Sunday, August 02, 2015 4:26:55 PM

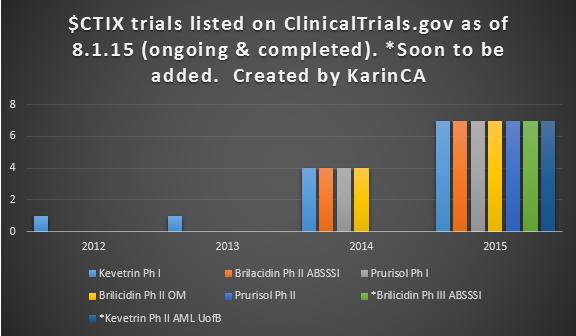

Clinical trials, the lifeblood of bio-tech, have multiplied exponentially in just a few years. All at very minimal dilution based upon the CEO's repeated ability to secure beneficial financing, grants and sponsors. This compares and contrasts very favourably to so many other biotechs whose financing generally have multiple toxic elements absent from Cellceutix's financing deals. (I reference PIPES with large fixed discounts, warrants, absence of protective clauses prohibiting shorting, dodgy financiers, etc. Those who know early stage biotech investing understand)

Amazing progress! Not only have the clinical trials increased exponentially, there have been no failed trials. So far Brilacidin and Prurisol have completed trials meeting their endpoints, and Kevetrin is a near certain Phase 1 success for its primary endpoint. Secondary endpoints for efficacy look promising as well with Cellceutix receiving orphan drug status for ovarian cancer and planning a Phase 2/3 clinical trial. This is a very low risk period IMO, as there are both a variety of clinical trials and no short-term pass or fail catalysts. Risk will increase down the road as we get closer to trial end catalysts.

Obviously the CTIX share price has not yet fully reflected this tremendous progress, despite being up multiples from the 2012 levels. The answers to this mystery are quite obvious. The large sellers which appeared last March when the transfer shares became unrestricted and the pending up-listing status leaving CTIX on the lower volume OTC. The sellers predictable as a known factor, and the pending up-listing status less predictable as it involved the discretionary decision making by NASDAQ. A quicker up-listing decision by NASDAQ could have better absorbed the selling due to increase liquidity on the NASDAQ - volume and a wider institutional and retail market - but that is now behind us.

The pending up-listing to the NASDAQ is likely now weeks away, as opposed to months, and the selling pressure has shown little appetite at lower share prices and may have already dealt with the lion's share of the transfer shares. The former quite obvious, the latter my opinion.

Pending transfers alternatively will be 60% of the prior amount, and similarly restricted for six months once they happen. CTIX will almost certainly be a NASDAQ stock by that time, with much increased trading volume and an increased appetite for shares among the new NASDAQ institutional and retail buyers as the Cellceutix clinical trials continue to progress.

The CTIX chart is now back in the multi-bottom support zone. I can't predict the future (determined by future buyers and sellers), but I like the odds for a rally continuation from this support zone building on the first rally leg break-out. Rally leg pull-backs are common, not unusual. They are stronger when they bounce off of the break-out level, true, but pull-backs of the full rally leg are quite common also, with the chart remaining bullish as long as support holds.

We'll see if CTIX remains in this range or starts a second rally wave up to start approaching a more reasonable share price for CTIX, which IMO is deeply undervalued currently. Alternately, lower prices are always possible, but it would really surprise me to see this multi-month support zone not hold.

You bets your money and you takes your chances. My bet is on the market catching up with the remarkable progress the Cellceutix CEO Leo Ehrlich has made in multiplying clinical trials while keeping financing favourable and at a frugal level.

(Click chart to enlarge)

"Games are won by players who focus on the playing field -- not by those whose eyes are glued to the scoreboard." - Warren Buffett

Recent IPIX News

- Form 8-K - Current report • Edgar (US Regulatory) • 02/01/2024 01:30:25 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 12/05/2023 09:25:58 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 11/20/2023 09:05:44 PM

- Form NT 10-Q - Notification of inability to timely file Form 10-Q or 10-QSB • Edgar (US Regulatory) • 11/15/2023 01:00:19 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 10/30/2023 08:15:25 PM

- Form 10-K - Annual report [Section 13 and 15(d), not S-K Item 405] • Edgar (US Regulatory) • 09/28/2023 01:00:08 PM

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM