Saturday, October 17, 2015 11:36:44 PM

$250 an ounce in the early-00's to more than $1900 an ounce in 2011

are still pretty much in place.

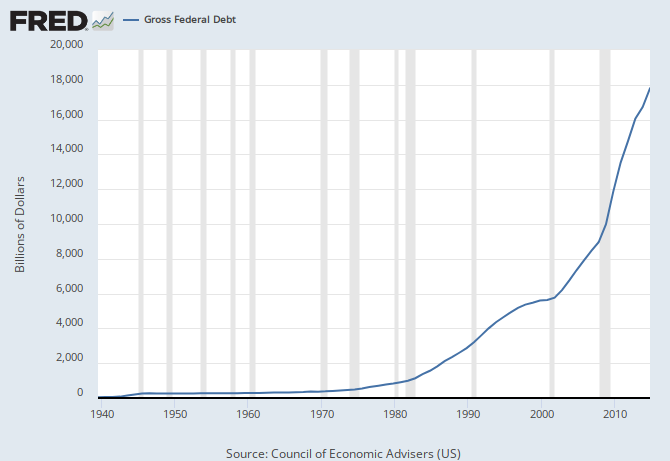

I summarize them as the proliferation of paper.

Paper in the form of debt:

And paper in the form of currency:

There's plenty more to be worried about, but these two charts alone

speak volumes.

The pullback in the price of gold has been a gift to hard-asset

investors — individual, institutional and official — everywhere.

It likely won't last; and in fact, the long-term uptrend may now

be re-exerting itself.

It's disturbing when you think that since the financial crisis —

which was at its core a debt crisis —

global debt has grown by a staggering $57 trillion.

Global policy makers are attempting to paper-over a debt crisis

with more debt.

Seven years after the bursting of a global credit bubble resulted

in the worst financial crisis since the Great Depression,

debt continues to grow.

In fact, rather than reducing indebtedness, or deleveraging,

all major economies today have higher levels of borrowing relative

to GDP than they did in 2007.

Global debt in these years has grown by $57 trillion . . .

— McKinsey & Company

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=117748150

God Bless

Recent CMCL News

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 06/12/2024 10:00:13 AM

- Caledonia Mining Corporation Plc: Cancellation of the block admission in respect of ATM Sales Agreement • GlobeNewswire Inc. • 06/12/2024 06:00:00 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 06/03/2024 06:03:47 PM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 06/03/2024 10:05:05 AM

- Caledonia to file preliminary economic assessment on chosen approach to develop the Bilboes sulphide gold project • GlobeNewswire Inc. • 06/03/2024 06:00:00 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 05/24/2024 10:00:09 AM

- Caledonia Mining Corporation Plc: Notification of relevant change to significant shareholder • GlobeNewswire Inc. • 05/24/2024 06:00:00 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 05/23/2024 03:16:20 PM

- Caledonia Mining Corporation Plc: Notification of relevant change to significant shareholder • GlobeNewswire Inc. • 05/23/2024 06:00:00 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 05/20/2024 10:05:07 AM

- Caledonia Mining Corporation Plc: Utilisation of the block admission in respect of ATM Sales Agreement • GlobeNewswire Inc. • 05/20/2024 06:00:00 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 05/15/2024 10:00:13 AM

- Caledonia Mining Corporation Plc: Increases in mineral resources and mineral reserves estimates at Blanket Mine, publication of Annual Report on Form 20-F and notice of a shareholder webinar • GlobeNewswire Inc. • 05/15/2024 06:00:00 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 05/13/2024 03:28:58 PM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 05/13/2024 10:05:06 AM

- Caledonia Mining Corporation Plc Results for the Quarter ended March 31, 2024; Notice of Management Conference Call • GlobeNewswire Inc. • 05/13/2024 06:00:00 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 05/09/2024 10:00:09 AM

- Caledonia Mining Corporation Plc Notice of Results and Investor Presentation • GlobeNewswire Inc. • 05/09/2024 06:00:00 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 05/07/2024 06:26:41 PM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 05/07/2024 06:25:51 PM

- Caledonia Mining Corporation Plc: Results of Annual General Meeting • GlobeNewswire Inc. • 05/07/2024 11:30:15 AM

- Caledonia Mining Corporation Plc: Notification of relevant change to significant shareholder • GlobeNewswire Inc. • 04/16/2024 06:00:00 AM

- Caledonia Mining Corporation Plc: Notification of relevant change to significant shareholder • GlobeNewswire Inc. • 04/15/2024 06:00:00 AM

- Caledonia Mining Corporation Plc: Issue of Securities Pursuant to Long Term Incentive Plan Awards and Issue of New Long Term Incentive Plan Awards • GlobeNewswire Inc. • 04/10/2024 06:05:00 AM

- Caledonia Mining Corporation Plc Notification of relevant change to significant shareholder • GlobeNewswire Inc. • 04/10/2024 06:05:00 AM

Mass Megawatts Announces $220,500 Debt Cancellation Agreement to Improve Financing and Sales of a New Product to be Announced on July 11 • MMMW • Jun 28, 2024 7:30 AM

VAYK Exited Caribbean Investments for $320,000 Profit • VAYK • Jun 27, 2024 9:00 AM

North Bay Resources Announces Successful Flotation Cell Test at Bishop Gold Mill, Inyo County, California • NBRI • Jun 27, 2024 9:00 AM

Branded Legacy, Inc. and Hemp Emu Announce Strategic Partnership to Enhance CBD Product Manufacturing • BLEG • Jun 27, 2024 8:30 AM

POET Wins "Best Optical AI Solution" in 2024 AI Breakthrough Awards Program • POET • Jun 26, 2024 10:09 AM

HealthLynked Promotes Bill Crupi to Chief Operating Officer • HLYK • Jun 26, 2024 8:00 AM