight Against Turing Pharmaceuticals With Low-Cost Daraprim Alternative

Nov 24, 2015...Progressive Care Inc. Reports Positive Response From New York Road Show

Nov 17, 2015...Progressive Care Closes October With Strong Year-Over-Year Performance

Nov 10, 2015...Progressive Care: PharmCo, LLC Delivers Fourth Consecutive Quarter of Profitability

Oct 13, 2015...Progressive Care's Strong Third Quarter Brings Revenues to $10 Million

Sep 10, 2015...Progressive Care Continues Record Breaking Run in August

Aug 29, 2015...Progressive Care Announces Record Prescription Sales for July 2015

Latest Filing(s)

Jan 6, 2016...Attorney Letter with Respect to Current Information

Jan 5, 2016...Material Agreement Mars CEO 01.05.2015.docx.pdf

Jan 4, 2016...Officer/Director/Affiliate Stock Transactions

Dec 30, 2015...Attorney Letter with Respect to Current Information

Nov 10, 2015...Quarterly Report - CONSOLIDATED FINANCIAL STATEMENTS FOR THE QUARTER ENDED SEPTEMBER 30, 2015

Click here to see most recent filings (and all filings) on the OTC Markets website

Posted on iHub 1/25/2016:

Post #28622 (MoneyForNuthin)

How RXMD is going to get to $1

This is a 40x improvement over today's ~$0.025 share price. Do I think it will happen this year? Though some believe it's possible, I wouldn't bet the farm on it. Do I think it's very possible within the next 3-5 years? Absolutely! Here's how and why...

First, Progressive Care, Inc. (RXMD) is clearly undervalued, but the pps is correcting and will be reaching upward for 0.10+ before you know it. Organic growth and a handful of acquisitions - simply executing the strategic plan - will do the rest. I see RXMD as a serious buyout target in 2-3 years!

Large national pharmacy companies are fending off competition from mail-order prescription discounters, online pharmacies, wholesale retailers such as Costco and health clinics, among others:

- Dec 16, 2015 - CVS Health Corporation (NYSE:CVS) and Target Corporation (NYSE:TGT) announced today that CVS Health has completed the acquisition of Target's pharmacy and clinic businesses for approximately $1.9 billion.

- Oct 28, 2015 - Walgreens said on Tuesday that it will buy rival Rite Aid in a $17.2 billion deal that would whittle the nation's one-time mom-and-pop drug-store industry into two massive chains. Walgreens Boots Alliance, which operates the namesake drug store chain, said it is paying $9 per share in cash in a valuation that includes the assumption of debt. That reflects a 48% premium above Rite Aid's value at the close of trading Monday.

- Aug 19, 2015 - CVS Health Corp. (CVS - Analyst Report) has completed the acquisition of Ohio-based pharmacy services provider, Omnicare, for $12.7 billion, including a debt of $2.3 billion, well ahead of time. The buyout reflects the company’s foray into a new pharmacy distribution channel – the long-term specialty care market.

- From a 2010 article:

Omnicare has a rich history of growth through acquisitions, which has made it a dominant player in the industry. The company boasts a reasonably sound balance sheet and is well positioned with healthy cash flow, which it can use for further acquisitions, debt repayments and share repurchases. Omnicare is pursuing an aggressive acquisition strategy in fiscal 2010. The company agreed to buy institutional pharmacy businesses in July 2010 and is also in advanced negotiations for other acquisitions.

While the goliaths have been hammering away at acquisitions and consolidation in the broader pharmacy retail sales and services markets to maximize commodity-type margins, Progressive Care, Inc. (RXMD) has been quietly whittling away at a health services business model that focuses on a small but substantial piece of the very large pie. This piece of pie, however, concentrates on high-margin revenue derived from medications and services for an underserved segment of the market. Progressive Care specializes in the care and management of patients with special needs, long-term care needs, and including medications for infectious diseases.

As stated in the Open Letter to Shareholders, Progressive Care will continue to strengthen the successful PharmCo model by "adding business elements that cater to specific under-served markets and demographics." In doing so, Progressive Care raises the bar, creating a steeper barrier to entry for regional competition in existing markets. For example, Progressive Care will add a "closed-door pharmacy facility" to the existing PharmCo operation this year. It seems likely that this will be a nearby (near the existing PharmCo site) satellite pharmacy operation embedded in a long-term care or other health services facility in one of the underserved markets/demographics of focus.

As also stated in the Open Letter to Shareholders, Progressive Care "will also look for opportunities to expand the pharmacy through establishing new locations or through mergers/acquisitions with similarly positioned independent pharmacies," and "will seek licensures in additional states in order to begin positioning PharmCo as a national brand."

Progressive Care, Inc. (RXMD) has it in the game plan to grow revenue organically and to expand into other markets nationally through acquisitions.

The goliaths have it in their game plan to continue increasing shareholder value - indefinitely. As the pending market consolidation in the major pharmacy store and services sector is nearing completion, these companies will look to the next opportunities, especially those that offer higher gross margins. They will not be able to do this organically through existing infrastructure, as the services are much more specialized than what a discount pharmacy operation can profitably support. That is, it's simply not a good product mix. The only way they will be able to continue improving shareholder value at their historic rates is through acquisitions.

If you're trading on the OTCBB and you're new to RXMD, it would be a very smart move IMO to diversify your "investments" and take 10-20% of your funds and get a starting position in this stock for the long-haul growth toward this 40-50-60x gain opportunity over 3-5-7 years. Add when you can on any dips and stay long, and use other funds for flipping other penny stocks if that's something that appeals to you. Wanna retire young? This is a road map that's easy to read.

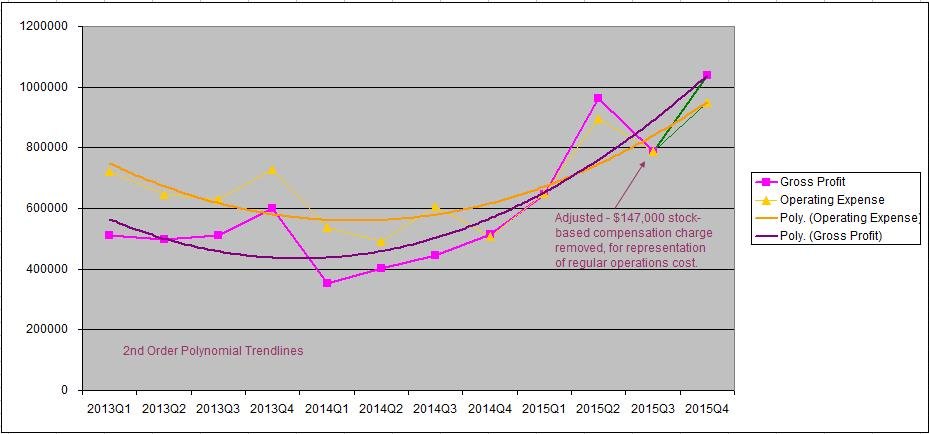

The following financial data was compiled by a shareholder, MoneyForNuthin, from quarterly and annual reports filed by Progressive Care, Inc. to OTC Markets. MoneyForNuthin is not affiliated with the company. Projections made in green text (spreadsheets) and green chart line extensions for Q4 2015 data points are made by MoneyForNuthin - these projections did NOT originate from Progressive Care, Inc. This information is provided as an aid to investors for their due diligence, and is not intended to be used directly as a guide for investing. Do your own DD, trade at your own risk.

(click chart image for full view)

Composite Balance Sheet (with nominal projection for December 31, 2015 cash position)

contributed by shareholder, derived from company financial filings

Zero Debt (debt payoff close-up - showing paydown over 2015 quarterlies)

contributed by shareholder, derived from company financial filings

The following photo is a street view screen shot from Google on December 15, 2015

(click the image for full view)

The following images are recent photos after makeover of storefront, processing and office areas in Autumn 2015

The following pics contributed by RXMD shareholder on November 13, 2015

(click the images for complete panoramic views)

Compounding Room:

Drug Room:

Prescription Filling Area:

Back Office - roughly 8-10 workstations throughout the whole room that looked to be "lived in" by employees that have been there for a while:

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.