Wednesday, May 27, 2015 11:12:22 AM

Silver Bull Has Published Its First Zinc-Focused Resource Estimate - And The Project Seems Viable

May 26, 2015 8:54 AM ET

Summary

* Silver Bull is trying to 're-brand' its silver project as a zinc project and has now released an updated zinc-focused resource estimate.

* The updated estimate is better than I expected as the project now contains almost 5 billion pounds of zinc, with the majority accessible through an open pit.

* I would expect a PEA to be very positive as there's a high-grade open pittable zinc zone with a double-digit zinc grade, ensuring a short payback period.

Introduction

I have written a PRO-article on Silver Bull Resources (NYSEMKT:SVBL; TSX:SVB) approximately 18 months ago ( http://tinyurl.com/m4jddm9 ), and even though I was quite positive about the company's project, Silver Bull was unable to advance it as a silver project and decided late last year it would re-brand the project as a zinc project instead of a silver project. Even though the company has lost almost 70% of its share price since the original article, I would like to discuss the updated resource estimate and the implications for the company.

The updated resources

As part of the campaign to overhaul the Sierra Mojada project to present it as a zinc opportunity rather than a silver project, Silver Bull reworked the original resource estimate which was predominantly focused on the silver resources.

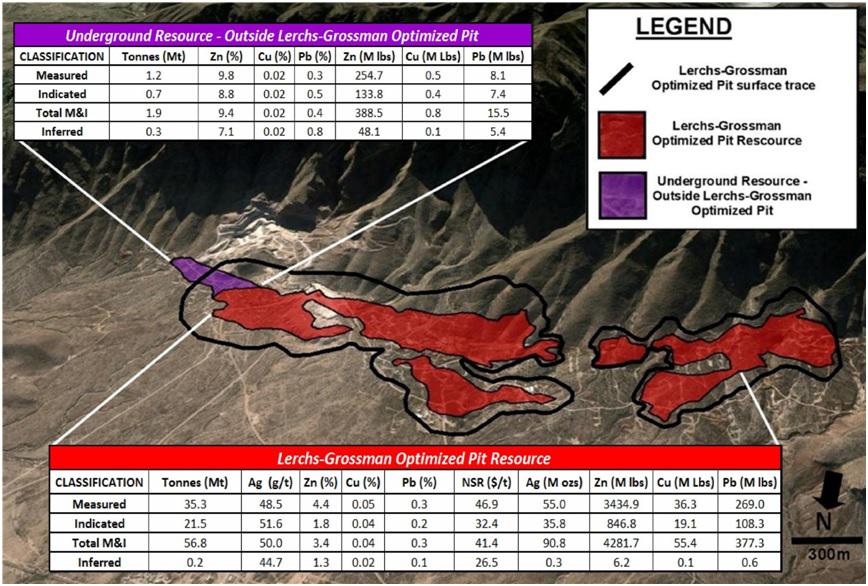

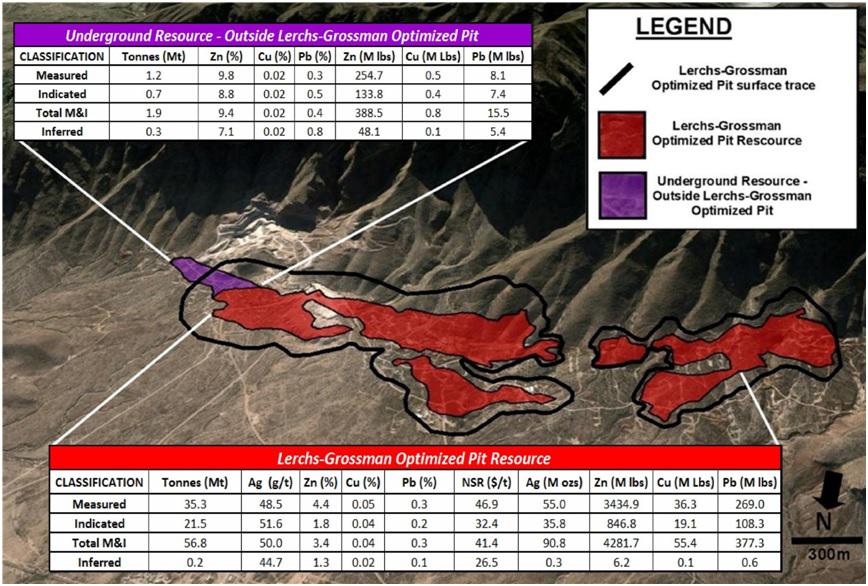

Source: press release

The updated resource estimate at Sierra Mojada will definitely attract some interest as the project now contains in excess of 4.7 billion pounds of zinc, 91 million ounces of silver, 400 million pounds of lead and a little bit of copper. That's not a bad start and definitely better than the zinc resources portrayed in the previous resource estimate. The average grade is okay-ish at 3.6% zinc. This isn't very high for a zinc project but as there's approximately 1.5 ounces of silver per tonne of rock, the Sierra Mojada zinc project should have a substantial by-product revenue which definitely compensates for a relatively low zinc grade.

What has changed compared to the previous resource estimate?

Okay, so what did Silver Bull exactly do different compared to the silver-focused resource estimate?

First of all, this is the first time Silver Bull has included the high-grade zinc zone in an NI 43-101 resource estimate. This immediately resulted in a substantial increase in the average grade of the zinc (from less than 2% to almost 4%), and this was the main factor why the zinc resources more than doubled.

Secondly, the current resource estimate is based on a pit-constrained mineralized envelope. To calculate the size of the pit, consultants need to base their decisions on the commodity prices (lower commodity prices mean the average grade of the mineable resource needs to increase, so lower grade zones will have to be cut out of the mine plan). The previous resource estimate was based on a zinc price of $0.95/lbs and a silver price of $29.20/oz.

Since that estimate, the silver price has definitely collapsed and using a $29.2 silver price would almost be a criminal offense and would result in the company losing all credibility. That's why the new pit shell was based on more conservative numbers. The used zinc price increased slightly to $1/lbs but the used silver price was reduced to $18/oz which is more in line with the current economic situation. This increases the confidence in the resource estimate which will be used for an updated PEA.

What's next for Silver Bull?

The overhaul of the previous resource estimate was just the first step in converting Silver Bull Resources into Zinc Bull Resources. A second step will be to use the updated resource estimate as a start for an updated Preliminary Economic Assessment.

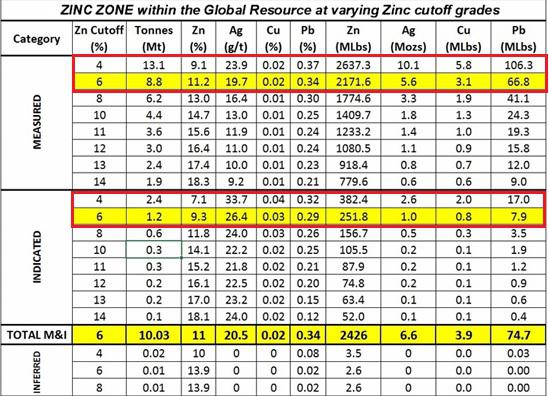

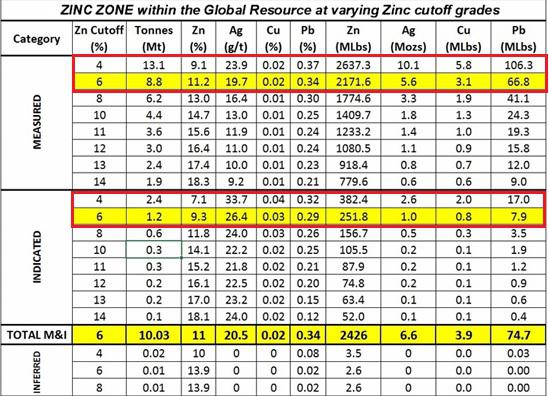

Source: press release

I actually have high hopes for a zinc-focused PEA. Even though the resource estimate indicates the average grade of the deposit is 3.6% zinc which is just so-so, there's a separate zone inside the mineralized envelope which contains almost 2.5 billion pounds of zinc (see previous image) at a much better grade of 11% (or 3 billion pounds at a grade of 8.5%, depending on the cutoff grade you'd use).

That's very likely the zone a PEA will be focusing on as it will ensure a relatively low initial capital expenditure and a short payback period. As the market is currently focusing on low-capex high-IRR projects, this might be the best way forward and I'd like to see an updated time line from Silver Bull.

Investment thesis

Silver Bull got hit by the turmoil in the precious metals markets, but the bull isn't dead yet. The recent resource estimate is a good first step to convert the Sierra Mojada silver project into a zinc project with a substantial silver production which will be applied as a by-product credit.

The next step for Silver Bull will be to complete a PEA on the zinc-focused scenario and as the project contains a very high-grade zinc zone, I would expect said PEA to be positive. I'm still keeping an eye on Silver Bull Resources, and it's quite unfortunate to see the recent decline in the share price as the new focus on zinc actually makes a lot of sense.

http://seekingalpha.com/article/3210846-silver-bull-has-published-its-first-zinc-focused-resource-estimate-and-the-project-seems-viable

May 26, 2015 8:54 AM ET

Summary

* Silver Bull is trying to 're-brand' its silver project as a zinc project and has now released an updated zinc-focused resource estimate.

* The updated estimate is better than I expected as the project now contains almost 5 billion pounds of zinc, with the majority accessible through an open pit.

* I would expect a PEA to be very positive as there's a high-grade open pittable zinc zone with a double-digit zinc grade, ensuring a short payback period.

Introduction

I have written a PRO-article on Silver Bull Resources (NYSEMKT:SVBL; TSX:SVB) approximately 18 months ago ( http://tinyurl.com/m4jddm9 ), and even though I was quite positive about the company's project, Silver Bull was unable to advance it as a silver project and decided late last year it would re-brand the project as a zinc project instead of a silver project. Even though the company has lost almost 70% of its share price since the original article, I would like to discuss the updated resource estimate and the implications for the company.

The updated resources

As part of the campaign to overhaul the Sierra Mojada project to present it as a zinc opportunity rather than a silver project, Silver Bull reworked the original resource estimate which was predominantly focused on the silver resources.

Source: press release

The updated resource estimate at Sierra Mojada will definitely attract some interest as the project now contains in excess of 4.7 billion pounds of zinc, 91 million ounces of silver, 400 million pounds of lead and a little bit of copper. That's not a bad start and definitely better than the zinc resources portrayed in the previous resource estimate. The average grade is okay-ish at 3.6% zinc. This isn't very high for a zinc project but as there's approximately 1.5 ounces of silver per tonne of rock, the Sierra Mojada zinc project should have a substantial by-product revenue which definitely compensates for a relatively low zinc grade.

What has changed compared to the previous resource estimate?

Okay, so what did Silver Bull exactly do different compared to the silver-focused resource estimate?

First of all, this is the first time Silver Bull has included the high-grade zinc zone in an NI 43-101 resource estimate. This immediately resulted in a substantial increase in the average grade of the zinc (from less than 2% to almost 4%), and this was the main factor why the zinc resources more than doubled.

Secondly, the current resource estimate is based on a pit-constrained mineralized envelope. To calculate the size of the pit, consultants need to base their decisions on the commodity prices (lower commodity prices mean the average grade of the mineable resource needs to increase, so lower grade zones will have to be cut out of the mine plan). The previous resource estimate was based on a zinc price of $0.95/lbs and a silver price of $29.20/oz.

Since that estimate, the silver price has definitely collapsed and using a $29.2 silver price would almost be a criminal offense and would result in the company losing all credibility. That's why the new pit shell was based on more conservative numbers. The used zinc price increased slightly to $1/lbs but the used silver price was reduced to $18/oz which is more in line with the current economic situation. This increases the confidence in the resource estimate which will be used for an updated PEA.

What's next for Silver Bull?

The overhaul of the previous resource estimate was just the first step in converting Silver Bull Resources into Zinc Bull Resources. A second step will be to use the updated resource estimate as a start for an updated Preliminary Economic Assessment.

Source: press release

I actually have high hopes for a zinc-focused PEA. Even though the resource estimate indicates the average grade of the deposit is 3.6% zinc which is just so-so, there's a separate zone inside the mineralized envelope which contains almost 2.5 billion pounds of zinc (see previous image) at a much better grade of 11% (or 3 billion pounds at a grade of 8.5%, depending on the cutoff grade you'd use).

That's very likely the zone a PEA will be focusing on as it will ensure a relatively low initial capital expenditure and a short payback period. As the market is currently focusing on low-capex high-IRR projects, this might be the best way forward and I'd like to see an updated time line from Silver Bull.

Investment thesis

Silver Bull got hit by the turmoil in the precious metals markets, but the bull isn't dead yet. The recent resource estimate is a good first step to convert the Sierra Mojada silver project into a zinc project with a substantial silver production which will be applied as a by-product credit.

The next step for Silver Bull will be to complete a PEA on the zinc-focused scenario and as the project contains a very high-grade zinc zone, I would expect said PEA to be positive. I'm still keeping an eye on Silver Bull Resources, and it's quite unfortunate to see the recent decline in the share price as the new focus on zinc actually makes a lot of sense.

http://seekingalpha.com/article/3210846-silver-bull-has-published-its-first-zinc-focused-resource-estimate-and-the-project-seems-viable

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.