Thursday, April 02, 2015 3:55:21 PM

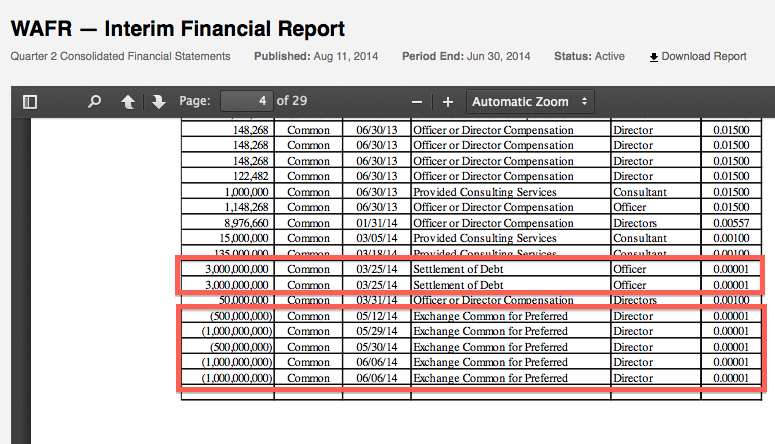

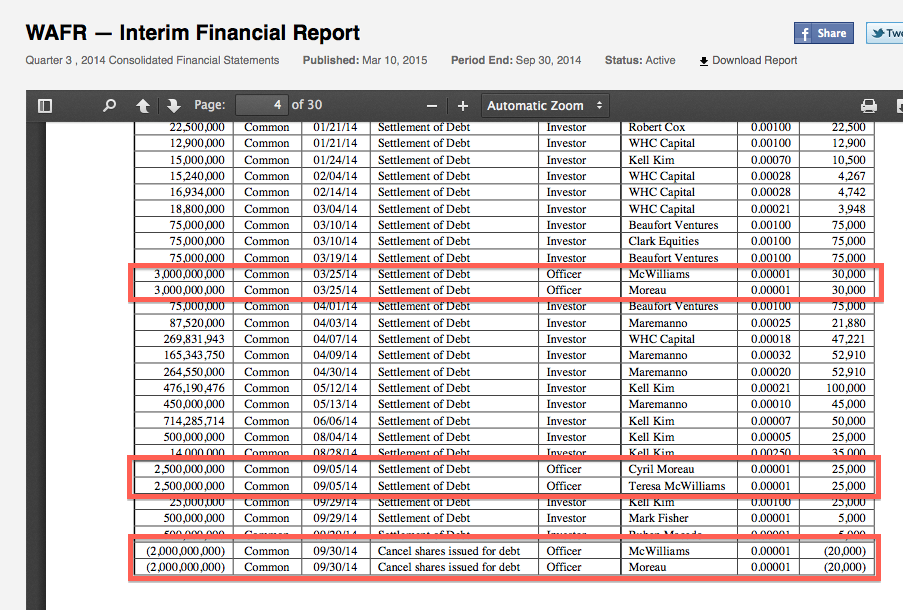

However, the Q3 from last year shows that 6 billion were issued in March, none were converted or "returned to the Treasury" before another 5 billion were issued in early September of which 4 billion were canceled later that month. Hmmm....6 billion plus 5 billion equals 11 billion. How do you even do that when only 9 billion are authorized?

Furthermore, the Q3 states that there were 6 billion shares outstanding as of the end of September, so whatever really happened to those shares, they did NOT go back into the Treasury. In fact, as of March 15th, 2015, OTCMarkets shows Outstanding Shares at 8,545,207,089 and Authorized at 8,964,324,990, which means Waffer's treasury stocks total a mere 419,117,901. One can only wonder if the float is really 42 million, especially in light of 520 million shares trading on one day in October post reverse split.

One thing is clear. Waffer's accounting sucks. Perhaps not as badly as Roger's, but pretty impressively poorly all the same.

FEATURED Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM

North Bay Resources Announces Mt. Vernon Gold Mine Bulk Sample, Sierra County, California • NBRI • Sep 11, 2024 9:15 AM

One World Products Issues Shareholder Update Letter • OWPC • Sep 11, 2024 7:27 AM

Kona Gold Beverage Inc. Reports $1.225 Million in Revenue and $133,000 Net Profit for the Quarter • KGKG • Sep 10, 2024 1:30 PM