Mar. 25, 2015 8:51 AM ET

By Ben Kramer-Miller

Endeavour Silver has seen high production costs and declining production, which is contrary to the story that drove the stock to new highs in 2010-11.

Bearish investors are assuming temporary issues are actually more permanent, yet production growth is coming and high costs were short-lived.

Endeavour Silver's woes have made it cheap relative to its peer group.

As investors realize that growth is coming while costs will decline Endeavour shares should play catch-up, and thereby offer a compelling opportunity for silver bulls.

Overview

Endeavour Silver (NYSE:EXK) is a mid-tier silver producer with three operations in Mexico - Guanacevi, Bolanitos, and El Cubo. This had been one of the best-performing silver stocks as silver rose from $9/oz. to nearly $50/oz. from 2008 - 2011 given its history of production and resource growth and its relatively low production costs. However, it has been one of the hardest hit of late given that 2014 was the first year in a decade in which we didn't see this growth. The company's poor performance was exacerbated as its all-in production costs at El Cubo came in at ~$35/oz., and in the fourth quarter the company took a write-down of $83 million on this project.

The company's 2015 guidance wasn't exactly promising either, since production at Guanacevi and Bolanitos is expected to decline. Investors should note, however, that this is mostly due to these mine's showing an especially strong performance in 2014 given their higher ore grades and silver recovery rates (although this was masked by the high production costs at El Cubo and a falling silver price).

In short what we've seen is that those attributes of Endeavour Silver that have made it an attractive investment in the past have seemingly dissipated, and the stock has fallen to reflect that.

But have the company's fundamentals really shifted? Sure, we have seen some short-term issues, but to argue that a few rocky quarters negate a decade of exceptional performance by Brad Cooke and his team is short-sighted. Furthermore, this short-sightedness has created a compelling opportunity for those willing to take the other side of a trade that has become decidedly bearish. I cite the following points to support my thesis.

Endeavour Silver has become incredibly inexpensive compared with its peers. I specifically have in mind Fortuna Silver (NYSE:FSM) and First Majestic Silver (NYSE:AG). My readers know that these are two companies that I like and have owned (I still own First Majestic), given their regular production growth, resource growth, and low costs. These three companies all have the same attributes that make them excellent vehicle through which to express a bullish silver position, yet Endeavour's 2014 issues have made it the least expensive option by far using key metrics.

Endeavour Silver may not grow its production substantially (if at all) this year or next but it does have near-term growth potential in its Terronera Project, which has the potential to become the company's largest through a 2-stage development.

The recently announced ramp-up of production at El Cubo should keep production relatively flat on a year/year basis with a minimal capital expenditure.

Weakness in the Mexican Peso should reduce production costs on a USD basis.

Before I get into these points in greater depth I must point out that Endeavour Silver is hardly out of the woods considering its production costs relative to the current silver price. The silver price is incredibly low relative to the cost of production for all but a handful of company's (e.g. Tahoe Resources (NYSE:TAHO)) which trade at a significant premium to the value of their discounted cash-flow as a result. This has led to project postponements (e.g. Pitarrilla) and temporary suspensions (e.g. Velardena). While the low silver price may lead to a supply reduction that ultimately pushes prices higher investors need to keep in mind that ~70% of global silver production is by-product production, meaning that the companies that mine most of the world's silver don't really care what the silver price is. There are certainly reasons to be bullish of silver given a rise in investment demand along side gold and given a rise in industrial applications (e.g. photovoltaic cells in solar panels), but this won't necessarily lead to an increase in the silver price in the near term. As a result, silver miners such as Endeavour Silver could continue to lose money, and this will clearly put pressure on the stock price. This means that there is inevitably a speculative aspect to an investment in Endeavour Silver. But once the silver market recovers Endeavour Silver will be among the best positioned companies to profit from this.

Endeavour Silver's Relative Valuation

Endeavour Silver is not the cheapest silver mining company, but if we compare it only with companies in its peer group I would argue that it is. Fortuna Silver and First Majestic Silver share similarities with Endeavour Silver.

They all have multiple projects in Mexico.

They all have histories of production and resource growth.

They all have histories of low production costs.

If we look at their relative valuations compared with their annual silver equivalent production we will find that Endeavour Silver is incredibly inexpensive. Endeavour Silver should produce ~11 million ounces of silver with a valuation of just $208 million. Meanwhile Fortuna will produce just 9 million ounces in spite of its $488 million valuation. Finally First Majestic will produce 16 million ounces with a $656 million valuation. This gives the three companies respective market cap/annual AgEq. production ratios of $19.oz., $54/oz., and $40/oz.

Investors should note that the disparity in valuations between First Majestic and Endeavour is offset by the former company's production costs, which are expected to be ~$2/oz. lower than Endeavour's placing that company in the black in 2015 assuming the silver price remains relatively flat. But Fortuna expects to have similar production costs to Endeavour and the valuation disparity has no validation (despite Fortuna's stronger balance sheet and larger working capital position) unless we assume tremendous growth for Fortuna vs. no growth or even production declines for Endeavour while Endeavour is slated to grow longer term. In fact, while I think Fortuna Silver is an excellent company pair, traders may want to consider going long Endeavour vs. going short Fortuna.

2 - Endeavour Silver's Growth (Terronera)

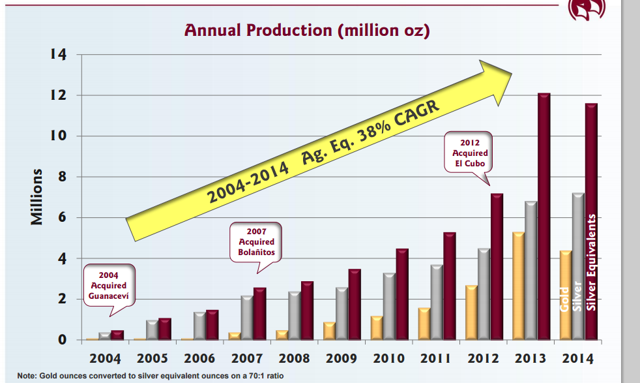

As I've mentioned, Endeavour Silver's growth streak has ended in 2014 as production declined.

(Source: Endeavour Silver's Presentation)

Endeavour Silver is also not slated to grow production in 2015, which should be roughly flat. Still, growth in 9 out of 11 years at a significant double-digit clip is nothing short of phenomenal. Investors giving up on Endeavour Silver - especially at the current valuation - are far too concerned with the current lack of growth to realize that Endeavour's management has made astute acquisitions and has demonstrated an ability to exploit opportunities at its acquired projects. Furthermore, such investors seem to be assuming that just because Endeavour Silver isn't growing its production now that its team isn't working towards growing production, when it is actually pursuing multiple opportunities that will take a couple of years to execute.

The biggest opportunity is at the Terronera Project - acquired in 2013. The Terronera property contains multiple small historic mines and ore veiins that a company such as Endeavour can consolidate into a significant mine - the company's largest in fact if management can execute its longer-term plan.

The maiden Terronera resource estimate shows a project with 29 million ounces of silver and 225,000 oz. of gold (44 million AgEq oz. assuming a 70:1 gold:silver ratio with the company). Management plans on completing the drilling needed in order to convert some of these resources into reserves in preparation for a pre-feasibility study. Assuming this PFS is promising we should see the company develop the project in preparation for a 2016 production commencement. The company is targeting a 2-stage development, with the first stage reaching ~4 million ounces of AgEq. production in the mine's first full year (2017). Stage two should lead to a doubling of production to 8 million AgEq. oz. which means tremendous growth for the company. While we don't know the initial capital costs the company's $20 million in working capital (as of December 31st) and its $50 million credit line (soon to be $25 million in July) should be sufficient to develop the project, especially given that this development will take place over time.

Furthermore, assuming the company can generate flat production at its 3 producing projects combined (recent discoveries at Bolanitos and El Cubo suggest that this is a probable scenario) we should be able to see production grow at a CAGR of nearly 15% as the Terronera Project matures. This doesn't take into consideration potential growth from acquisitions. In my discussion with Brad Cooke, he told me that the company is exploring opportunities in both gold and silver throughout North America. Investors who follow the junior space know that there are several opportunities - juniors that have compelling projects, but which lack the capital with which to develop them. While this opportunity is open to other mid-tier producers, it flies in the face of the market's apparent belief that Endeavour Silver's growth is behind it.

3 - Expansion At El Cubo

Until Endeavour Silver's recent announcement that it is going to be expanding production at El Cubo, 2015 was supposed to be another year of declining production. The El Cubo expansion announcement along with a turn in gold and silver prices last week sent shares bounding off of a multi-year low, as the implication is that production will not decline in 2015. Rather, it will be flat.

Before I get into the El Cubo expansion, note again that 2014 was expected to be weaker than it was, yet high grades/recoveries at Guanacevi and Bolanitos meant that the company surprised to the upside. 2015 guidance calls for a "normalization" of grades and recoveries, but we could very well see upside surprises at these two projects again. That being said the production decline was in comparison to these better than expected figures.

Investors should note also that expansion at El Cubo is a far cry from what management was suggesting a few months ago, namely that the mine might be put into care and maintenance (cf. Endeavour's Q3 MD&A). Yet opex came down in Q4 while silver and gold prices seem to have stabilized, both of which bode well for El Cubo.

Production at El Cubo is expected to rise from 1,550 tpd. up to 2,200 tpd. Production guidance was for 3.5-3.8 million AgEq. oz., and this figure is expected to rise to 4.3-4.8 million AgEq. oz. making El Cubo the company's largest producing mine. This increased production should also lower the company's overall AISC to $16-$17.5/oz. on a by-product basis. Meanwhile, the added capex is just $3.8 million, which is minimal compared with the company's original ~$33 million allocation towards capital expenditures for 2015.

Overall we should see production growth come in flat year over year, although another outperformance at the company's Guanacevi and Bolanitos Projects could push production to a higher level than what we saw last year.

4 - Mexican Peso Weakness

Given recent weakness in the value of the Mexican Peso Endeavour Silver's input costs should come down in US dollar terms. With the USDMXN cross at 15.1 and Endeavour Silver's expectations for 14.5 the company has a fair amount of wiggle room, and investors should expect production costs to come in towards the lower end of guidance should the Peso remain weak or weaken further. With that in mind Endeavour is likely generating positive cash-flow relative to its AISC estimates at $16.8/oz. silver, although the margin is razor thin.

The Bottom Line

As is often the case in the mining industry, short-term phenomena can have a tremendous impact on market sentiment and on a given mining company's share price. Endeavour Silver saw its Ripkenesque growth stream come to a halt last year. It also saw its average production costs come in high relative to its peers thanks to high costs at El Cubo. The second and third points that I bring up should demonstrate to investors that these are temporary issues. Endeavour Silver has the potential to grow long term, and it has the potential to bring its costs down so that it is competitive with its peers.

Yet the market doesn't see it this way. As point #1 reveals, Endeavour Silver is unjustifiably cheap relative to its peers. This relative value is the result of near-term issues. Therefore, investors looking for a growth company leveraged to the silver price have a unique opportunity in Endeavour Silver to buy this growth at a price that assumes none.

Recent EXK News

- Endeavour Silver Provides Q1 2024 Construction Progress Update on Terronera; Construction Progress Reaches 53% Completion • GlobeNewswire Inc. • 04/23/2024 09:00:00 PM

- Endeavour Silver Celebrates Milestone: Terronera Surpasses 50% Construction Completion • GlobeNewswire Inc. • 04/22/2024 10:00:00 AM

- Endeavour Silver Announces Nomination of Angela Johnson to Board of Directors • GlobeNewswire Inc. • 04/18/2024 10:50:00 AM

- Endeavour Silver Announces First Drawdown on The Terronera Senior Secured Debt Facility • GlobeNewswire Inc. • 04/10/2024 10:50:00 AM

- Endeavour Silver Delivers Strong Production in Q1 2024 • GlobeNewswire Inc. • 04/09/2024 10:50:00 AM

- Form 40-F - Registration statement [Section 12] or Annual Report [Section 13(a), 15(d)] • Edgar (US Regulatory) • 03/11/2024 12:47:28 PM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 03/11/2024 10:51:04 AM

- Endeavour Silver Reports 2023 Financial Results: Earnings Conference Call at 9am PST (12pm EST) Time • GlobeNewswire Inc. • 03/11/2024 10:50:00 AM

- U.S. Index Futures Dip Ahead of Inflation Data and Oracle’s Earnings; Oil Prices Edge Higher • IH Market News • 03/11/2024 10:39:47 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 03/08/2024 07:45:08 PM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 02/12/2024 10:30:04 PM

- Endeavour Silver Provides Q4 2023 Construction Progress Update On the Terronera Mine • GlobeNewswire Inc. • 02/12/2024 10:00:00 PM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 01/24/2024 11:51:06 AM

- Endeavour Silver Provides 2024 Update for the Terronera Project; Initial Production Remains on Schedule for End of 2024 • GlobeNewswire Inc. • 01/24/2024 11:50:00 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 01/11/2024 11:51:04 AM

- Endeavour Silver Provides 2024 Guidance; Production expected at 5.3 – 5.8 Million oz Silver and 34,000-38,000 oz Gold for 8.1- 8.8 Million oz Silver Equivalent ¹ • GlobeNewswire Inc. • 01/11/2024 11:50:00 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 01/09/2024 11:51:05 AM

- Endeavour Silver Produces 5,672,703 Oz Silver and 37,858 Oz Gold (8.7 Million Silver Equivalent Oz) in 2023; Improved Fourth Quarter Production Delivers Annual Guidance • GlobeNewswire Inc. • 01/09/2024 11:50:00 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 12/20/2023 05:53:57 PM

- Endeavour Silver Announces At-the-Market Offering of up to US$60 Million • GlobeNewswire Inc. • 12/18/2023 10:48:39 PM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 12/18/2023 10:29:45 PM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 12/18/2023 10:28:35 PM

- Form SUPPL - Voluntary Supplemental Material by Foreign Issuers [Section 11(a)] • Edgar (US Regulatory) • 12/18/2023 10:27:27 PM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 12/05/2023 11:51:04 AM

- Endeavour Silver Announces Appointment of Chief Financial Officer • GlobeNewswire Inc. • 12/05/2023 11:50:00 AM

FEATURED NanoViricides Reports that the Phase I NV-387 Clinical Trial is Completed Successfully and Data Lock is Expected Soon • May 2, 2024 10:07 AM

ILUS Files Form 10-K and Provides Shareholder Update • ILUS • May 2, 2024 8:52 AM

Avant Technologies Names New CEO Following Acquisition of Healthcare Technology and Data Integration Firm • AVAI • May 2, 2024 8:00 AM

Bantec Engaged in a Letter of Intent to Acquire a Small New Jersey Based Manufacturing Company • BANT • May 1, 2024 10:00 AM

Cannabix Technologies to Deliver Breath Logix Alcohol Screening Device to Australia • BLO • Apr 30, 2024 8:53 AM

Hydromer, Inc. Reports Preliminary Unaudited Financial Results for First Quarter 2024 • HYDI • Apr 29, 2024 9:10 AM