| Followers | 373 |

| Posts | 16744 |

| Boards Moderated | 3 |

| Alias Born | 03/07/2014 |

Friday, July 31, 2015 11:16:53 AM

WHAT????????????????? A "fully vetted" what????????????? LOL !! "priming" what supposedly, LOL !! It's GOING RED as of right now, LOL !!

CDEL is parked on the Ask right now? THAT is the day's capper right there, LOL !!! This isn't going anywhere IMO? How and why?

0.006 / 0.0064 (40000 x 162700)

Bid just DROPPED, FELL OUT LOL !! And yes, it's CDEL on that Bid now and CDEL a few levels out on the Ask, setting the "cap" still. NOT going anywhere I can see???? LOL !! "vetted" what???????????

There only $240 whopping bucks WERE left on that Bid at .006 and then 1.1 MILLION shares right below it at .0055 like yesterday. The Bid yesterday stayed in the .005's and WENT NOWHERE, LOL !!! Despite some AM micro "pop" to .007 while the dilution MM's (ole CDEL and BMAK) "worked it" a tad. Nothing new here???????????????

0.0056 / 0.0062 (11000 x 122800)

Kramer and his companies Asher, KBM Worldwide (run by his brother Seth) and now his new incarnation Vis Vires group are MASS DILUTION CONVERTIBLE DEBT HEDGE LENDERS, LOL !!!! They don't make share prices "go up", they're notorious SHARE PRICE CRUSHING MACHINES, LOL !!!! By the very nature of what they do- the LOWER THE SHARE PRICE GOES, the MORE THEY PROFIT, LOL!!! THAT is floorless convertible toxic debt 101 !!

Here's the SEC own commentary on floorless convertible debt and what it does to the common share price of companies that choose to use it:

http://www.sec.gov/answers/convertibles.htm

Quote from THEE SEC:

"By contrast, in less conventional convertible security financings, the conversion ratio may be based on fluctuating market prices to determine the number of shares of common stock to be issued on conversion. A market price based conversion formula protects the holders of the convertibles against price declines, while subjecting both the company and the holders of its common stock to certain risks. Because a market price based conversion formula can lead to dramatic stock price reductions and corresponding negative effects on both the company and its shareholders, convertible security financings with market price based conversion ratios have colloquially been called "floorless", "toxic," "death spiral," and "ratchet" convertibles."

THAT is the "business" that Curt Kramer is in, LOL!!!

Here's the history of Kramer when he did biz as "Asher" (who by the way, has loan/notes with BHRT also, or at least did- if he hasn't converted them all to dilution shares yet. But he still held debt/notes on the company as recent as the last 10-Q filing)

http://investorshub.advfn.com/~-ASHER-~-25451/

That I-HUB board explains Curt Kramer's penny lending history (aka toxic debt to a tee IMO)

Here's a few more well written articles that explain the "effects" of toxic debt on companies. WHY DOES ONE THINK CURT KRAMER NEEDED/WAS REQUIRED TO FILE A SEC FORM 13G showing he now holds 9.99% or more the BHRT O/S shares, LOL ???????? Cause he's DILUTED THEM OUT BY 10's and 10's and 10's OF MILLIONS OF SHARES, the lower this share price has gone- and he's (his companies Asher, Vis Vires) are STILL GOING, STILL CONVERTING AND DILUTION, LOL, that's why.

https://en.wikipedia.org/wiki/Death_spiral_financing

http://www.bloomberg.com/news/articles/2015-03-12/josh-sason-made-millions-from-penny-stock-financing

That Bloomberg piece (who by the way, BHRT has a toxic, convertible debt deal/note they did with that firm too, aka Magna) - it explains in great detail how these penny hedge firm lenders "do what they do" and create the "death spiral" to ever more dilution. They even have a graphic/explanation box on the left side of the article showing the process and steps in detail, it's titled, "HOW DO YOU MAKE MONEY IN FALLING STOCKS", LOL!!! Explains EXACTLY what the Curt Kramer's and "Vid Vires" groups of the world "do" and how they do it with their hedge fund convertible debt lending to cash desperate nano and micro caps like BHRT. A very well written article with video commentary included.

Here's a SEC link to EVERY DEAL "Vis Vires" has open- LOOK AT ALL THE 13G filings they've done as they've gotten major holdings in cash poor companies, most trading for like .0001 or whatever, as Vis Vires or Asher gains ever more of their shares via CONVERTIBLE DEBT "conversions" aka "toxic" note "financing". Those company's shares don't "go up" LOL?????? They get plastered DOWN. There's no "promo" thingy or any "MAXM give them $10 million" imaginary dollars or whatever, LOL !!! Nope, DOES NOT HAPPEN, LOL !!!

169 SEC search results for "Vis Vires Group" and they firm was only incorporated in Nov of 2014 according to the NY Secretary of State site- this company wastes NO TIME as a prolific lender of "last resort" to cash poor penny stock companies. LOOK AT ALL THOSE SEC FILINGS- look at how many 13G filings where he/Kramer has gained 10% or more ownership via mass dilution conversion of toxic, floorless "note" loan deals:

https://searchwww.sec.gov/EDGARFSClient/jsp/EDGAR_MainAccess.jsp?search_text=%22vis%20vires%22&isAdv=false

SEC has 1230 "search results" for the term "Curt Kramer" which would thus include his past Asher deals in addition to "Vis Vires" group- loaning convertible, floorless "notes" to cash poor penny stock companies. OVER ONE THOUSANDS entries, LOL !!! Look at um- and see if any of um "go big" or are "primed" or have "promo thingies" or whatever, LOL !!!!!!!!!!!!!!!!

https://searchwww.sec.gov/EDGARFSClient/jsp/EDGAR_MainAccess.jsp?search_text=%22curt%20kramer%22&isAdv=false

Just more floorless, CONVERTIBLE DILUTION DEBT lending/notes and massive common share dilution taking place IMO. NOTHING new here. I'd expect when the 10-Q finally gets released in the next week or so- that the O/S share count is once again gonna show a MASSIVE INCREASE caused by commons share dilution for survival cash and also for being issued out for everything from paying commons bills such as "accounts payable" to "services rendered" or whatever- just as in the past approx FIVE YEARS of BHRT 10-Q and 10-K filings. NOTHING "new" IMO. NOPE.

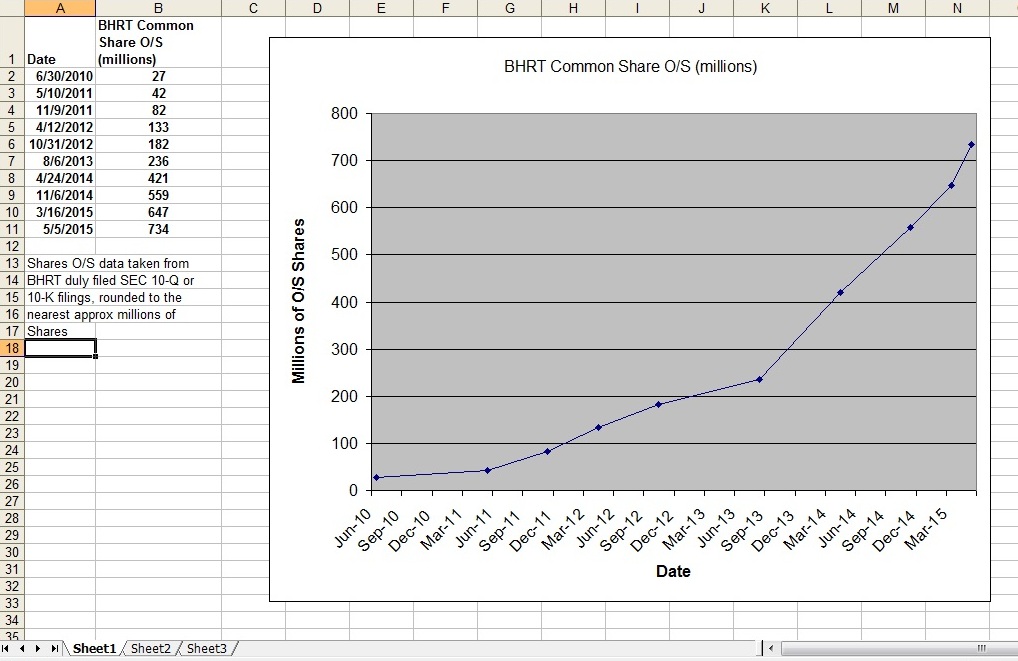

What does massive common share dilution "look like"??? Well a simple picture/graph shows it quite well IMO.

I expect that graph to go more "vertical" once this next 10-Q is released, aka show INCREASING/ACCELERATING common share dilution, NOT a reduction thereof.

My .0055 or so CENTS worth, as that's all the Bid is at, so that's all one would get for their shares, MAX if they tried to sell more than about $500 whopping bucks worth

Posts contain only my amateur opinions, personal views and thoughts. I discuss stocks as a hobby only. Always do one's own due diligence before investing.

FEATURED Cannabix's Breath Logix Alcohol Device Delivers Positive Impact to Private Monitoring Agency in Montana, USA • Apr 25, 2024 8:52 AM

Bantec Reports an Over 50 Percent Increase in Sales and Profits in Q1 2024 from Q1 2023 • BANT • Apr 25, 2024 10:00 AM

Kona Gold Beverages, Inc. Announces Name Change to NuVibe, Inc. and Initiation of Ticker Symbol Application Process • KGKG • Apr 25, 2024 8:30 AM

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM