Sunday, January 24, 2016 8:55:21 PM

Asian Stocks Extend Global Rebound With Oil Above $32; Yen Rises

Emma O'Brien

ek_obrien

Jonathan Burgos

January 24, 2016 — 4:31 PM CST

Updated on January 24, 2016 — 7:38 PM CST

Chinese shares open higher after first weekly advance in 2016

This week's BOJ, Fed meetings in focus after ECB sparks rally

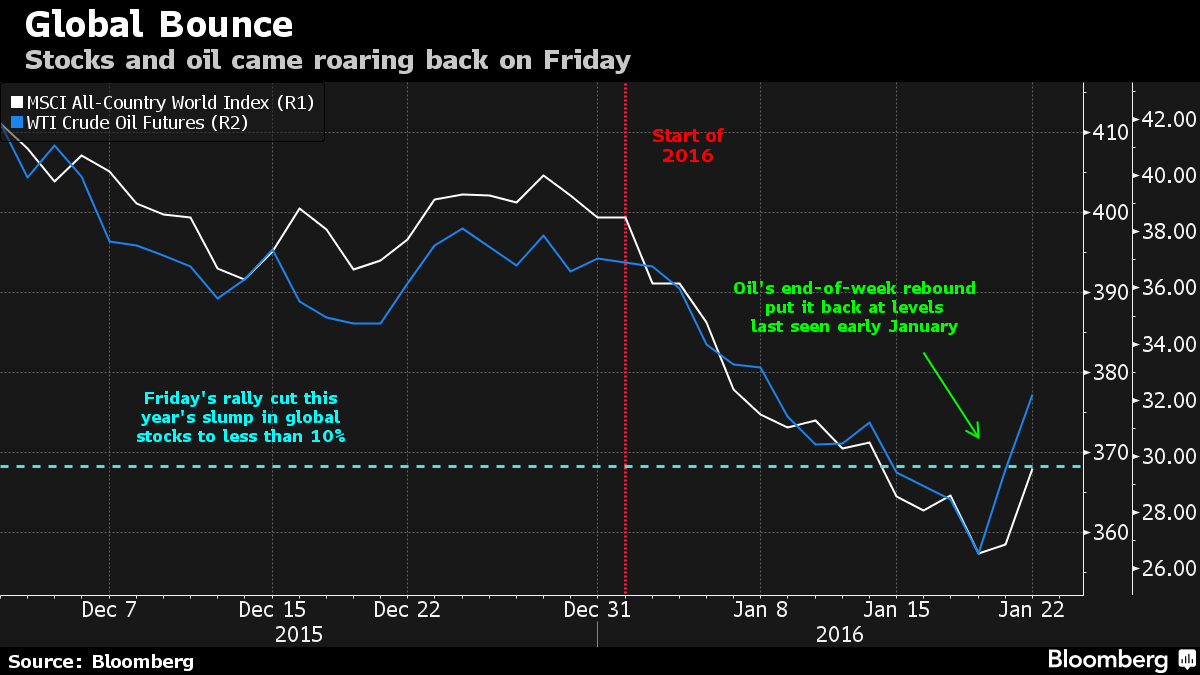

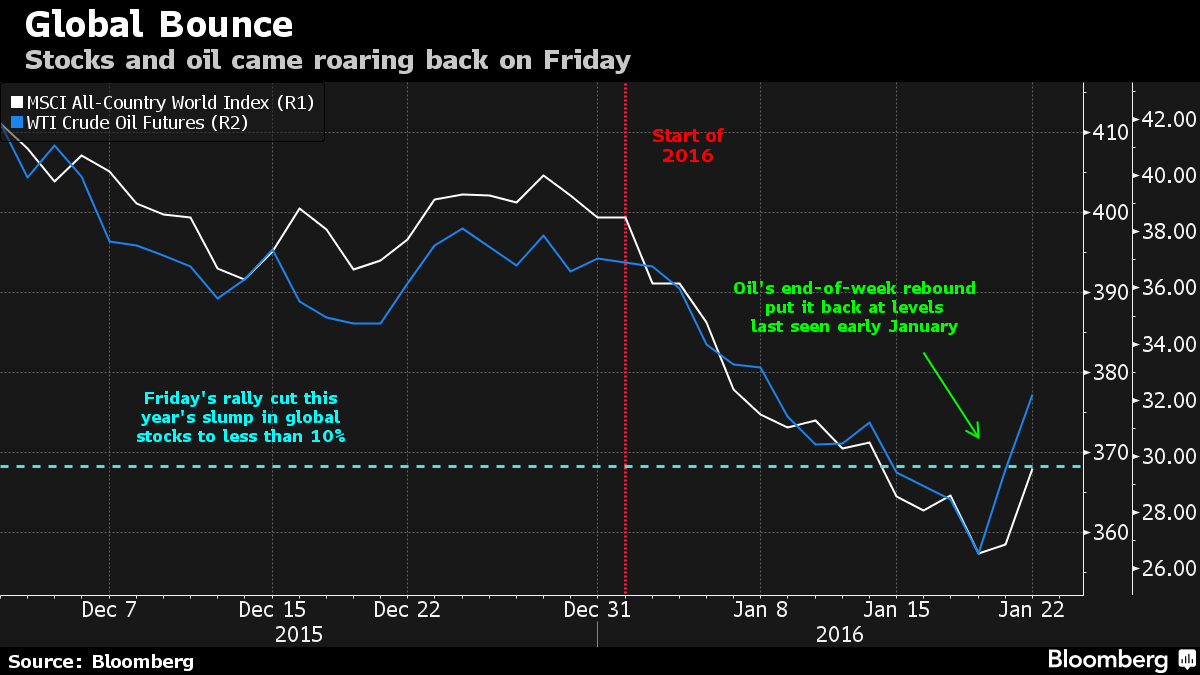

Asian equities extended gains as bets central banks will come to the rescue of turbulent financial markets fuels a rebound in global stocks. While oil held above $32 a barrel, the yen and gold tried to stage a comeback.

Gains across the board in Asia saw the MSCI All-Country World Index embark on a third day of increases, after a 2 percent jump in U.S. shares on Friday contributed to the gauge’s best day since June 2012. U.S. crude oil traded at $32.44 following its steepest two-day advance since 2008. The Korean won strengthened a second day, even as the yen rose from a two-week low in the wake of Japanese trade data, while the Australian and New Zealand dollars retreated. Copper and nickel fell as gold resumed its advance.

European Central Bank President Mario Draghi gave markets the lift they needed amid the worst start to a year on record for stocks around the world. His indication that stimulus could be boosted as soon as March, coupled with speculation China could ease policy further to soothe investors, fueled a surge across risk-asset classes at the end of last week, aided by the recovery in crude oil prices. While Bank of Japan Governor Haruhiko Kuroda played down the impact of the recent gyrations on his economy, economists are predicting the Federal Reserve will hold fire on interest rates when it meets this week.

“There will be some waiting and seeing among policy makers until they know how this market volatility will affect the global economy,” Michael McCarthy, chief strategist at CMC Markets in Sydney, said by phone. “Given the depression in the markets, there’s scope for the market to add to Friday’s gains. We’ve got a very eventful week, with the BOJ and Fed meetings, so there’s a lot for investors to react to. Volatility is likely to continue.”

Singapore reports on consumer prices Monday, while Malaysian markets are closed for a holiday.

Stocks

The MSCI Asia Pacific Index gained 0.9 percent as of 10:31 a.m. Tokyo time, after a 3.5 percent surge on Friday trimmed its third straight weekly drop to 1.4 percent. Despite the slight comeback in the yen, Japanese shares rose a second day, with the Topix index increasing 0.9 percent to be set for its highest close since Jan. 19.

Energy producers and banks drove Australia’s S&P/ASX 200 Index up 1.3 percent following the revival in crude oil, while New Zealand’s S&P/NZX 50 Index rose 0.7 percent. The Kospi index in Seoul gained 1.1 percent.

In Hong Kong, the Hang Seng and Hang Seng China Enterprises indexes opened higher, rising 1.4 percent and 1.1 percent respectively. The Shanghai Composite Index climbed 0.4 percent. The gauge, whose gyrations in the first proper week of trading this year sparked the global selloff, ended Friday up 1.3 percent as China signaled it would curb overcapacity in industries such as coal that have been dragging down economic growth.

Less certain is the longer-term outlook for risk assets globally, according to Philip Borkin, a senior economist in Auckland at ANZ Bank New Zealand Ltd.

“One of my colleagues put it quite aptly recently when he stated that financial markets were almost like a tantruming toddler, and that central banks have been attempting to console them by rewarding them with another toy,” Borkin said in a client note Monday. “Any parent would tell you that that is hardly the way to encourage long-lasting good behavior. At some stage, particularly if real activity data are still hanging in there OK, some tough love is required.”

The rebound in crude -- which saw Brent end Friday up more than 10 percent -- stoked gains in Middle Eastern stocks Sunday, with Dubai’s DFM General Index climbing the most in more than a year and Saudi Arabia’s benchmark soaring as much as 6.8 percent. Crude remains the biggest source of revenue for the six-nation Gulf Cooperation Council. In Russia, which counts on energy for about 50 percent of budget revenue, the MICEX index jumped 2.4 percent on Friday to its highest level since Jan. 6.

The S&P 500 advanced 2 percent Friday, the most since Dec. 4, to 1,906.90, while the Dow Jones Industrial Average regained 211 points. Futures on the S&P 500 erased early gains to fall 0.2 percent with those on the Dow Average.

Currencies

The won led gains among Asian currencies, climbing 0.3 percent after jumping 1.1 percent on Friday.

The Aussie was the worst performer among the Asian majors, falling 0.3 percent after a disappointing business confidence report. New Zealand’s dollar retreated 0.2 percent in a second day of losses as investors mulled the outlook for monetary policy. While the Reserve Bank of New Zealand is projected to keep rates on hold at a review Thursday, some economists are predicting further reductions before the end of June.

The yen, which typically moves at odds with Japanese stocks, rallied 0.2 percent to 118.60 per dollar following a 0.9 percent decline Friday that capped its first weekly drop in three weeks.

Governor Kuroda said in an interview with Bloomberg TV in Davos that the turbulence in financial markets hadn’t affected corporate behavior “unduly.” He did, however, emphasize that the central bank is “carefully” watching markets for any potential impact on the real economy.

Data released Monday showed Japan’s annual trade deficit narrowed almost 80 percent in December from a record as the cost of energy imports dipped and weakness in the yen spurred some gains in exports. Economists expect the BOJ to keep stimulus at current levels later this week.

http://www.bloomberg.com/news/articles/2016-01-24/futures-point-to-more-asian-gains-after-stock-surge-oil-rebound

Emma O'Brien

ek_obrien

Jonathan Burgos

January 24, 2016 — 4:31 PM CST

Updated on January 24, 2016 — 7:38 PM CST

Chinese shares open higher after first weekly advance in 2016

This week's BOJ, Fed meetings in focus after ECB sparks rally

Asian equities extended gains as bets central banks will come to the rescue of turbulent financial markets fuels a rebound in global stocks. While oil held above $32 a barrel, the yen and gold tried to stage a comeback.

Gains across the board in Asia saw the MSCI All-Country World Index embark on a third day of increases, after a 2 percent jump in U.S. shares on Friday contributed to the gauge’s best day since June 2012. U.S. crude oil traded at $32.44 following its steepest two-day advance since 2008. The Korean won strengthened a second day, even as the yen rose from a two-week low in the wake of Japanese trade data, while the Australian and New Zealand dollars retreated. Copper and nickel fell as gold resumed its advance.

European Central Bank President Mario Draghi gave markets the lift they needed amid the worst start to a year on record for stocks around the world. His indication that stimulus could be boosted as soon as March, coupled with speculation China could ease policy further to soothe investors, fueled a surge across risk-asset classes at the end of last week, aided by the recovery in crude oil prices. While Bank of Japan Governor Haruhiko Kuroda played down the impact of the recent gyrations on his economy, economists are predicting the Federal Reserve will hold fire on interest rates when it meets this week.

“There will be some waiting and seeing among policy makers until they know how this market volatility will affect the global economy,” Michael McCarthy, chief strategist at CMC Markets in Sydney, said by phone. “Given the depression in the markets, there’s scope for the market to add to Friday’s gains. We’ve got a very eventful week, with the BOJ and Fed meetings, so there’s a lot for investors to react to. Volatility is likely to continue.”

Singapore reports on consumer prices Monday, while Malaysian markets are closed for a holiday.

Stocks

The MSCI Asia Pacific Index gained 0.9 percent as of 10:31 a.m. Tokyo time, after a 3.5 percent surge on Friday trimmed its third straight weekly drop to 1.4 percent. Despite the slight comeback in the yen, Japanese shares rose a second day, with the Topix index increasing 0.9 percent to be set for its highest close since Jan. 19.

Energy producers and banks drove Australia’s S&P/ASX 200 Index up 1.3 percent following the revival in crude oil, while New Zealand’s S&P/NZX 50 Index rose 0.7 percent. The Kospi index in Seoul gained 1.1 percent.

In Hong Kong, the Hang Seng and Hang Seng China Enterprises indexes opened higher, rising 1.4 percent and 1.1 percent respectively. The Shanghai Composite Index climbed 0.4 percent. The gauge, whose gyrations in the first proper week of trading this year sparked the global selloff, ended Friday up 1.3 percent as China signaled it would curb overcapacity in industries such as coal that have been dragging down economic growth.

Less certain is the longer-term outlook for risk assets globally, according to Philip Borkin, a senior economist in Auckland at ANZ Bank New Zealand Ltd.

“One of my colleagues put it quite aptly recently when he stated that financial markets were almost like a tantruming toddler, and that central banks have been attempting to console them by rewarding them with another toy,” Borkin said in a client note Monday. “Any parent would tell you that that is hardly the way to encourage long-lasting good behavior. At some stage, particularly if real activity data are still hanging in there OK, some tough love is required.”

The rebound in crude -- which saw Brent end Friday up more than 10 percent -- stoked gains in Middle Eastern stocks Sunday, with Dubai’s DFM General Index climbing the most in more than a year and Saudi Arabia’s benchmark soaring as much as 6.8 percent. Crude remains the biggest source of revenue for the six-nation Gulf Cooperation Council. In Russia, which counts on energy for about 50 percent of budget revenue, the MICEX index jumped 2.4 percent on Friday to its highest level since Jan. 6.

The S&P 500 advanced 2 percent Friday, the most since Dec. 4, to 1,906.90, while the Dow Jones Industrial Average regained 211 points. Futures on the S&P 500 erased early gains to fall 0.2 percent with those on the Dow Average.

Currencies

The won led gains among Asian currencies, climbing 0.3 percent after jumping 1.1 percent on Friday.

The Aussie was the worst performer among the Asian majors, falling 0.3 percent after a disappointing business confidence report. New Zealand’s dollar retreated 0.2 percent in a second day of losses as investors mulled the outlook for monetary policy. While the Reserve Bank of New Zealand is projected to keep rates on hold at a review Thursday, some economists are predicting further reductions before the end of June.

The yen, which typically moves at odds with Japanese stocks, rallied 0.2 percent to 118.60 per dollar following a 0.9 percent decline Friday that capped its first weekly drop in three weeks.

Governor Kuroda said in an interview with Bloomberg TV in Davos that the turbulence in financial markets hadn’t affected corporate behavior “unduly.” He did, however, emphasize that the central bank is “carefully” watching markets for any potential impact on the real economy.

Data released Monday showed Japan’s annual trade deficit narrowed almost 80 percent in December from a record as the cost of energy imports dipped and weakness in the yen spurred some gains in exports. Economists expect the BOJ to keep stimulus at current levels later this week.

http://www.bloomberg.com/news/articles/2016-01-24/futures-point-to-more-asian-gains-after-stock-surge-oil-rebound

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.