| Followers | 376 |

| Posts | 17211 |

| Boards Moderated | 3 |

| Alias Born | 03/07/2014 |

Wednesday, July 29, 2015 10:35:50 AM

"

WHAT????????????????? What supposed company with that backgroun is supposedly " is investing in a broken down Biotechnology Company trading at half a cent and purchased 73m shares in the open market?"

LOL !!!!!! What?????????

There's Curt Kramer of a NY HEDGE FUND who's been doing CONVERTIBLE DEBT lending to a "broken down Biotechnology Company trading at half a cent" but he and NO ONE ELSE has "bought 73 million shares in the open market", LOL ?????

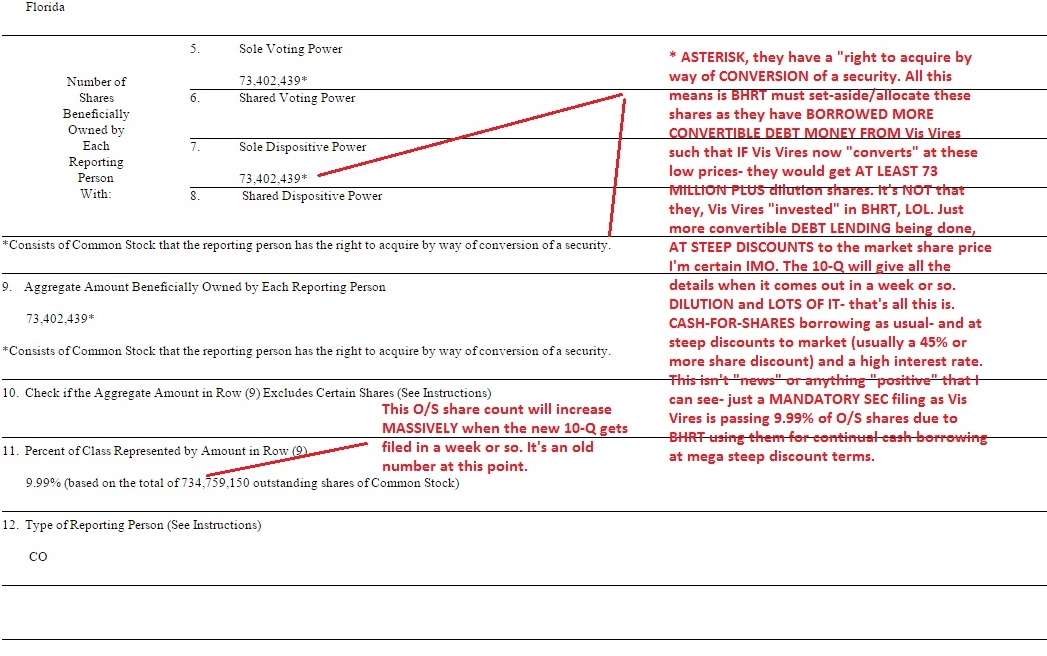

The SEC Form 13G has an (*) and a "sub note" RIGHT ON THE FORM that what he/ Curt Kramer has is the RIGHT TO CONVERT UP TO approx 73 MILLION DILUTION SHARES as part of CONVERTIBLE DEBT LENDING to Bioheart (a broken down 1/2 CENT sorta "biotecnhology company", LOL ) - and THAT is all that Form 13G says.

The upcoming SEC filing 10-Q for BHRT will show IMO that one or more convertible DEBT deals have been done AGAIN (as this is not the first by any means) CONVERTIBLE DEBT DEALS have been done between BHRT and Vis Vires Group the HEDGE FUND LENDER OF LAST RESORT and who gets MEGA STEEP SHARE DISCOUNTS and HIGH INTEREST RATE- the 10-Q is going to show more LOAN/NOTE deals between Vis Vires and Bioheart, JUST AS PAST 10-Q/10-K FILINGS SHOW, LOL !!!!!!!!!!!!

From the last SEC filed BHRT 10-Q, PAGE 34:

"On April 13, 2015, the Company entered into a Securities Purchase Agreement with Vis Vires Group, Inc. (“Vis”), for the sale of an 8% convertible note in the principal amount of $33,000 (the “Note”).

The Note bears interest at the rate of 8% per annum. All interest and principal must be repaid on January 16, 2016. The Note is convertible into common stock, at Vis’s option, at a 45% discount to the average of the three lowest closing bid prices of the common stock during the 10 trading day period prior to conversion. In the event the Company prepays the Note in full, the Company is required to pay off all principal, interest and any other amounts owed multiplied by (i) 140% if prepaid during the period commencing on the closing date through 179 days thereafter. After the expiration of 180 days following the date of the Note, the Company has no right of prepayment."

Was that the supposed JAPANESE INDUSTRIAL IMPORT/EXPORT COMPANY that did that FLOORLESS, TOXIC, CONVERTIBLE DEBT LOAN deal, LOL????????? Is that supposedly them- the "VIS VIRES GROUP"????????? LOL !!!

Or was it this deal from the last SEC filed 10-K, PAGE F-35:

"On February 19, 2015, the Company entered into a Securities Purchase Agreement with Vis Vires Group, Inc. (“VIS”), for the sale of an 8% convertible note in the principal amount of $38,000 (the “Note”).

The Note bears interest at the rate of 8% per annum. All interest and principal must be repaid on November 23, 2015. The Note is convertible into common stock, at VIS’s option, at a 45% discount to the average of the three lowest closing bid prices of the common stock during the 10 trading day period prior to conversion. In the event the Company prepays the Note in full, the Company is required to pay off all principal, interest and any other amounts owing multiplied by (i) 140% if prepaid during the period commencing on the closing date through 179 days thereafter. After the expiration of 180 days following the date of the Note, the Company has no right of prepayment."

LOL !!!!! The approx 73 MILLION shares on the SEC Form 13G WERE NOT "purchased on the open market" LOL !!! There part of the shares needed to "cover" these CONVERTIBLE DEBT DEALS by Vis Vires- and most certainly additional deals that have occurred since these last TWO deals already done. THE MORE THE COMMON SHARE PRICE HAS FALLEN, the MORE DILUTIVE THESE DEALS BECOME (look at the 45% share discount rate, floating, bottomless) and then if more loans were made- such that upon CONVERSION they might result in 9.99% of the float being converted, aka approx 73 MILLION shares, then ole VIS VIRES, aka Curt Kramer of ASHER FAME MUST FILE THAT SEC 13G and THAT is all this means.

SEE THE ASTERISK, "RIGHT TO ACQUIRE UPON CONVERSION" those 73 MILLION shares may need to be issued- it's a CONVERTIBLE DEBT obligation. It's tied to an underlying note instrument, aka DEBT, aka a LOAN FOR SHARES DEAL(S), TWO of which are stated above already from the BHRT prior 10-Q and 10-K.

There was no 73 MILLION shares "purchased in the open market", LOL !!!!!!!! Nope.

AND NOTHING to do with "nuclear bombs" and "fascism" LOL !!!!! Holy cow, LOL !!!!!!!!

TOTAL NONSENSE.

Posts contain only my amateur opinions, personal views and thoughts. I discuss stocks as a hobby only. Always do one's own due diligence before investing.

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM