Thursday, August 06, 2015 6:41:40 PM

by Oliver RenickCallie Bost

August 6, 2015 — 12:53 PM EDT Updated on August 6, 2015 — 4:47 PM EDT

http://www.bloomberg.com/news/articles/2015-08-06/media-wipeout-taking-down-pillar-of-bull-market-in-u-s-stocks

A bull market without Apple Inc. is one thing. Removing cable television and movie stocks from the 6 1/2-year rally in U.S. equities is a little harder to imagine.

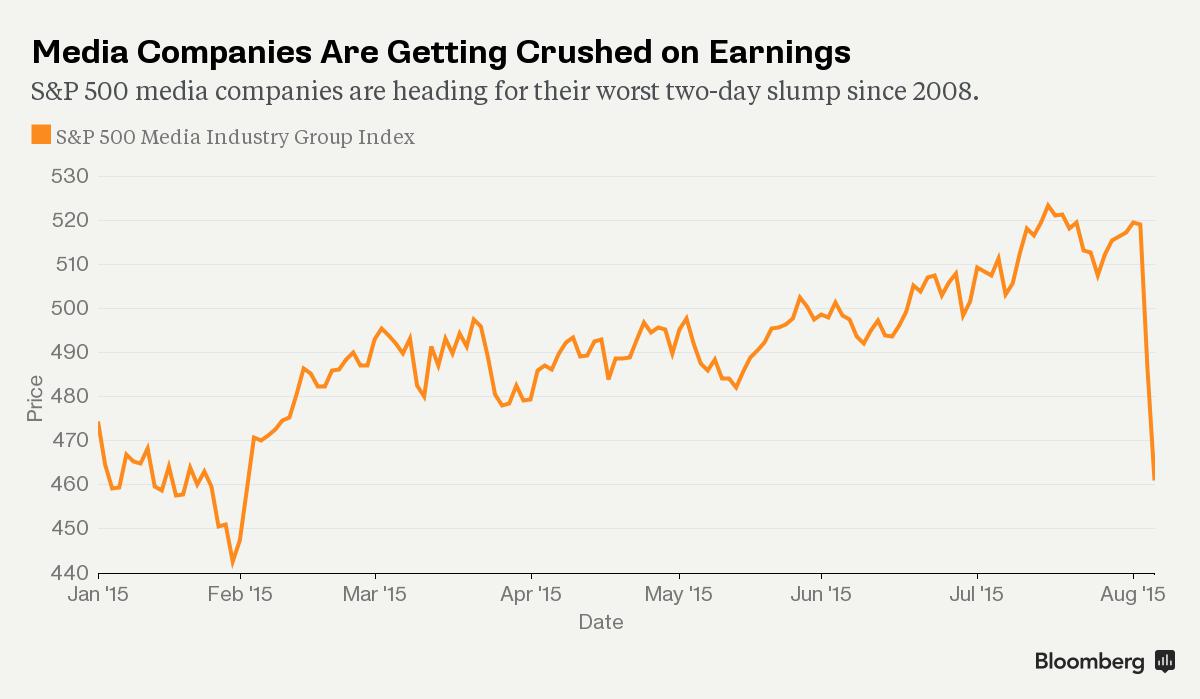

Ignited by a plunge in Walt Disney Co., shares tracked by the 15-company S&P 500 Media Index have tumbled 8.2 percent in two days, the biggest slump for the group since 2008. The drop erased all of 2015’s gains for a group that has posted annualized returns of more than 33 percent since 2009.

A price graph for the S&P 500 Media Industry Group Index.

More than technology or even biotech, media stocks have ruled the roost during the share advance that restored $17 trillion to American equity prices since the financial crisis. Companies from CBS Corp. to Tegna Inc. and Time Warner Cable Inc. are among stocks with the 60 biggest increases during the stretch.

“This sector stripped out is certainly not going to help,” Larry Peruzzi, director of international trading at Cabrera Capital Markets LLC in Boston, said by phone. “There are a lot of companies adding pressure here and there’s an argument to be made that it’s an indicator of consumer sentiment, because that’s where media revenues come from.”

Disappointing results from Disney after the close of trading Tuesday sparked the two-day rout. Selling spread to other television and publishing companies as quarterly reports from CBS to 21st Century Fox Inc. and Viacom Inc. were marked by shrinking U.S. ad sales and profits propped up by stock buybacks.

Market Pillar

Until Tuesday, media shares were the best-performing shares of the bull market, rising 531 percent to eclipse automakers, retail stores and banks. The industry’s market capitalization was about $650 billion, compared with $135 billion in March 2009.

That value is evaporating. In just five stocks -- Disney, Time Warner Inc., Fox, CBS and Comcast Corp. -- almost $50 billion of value was erased in two days. Viacom slid 14 percent on Thursday alone, its biggest drop since October 2008.

The selloff is a blow to investors who have seen breadth dry up and the number of advancing industries narrow. More than 100 percent of this year’s increase in the S&P 500 is attributable to two sectors, health-care and retail, the tightest clustering for an advancing year since at least 2000, data compiled by Bloomberg show.

So fast has been their ascent that media companies have played a part in one of Wall Street’s favorite trades this year, momentum. Disney, with an annual return of 37 percent since 2009, is the No. 2 stock by value in the iShares MSCI USA Momentum Index Fund, an exchange-traded security whose capitalization has risen 66 percent to more than $800 million this year.

Valuation Check

From a valuation perspective, the two-day selloff in cable and movie stocks has brought their price-earnings ratio back into line with the rest of the market. At 18.8, the multiple is 10 percent below the bull market high of 21 reached in March 2014, data compiled by Bloomberg show.

Earnings in the group are poised to grow at an average rate of about 12 percent over the next three years, according to analyst estimates compiled by Bloomberg. That’s about 50 percent faster than the full S&P 500 and above the rate forecast for industries including software and banks.

“It’s been a rough few days,” said Walter Todd, who oversees about $1.1 billion as chief investment officer for Greenwood Capital Associates. “People are shooting first and asking questions later. As an investor in Disney and Time Warner, this indiscriminate selling, to me, is just nuts.”

Recent VXX News

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 09/04/2024 03:13:56 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 09/04/2024 03:03:20 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 09/04/2024 03:03:17 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 09/04/2024 03:02:00 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 09/04/2024 02:55:01 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 09/04/2024 02:43:31 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 09/04/2024 02:41:39 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 09/04/2024 02:37:13 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 09/03/2024 07:50:34 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 09/03/2024 07:48:28 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 09/03/2024 07:45:20 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 09/03/2024 07:44:01 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 09/03/2024 07:40:58 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 09/03/2024 07:32:41 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 09/03/2024 07:31:05 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 09/03/2024 06:59:48 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 09/03/2024 06:55:59 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 08/30/2024 06:36:03 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 08/30/2024 06:17:15 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 08/30/2024 06:17:13 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 08/30/2024 05:08:26 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 08/30/2024 04:51:12 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 08/30/2024 04:51:00 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 08/30/2024 04:17:39 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 08/30/2024 04:14:48 PM

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM